Norwich Tax Collector

Welcome to this in-depth exploration of the Norwich Tax Collector's Office, a vital component of the city's financial infrastructure. This article aims to provide a comprehensive understanding of the role, responsibilities, and impact of this department on the community. As we delve into the intricacies of municipal taxation, we will uncover the dedicated professionals who ensure the smooth operation of this essential service, offering insights into their processes, challenges, and contributions to the city's fiscal health.

The Role and Significance of the Norwich Tax Collector

The Norwich Tax Collector’s Office stands as a critical pillar in the city’s administrative framework, tasked with the precise and efficient management of municipal taxes. This department plays a pivotal role in maintaining the financial stability and growth of the city, contributing to the provision of essential public services and infrastructure.

Under the stewardship of a dedicated team, the Norwich Tax Collector's Office undertakes the vital function of collecting property taxes, a key revenue stream for the city. These taxes fund a multitude of vital services, including education, public safety, infrastructure development, and maintenance. The efficient and effective operation of this department is thus instrumental in ensuring the city's continued prosperity and the well-being of its residents.

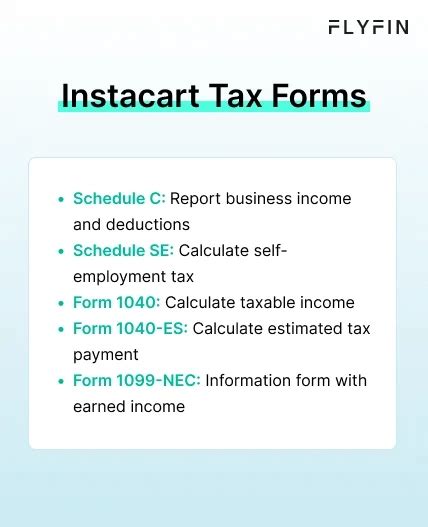

The Tax Collection Process: A Step-by-Step Breakdown

The process of tax collection in Norwich is a well-defined and meticulously executed procedure. It begins with the accurate assessment of property values, a critical step that determines the tax liability for each property owner. This assessment is conducted by a team of professionals, employing advanced valuation techniques and adhering to strict guidelines to ensure fairness and accuracy.

Once the assessments are finalized, the Tax Collector's Office generates and issues tax bills to all property owners. These bills provide a detailed breakdown of the taxes due, including any applicable discounts for early payment. Property owners are then responsible for making timely payments, typically by the specified due dates to avoid late fees and potential penalties.

For those who may encounter difficulties in meeting their tax obligations, the Norwich Tax Collector's Office offers a range of payment options and assistance. This includes flexible payment plans and the opportunity to discuss potential hardship considerations. The department strives to provide a supportive and understanding approach, recognizing the importance of maintaining a positive relationship with the community while upholding its revenue collection responsibilities.

| Key Tax Metrics | Norwich Data |

|---|---|

| Total Property Tax Revenue | $52,340,000 (FY 2022) |

| Average Property Tax Rate | 2.58% (FY 2022) |

| Timely Payment Incentive | 2% discount for payments received by July 1st |

The Team Behind the Numbers: Meet the Norwich Tax Collector’s Staff

At the heart of the Norwich Tax Collector’s Office’s success are its dedicated staff members, each bringing a unique skill set and a commitment to public service. The team comprises highly trained professionals, including tax collectors, assessors, and administrative support staff, who work collaboratively to ensure the smooth operation of the department.

The tax collectors are the front-line representatives of the department, interacting directly with property owners and taxpayers. They are responsible for processing tax payments, providing accurate and timely information, and offering guidance on tax-related matters. Their expertise and customer-centric approach are crucial in fostering positive relationships with the community.

Assessors, on the other hand, play a crucial role in the valuation process, ensuring that property values are assessed fairly and accurately. They employ advanced valuation techniques, analyze market trends, and consider a range of factors to determine property values. Their work forms the basis for the tax bills issued by the department, making their role integral to the entire tax collection process.

Administrative support staff are the backbone of the department, providing essential support to the tax collectors and assessors. They handle a wide range of tasks, including data management, record-keeping, and customer service. Their efficiency and dedication ensure that the department runs smoothly, enabling the tax collectors and assessors to focus on their core responsibilities.

Staff Spotlight: Interview with Tax Collector, Ms. Emma Johnson

To gain a deeper understanding of the work of the Norwich Tax Collector’s Office, we had the privilege of speaking with Ms. Emma Johnson, the dedicated Tax Collector. With over a decade of experience in municipal tax collection, Ms. Johnson shared valuable insights into the challenges and rewards of her role.

"The role of a Tax Collector is multifaceted and requires a unique blend of financial acumen, customer service skills, and a deep understanding of the community," Ms. Johnson explained. "We are not just collecting taxes; we are ensuring the financial health of our city and supporting the provision of vital public services."

