Property Tax Denton County

Property taxes are a significant financial obligation for homeowners and businesses alike. In Denton County, Texas, understanding the property tax system and its unique features is crucial for effective financial planning. This comprehensive guide aims to delve into the intricacies of Property Tax Denton County, providing an in-depth analysis of the assessment process, tax rates, and payment options. By exploring real-world examples and industry insights, we will equip you with the knowledge to navigate this essential aspect of homeownership.

Navigating Property Taxes in Denton County: An In-Depth Guide

Property taxes in Denton County are an essential component of the local economy and infrastructure development. The county’s tax system, while complex, is designed to ensure fair and equitable assessments for all property owners. This section provides an overview of the key aspects of property taxes in Denton County, shedding light on the process from assessment to payment.

The Assessment Process: A Detailed Breakdown

The property tax assessment process in Denton County begins with the appraisal district, which is responsible for determining the value of each property within the county. This value, known as the appraised value, forms the basis for calculating the property tax bill. The appraisal district employs a team of professionals who assess properties based on various factors, including market trends, property characteristics, and recent sales data.

For instance, consider the case of a residential property in Denton County. The appraisal district would evaluate factors such as the property's square footage, number of bedrooms and bathrooms, age of the structure, and any recent improvements or additions. These details are then compared to similar properties in the area to ensure an accurate and fair appraisal.

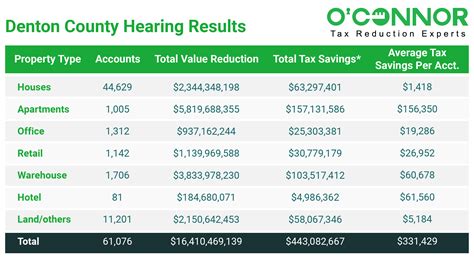

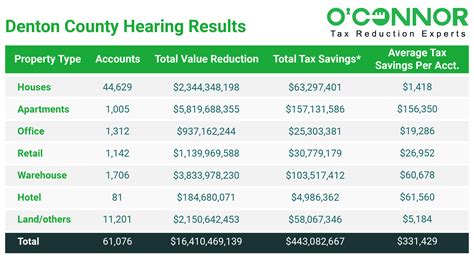

Once the appraised value is determined, it is subject to a protest period during which property owners can challenge the assessed value. This process allows for transparency and ensures that property owners have an opportunity to provide additional information or dispute any inaccuracies. The protest period typically occurs annually, providing homeowners with a chance to review and address any concerns regarding their property's value.

| Protest Period Dates | Appraisal District Contact |

|---|---|

| May 15th - June 15th | Denton County Appraisal District: (940) 349-3500 |

Following the protest period, the appraisal district finalizes the appraised values, and the tax rate is set by the various taxing entities, including the county, school districts, and municipalities.

Understanding Tax Rates and Calculations

The property tax rate in Denton County is determined by a combination of tax rates set by different taxing entities. These entities include the county government, school districts, community colleges, and special districts such as water districts or hospital districts. Each entity sets its own tax rate, which is then applied to the appraised value of the property.

To calculate the total property tax bill, the appraised value is multiplied by the effective tax rate, which is the sum of all the tax rates from the various entities. For example, if a property has an appraised value of $200,000 and the effective tax rate is 2%, the property tax bill would be $4,000.

Denton County provides an online tax rate database that allows property owners to look up the tax rates for their specific property. This tool is a valuable resource for understanding the breakdown of tax rates and how they contribute to the overall tax bill.

It's worth noting that tax rates can vary significantly depending on the location within Denton County. For instance, properties located within certain school districts may have higher tax rates to support education initiatives, while others might benefit from lower tax rates due to different taxing entity priorities.

Payment Options and Deadlines

Denton County offers several payment options to accommodate the diverse financial needs of property owners. The primary method is through an online payment portal, which provides a convenient and secure way to make payments. Property owners can also opt for traditional methods such as mailing a check or money order to the tax office or paying in person at the designated tax collection offices.

The tax collection period typically begins in October and extends until January of the following year. It's important for property owners to be aware of the deadlines to avoid late fees and penalties. Denton County provides a detailed tax calendar on its website, outlining important dates and milestones throughout the tax year.

Additionally, Denton County offers a tax payment plan for property owners who may require more flexible payment options. This plan allows for monthly installments, providing a manageable way to budget for property taxes throughout the year. It's advisable for property owners to explore these payment options and choose the one that best suits their financial circumstances.

Comparative Analysis: Denton County vs. Surrounding Areas

To gain a comprehensive understanding of property taxes in Denton County, it’s beneficial to compare it with neighboring counties and regions. This section provides a comparative analysis, highlighting the unique aspects and considerations of property taxes in Denton County relative to other areas.

