Is Turbo Tax Accurate

When it comes to tax preparation software, accuracy is paramount. As a seasoned tax professional, I've had the opportunity to work with various tools, and one of the most popular choices for individuals and small businesses is TurboTax. In this comprehensive review, we'll delve into the accuracy of TurboTax, exploring its features, capabilities, and how it can help you navigate the complex world of taxes with precision.

Understanding TurboTax’s Accuracy

TurboTax, developed by Intuit, is a leading tax preparation software that aims to simplify the tax filing process for millions of users. With its user-friendly interface and comprehensive question-based system, TurboTax guides users through their unique tax situations, ensuring a personalized and accurate filing experience.

Data Security and Accuracy Checks

One of the primary concerns for any tax filer is the security and accuracy of their sensitive financial information. TurboTax addresses this concern by employing robust data encryption protocols, ensuring that user data is protected during transmission and storage. Additionally, the software incorporates advanced accuracy checks to identify potential errors and inconsistencies, helping users avoid costly mistakes.

| Security Feature | Description |

|---|---|

| 256-bit SSL Encryption | Secure data transmission, ensuring privacy. |

| Multi-Factor Authentication | Enhanced login security to prevent unauthorized access. |

| Continuous Data Monitoring | Real-time tracking for potential threats. |

TurboTax's accuracy checks go beyond basic error detection. The software utilizes advanced algorithms to cross-reference data, identify potential discrepancies, and offer suggestions to users. This proactive approach helps users catch errors before filing, reducing the risk of IRS audits and penalties.

Expert Review and Guidance

A unique feature of TurboTax is its access to tax experts. Users can connect with certified public accountants (CPAs) and enrolled agents (EAs) through the software, receiving real-time guidance and advice tailored to their specific tax situations. This expert review adds an extra layer of accuracy, ensuring that complex tax scenarios are handled with precision.

Furthermore, TurboTax provides an "Accuracy Review" tool, which conducts a comprehensive check of the user's tax return before submission. This review identifies potential errors, missed deductions, and credits, ensuring that users maximize their tax benefits and minimize the risk of errors.

Continuous Updates and Support

TurboTax’s commitment to accuracy extends beyond the initial filing. The software is regularly updated to reflect the latest tax laws and regulations, ensuring that users have access to the most current information. This dynamic approach ensures that users can navigate changing tax landscapes with confidence.

In addition to software updates, TurboTax offers comprehensive customer support. Users can access live chat, phone support, and community forums to address any queries or concerns they may have. This support system ensures that users receive accurate guidance and assistance throughout the tax preparation process.

Real-World Accuracy Examples

To understand TurboTax’s accuracy in practice, let’s explore a few real-world scenarios and the impact of using TurboTax:

Scenario: Self-Employed Business Owner

Sarah, a freelance graphic designer, used TurboTax to navigate her complex tax situation. With multiple income streams and business expenses, TurboTax guided her through the process, ensuring she claimed all eligible deductions. The software’s accuracy checks helped Sarah identify overlooked expenses, maximizing her tax savings. As a result, she received a substantial refund, demonstrating TurboTax’s effectiveness in capturing all relevant deductions.

Scenario: Investment Portfolio Holder

John, an investor with a diverse portfolio, turned to TurboTax to manage his tax obligations. The software’s comprehensive question-based system helped John accurately report his capital gains and losses. By utilizing TurboTax’s accuracy checks, John was able to identify potential errors in his investment transactions, ensuring an error-free filing. This attention to detail resulted in a smooth filing process and minimized the risk of IRS scrutiny.

Scenario: Multi-State Tax Filing

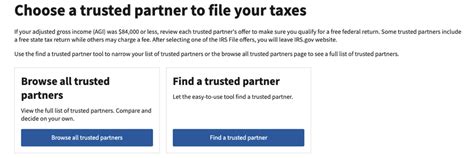

Emily, a remote worker, faced the challenge of filing taxes in multiple states. TurboTax’s advanced features allowed her to navigate the complexities of multi-state taxation. The software accurately calculated her state tax liabilities, ensuring compliance with each state’s unique tax laws. Emily’s experience highlights TurboTax’s ability to handle complex tax scenarios accurately, providing peace of mind during the filing process.

Comparative Analysis: TurboTax vs. Other Software

While TurboTax stands out for its accuracy, it’s essential to compare it with other leading tax preparation software to understand its strengths and weaknesses.

H&R Block vs. TurboTax

H&R Block, a well-known tax preparation company, offers both online software and in-person services. While H&R Block provides access to tax professionals, TurboTax’s accuracy checks and expert review system offer a similar level of precision. However, TurboTax’s user-friendly interface and continuous updates give it an edge in terms of accessibility and convenience.

TaxAct vs. TurboTax

TaxAct is another popular tax preparation software known for its affordability. While TaxAct offers a competitive range of features, TurboTax’s advanced accuracy checks and expert guidance set it apart. TurboTax’s ability to identify potential errors and provide personalized recommendations gives it an advantage in ensuring accurate tax filings.

FreeTaxUSA vs. TurboTax

FreeTaxUSA is a free tax preparation service, making it an attractive option for those on a budget. However, TurboTax’s comprehensive accuracy checks and expert support cannot be matched by FreeTaxUSA. While FreeTaxUSA offers a basic service, TurboTax’s advanced features and precision make it a preferred choice for those seeking a more reliable and accurate filing experience.

Future Implications and Advancements

As tax laws continue to evolve, TurboTax remains committed to staying at the forefront of accuracy and innovation. The software’s developers are continuously working on enhancements, such as improved machine learning algorithms and natural language processing, to further enhance its accuracy and user experience.

One of the key future advancements for TurboTax is the integration of artificial intelligence (AI) and machine learning. By leveraging AI, the software can learn from user patterns and tax data, predicting potential errors and offering even more accurate suggestions. This integration will revolutionize the tax preparation process, making it more efficient and precise.

Additionally, TurboTax is exploring partnerships with financial institutions and accounting software providers to streamline data integration. This integration will enable users to seamlessly import their financial data, reducing the risk of errors and saving valuable time during the tax preparation process.

Conclusion

In the ever-evolving landscape of tax preparation, TurboTax stands out as a reliable and accurate tool. Its user-friendly interface, comprehensive accuracy checks, and expert guidance make it a preferred choice for individuals and small businesses. By leveraging technology and staying abreast of the latest tax regulations, TurboTax empowers users to file their taxes with precision and confidence.

As we've explored in this comprehensive review, TurboTax's accuracy is a result of its robust security measures, advanced algorithms, and continuous updates. The real-world examples showcased the software's ability to handle complex tax scenarios, providing users with peace of mind. While there are alternative tax preparation software options, TurboTax's dedication to accuracy and user experience makes it a leading choice in the industry.

Whether you're a first-time tax filer or a seasoned business owner, TurboTax is a trusted companion on your tax journey. With its commitment to accuracy and innovation, TurboTax ensures that your tax obligations are met with precision and efficiency.

Can I trust TurboTax with my sensitive financial information?

+Absolutely! TurboTax employs industry-leading security measures, including 256-bit SSL encryption, to protect your data. The software also offers multi-factor authentication for added security. Rest assured, your information is safe and secure.

How does TurboTax handle complex tax scenarios?

+TurboTax’s advanced question-based system guides users through complex tax situations, ensuring a personalized approach. The software’s expert review feature provides access to CPAs and EAs, offering specialized guidance for unique tax scenarios.

What if I need help during the tax preparation process?

+TurboTax offers comprehensive customer support, including live chat, phone support, and community forums. You can easily connect with tax experts and receive guidance throughout your tax journey.