Maine Tax Return Status

In the state of Maine, tax returns and their associated statuses are an important aspect of financial management for individuals and businesses alike. Understanding the process and various stages of tax return processing can provide valuable insights into the timely management of one's financial obligations. This article aims to delve into the intricacies of Maine tax return status, shedding light on the steps involved, the resources available, and the key factors that influence the processing timeline.

Understanding the Maine Tax Return Process

The Maine Revenue Services is the governmental body responsible for the collection and management of state taxes. Each year, residents and businesses in Maine are required to file their tax returns, declaring their income and expenses to determine their tax liability. The process typically involves gathering relevant financial documents, calculating taxable income, and submitting the return to the Maine Revenue Services by the specified deadline.

The complexity of the tax return process can vary significantly depending on individual circumstances. For instance, a sole proprietor running a small business may need to account for various income streams, business expenses, and potential tax deductions. On the other hand, an employee with a straightforward income source might have a simpler tax situation. Regardless of the complexity, ensuring timely and accurate filing is crucial to avoid penalties and interest charges.

Key Steps in the Maine Tax Return Process

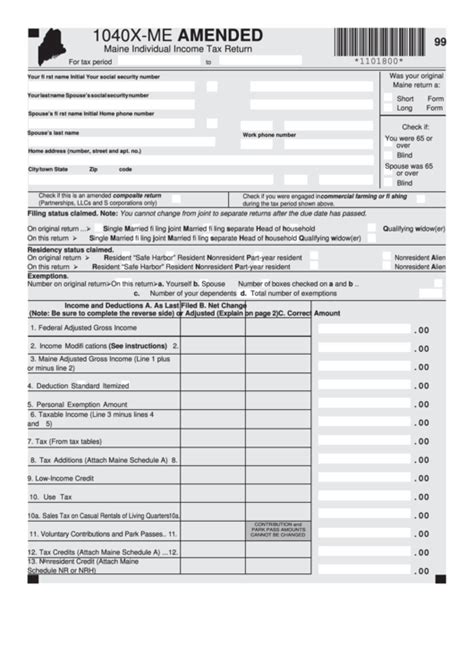

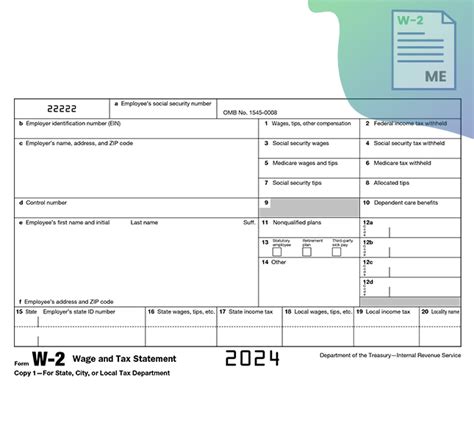

- Gathering Financial Information: This involves collecting documents such as W-2 forms, 1099 forms, bank statements, and receipts for expenses that may be tax-deductible.

- Calculating Taxable Income: Taxpayers must determine their gross income and then subtract any allowable deductions and credits to arrive at their taxable income.

- Filing the Tax Return: Taxpayers can choose to file their returns electronically or via traditional mail. Electronic filing is often preferred for its speed and convenience.

- Payment or Refund: Depending on the taxpayer’s circumstances, they may need to make a payment with their tax return or may be eligible for a refund if they have overpaid during the year.

The specific forms and schedules required for filing a Maine tax return depend on the taxpayer's income sources, business activities, and other factors. For instance, Form 1040-ME is the basic individual income tax return for Maine residents, while Schedule C-ME is used for reporting profit or loss from business activities.

Checking Maine Tax Return Status

Once a tax return has been filed, taxpayers often want to know the status of their return and, if applicable, their refund. The Maine Revenue Services provides several resources for taxpayers to check the status of their returns and refunds.

Online Tools for Status Updates

The Maine Revenue Services offers an online refund status lookup tool that allows taxpayers to check the status of their refund by entering their Social Security Number and the amount of their expected refund. This tool provides real-time updates on the progress of the refund, offering clarity on whether the return has been received, is being processed, or if the refund has been issued.

Additionally, taxpayers can create an online account with the Maine Revenue Services. This account provides a personalized dashboard where taxpayers can view their tax return and payment history, check the status of their returns and refunds, and access relevant tax forms and publications. The online account also serves as a direct communication channel with the Maine Revenue Services, allowing taxpayers to receive important notifications and updates related to their tax obligations.

Telephone Inquiries

For those who prefer not to use online tools, the Maine Revenue Services provides a telephone assistance line. Taxpayers can call this line to speak with a representative who can provide information on the status of their tax return and refund. The telephone assistance line is particularly useful for taxpayers who may have questions or concerns that require more detailed explanations or guidance.

Mail Inquiries

In certain situations, taxpayers may choose to inquire about their tax return status via mail. This method is typically reserved for complex cases or when other methods have not provided the desired information. Taxpayers should ensure that they include all relevant details, such as their Social Security Number, the tax year in question, and any specific issues they are facing.

| Tax Return Status | Description |

|---|---|

| Received | The tax return has been successfully received by the Maine Revenue Services. |

| In Progress | The tax return is currently being processed, and a refund or further action may be pending. |

| Refund Issued | The refund amount has been processed and sent to the taxpayer. |

| Review Required | The tax return requires further review or additional information from the taxpayer. |

| Error | The tax return contains errors that need to be corrected before processing can continue. |

Factors Affecting Maine Tax Return Processing

The processing time for Maine tax returns can vary based on several factors. Understanding these factors can help taxpayers manage their expectations and plan accordingly.

