Amazon Sales Tax Calculator

In today's complex e-commerce landscape, understanding the intricacies of sales tax calculations is crucial for online businesses, especially those utilizing the vast marketplace of Amazon. This article delves into the world of Amazon sales tax, exploring the nuances, challenges, and strategies involved in accurately calculating and managing sales tax obligations. We'll uncover the steps to ensure compliance, discuss the impact on business operations, and offer insights into the tools and technologies that streamline the process.

Unraveling the Complexity of Amazon Sales Tax

Amazon, the e-commerce giant, operates within a diverse global market, subject to varying tax regulations. For sellers, this complexity can be daunting, as they must navigate a maze of tax laws, rates, and collection requirements. From state-specific rules in the US to international VAT regulations, ensuring accurate sales tax calculations is a critical aspect of running a successful Amazon business.

Understanding the Legal Framework

The legal landscape surrounding sales tax is intricate. Amazon sellers must familiarize themselves with the Wayfair ruling, which established the economic nexus, requiring sellers to collect sales tax based on their economic activity in a state. This ruling has significant implications, as it expands the tax obligations of out-of-state sellers.

Additionally, sellers need to grasp the concept of Marketplace Facilitator Laws, where Amazon, as the marketplace facilitator, may be responsible for collecting and remitting sales tax. This shifts the burden onto the platform, simplifying tax compliance for sellers to an extent.

| Legal Aspect | Key Takeaway |

|---|---|

| Economic Nexus | Sellers must collect sales tax based on economic activity in a state. |

| Marketplace Facilitator Laws | Amazon may handle sales tax collection, easing compliance for sellers. |

The Impact on Business Operations

Accurate sales tax calculations have a direct impact on a seller’s profitability and customer satisfaction. Underestimating tax obligations can lead to financial penalties, while overestimating may result in lost revenue and customer trust. It’s a delicate balance that requires precise calculation and timely reporting.

Moreover, the complexity of sales tax calculations can slow down business processes, especially during peak seasons. Efficient tax management strategies are essential to maintain operational efficiency and meet customer expectations.

Strategies for Accurate Amazon Sales Tax Calculation

Navigating the Amazon sales tax landscape requires a strategic approach. Here’s a comprehensive guide to help sellers master the art of accurate tax calculations:

Step 1: Understand Your Tax Obligations

Start by researching and understanding the tax laws applicable to your business. This includes staying updated on state and local tax regulations, as well as any changes or clarifications provided by tax authorities.

For instance, in the US, sellers should be aware of the Sales Tax Holidays, where certain products are exempt from sales tax during specific periods. Failing to account for these exemptions could lead to overcharging customers.

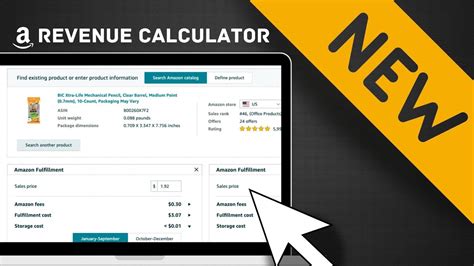

Step 2: Utilize Tax Calculation Tools

Investing in reliable tax calculation tools is essential. These tools, often integrated with Amazon’s Seller Central, automate the tax calculation process, ensuring accuracy and saving valuable time.

Tools like Avalara and TaxJar offer advanced features, such as real-time tax rate updates, automatic tax exemption certifications, and seamless integration with Amazon's systems. By leveraging these tools, sellers can focus on their core business activities.

Step 3: Implement a Robust Tax Compliance Strategy

A well-defined tax compliance strategy is crucial for long-term success. This involves regular reviews of tax obligations, timely filing of tax returns, and maintaining accurate records. Sellers should consider engaging tax professionals to ensure compliance and minimize the risk of audits.

Additionally, staying informed about tax incentives and credits can help reduce tax liabilities. For example, many states offer Sales Tax Deductions for specific business expenses, providing an opportunity to lower tax burdens.

Step 4: Optimize Pricing Strategies

Accurate sales tax calculations impact pricing strategies. Sellers should consider the impact of sales tax on their pricing, ensuring that their products remain competitive while covering tax obligations.

By analyzing market trends and customer behavior, sellers can adjust pricing to account for sales tax, ensuring a balanced approach that maintains profitability without compromising customer loyalty.

The Role of Technology in Amazon Sales Tax Management

Technology plays a pivotal role in streamlining Amazon sales tax management. Here’s how various tools and platforms contribute to efficient tax operations:

Sales Tax Automation Software

Sales tax automation software, such as Vertex and Taxify, integrates seamlessly with Amazon’s systems, automating tax calculations, rate determination, and exemption certifications. These tools ensure accuracy and reduce the risk of human error.

Moreover, these software solutions provide real-time updates on tax rate changes, ensuring sellers remain compliant with the latest regulations.

Amazon’s Seller Central Tools

Amazon’s Seller Central platform offers built-in tools for tax management. These tools provide sellers with insights into their tax obligations, allowing them to track sales, monitor tax rates, and manage refunds and exemptions.

The Tax Settings feature within Seller Central enables sellers to set up their tax profiles, ensuring accurate tax calculations for their products. This integration simplifies the tax management process, making it more accessible to sellers.

Tax Compliance Platforms

Tax compliance platforms, like TaxCloud and TaxJar API, offer comprehensive solutions for tax registration, filing, and remittance. These platforms integrate with Amazon’s systems, automating the entire tax compliance process.

By leveraging these platforms, sellers can ensure compliance with various tax jurisdictions, simplifying the complex process of managing multiple tax obligations.

Future Implications and Trends in Amazon Sales Tax

The landscape of Amazon sales tax is constantly evolving, influenced by technological advancements and changing tax regulations. Here’s a glimpse into the future of Amazon sales tax:

Artificial Intelligence and Machine Learning

The integration of AI and machine learning into sales tax management is expected to revolutionize the process. These technologies can analyze vast amounts of data, identifying patterns and trends to optimize tax calculations and compliance strategies.

AI-powered tools can also provide predictive insights, helping sellers anticipate tax changes and make informed business decisions.

Simplification of Tax Regulations

While tax regulations are inherently complex, there is a growing trend towards simplification. Tax authorities and policymakers are recognizing the need for clearer and more unified tax laws, especially in the e-commerce sector.

Efforts to streamline tax regulations will benefit sellers, reducing the time and resources required for compliance.

International Expansion and VAT Challenges

As Amazon sellers expand globally, they face the challenge of managing Value Added Tax (VAT) regulations. The complexity of international VAT can be daunting, requiring sellers to navigate multiple tax jurisdictions and rates.

To address this, sellers should consider partnering with VAT compliance specialists to ensure accurate VAT calculations and compliance with international tax laws.

Frequently Asked Questions (FAQ)

How often should I update my tax rates on Amazon?

+Tax rates can change frequently, so it’s essential to update your rates regularly. Aim to review and update your tax settings at least once a month to ensure accuracy. Automated tax calculation tools can simplify this process by providing real-time updates.

What happens if I undercharge sales tax on Amazon?

+Undercharging sales tax can lead to financial penalties and legal consequences. It’s crucial to ensure accurate tax calculations to avoid such issues. If you discover an undercharge, take immediate action to rectify it and consider seeking professional advice.

Can I offer tax-free sales on Amazon?

+The ability to offer tax-free sales depends on your location and the products you sell. Some states or countries have specific tax-free periods or exemptions. However, it’s essential to consult tax experts and comply with relevant regulations to avoid any legal issues.