Va Tax Rebate

The Virginia Tax Rebate, a recent initiative introduced by the state government, has been a topic of interest for many residents. This article aims to delve into the details of this program, providing an in-depth analysis of its benefits, eligibility criteria, and impact on the community.

Understanding the Virginia Tax Rebate Program

The Virginia Tax Rebate, officially known as the Virginia Individual Income Tax Refund, is a financial incentive aimed at providing relief to eligible taxpayers in the state. This program was established to stimulate economic growth and support individuals and families facing financial challenges.

The tax rebate, introduced as part of the state's fiscal year 2023-2024 budget, offers a one-time refund to qualified residents. This initiative reflects the state's commitment to promoting financial well-being and ensuring that the benefits of economic growth are shared across all segments of society.

Key Features and Benefits

The Virginia Tax Rebate program boasts several key features that make it an attractive proposition for taxpayers:

- Direct Monetary Relief: Eligible taxpayers can receive a refund of up to 600</strong> for individuals and <strong>1,200 for married couples filing jointly. This direct financial support can make a significant difference in managing household expenses.

- No Application Process: Unlike many other government programs, the tax rebate is automatically applied during the tax filing process. This streamlined approach ensures that eligible taxpayers receive their refunds promptly without the need for additional paperwork.

- Inclusive Eligibility Criteria: The program is designed to benefit a wide range of taxpayers. To qualify, individuals must have a Virginia adjusted gross income (AGI) of $100,000 or less for the tax year 2022. This threshold makes the rebate accessible to a substantial portion of the state’s population.

Impact and Potential Outcomes

The Virginia Tax Rebate program is expected to have a positive impact on the state’s economy and the well-being of its residents. By putting money directly into the hands of taxpayers, the program aims to:

- Boost Consumer Spending: The rebates can stimulate economic activity as recipients are likely to use the funds for essential purchases, contributing to local businesses and potentially creating a ripple effect of economic growth.

- Reduce Financial Stress: For many low- and middle-income households, the tax rebate can provide much-needed relief. This additional income can help individuals and families manage unexpected expenses, pay off debts, or simply save for future needs.

- Encourage Tax Compliance: By offering a direct incentive, the program may motivate taxpayers to file their returns accurately and on time. This, in turn, can improve tax compliance rates and enhance the overall efficiency of the state’s tax system.

Eligibility and Filing Process

Understanding the eligibility criteria and filing process is crucial for residents to maximize the benefits of the Virginia Tax Rebate program.

Eligibility Requirements

To be eligible for the Virginia Tax Rebate, individuals must meet the following criteria:

- Residency: You must be a legal resident of Virginia for the entire tax year. This means you must have lived in the state for the full 12 months of the tax year 2022.

- Income Threshold: Your Virginia adjusted gross income (AGI) must be $100,000 or less for the tax year 2022. This includes all income sources, such as wages, self-employment income, and investment gains.

- Filing Status: The rebate is available to individuals and married couples filing jointly. If you are married and file separately, you will not be eligible for the rebate.

It's important to note that certain types of income, such as Social Security benefits, pensions, and military retirement pay, are not included in the calculation of your Virginia AGI. This means that individuals receiving these forms of income may still qualify for the rebate, even if their total income exceeds $100,000.

Filing Your Taxes for the Rebate

The process of claiming your Virginia Tax Rebate is relatively straightforward and integrated into the standard tax filing procedure. Here’s a step-by-step guide:

- Gather Your Documents: Collect all the necessary tax documents, such as W-2 forms, 1099s, and any other income statements. Ensure you have accurate records of your income and expenses for the tax year 2022.

- Choose Your Filing Method: You can file your taxes online using approved tax preparation software or file a paper return. The Virginia Department of Taxation provides a list of free tax preparation options for eligible residents.

- Complete Your Tax Return: When filling out your tax return, make sure to include all relevant income and deductions. The rebate will be automatically calculated based on your AGI and filing status.

- Submit Your Return: Once you’ve completed your tax return, submit it to the Virginia Department of Taxation. You can e-file your return or mail it to the appropriate address, depending on your chosen filing method.