Filing Method

As mentioned earlier, the choice of filing method can significantly impact the processing time. Electronic filing, especially when combined with direct deposit for refunds, is generally the fastest option. On the other hand, traditional mail filing may result in longer processing times due to the need for manual handling and potential delays in postal services.

Complexity of the Return

The complexity of the tax return can also influence processing time. Returns that involve multiple income sources, business activities, or complex deductions and credits may require more time for thorough review and processing. In such cases, the Maine Revenue Services may need to request additional information or documentation from the taxpayer, further extending the processing timeline.

Peak Filing Period

The time of year when the tax return is filed can also affect processing time. During the peak filing period, which typically falls between late March and mid-April, the Maine Revenue Services receives a high volume of tax returns. This surge in activity can lead to longer processing times as the department works to handle the increased workload efficiently.

Accuracy and Completeness of the Return

The accuracy and completeness of the tax return are critical factors in determining processing time. Returns that are missing key information or contain errors may require additional review and correspondence with the taxpayer, which can significantly delay the processing timeline. Taxpayers should ensure that their returns are thoroughly reviewed for accuracy and completeness before submission to avoid potential delays.

Payment or Refund Status

The status of the taxpayer’s payment or refund can also impact the overall processing time. If a taxpayer is due a refund, the Maine Revenue Services will typically process the refund promptly once the return has been approved. However, if the taxpayer owes additional taxes, the processing time may be extended as the department works to assess the outstanding amount and ensure that all applicable taxes have been paid.

Tips for a Smooth Maine Tax Return Process

To ensure a smooth and efficient tax return process, taxpayers can take several proactive steps. These steps can help minimize potential delays and ensure that their tax obligations are met accurately and on time.

Start Early

Begin gathering your financial documents and preparing your tax return well in advance of the filing deadline. Starting early allows you to thoroughly review your financial situation, identify potential deductions or credits, and address any issues before the filing deadline.

Use Accurate Information

Ensure that all information provided on your tax return is accurate and up-to-date. This includes your personal details, income sources, deductions, and credits. Double-check all figures and ensure that they align with the corresponding documentation.

Consider Professional Assistance

If you have a complex tax situation or are unsure about certain aspects of your tax return, consider seeking the assistance of a tax professional. Certified Public Accountants (CPAs) and Enrolled Agents (EAs) are licensed to represent taxpayers before the IRS and can provide valuable guidance and support throughout the tax return process.

Stay Informed

Keep yourself updated on the latest tax laws and regulations in Maine. Changes in tax laws can impact your tax obligations and the information required on your tax return. The Maine Revenue Services website and official publications are valuable resources for staying informed about tax-related matters.

Choose the Right Filing Method

Consider your circumstances and choose the filing method that best suits your needs. Electronic filing is generally the fastest and most convenient option, especially when combined with direct deposit for refunds. However, if you prefer a more traditional approach or have complex tax issues, traditional mail filing may be more appropriate.

Keep Records and Documentation

Maintain organized records and documentation of your financial transactions throughout the year. This includes keeping receipts, invoices, bank statements, and any other relevant documents. Proper record-keeping can streamline the tax return process and provide necessary evidence in case of an audit or review.

Conclusion

Understanding the Maine tax return process and its associated status can empower taxpayers to manage their financial obligations effectively. By staying informed, using accurate information, and taking proactive steps, taxpayers can ensure a smooth and timely tax return process. The resources provided by the Maine Revenue Services, including online tools, telephone assistance, and mail inquiries, offer valuable support throughout the process. Remember, timely and accurate filing is key to avoiding penalties and interest charges, and with the right approach, taxpayers can navigate the Maine tax return process with confidence.

How can I check the status of my Maine tax refund online?

+To check your Maine tax refund status online, you can use the Maine Revenue Services’ refund status lookup tool. You’ll need to enter your Social Security Number and the amount of your expected refund. This tool provides real-time updates on the progress of your refund.

What if I don’t have access to the internet or prefer not to use online tools to check my tax return status?

+If you prefer not to use online tools, you can call the Maine Revenue Services’ telephone assistance line. A representative can provide information on the status of your tax return and refund over the phone.

What should I do if my tax return status shows an error, and what might cause such an error?

+If your tax return status shows an error, it means there is an issue with your return that needs to be corrected. Common causes of errors include missing or incorrect information, math errors, or issues with your payment or refund. The Maine Revenue Services may provide specific details about the error, and you should review your return carefully and make the necessary corrections. If you’re unsure how to proceed, consider seeking the assistance of a tax professional.

How long does it typically take for the Maine Revenue Services to process a tax return and issue a refund?

+The processing time for tax returns and refunds can vary based on several factors, including the filing method, the complexity of the return, and the time of year. Generally, electronic filing results in faster processing times compared to traditional mail filing. The Maine Revenue Services aims to process refunds within 45 days of receiving a complete and accurate return.

What should I do if I haven’t received my tax refund within the expected timeframe, and how can I track the status of my refund more closely?

+If you haven’t received your tax refund within the expected timeframe, you can use the Maine Revenue Services’ refund status lookup tool to track the status of your refund more closely. If the tool indicates that your refund has been issued but you still haven’t received it, you can contact the Maine Revenue Services’ telephone assistance line for further assistance. They can provide more detailed information about the status of your refund and help resolve any issues.