Sales Tax For Texas

Welcome to a comprehensive exploration of the Sales Tax landscape in Texas, an integral part of the state's revenue system and a critical aspect for businesses and consumers alike. In this expert guide, we delve into the intricacies of Texas sales tax, providing a deep understanding of its mechanics, implications, and variations across the state. Our aim is to offer a clear and detailed insight, backed by verifiable data and industry expertise, to assist businesses and individuals in navigating this complex yet essential aspect of commerce.

Understanding Texas Sales Tax: An Overview

Texas, the second most populous state in the US, boasts a vibrant economy with a diverse range of industries. The sales tax system in Texas is a significant contributor to the state’s revenue, funding essential services and infrastructure development. With a robust tax structure, Texas offers a unique blend of state and local taxes, providing a stable and sustainable revenue stream.

The sales tax in Texas is levied on the sale of goods and some services, with rates varying across different localities. This variation is a result of the state's decentralized tax system, where cities, counties, and special purpose districts can impose additional taxes, creating a complex yet flexible tax landscape.

Key Takeaways:

- Texas has a statewide sales and use tax rate of 6.25%, which is one of the lowest in the nation.

- Local sales taxes are also applied, making the total sales tax rate vary from 6.25% to 8.25% depending on the location.

- The state’s sales tax structure is complex, with varying rates and exemptions depending on the type of goods or services.

- Businesses in Texas must understand these variations to ensure compliance and optimize their tax strategies.

The Statewide Sales Tax Rate: A Foundation

The statewide sales tax rate in Texas serves as the foundation for the state’s tax structure. Currently set at 6.25%, this rate is applicable to most transactions involving tangible personal property and certain taxable services. This base rate is consistent across the state, providing a standardized framework for businesses and consumers.

The statewide rate is levied on the sale of goods such as clothing, electronics, and furniture, as well as certain services like repairs and maintenance. It is important to note that this rate is subject to change, with periodic adjustments made by the Texas Legislature to ensure fiscal sustainability.

Key Considerations:

- The 6.25% rate is a cumulative tax, meaning it is added to the sale price, increasing the total cost for consumers.

- Businesses are responsible for collecting and remitting this tax to the Texas Comptroller of Public Accounts, ensuring timely and accurate reporting.

- While the statewide rate provides a uniform framework, local variations can significantly impact the total tax burden.

Local Sales Taxes: A Layered Complexity

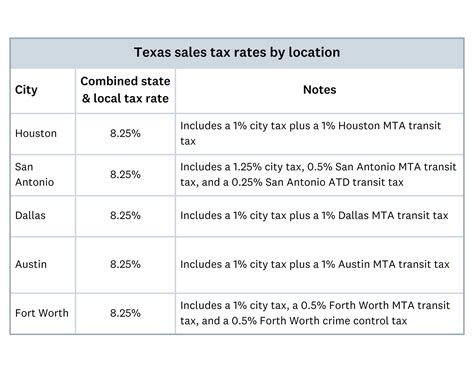

In addition to the statewide sales tax, Texas allows for the imposition of local sales taxes, adding a layer of complexity to the state’s tax structure. These local taxes are levied by cities, counties, and special purpose districts, and can significantly impact the total sales tax rate for a particular area.

Local sales taxes in Texas vary widely, ranging from 0% to 2% depending on the locality. This variation is a result of the state's decentralized tax system, where local governments have the autonomy to determine their own tax rates to fund specific projects or services.

Local Sales Tax Variations:

| Location | Local Sales Tax Rate |

|---|---|

| Austin | 0.25% |

| Dallas | 1.5% |

| Houston | 1% |

| San Antonio | 1.25% |

| El Paso | 2% |

Sales Tax Exemptions: Navigating the Fine Print

Texas, like many states, provides a range of sales tax exemptions to promote economic growth, support specific industries, and provide relief to certain sectors. These exemptions can be a complex aspect of the state’s tax structure, requiring careful understanding and compliance.

