Unraveling the Story Behind Franchise Tax Texas and Its Impact on Businesses

In the complex landscape of municipal revenue generation, franchise tax in Texas emerges as a pivotal mechanism, intricately shaping the fiscal strategies of myriad businesses across the state. With a history rooted in balancing government funding needs and economic competitiveness, this levy influences operational planning, corporate structuring, and regional economic vitality. Texas’s unique approach—marked by its broad tax base, variable rates, and evolving legal interpretations—necessitates an in-depth understanding of its origins, formulation, and ongoing implications. This exploration aims to dissect the narrative behind Texas franchise tax, offering clarity for business leaders, policymakers, and economic analysts seeking to navigate its nuances and leverage its strategic potential.

Historical Evolution of Texas Franchise Tax and Its Foundational Principles

The genesis of the franchise tax in Texas traces back to the early 20th century, amidst a wave of state-level reforms designed to diversify revenue streams beyond property taxes and state income. Texas, with its unconventional reliance on business privilege taxes, established a framework that emphasized a business’s ability to pay, rather than mere juridical existence, aligning with broader tax philosophies centered around economic capacity. Initially, the tax focused on gross receipts, providing a straightforward, if broad, metric for taxation.

Over subsequent decades, legislative adjustments reflected shifting economic landscapes and political priorities. The 1990s, in particular, marked a period of significant reform, with the introduction of margins-based calculations to replace gross receipts, aiming to create a more balanced and fair assessment aligned with profitability rather than gross revenue. This adaptation was also a response to concerns about tax avoidance and the need for modernization in a rapidly changing business environment.

Key legislative milestones in the evolution of franchise tax in Texas

Understanding the historical milestones provides critical context for comprehending its current structure:

- 1981: Introduction of the gross receipts-based franchise tax, primarily targeting corporations.

- 1993: Revisions to include variability in rates based on size and revenue thresholds.

- 2006: A legislative overhaul introduced the margins-based tax calculation method, emphasizing profit margins and thereby aligning tax liability more closely with profitability.

- 2019: Major rate adjustments and exemption thresholds, reflecting economic shifts and political directives.

This progression underscores Texas’s strategic balancing act—funding essential public services while maintaining an attractive climate for business growth. Central to this narrative is the inherent tension between revenue needs and economic competitiveness, shaping the way the franchise tax continues to evolve.

Structural Components and Calculation Methodologies of Texas Franchise Tax

At its core, the Texas franchise tax operates through a complex yet systematically structured framework, combining multiple calculation methods to accommodate diverse business models. Recognizing these components is essential for any entity to ensure compliance and optimize tax liability.

Tax base: gross receipts, total revenue, or margins?

The primary tax base for most businesses is either gross receipts or, since the 2006 reforms, a calculation based on taxable margin. The taxable margin can be determined via several methods, including:

- Total Revenue Minus Cost of Goods Sold (COGS): Predominantly suitable for manufacturing entities.

- Total Revenue Minus Compensation: Particularly relevant for service-based businesses with significant labor costs.

- Total Revenue Minus 30% of Revenue: A simplified approach used when other deductions are less straightforward.

This flexibility allows Texas to accommodate various industries while incentivizing efficient business practices, especially through the margin-based calculation, which often results in a lower tax liability for profitable companies.

