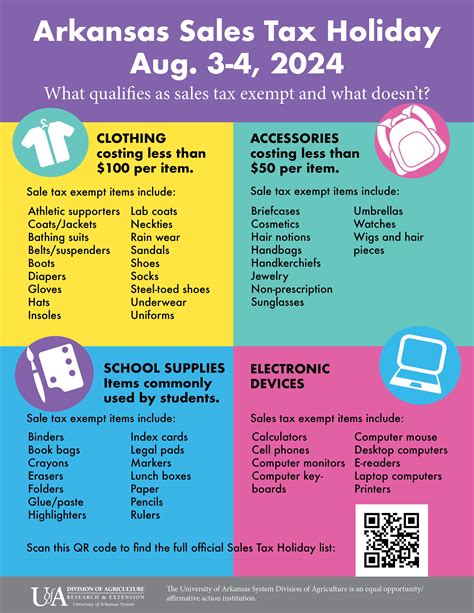

Tax Free Weekend Arkansas

Arkansas, a state renowned for its natural beauty and vibrant communities, offers residents and visitors an exciting opportunity to save on their shopping sprees with the annual Tax-Free Weekend. This much-anticipated event is a boon for shoppers, allowing them to make significant savings on essential items without the burden of sales tax. In this article, we delve into the details of Arkansas' Tax-Free Weekend, exploring its history, eligible items, and providing valuable insights to help you make the most of this special shopping occasion.

A History of Savings: Arkansas' Tax-Free Weekend

The concept of Tax-Free Weekend is not a novel idea, but rather a well-established tradition in many states across the US. Arkansas first introduced its Tax-Free Weekend in 1997, with the primary aim of providing relief to families gearing up for the upcoming school year. Over the years, this event has become a highly anticipated fixture on the state's calendar, offering substantial savings to residents.

The original intent of Tax-Free Weekend was to assist families in purchasing school supplies and clothing without the added expense of sales tax. However, over time, the event has evolved to encompass a broader range of items, making it a beneficial shopping opportunity for all Arkansans, not just those with school-going children.

The Arkansas Tax-Free Weekend typically falls on the first weekend of August, offering a convenient and cost-effective way to stock up on essential items before the start of the school year.

Eligible Items: What's on the Tax-Free List?

The Arkansas Tax-Free Weekend is an opportunity to save on a wide array of items, from clothing and footwear to school supplies and even technology. Understanding the eligible items is key to making the most of this event.

Clothing and Footwear

One of the most popular categories during Tax-Free Weekend is clothing and footwear. Arkansas waives sales tax on clothing items priced under a certain threshold. This includes a diverse range of apparel, from casual wear to formal attire, ensuring that you can refresh your wardrobe without the added tax.

Footwear is also included in this category, making it an excellent time to invest in new shoes, sneakers, or boots. Whether you're looking for comfortable everyday shoes or a stylish pair for special occasions, Tax-Free Weekend offers an excellent opportunity to save.

| Clothing and Footwear Threshold | $100 |

|---|---|

| Items Priced Under | Tax-Free |

School Supplies

Tax-Free Weekend is a godsend for parents and students preparing for the new school year. Arkansas exempts a wide range of school supplies from sales tax, making it an ideal time to stock up on essential items.

From notebooks and pens to calculators and backpacks, you can find everything you need for a successful academic year. Additionally, items such as art supplies, musical instruments, and even computers and software are often included in the tax-free category, offering significant savings on educational tools.

| School Supplies Threshold | $2,500 |

|---|---|

| Items Priced Under | Tax-Free |

Technology and Electronics

In a move to encourage digital literacy and provide relief to families, Arkansas includes technology and electronics in its Tax-Free Weekend offerings. This category covers a wide range of devices, including computers, laptops, tablets, and even certain software.

Whether you're a student needing a new laptop for college or a parent looking to upgrade your home office setup, Tax-Free Weekend presents an excellent opportunity to save on these often costly items.

| Technology and Electronics Threshold | $2,500 |

|---|---|

| Items Priced Under | Tax-Free |

Planning Your Tax-Free Shopping Spree

With the Arkansas Tax-Free Weekend fast approaching, it's essential to plan your shopping strategy to make the most of this event. Here are some tips to help you navigate this exciting shopping occasion:

- Create a Shopping List: Start by making a comprehensive list of items you need or plan to purchase. This will help you stay focused and ensure you don't miss out on any essential purchases.

- Research Prices: Compare prices across different retailers to ensure you're getting the best deals. Many stores offer additional discounts and promotions during Tax-Free Weekend, so keep an eye out for these opportunities.

