Nm State Tax Refund

In New Mexico, state tax refunds are an important financial topic for residents and businesses alike. These refunds can provide a much-needed boost to individuals' financial stability and contribute to economic growth by injecting funds back into the local economy. The process of understanding and claiming state tax refunds in New Mexico involves a combination of knowledge about the state's tax laws, eligibility criteria, and the specific procedures for filing and receiving refunds.

Understanding the Basics of New Mexico State Tax Refunds

New Mexico's tax system, like many other states, offers an opportunity for residents and businesses to receive refunds if they have overpaid their taxes during the fiscal year. These refunds are a result of various factors, including tax deductions, credits, and exemptions, which can reduce the overall tax liability of an individual or entity.

The state's gross receipts tax is a significant component of its tax system, levied on the sale of goods and services within the state. This tax, along with the compensating tax on out-of-state purchases, forms the basis for many tax refund claims. Additionally, New Mexico offers a variety of tax credits and incentives, such as the Low-Income Worker Tax Credit and the Research and Development Tax Credit, which can further reduce tax liabilities and potentially lead to refunds.

Eligibility and Criteria for Refunds

Eligibility for a New Mexico state tax refund depends on several factors. Firstly, individuals must have filed their state tax returns accurately and on time. Late or incomplete filings can lead to delays or even denial of refunds. Secondly, the taxpayer's income, deductions, and credits must meet the state's criteria for refund eligibility. For instance, the Low-Income Worker Tax Credit is available to individuals and families with low to moderate incomes, providing a refundable credit of up to $1,200.

| Tax Credit | Eligibility Criteria |

|---|---|

| Low-Income Worker Tax Credit | Income below a certain threshold (varies annually) |

| Research and Development Tax Credit | Businesses conducting qualified research activities |

| Job Creation Tax Credit | Businesses creating new full-time jobs in New Mexico |

It's important to note that while these credits can lead to refunds, they must be claimed on the appropriate tax forms. Failure to do so may result in the forfeiture of the refund.

The Process of Claiming a Refund

Claiming a New Mexico state tax refund involves several steps. First, taxpayers must ensure they have all the necessary documentation, including W-2s, 1099s, and any other tax-related forms. Then, they must complete the appropriate tax forms, such as the Individual Income Tax Return (Form PIT-1) or the Business Tax Return (Form CIT-1), depending on their status.

When filing, it's crucial to review the forms carefully and ensure all deductions, credits, and exemptions are claimed accurately. This step can be complex, especially for businesses or individuals with multiple sources of income or complex financial situations. Therefore, seeking the advice of a tax professional or using reputable tax preparation software can be beneficial.

Once the forms are completed, taxpayers can file their returns electronically or by mail. The New Mexico Taxation and Revenue Department (TRD) encourages electronic filing, as it's faster, more secure, and reduces the chances of errors. After filing, taxpayers must wait for the TRD to process their returns, which can take several weeks. During this time, it's essential to keep track of the refund status using the tools provided by the TRD, such as the online refund tracker or the automated phone system.

Maximizing Your New Mexico State Tax Refund

Maximizing your state tax refund in New Mexico involves a strategic approach to tax planning and filing. Here are some key strategies to consider:

Take Advantage of Tax Credits and Deductions

New Mexico offers a range of tax credits and deductions that can significantly reduce your tax liability and increase your potential refund. For example, the Property Tax Credit can provide a refund of up to $300 for homeowners, while the Dependent Care Tax Credit can help offset the costs of childcare. Understanding and claiming these credits is essential to maximizing your refund.

| Tax Credit | Description |

|---|---|

| Property Tax Credit | A refundable credit for homeowners based on property taxes paid |

| Dependent Care Tax Credit | A credit for expenses related to caring for a dependent child or adult |

| Child and Dependent Care Tax Credit | A federal credit for childcare expenses, which can be claimed in addition to the state credit |

Consider Tax-Efficient Retirement Savings

Contributing to tax-advantaged retirement accounts, such as IRAs or 401(k)s, can reduce your taxable income and increase your refund. These accounts allow you to save for retirement while lowering your tax liability. For instance, contributions to a Traditional IRA are tax-deductible, which can result in immediate tax savings and a larger refund.

