Idaho Income Tax Rate

Idaho's tax system plays a crucial role in the state's economic landscape, influencing the financial decisions of both individuals and businesses. Understanding the intricacies of Idaho's income tax rate is essential for residents, investors, and anyone considering relocating to this beautiful state.

Idaho’s Progressive Income Tax Structure

Idaho operates on a progressive income tax system, which means that the tax rate increases as income rises. This approach ensures fairness and contributes to a stable revenue stream for the state’s operations and services.

Tax Brackets and Rates

Idaho’s income tax brackets are divided into six categories, each with a corresponding tax rate. As of the 2023 tax year, these brackets and rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| First $2,400 | 1.6% |

| Next $2,400 | 3.2% |

| Next $5,000 | 5.1% |

| Next $12,000 | 6.0% |

| Next $38,000 | 6.9% |

| Income over $65,400 | 7.8% |

These rates are applicable for both single and joint filers. It's important to note that the brackets are not adjusted for inflation, which means that the income thresholds remain the same from year to year unless explicitly changed by the state legislature.

Taxable Income and Exemptions

Idaho’s income tax is applied to various sources of income, including wages, salaries, commissions, bonuses, and most types of investment income. However, certain types of income are exempt from taxation, such as:

- Federal military retirement benefits.

- A portion of Social Security benefits.

- Certain public and private pensions.

- Capital gains from the sale of a primary residence.

- Gifts and inheritances.

Additionally, Idaho offers various tax credits and deductions to help reduce the tax burden for eligible residents. These include credits for property taxes, childcare expenses, and even a tax credit for certain expenses related to solar energy systems.

Impact on Residents and Businesses

Idaho’s income tax rate has significant implications for both individuals and businesses operating within the state. For residents, the progressive tax structure means that as their income increases, their effective tax rate also increases. This encourages financial planning and may influence decisions related to investments, savings, and retirement planning.

Attracting Businesses

Idaho’s relatively low tax rates, especially when compared to some neighboring states, make it an attractive destination for businesses. A lower tax burden can translate to increased profitability for companies, making Idaho a competitive choice for corporate headquarters, manufacturing facilities, and other commercial operations.

Furthermore, Idaho's business-friendly environment extends beyond income tax rates. The state offers various incentives, such as tax credits for research and development, job creation, and investment in renewable energy projects. These initiatives aim to foster economic growth and attract innovative industries to the state.

Economic Growth and Revenue

Idaho’s progressive income tax system contributes to a stable revenue stream for the state government. This revenue is crucial for funding essential services, such as education, healthcare, infrastructure development, and public safety. By ensuring a fair and progressive tax structure, Idaho can maintain a balanced budget and invest in initiatives that benefit its residents and businesses.

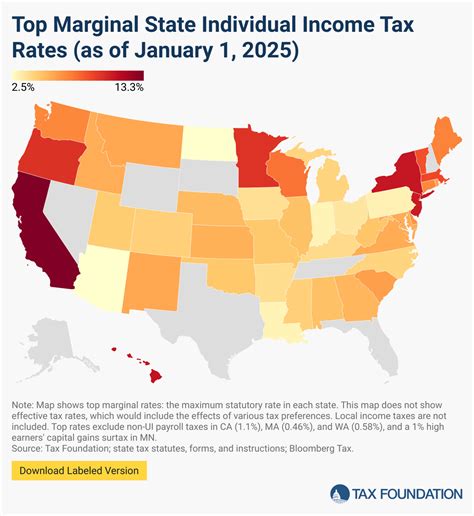

Comparison with Other States

When compared to other states, Idaho’s income tax rates are relatively low. As of 2023, Idaho ranks among the states with the lowest income tax burdens. This competitive advantage has contributed to the state’s economic growth and has made it an appealing destination for businesses and individuals alike.

However, it's important to note that tax rates are just one factor among many that influence economic decisions. Other factors, such as cost of living, business regulations, and the availability of skilled labor, also play significant roles in shaping Idaho's economic landscape.

Future Implications and Considerations

While Idaho’s current tax system is designed to promote fairness and economic growth, it’s subject to potential changes and adjustments. The state legislature periodically reviews and updates tax laws to align with economic realities and evolving needs.

As Idaho continues to grow and attract new residents and businesses, the state's tax structure may undergo further refinement. This could include adjustments to tax rates, brackets, and exemptions to ensure that the system remains fair, competitive, and responsive to the changing economic landscape.

Additionally, Idaho's tax system is influenced by federal tax policies and economic trends. Changes in federal tax laws, such as tax reform initiatives, can have a ripple effect on state-level taxation. Therefore, staying informed about both federal and state tax policies is essential for individuals and businesses operating in Idaho.

Are there any income tax deductions available in Idaho?

+Yes, Idaho offers various tax deductions, including deductions for charitable contributions, medical and dental expenses, and certain property taxes. Additionally, residents can take advantage of standard deductions or choose to itemize their deductions based on their specific circumstances.

How does Idaho’s income tax rate compare to other states in the region?

+Idaho’s income tax rates are generally lower compared to neighboring states like Washington and Oregon. This competitive advantage has made Idaho an attractive option for businesses and individuals seeking a more favorable tax environment.

Are there any special tax considerations for retirees in Idaho?

+Yes, Idaho offers tax exemptions for a portion of Social Security benefits and certain public and private pensions. These exemptions can provide significant tax savings for retirees, making Idaho an appealing retirement destination.