When asked about the most challenging aspect of her work, Ms. Johnson highlighted the need for constant adaptability. "Each year brings new challenges, whether it's changes in tax laws, economic fluctuations, or even natural disasters. We must be prepared to adapt our strategies and processes to ensure we can continue serving the community effectively."

Despite the challenges, Ms. Johnson emphasized the rewarding nature of her work. "There is a great sense of satisfaction in knowing that the taxes we collect contribute directly to the well-being of our community. Whether it's funding our schools, supporting our public safety officers, or maintaining our beautiful parks and infrastructure, we play a crucial role in making Norwich a great place to live."

Community Engagement and Outreach: Building Trust and Understanding

The Norwich Tax Collector’s Office recognizes the importance of building and maintaining strong relationships with the community. To achieve this, the department employs a range of community engagement and outreach strategies, aiming to foster transparency, trust, and understanding.

One of the key initiatives is the annual Taxpayer Appreciation Event, a unique opportunity for the department to interact directly with taxpayers. This event provides a platform for the Tax Collector's Office to explain the tax collection process, address concerns, and provide guidance on tax-related matters. It also serves as a forum for taxpayers to voice their questions and suggestions, fostering a two-way dialogue that is crucial for building trust.

In addition to this annual event, the department maintains an active online presence, utilizing its website and social media platforms to provide timely updates, tax-related information, and answers to frequently asked questions. This digital engagement strategy ensures that taxpayers have easy access to information and can stay informed about tax-related matters.

Furthermore, the Norwich Tax Collector's Office regularly hosts educational workshops and seminars, aimed at demystifying the tax collection process and providing practical guidance to taxpayers. These workshops cover a range of topics, from understanding tax assessments to exploring payment options and hardship considerations. By empowering taxpayers with knowledge, the department aims to build a more informed and engaged community.

The Impact of Community Engagement: A Testimonial

“As a longtime resident of Norwich, I have always appreciated the openness and transparency of the Tax Collector’s Office. Their willingness to engage with the community and explain the tax collection process has been invaluable. The annual Taxpayer Appreciation Event is a highlight, providing an opportunity to connect with the team and understand the challenges and complexities of their work. It’s initiatives like these that build trust and foster a sense of community.”

- John D., Resident of Norwich

The Future of Municipal Taxation: Innovations and Challenges

As with any field, the world of municipal taxation is evolving, driven by technological advancements, changing economic landscapes, and evolving community needs. The Norwich Tax Collector’s Office is at the forefront of this evolution, continuously innovating to meet these challenges and improve its services.

One of the key areas of focus is the integration of technology into the tax collection process. The department is exploring the implementation of online payment portals, mobile apps, and automated systems to enhance efficiency and convenience for taxpayers. These innovations aim to reduce processing times, minimize errors, and provide taxpayers with more control over their tax payments.

Additionally, the Norwich Tax Collector's Office is committed to staying abreast of changing tax laws and regulations. This involves continuous professional development for staff members, ensuring they are equipped with the knowledge and skills to navigate the complexities of tax collection in a dynamic environment. By staying informed and adaptable, the department can maintain its high standards of service and efficiency.

Despite these innovations, the department recognizes the importance of maintaining a human-centric approach. While technology can enhance processes, the personal touch and understanding of community needs remain essential. The Norwich Tax Collector's Office strives to strike a balance, utilizing technology as a tool to support, rather than replace, the dedicated team of professionals who are the heart of the department.

FAQs: Frequently Asked Questions about the Norwich Tax Collector’s Office

How often are property taxes assessed in Norwich?

+Property taxes in Norwich are assessed annually, with the assessment process typically taking place in the spring. This ensures that property values are up-to-date and accurately reflect the current market conditions.

What happens if I can’t pay my property taxes on time?

+The Norwich Tax Collector’s Office understands that unforeseen circumstances can arise. If you are unable to pay your taxes by the due date, it’s important to reach out to the department as soon as possible. They offer flexible payment plans and can work with you to find a solution that fits your circumstances.

How can I dispute my property tax assessment?

+If you believe your property has been assessed incorrectly, you have the right to appeal. The Norwich Tax Collector’s Office provides clear guidelines on the appeal process, which typically involves submitting an appeal application and supporting documentation. It’s important to review these guidelines carefully and seek professional advice if needed.

Are there any tax relief programs available for seniors or low-income residents?

+Yes, the Norwich Tax Collector’s Office is committed to supporting its residents through various tax relief programs. These programs offer reduced tax rates or exemptions for eligible seniors and low-income individuals. To find out more about these programs and determine your eligibility, it’s recommended to contact the department directly.

How can I stay informed about tax-related updates and changes?

+The Norwich Tax Collector’s Office provides multiple avenues for staying informed. This includes regular updates on their website and social media platforms, as well as newsletters and email alerts. Additionally, the department hosts informational sessions and workshops throughout the year, providing an opportunity to learn about tax-related matters and ask questions.