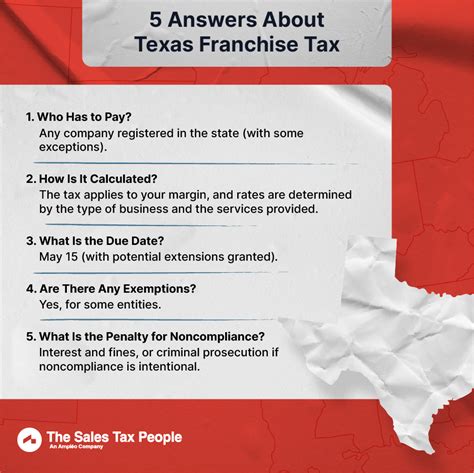

Tax rates and exemption thresholds

Current legislation sets a base rate of 0.75% on entities with total revenue exceeding 1,130,000, with variations for different business types. Smaller businesses below this threshold are often exempt or pay a reduced rate, fostering a conducive environment for startups and small enterprises. The thresholds and rates are periodically adjusted, reflecting inflation and fiscal policy shifts. For example, in 2023, the exemption amount was increased from previous figures, reducing the tax burden on small businesses.</p> <table> <tr><th>Key Metric</th><th>Value and Context</th></tr> <tr><td>Exemption Threshold</td><td>1,130,000 (2023), adjusted annually for inflation Standard Rate0.75% on revenue above threshold Reduced Rate0.375% for certain qualifying entities

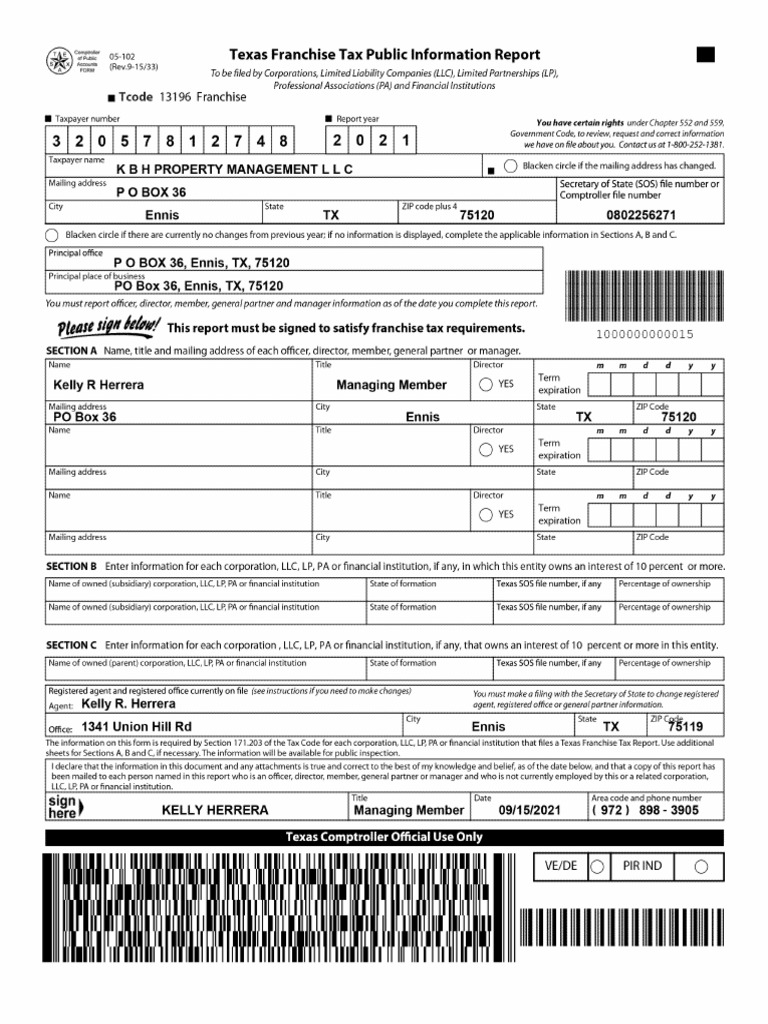

Legal Framework and Regulatory Oversight

The franchise tax operates within a dynamic legal environment, governed by the Texas Revenue Code, enforced and interpreted through the Texas Comptroller’s office, which functions as the primary regulatory authority. Over the years, legal disputes and rulings have refined the applicative scope, especially regarding definitions of “business” and “revenue,” influencing tax planning strategies.