- Check Store Policies: Different retailers may have varying policies regarding Tax-Free Weekend. Some may offer additional discounts or promotions, while others may have specific rules about eligible items. Familiarize yourself with these policies to make informed decisions.

- Consider Online Shopping: If you're unable to shop in-store, many retailers offer online shopping with tax-free benefits during this period. Take advantage of this option to enjoy the savings from the comfort of your home.

- Stay Informed: Keep yourself updated on any changes or updates to the Tax-Free Weekend regulations. This will ensure you're aware of any new eligible items or any adjustments to the tax thresholds.

Maximizing Your Savings: Strategies for a Successful Tax-Free Weekend

To ensure you maximize your savings during Arkansas' Tax-Free Weekend, consider these strategic tips:

- Combine Tax-Free with Sales: Many retailers offer sales and promotions during Tax-Free Weekend, so combine these discounts with the tax exemption to maximize your savings. Look out for clearance sales or store-wide promotions to make the most of this opportunity.

- Use Coupons and Rewards: Take advantage of coupons, loyalty programs, and rewards points to further reduce your expenses. Many retailers offer additional discounts for loyal customers or those who use specific payment methods, so explore these options.

- Plan Your Timing: Consider shopping during off-peak hours to avoid crowds and long queues. This can also help you have a more relaxed shopping experience and ensure you have enough time to find the items you need.

- Compare Online and In-Store Prices: Sometimes, the same item may be priced differently online and in-store. Compare prices across different channels to ensure you're getting the best deal.

- Bundle Your Purchases: If you're buying multiple items, consider bundling your purchases to maximize your savings. This way, you can ensure that all eligible items fall under the tax-free threshold.

A Word of Caution: Understanding the Limitations

While Arkansas' Tax-Free Weekend offers substantial savings, it's important to understand its limitations. Not all items are eligible for tax exemption, and there may be specific rules and regulations that apply. Here are some key points to keep in mind:

- The tax exemption only applies to qualifying items purchased during the designated Tax-Free Weekend. Any purchases made before or after this period will be subject to sales tax.

- Certain items, such as jewelry, watches, and certain luxury goods, are typically not included in the tax-free category. Always check the official list of eligible items to avoid any surprises.

- Some retailers may have specific policies regarding tax-free purchases. It's advisable to clarify these policies with the store before making your purchases.

- The tax exemption is not applicable to shipping and handling charges, so be sure to factor these costs into your budget.

Future Outlook: What's Next for Arkansas' Tax-Free Weekend

Arkansas' Tax-Free Weekend has become an integral part of the state's retail landscape, offering substantial savings to residents and contributing to the local economy. As we look to the future, it's evident that this event will continue to play a vital role in the state's shopping calendar.

With the increasing popularity of online shopping, it's likely that Arkansas will continue to adapt its Tax-Free Weekend policies to accommodate this trend. This may include extending the tax exemption to online purchases or implementing specific regulations for e-commerce platforms.

Furthermore, as the state continues to evolve and adapt to changing consumer needs, we can expect to see the eligible items category expand to include new and emerging technologies. This could include items such as smart home devices, virtual reality gear, and other innovative products.

Arkansas' commitment to providing tax relief to its residents during this annual event is a testament to its understanding of the needs and challenges faced by its citizens. As the state continues to grow and prosper, Tax-Free Weekend will undoubtedly remain a much-loved tradition, offering a unique opportunity for savings and a boost to the local economy.

Frequently Asked Questions

When is Arkansas’ Tax-Free Weekend in 2024?

+

Arkansas’ Tax-Free Weekend typically falls on the first weekend of August each year. For 2024, it is expected to be held on August 2nd and 3rd, but it’s advisable to check the official state website for any updates closer to the date.

Are there any restrictions on the number of items I can purchase during Tax-Free Weekend?

+

No, there are no restrictions on the quantity of items you can purchase during Tax-Free Weekend. However, it’s important to ensure that each item falls within the eligible price range to qualify for the tax exemption.

Can I purchase items online and still enjoy the tax-free benefits?

+

Yes, many retailers offer online shopping with tax-free benefits during Arkansas’ Tax-Free Weekend. However, it’s advisable to check the retailer’s policies and ensure that the items you select are eligible for the tax exemption.

Are there any specific rules for returning tax-free items?

+

Return policies may vary depending on the retailer. Some stores may offer full refunds or exchanges for tax-free items, while others may deduct the tax amount from the refund. It’s best to check the store’s return policy before making a purchase.

Can I combine Tax-Free Weekend with other discounts or promotions?

+

Absolutely! Tax-Free Weekend is an excellent opportunity to combine tax-free savings with other discounts and promotions offered by retailers. Keep an eye out for store-wide sales or specific promotions during this period to maximize your savings.