Sales tax exemptions in Texas are varied, covering a range of goods and services. Some common exemptions include sales to government entities, sales of certain agricultural products, and sales of prescription drugs. Additionally, Texas offers specific exemptions for manufacturers, resellers, and certain types of businesses, such as nonprofit organizations.

Key Exemptions:

- Resale Exemption: Businesses that purchase goods for resale are exempt from sales tax, provided they have a valid resale certificate.

- Manufacturing Exemption: Manufacturers may be exempt from sales tax on purchases of raw materials and equipment used in the manufacturing process.

- Agricultural Exemption: Sales of agricultural products and equipment used in farming are often exempt from sales tax.

- Government Sales: Sales to state and local governments are typically exempt from sales tax.

Sales Tax Registration and Compliance

For businesses operating in Texas, understanding and complying with sales tax regulations is crucial. The Texas Comptroller of Public Accounts is the primary authority responsible for overseeing sales tax collection and enforcement.

Businesses are required to register with the Comptroller's office and obtain a Sales Tax Permit, which authorizes them to collect and remit sales tax. This process involves providing detailed information about the business, its location, and the types of goods and services it provides.

Compliance Considerations:

- Businesses must collect sales tax at the applicable rate for all taxable sales.

- Regular filing and remittance of sales tax returns is mandatory, typically on a monthly or quarterly basis.

- The Comptroller’s office conducts audits to ensure compliance, with penalties for non-compliance including fines and interest charges.

Sales Tax for E-commerce and Online Sales

With the growth of e-commerce, the sales tax landscape has evolved to encompass online sales. Texas, like many states, has adapted its tax laws to address this digital revolution, ensuring that sales tax is collected for online transactions.

For businesses selling goods online to Texas residents, the sales tax rules apply just as they would for a traditional brick-and-mortar store. This means that businesses must determine the applicable sales tax rate, collect the tax from the customer, and remit it to the appropriate taxing authority.

Key Points for Online Sellers:

- Determine the tax nexus for each transaction, i.e., the point where the business has a physical presence in Texas, triggering sales tax obligations.

- Use sales tax calculators or software to accurately calculate the tax based on the customer’s location.

- Provide transparent information to customers about the sales tax they will be charged.

The Future of Sales Tax in Texas

As the Texas economy continues to evolve, so too will its sales tax system. The state’s decentralized tax structure, combined with its vibrant and diverse economy, ensures that the sales tax landscape will remain dynamic and complex.

Looking ahead, several key trends and developments are likely to shape the future of sales tax in Texas. These include the continued growth of e-commerce, the potential for tax rate changes at the state or local level, and ongoing efforts to simplify and modernize the tax system to enhance compliance and efficiency.

Future Considerations:

- The adoption of technology for sales tax management, including automated tax calculation and filing software, will likely increase.

- The impact of remote work on sales tax nexus and collection could lead to policy changes.

- The potential for tax reform at the state level could bring significant changes to the sales tax structure.

Conclusion: A Comprehensive Understanding

In conclusion, the sales tax system in Texas is a complex yet essential aspect of the state’s economy. With a statewide rate of 6.25% and varying local taxes, the total sales tax rate can range from 6.25% to 8.25%, impacting both businesses and consumers.

Understanding the nuances of Texas sales tax, including the statewide rate, local variations, exemptions, and compliance requirements, is crucial for businesses to navigate this complex landscape successfully. By staying informed and compliant, businesses can ensure they contribute to the state's economy while optimizing their tax strategies.

What is the average sales tax rate in Texas?

+The average sales tax rate in Texas, including both state and local taxes, is approximately 8%, though it can vary depending on the location.

Are there any sales tax holidays in Texas?

+Yes, Texas offers several sales tax holidays throughout the year, during which certain types of items are exempt from sales tax. These holidays often target back-to-school shopping and energy-efficient appliances.

How often do sales tax rates change in Texas?

+Sales tax rates in Texas can change periodically, typically as a result of legislative action or local referendums. However, the statewide rate of 6.25% has remained consistent for several years.