Key legal considerations and recent court rulings

Notable cases have challenged the interpretation of what constitutes taxable revenue, especially concerning non-traditional revenue streams such as digital sales or inter-company transactions. These rulings have incrementally expanded or clarified the tax base, prompting businesses to reassess their compliance strategies and accounting practices.

Legislative amendments often respond to such legal precedents, aiming to close loopholes or adapt to emerging economic realities. This ongoing dialogue between legislation, legal interpretation, and business practice underscores the importance of thorough legal and tax expertise for compliant operation.

Impact of Texas Franchise Tax on Business Strategy and Economic Climate

Beyond finances, the franchise tax exerts palpable influence on how businesses formulate strategies, structure operations, and consider expansion within Texas. Its presence shapes investment decisions, encourages efficiency, and, in some cases, spurs innovation aimed at minimizing liabilities.

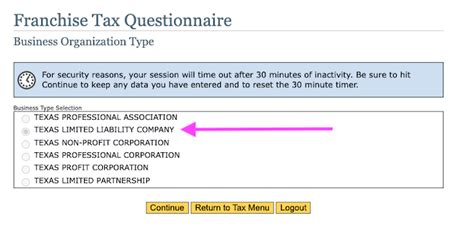

Tax planning and corporate structuring

Many firms actively organize their legal presence and operational footprint to optimize franchise tax obligations. This includes choosing entities—such as LLCs or S-corporations—that benefit from exemption thresholds or lower rates, and adopting accounting methods aligned with legal frameworks to reduce taxable margins.

Such strategic planning often requires sophisticated legal and financial expertise, ensuring that companies remain compliant while leveraging available incentives and deductions.

Economic implications and regional development

While some critics argue that franchise tax may subtly discourage small to medium enterprise growth, supporters emphasize its role in stabilizing state revenue and funding infrastructure projects. Data indicates that Texas maintains a steady economic growth rate, partially attributable to its competitive tax environment, including the franchise tax.

| Economic Indicator | Impact |

|---|---|

| Business Formation Rate | Consistently high in Texas, surpassing national averages |

| Small Business Growth | Moderate, with potential barriers for high-margin startups due to tax thresholds |

| Revenue Collection | Stable, covering significant portions of local infrastructure and public service budgets |

Future Directions: Proposed Reforms and Challenges

As the Texas economy evolves, so too does the discourse surrounding franchise tax reform. Policy debates focus on simplifying the tax structure, increasing transparency, and adjusting exemption thresholds to better support emerging sectors like technology or renewable energy. Given the historical trend of periodic reforms, anticipating future changes remains a critical component for strategic planning.

Key proposed reforms and their implications

- Simplification of calculation methods: Moving toward a more straightforward tax base to reduce compliance costs.

- Expansion of exemptions: To foster small enterprise development and innovation clusters.

- Alignment with federal tax policies: Harmonizing state and federal tax structures to prevent double taxation and increase clarity.

- Increased digital compliance tools: Enhancing technology-driven enforcement and taxpayer assistance systems.

These reforms, if realized, could recalibrate the tax landscape, offering both opportunities and challenges for businesses and policymakers alike.

How does the Texas franchise tax compare to other states’ business taxes?

+Unlike many states that rely heavily on gross receipts or corporate income taxes, Texas employs a unique margin-based approach and offers relatively low rates with sizable exemptions. This model often results in more predictable and potentially lower tax liabilities for profitable businesses, positioning Texas as a competitive environment for corporate operations.

What industries are most affected by the franchise tax?

+Manufacturing, retail, and technology sectors are particularly influenced, as their revenue structures and margins determine their tax liabilities. Service providers with high labor costs may benefit from the compensation deduction method, while digital enterprises need to navigate evolving definitions of taxable revenue.

Are there any recent legislative proposals to overhaul the franchise tax?

+Yes. Several legislative bills aim to simplify calculation methods, increase exemption thresholds, or modify rate structures, driven by feedback from business communities and fiscal analysts. The outcome of these proposals depends on political priorities, economic conditions, and advocacy efforts.