Utilize Education Credits and Tuition Payments

If you or a dependent are pursuing higher education, you may be eligible for tax credits or deductions related to tuition and fees. The American Opportunity Tax Credit, for example, can provide a credit of up to $2,500 for qualified education expenses. Additionally, tuition payments may be deductible or eligible for tax credits, further reducing your tax liability.

Optimize Business Expenses and Tax Strategies

For business owners, careful management of expenses and tax strategies can lead to significant tax savings and larger refunds. This includes tracking and deducting business expenses, such as office supplies, travel, and advertising costs. Additionally, understanding and claiming business tax credits, like the New Mexico Economic Development Tax Credit, can further reduce tax liabilities.

Avoiding Common Pitfalls with State Tax Refunds

While state tax refunds can provide a welcome financial boost, there are several common pitfalls to avoid. These include errors in filing, missing out on eligible credits or deductions, and falling victim to tax scams or fraudulent schemes.

Common Errors in Filing

One of the most common errors when claiming a state tax refund is incorrect or incomplete information on tax forms. This can include typos, incorrect Social Security numbers, or mismatched personal information. Such errors can lead to delays in processing, additional scrutiny from the tax authority, or even the denial of your refund claim.

To avoid these errors, it's crucial to review your tax forms carefully before filing. Double-check all personal information, such as names, addresses, and Social Security numbers, to ensure accuracy. Additionally, verify that all income, deductions, and credits are entered correctly and that you have the necessary supporting documentation.

Missing Out on Eligible Credits and Deductions

Another pitfall to avoid is failing to claim all the credits and deductions you're entitled to. New Mexico, like many states, offers a variety of tax credits and deductions that can significantly reduce your tax liability and increase your refund. However, these benefits are often overlooked or misunderstood, especially by those who are not well-versed in tax law.

To ensure you're claiming all eligible credits and deductions, it's recommended to consult with a tax professional or use reputable tax preparation software. These resources can guide you through the process, ensuring you don't miss out on any opportunities to reduce your tax burden and maximize your refund.

Awareness of Tax Scams and Fraudulent Schemes

Unfortunately, tax scams and fraudulent schemes are common during tax season. These schemes can take many forms, from identity theft to phony refund scams. It's essential to be vigilant and aware of these potential threats to protect your financial and personal information.

The New Mexico Taxation and Revenue Department (TRD) provides resources and guidance to help taxpayers recognize and avoid these scams. Some red flags to watch out for include unsolicited calls or emails claiming to be from the TRD or other tax authorities, requests for personal or financial information over the phone or via email, and promises of large refunds or tax benefits that seem too good to be true.

If you suspect you've encountered a tax scam or fraudulent scheme, it's crucial to report it to the TRD or the appropriate authorities immediately. This helps protect yourself and other taxpayers from falling victim to these schemes.

The Future of State Tax Refunds in New Mexico

The future of state tax refunds in New Mexico is closely tied to the state's economic and fiscal policies. As the state continues to evolve and adapt to changing economic conditions, tax policies and refund mechanisms are likely to undergo revisions and adjustments.

Potential Changes and Adjustments

One potential area of change is the expansion or modification of existing tax credits and deductions. For instance, the state may choose to increase the amount or eligibility criteria for certain credits, such as the Low-Income Worker Tax Credit, to provide greater relief to those in need. Alternatively, the state may introduce new tax credits or deductions to encourage specific behaviors or support certain industries.

Another area of potential change is the streamlining and modernization of the tax refund process. The state could invest in upgrading its technology infrastructure to make the process more efficient and secure. This could include implementing new online filing systems, improving data security measures, and enhancing communication channels to provide taxpayers with real-time updates on their refund status.