- Receive Your Rebate: If you are eligible, the rebate will be included in your tax refund. The timing of your rebate will depend on when you file your return and the processing time of the Department of Taxation. Generally, electronic returns are processed more quickly than paper returns.

It's essential to file your taxes accurately and on time to ensure you receive your rebate promptly. If you have any questions or need assistance with your tax return, the Virginia Department of Taxation provides a taxpayer assistance service to guide you through the process.

Case Studies: Real-Life Impact

To understand the tangible impact of the Virginia Tax Rebate program, let’s explore a few case studies of individuals who have benefited from this initiative.

Case Study 1: Single Parent Household

John, a single parent with two children, works as a teacher in a local school district. With a modest income, John often struggles to make ends meet. The Virginia Tax Rebate provided him with a much-needed financial boost.

John received a refund of $600, which he used to cover some of his children's extracurricular activities and purchase new school supplies. The rebate helped alleviate the financial strain of raising a family on a single income, allowing John to focus on providing a better future for his children.

Case Study 2: Young Professionals

Emily and Michael, a young married couple, recently started their careers in Virginia. With student loans and the rising cost of living, they were facing financial challenges. The tax rebate program offered them a chance to breathe a sigh of relief.

As a married couple filing jointly, Emily and Michael were eligible for a refund of $1,200. They used this money to pay off a portion of their student loan debt, reducing their monthly financial obligations. The rebate not only provided short-term relief but also contributed to their long-term financial goals.

Case Study 3: Senior Citizens

Alice, a retired senior citizen, has been living on a fixed income for several years. The rising cost of healthcare and living expenses has made it increasingly difficult for her to manage her finances.

The Virginia Tax Rebate program provided Alice with a $600 refund, which she used to cover her medication costs and some home maintenance expenses. This financial support helped ensure her retirement years were more comfortable and worry-free.

| Case Study | Eligibility Status | Rebate Amount | Usage |

|---|---|---|---|

| Single Parent Household | Eligible | $600 | Extracurricular Activities, School Supplies |

| Young Professionals | Eligible | $1,200 | Student Loan Repayment |

| Senior Citizens | Eligible | $600 | Healthcare, Home Maintenance |

Frequently Asked Questions

When can I expect to receive my Virginia Tax Rebate if I filed my taxes electronically?

+If you filed your taxes electronically and are eligible for the rebate, you can typically expect to receive your refund within 2-4 weeks from the date of filing. The exact timing may vary based on the volume of returns and the efficiency of the processing system.

What if I file my taxes on paper? How long will it take to receive my rebate?

+Paper returns generally take longer to process. If you filed your taxes on paper and are eligible for the rebate, it may take 4-6 weeks or more to receive your refund. The Department of Taxation recommends e-filing for faster processing times.

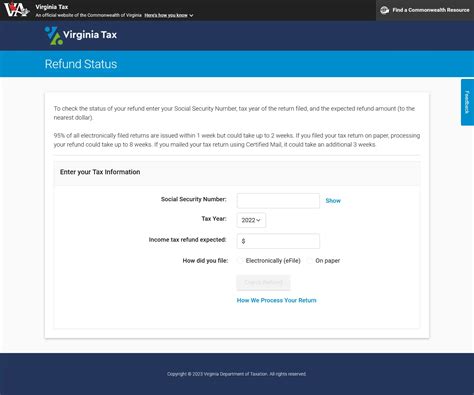

Can I check the status of my Virginia Tax Rebate online?

+Yes, you can check the status of your rebate online through the Virginia Department of Taxation’s refund status portal. You’ll need to provide your Social Security number and either your e-file reference number or the last four digits of your bank account number (if you opted for direct deposit).

Are there any plans to extend the Virginia Tax Rebate program beyond the current tax year?

+The Virginia Tax Rebate program is currently a one-time initiative for the tax year 2022. While there is no confirmation of its extension, the program’s success and positive impact on residents may influence future budgetary decisions. Stay tuned for updates on potential future rebate programs.