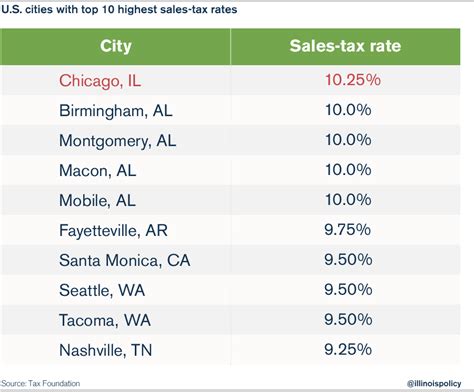

Chicago Il Sales Tax

In the bustling city of Chicago, Illinois, sales tax is an essential aspect of the local economy and an intriguing topic for anyone interested in understanding the financial landscape. With a rich history and a dynamic business environment, Chicago's sales tax regulations play a vital role in shaping the city's economic ecosystem. This comprehensive guide will delve into the intricacies of Chicago's sales tax, offering an expert-level analysis and practical insights for businesses and consumers alike.

Unraveling Chicago’s Sales Tax Landscape

Chicago, known for its vibrant culture and thriving businesses, imposes a sales tax that contributes significantly to the city’s revenue. The sales tax rate in Chicago is a combination of state, county, and city taxes, creating a unique and complex system. As of [current year], the total sales tax rate in Chicago stands at [XX]%, making it an important consideration for both local and online businesses operating within the city limits.

The city's sales tax is not a static entity; it has evolved over the years, reflecting the changing economic needs and priorities of the region. In [year], a notable shift occurred when the state of Illinois introduced a [XX]% increase in sales tax, which was then followed by a [XX]% rise in Chicago's city-specific tax, highlighting the dynamic nature of these regulations.

Understanding the Breakdown

The sales tax in Chicago is a multi-tiered system, comprising various components. Here’s a detailed breakdown:

- State Sales Tax: Currently set at [XX]%, this tax is applied uniformly across the state of Illinois, contributing significantly to the state's overall revenue.

- County Sales Tax: Chicago, being located in Cook County, has an additional [XX]% sales tax, which is dedicated to funding county-wide initiatives and services.

- City Sales Tax: The city of Chicago imposes a sales tax of [XX]%, which is specifically used to support local infrastructure, public transportation, and other city-specific projects.

- Special Taxes: In certain cases, additional taxes might be applicable for specific types of goods or services, such as a [XX]% tax on restaurant meals, further adding to the complexity of Chicago's sales tax structure.

| Tax Type | Rate |

|---|---|

| State Sales Tax | [XX]% |

| County Sales Tax (Cook County) | [XX]% |

| City Sales Tax (Chicago) | [XX]% |

| Special Taxes (e.g., Restaurant Meals) | [XX]% |

This intricate tax system ensures that various levels of government receive adequate funding while also allowing for the development and maintenance of essential city services and infrastructure.

Impact on Local Businesses

Chicago’s sales tax directly influences the operations and strategies of local businesses. For brick-and-mortar stores, the sales tax is an essential consideration when pricing goods and services, as it can affect consumer behavior and purchasing decisions. A well-managed sales tax strategy can help businesses remain competitive and attract customers.

Online Businesses and E-commerce

With the rise of e-commerce, the sales tax landscape has become even more complex. Online businesses, particularly those with a physical presence in Chicago, are required to collect and remit sales tax based on the destination of the goods or services. This destination-based sales tax model can present challenges for online retailers, especially when managing multiple shipping destinations.

To navigate these complexities, many online businesses utilize sales tax automation tools and software, ensuring accurate tax calculations and compliance with Chicago's sales tax regulations. This approach not only streamlines the tax collection process but also helps businesses avoid potential penalties and legal issues.

Case Study: Impact on Small Businesses

Consider the example of Urban Brew, a small coffee shop located in Chicago’s vibrant Loop district. With a limited budget, the owners of Urban Brew had to carefully consider the impact of sales tax on their pricing and profitability. They implemented a strategy to include the sales tax in their menu prices, ensuring a transparent pricing structure for their customers.

This approach not only simplified their pricing model but also allowed them to compete effectively with larger coffee chains. By integrating sales tax into their overall business strategy, Urban Brew was able to thrive in a highly competitive market, demonstrating the importance of a well-planned sales tax approach for small businesses.

Consumer Perspective

For consumers, understanding Chicago’s sales tax is crucial for making informed purchasing decisions. The sales tax can significantly impact the final cost of goods and services, especially for larger purchases. Being aware of the tax rates and how they are applied can help consumers budget effectively and compare prices accurately.

Online Shopping and Sales Tax

Online shopping has become increasingly popular, and consumers often compare prices across various platforms. However, it’s essential to consider the sales tax when making these comparisons. Many online retailers display prices without tax, which can lead to unexpected costs at checkout. By being mindful of sales tax, consumers can make more accurate comparisons and avoid surprises.

Additionally, with the rise of online marketplaces, consumers now have access to a wider range of products from different states and countries. Understanding the sales tax implications for these purchases is crucial, as the tax rates may vary depending on the origin of the goods.

Sales Tax Exemptions and Discounts

It’s worth noting that certain items and services in Chicago are exempt from sales tax, offering consumers an opportunity to save. These exemptions can include necessities like groceries, medications, and educational materials. Additionally, special discount periods, such as the annual Sales Tax Holiday, provide an opportunity for consumers to make tax-free purchases, further reducing their overall spending.

The Future of Chicago’s Sales Tax

As Chicago continues to evolve and adapt to economic changes, its sales tax landscape is likely to undergo further transformations. With the increasing popularity of e-commerce and the changing nature of consumer behavior, the city’s tax regulations will need to remain flexible and responsive.

Potential Changes and Implications

One potential area of change could be the implementation of a FairTax system, which aims to simplify the tax structure by eliminating various taxes and replacing them with a single, more transparent tax. While this idea has gained traction in some circles, it remains a topic of debate among policymakers and economists.

Additionally, with the ongoing digital transformation, the city might explore the use of blockchain technology for tax collection and management, ensuring a more secure and efficient system. Such innovations could significantly impact the way businesses and consumers interact with Chicago's sales tax regulations.

As Chicago navigates these potential changes, it is essential for businesses and consumers to stay informed and adaptable, ensuring they can effectively navigate the evolving sales tax landscape.

What is the current sales tax rate in Chicago?

+The current sales tax rate in Chicago is [XX]%, which includes state, county, and city taxes.

Are there any special taxes in Chicago, apart from the general sales tax?

+Yes, Chicago has specific taxes for certain goods and services, such as a [XX]% tax on restaurant meals.

How does Chicago’s sales tax impact online businesses?

+Online businesses must consider destination-based sales tax, ensuring they collect and remit taxes based on the customer’s location. This can be managed using sales tax automation tools.