The Impact of Economic Trends

Economic trends and conditions can also influence the state's tax refund landscape. During periods of economic growth, the state may experience increased tax revenues, potentially leading to larger refunds or additional tax credits to support residents and businesses. Conversely, during economic downturns, the state may face budgetary constraints, which could result in reduced refunds or temporary suspensions of certain tax credits.

Furthermore, the state's fiscal policies and budgetary decisions can significantly impact the availability and size of tax refunds. For example, if the state decides to increase spending on infrastructure or social programs, it may need to adjust tax rates or reduce certain tax credits to balance the budget. These decisions can have a direct impact on taxpayers and their ability to claim refunds.

Long-Term Implications and Opportunities

Looking ahead, the future of state tax refunds in New Mexico presents both challenges and opportunities. On the one hand, the state must carefully manage its fiscal responsibilities and ensure that tax policies remain sustainable and equitable. This may involve ongoing reviews and adjustments to tax rates, credits, and deductions to align with changing economic conditions and demographic trends.

On the other hand, the state has an opportunity to leverage its tax refund system as a tool for economic development and social welfare. By strategically designing and implementing tax policies, New Mexico can encourage investment, support low- and moderate-income residents, and promote economic growth. This could involve targeted tax incentives for specific industries, increased support for small businesses, or expanded tax credits for low-income families.

Frequently Asked Questions

When can I expect to receive my New Mexico state tax refund?

+The processing time for state tax refunds in New Mexico can vary. Generally, it takes about 4-6 weeks from the date of filing for the state to process and issue refunds. However, this timeline can be affected by various factors, including the complexity of your tax return, the volume of returns being processed, and any errors or discrepancies in your filing. It’s advisable to monitor your refund status using the tools provided by the New Mexico Taxation and Revenue Department (TRD) to stay informed.

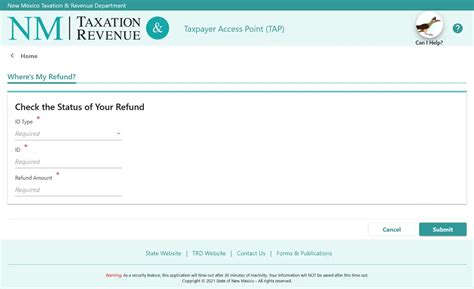

How can I check the status of my New Mexico state tax refund?

+You can check the status of your New Mexico state tax refund in several ways. The TRD offers an online refund tracker, which allows you to enter your Social Security number and date of birth to view the status of your refund. Additionally, you can call the TRD’s automated phone system at (505) 827-0700 and follow the prompts to check your refund status. Both methods provide real-time updates on the processing of your refund.

What should I do if my New Mexico state tax refund is delayed or incorrect?

+If you believe your New Mexico state tax refund is delayed or incorrect, it’s important to take prompt action. First, carefully review your tax return to ensure all information is accurate and complete. If you find errors, amend your return as soon as possible. If there are no errors on your end, contact the TRD’s Taxpayer Assistance Division at (505) 827-0700 for assistance. They can help investigate the issue and provide guidance on next steps.

Are there any penalties for late filing of New Mexico state tax returns?

+Yes, there are penalties for late filing of New Mexico state tax returns. If you fail to file your state tax return by the due date, you may be subject to a late filing penalty of 5% of the tax due, with a minimum penalty of $10. Additionally, interest may accrue on any unpaid tax balance. It’s important to file your return on time to avoid these penalties and ensure a smooth refund process.

Can I receive my New Mexico state tax refund via direct deposit?

+Yes, New Mexico offers the option of receiving your state tax refund via direct deposit. When filing your tax return, you can choose to have your refund deposited directly into your bank account. This method is faster, more secure, and eliminates the risk of lost or stolen refund checks. To use direct deposit, you’ll need to provide your banking information, including your account and routing numbers, on your tax return.