Pennsylvania Property Tax Refund

The Pennsylvania Property Tax/Rent Rebate Program is a vital financial relief initiative for eligible Pennsylvania residents. This program offers refunds on property taxes or rent payments, providing much-needed support to those who qualify. In this comprehensive guide, we delve into the intricacies of the Property Tax/Rent Rebate Program, exploring eligibility criteria, application processes, and the impact it has on Pennsylvania's communities.

Understanding the Pennsylvania Property Tax/Rent Rebate Program

The Property Tax/Rent Rebate Program, administered by the Pennsylvania Department of Revenue, is designed to assist residents with their property tax or rent expenses. This program is particularly beneficial for older adults, individuals with disabilities, and residents with low to moderate incomes. It serves as a crucial financial safety net, helping residents manage the rising costs of housing and property taxes.

Eligibility Criteria

To be eligible for the Property Tax/Rent Rebate Program, applicants must meet certain criteria. These criteria include:

- Residency: Applicants must be Pennsylvania residents for the entire rebate year.

- Income: The program sets income limits, which vary based on the applicant’s age, disability status, and marital status. For example, the income limit for a single individual aged 65 or older is 35,000, while for a married couple, it is 40,000. These limits are adjusted annually to account for inflation.

- Property Ownership: Applicants who own their homes must have a property tax bill, while renters must provide proof of rent payments.

- Filing Status: Applicants must file their taxes as Pennsylvania residents. Non-tax filers can also apply, but they must provide additional documentation.

It's important to note that certain exclusions apply. For instance, individuals who owe state or local taxes, or those who have overdue child support payments, may not be eligible for the program.

Application Process

The application process for the Property Tax/Rent Rebate Program is straightforward and can be completed online or by mail. Applicants are required to provide the following information and documentation:

- Personal Information: Name, address, Social Security number, and date of birth.

- Income Details: Applicants must report their total income from the previous year, including wages, pensions, Social Security benefits, and other sources.

- Property or Rent Details: Homeowners must provide a copy of their property tax bill, while renters need to supply rent receipts or a landlord’s statement.

- Tax Filing Information: Applicants who filed taxes must provide their filing status and tax return information.

- Bank Information: For those applying for direct deposit, bank account details are required.

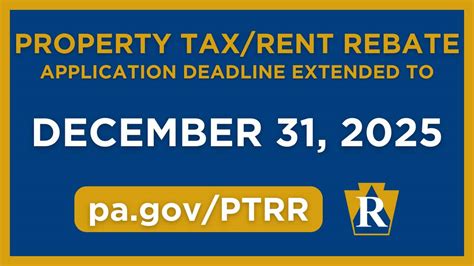

Applications are typically accepted starting in July and can be submitted until the program's deadline, which is usually in December. However, it's important to apply early as funds are limited, and applications are processed on a first-come, first-served basis.

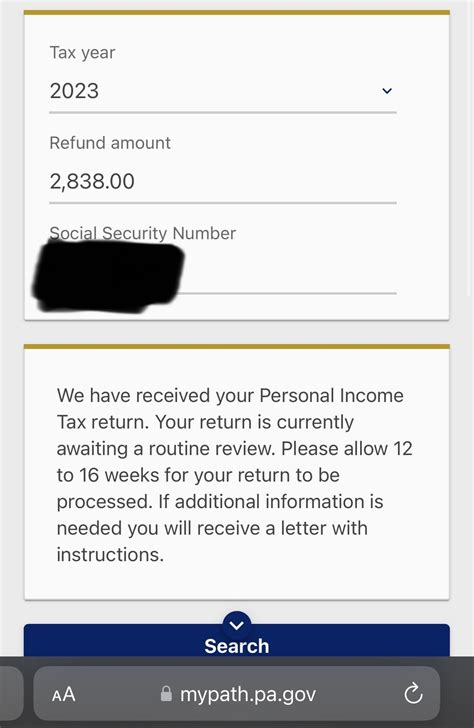

Refund Amounts and Payment Methods

The amount of the refund varies depending on the applicant’s income and property tax or rent expenses. The maximum refund for the 2022-2023 rebate year is 1,000 for homeowners and 900 for renters. However, the actual refund amount may be lower, as it is calculated based on the applicant’s income and expenses.

Refunds can be received through various methods, including check or direct deposit. Applicants can choose their preferred payment method during the application process. Direct deposit is often the fastest way to receive the refund, with funds typically arriving within a few weeks of the program's deadline.

Impact and Benefits of the Program

The Property Tax/Rent Rebate Program has a significant positive impact on Pennsylvania’s communities. It provides much-needed financial relief to eligible residents, helping them manage their housing costs and maintain their quality of life. The program’s benefits are particularly notable for older adults and individuals with disabilities, who often face financial challenges due to fixed incomes and rising living expenses.

According to the Pennsylvania Department of Revenue, the program has assisted over 475,000 residents with more than $175 million in refunds during the 2021-2022 rebate year. These refunds not only help individuals pay their property taxes or rent but also contribute to the local economy, as residents can use the funds for essential expenses or local purchases.

| Rebate Year | Number of Applicants | Total Refunds |

|---|---|---|

| 2021-2022 | 475,000 | $175 million |

| 2020-2021 | 450,000 | $160 million |

| 2019-2020 | 430,000 | $145 million |

FAQs

Can I apply for the program if I own multiple properties?

+Yes, you can apply for the program if you own multiple properties. However, you must choose one property for which you will receive the rebate. The program considers only the property tax or rent expenses of the selected property.

What happens if I miss the application deadline?

+If you miss the application deadline, you may still be able to apply for a late rebate. However, late applications are only accepted if funds are still available, and the refund amount may be reduced. It’s important to apply as early as possible to ensure you receive the full refund amount.

Can I apply for the program if I receive Social Security benefits?

+Yes, individuals receiving Social Security benefits can apply for the program. Social Security benefits are considered income, and the program takes them into account when determining eligibility and refund amounts. However, it’s important to report all income accurately to avoid any issues with the application.

How long does it take to receive the refund after submitting the application?

+The processing time for refunds can vary. Generally, it takes several weeks to a few months for the Department of Revenue to review and process applications. If you choose direct deposit, the refund may arrive faster. It’s advisable to check the program’s website for updates on processing times.

Are there any additional programs or resources for property tax relief in Pennsylvania?

+Yes, Pennsylvania offers other programs and resources to assist residents with property taxes. These include the Homestead/Farmstead Exclusion, which provides a property tax reduction for homeowners, and the Senior Citizen Property Tax or Rent Rebate Program, which offers additional support for eligible seniors. It’s worth exploring these options to maximize your financial relief.