Tax Rates and Assessment Trends

When comparing tax rates across different counties, it’s essential to consider the overall tax burden and how it affects property owners. Denton County’s tax rates, while varying depending on the specific taxing entity, are generally competitive with surrounding counties. This balance ensures that property owners in Denton County are not disproportionately burdened compared to their regional counterparts.

For instance, let's compare Denton County with Tarrant County, a neighboring county with a similar population and economic profile. While the tax rates may differ slightly between the two counties, the overall tax burden for a property of similar value would be comparable. This analysis helps property owners make informed decisions when considering different locations for their real estate investments.

Additionally, Denton County's appraisal district employs a market-driven approach to assessments, ensuring that property values are aligned with the current real estate market. This approach minimizes the impact of rapid market fluctuations and provides stability for property owners. In contrast, some counties may experience more volatile assessment trends, leading to unexpected tax increases or decreases.

Impact on Homeownership and Investment

Property taxes play a significant role in the decision-making process for homebuyers and real estate investors. Denton County’s property tax system, with its fair assessment process and competitive tax rates, contributes to a stable and attractive real estate market. This, in turn, fosters economic growth and supports the local community.

For homebuyers, the predictability and transparency of Denton County's property tax system provide peace of mind. They can make informed decisions about their financial commitments and budget accordingly. Real estate investors also benefit from the county's stable tax environment, as it reduces uncertainty and allows for more accurate financial projections.

Furthermore, Denton County's commitment to infrastructure development and education initiatives, funded in part by property taxes, enhances the overall quality of life and attracts businesses and residents. This positive feedback loop strengthens the local economy and contributes to the long-term success of the county.

Future Implications and Tax Planning Strategies

As the real estate market evolves and economic conditions change, it’s essential for property owners to stay informed and adapt their tax planning strategies. This section explores the future implications of property taxes in Denton County and provides valuable insights for effective financial management.

Economic Factors and Market Fluctuations

Economic factors, such as interest rates, inflation, and market trends, can significantly impact property values and, consequently, property taxes. Denton County’s appraisal district actively monitors these factors to ensure that assessments remain fair and accurate. However, property owners should be aware of potential changes and their impact on their tax obligations.

For instance, during periods of economic growth and rising property values, property owners may experience an increase in their tax burden. On the other hand, economic downturns or stagnant market conditions may lead to reduced property values and, subsequently, lower tax assessments. It's crucial for property owners to stay updated on market trends and assess their financial position accordingly.

Tax Planning Strategies for Property Owners

Effective tax planning is essential for property owners to optimize their financial strategies and minimize their tax burden. Here are some key strategies to consider:

- Regularly Review Assessments: Stay informed about your property's appraised value and review the assessment details annually. This allows you to identify any discrepancies or changes that may impact your tax obligations.

- Utilize Tax Deductions and Exemptions: Denton County offers various tax deductions and exemptions, such as the homestead exemption, which can reduce your taxable value. Understand the eligibility criteria and take advantage of these opportunities to lower your tax bill.

- Consider Investment Properties: Investing in rental properties can provide additional income streams and potential tax benefits. Consult with a tax professional to explore strategies for maximizing tax advantages associated with rental properties.

- Explore Alternative Payment Options: Denton County's tax payment plan can be a valuable tool for managing cash flow. Consider utilizing this option to spread out your tax payments and make them more manageable.

Conclusion

Understanding property taxes in Denton County is a crucial aspect of financial planning for homeowners and investors. By delving into the assessment process, tax rates, and payment options, this guide has provided a comprehensive overview of the property tax system in the county. With its fair and transparent approach, Denton County ensures that property owners are well-equipped to manage their tax obligations effectively.

Stay informed, explore tax planning strategies, and leverage the resources provided by the county to navigate the property tax landscape successfully. Remember, effective financial management is key to enjoying the benefits of homeownership and contributing to the vibrant community of Denton County.

What is the average property tax rate in Denton County?

+The average effective tax rate in Denton County varies depending on the location and taxing entities. As of the latest data, the average effective tax rate ranges from 1.7% to 2.2%.

When is the protest period for property tax assessments in Denton County?

+The protest period typically occurs from May 15th to June 15th annually. Property owners can dispute their assessed value during this period.

How can I pay my property taxes in Denton County?

+Denton County offers various payment options, including online payments, mailing checks, and in-person payments at designated tax collection offices. The tax office also provides a tax payment plan for flexible payment arrangements.

Are there any tax exemptions or deductions available in Denton County?

+Yes, Denton County offers several tax exemptions and deductions, such as the homestead exemption, disabled veteran exemption, and over-65 exemption. These exemptions can reduce the taxable value of your property, resulting in lower tax bills.

How often are property values reassessed in Denton County?

+Property values are typically reassessed annually in Denton County. The appraisal district conducts a comprehensive review of property values based on market trends and other relevant factors.