Tax Advocate Near Me

Are you looking for a tax advocate to help you navigate the complex world of taxes and ensure you get the best possible outcome? Finding a reliable and knowledgeable tax advocate near you can be a crucial step towards managing your financial affairs effectively. In this comprehensive guide, we will explore the ins and outs of tax advocacy, provide insights into the services tax advocates offer, and help you locate the right professional for your tax-related needs.

Understanding Tax Advocacy: Your Expert Guide

Tax advocacy is a specialized field that involves assisting individuals and businesses with tax-related matters. Tax advocates, also known as tax representatives or tax resolution specialists, are skilled professionals who possess a deep understanding of tax laws, regulations, and procedures. They act as your advocates, providing expert guidance and representation throughout the tax process.

Tax advocates play a vital role in various scenarios, including:

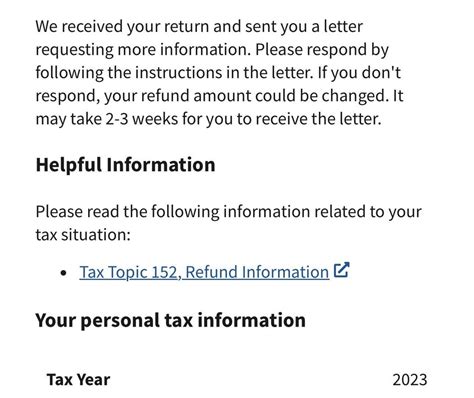

- Resolving tax disputes or controversies with the Internal Revenue Service (IRS) or other tax authorities.

- Helping taxpayers navigate complex tax codes and regulations to ensure compliance.

- Providing assistance with tax planning and strategy development to minimize tax liabilities.

- Representing taxpayers during audits, appeals, or collection actions.

- Negotiating tax debt relief options and settling tax debts.

Services Offered by Tax Advocates

Tax advocates offer a range of services tailored to meet the diverse needs of their clients. Here’s an overview of some of the key services they provide:

Tax Resolution and Representation

Tax advocates are well-versed in handling tax issues and disputes. They can assist you with:

- Audits: Representing you during IRS or state tax audits, ensuring your rights are protected and providing expert guidance.

- Appeals: Navigating the appeals process if you disagree with an audit decision, helping you present your case effectively.

- Collection Actions: Negotiating with tax authorities to resolve collection matters, such as wage garnishments or liens.

- Offer in Compromise (OIC): Assisting with the OIC process, where you propose a settlement amount to resolve your tax debt.

- Penalty Abatement: Requesting the removal or reduction of penalties imposed by tax authorities.

Tax Planning and Strategy

Tax advocates can help you develop comprehensive tax strategies to minimize your tax liabilities and maximize your financial benefits. Their services include:

- Tax Consulting: Providing expert advice on tax-efficient business structures, investments, and transactions.

- Business Tax Planning: Helping businesses optimize their tax positions and ensure compliance with relevant tax laws.

- Individual Tax Planning: Developing personalized tax strategies for individuals to reduce tax burdens.

- Estate and Inheritance Tax Planning: Assisting with estate planning to minimize tax obligations for your heirs.

Tax Compliance and Filing

Tax advocates can ensure you meet your tax compliance obligations accurately and on time. They offer services such as:

- Tax Return Preparation: Completing and filing tax returns for individuals, businesses, trusts, and estates.

- Amended Returns: Filing amended tax returns to correct errors or take advantage of additional deductions or credits.

- Extension Filings: Requesting and managing tax return extensions when needed.

- Tax Payment Plans: Setting up installment agreements with tax authorities to pay off tax debts over time.

Finding a Tax Advocate Near You

When searching for a tax advocate, it’s essential to find a professional who is knowledgeable, experienced, and trustworthy. Here are some steps to help you locate the right tax advocate in your area:

Online Directories

Start your search by utilizing online directories specifically designed for tax professionals. Websites like the National Association of Tax Professionals (NATP) or the National Association of Enrolled Agents (NAEA) can provide you with a list of tax advocates in your region. These directories often include detailed profiles, allowing you to learn more about each advocate’s qualifications, experience, and areas of expertise.

Local Business Directories

Explore local business directories or listings in your area. Many tax advocates advertise their services in local business directories, allowing you to find professionals with a strong presence in your community. You can often find contact information, websites, and reviews from previous clients, giving you valuable insights into their reputation and service quality.

Referrals and Recommendations

Word-of-mouth referrals are powerful tools when searching for a tax advocate. Reach out to trusted friends, family members, or business associates who have had positive experiences with tax professionals. Personal recommendations can provide valuable insights and help you find a tax advocate who has already established a solid reputation in your community.

Professional Networks

Connect with other professionals in your network, such as accountants, financial advisors, or attorneys. These professionals often collaborate with tax advocates and can provide referrals or recommendations based on their experiences. They may have insights into the expertise and reputation of specific tax advocates in your area.

Research and Due Diligence

Once you’ve identified potential tax advocates, it’s crucial to conduct thorough research and due diligence. Consider the following factors:

- Credentials and Qualifications: Verify the tax advocate's credentials, including their education, certifications, and any professional associations they belong to. Look for enrolled agents (EAs), certified public accountants (CPAs), or attorneys with a tax specialty.

- Experience: Assess their experience in handling cases similar to yours. Look for advocates who have a proven track record of successfully resolving tax issues for clients in your situation.

- Client Reviews and Testimonials: Read client reviews and testimonials to gauge the advocate's reputation and the quality of their services. Online review platforms and social media can provide valuable insights.

- Communication and Accessibility: Ensure the tax advocate is easily accessible and responsive to your inquiries. Effective communication is crucial throughout the tax advocacy process.

- Fees and Payment Terms: Understand the advocate's fee structure and payment terms. Ask for a clear breakdown of costs to ensure there are no surprises.

The Importance of Expert Tax Advocacy

Engaging the services of a qualified tax advocate can bring numerous benefits to individuals and businesses. Here’s why expert tax advocacy is essential:

- Expertise and Knowledge: Tax advocates possess specialized knowledge of tax laws and regulations, ensuring you receive accurate and up-to-date advice.

- Peace of Mind: Having an advocate by your side provides peace of mind, knowing that your tax matters are being handled by a professional.

- Efficient Resolution: Tax advocates can expedite the resolution of tax issues, saving you time and effort.

- Maximized Savings: With their strategic planning and negotiation skills, tax advocates can help you minimize tax liabilities and maximize savings.

- Compliance and Avoidance of Penalties: Tax advocates ensure you remain compliant with tax laws, avoiding potential penalties and legal consequences.

In conclusion, finding a tax advocate near you is a crucial step towards effectively managing your tax obligations and maximizing your financial well-being. By understanding the role of tax advocates, the services they offer, and taking a systematic approach to your search, you can locate the right professional to guide you through the complex world of taxes.

How much do tax advocates typically charge for their services?

+Tax advocate fees can vary depending on the complexity of your case, the advocate’s experience, and the services required. It’s best to discuss fees with potential advocates during your initial consultation. They may charge an hourly rate, a flat fee, or a percentage of the tax debt resolved.

Can tax advocates help with international tax matters?

+Yes, many tax advocates have expertise in international tax matters. They can assist individuals and businesses with cross-border tax issues, foreign tax credits, and compliance with international tax regulations.

What should I expect during my initial consultation with a tax advocate?

+During the initial consultation, you can expect the tax advocate to gather information about your tax situation, ask relevant questions, and provide an assessment of your case. They will discuss potential strategies, fees, and the next steps in the process. It’s a valuable opportunity to assess their expertise and decide if they are the right fit for your needs.