Instacart Tax Form

As an integral part of the gig economy, Instacart shoppers navigate a unique tax landscape. This comprehensive guide will shed light on the essential tax considerations for Instacart shoppers, helping them navigate their tax obligations with confidence and clarity. From understanding the different tax forms to knowing what expenses are deductible, we'll cover it all, ensuring you're well-prepared for tax season.

Understanding the Instacart Tax Landscape

The tax landscape for Instacart shoppers is multifaceted, encompassing a range of forms and considerations. At its core, Instacart considers its shoppers to be independent contractors, which means they are responsible for managing their own taxes. This responsibility includes understanding the various tax forms, keeping track of income and expenses, and staying updated with the latest tax regulations.

One of the primary tax forms Instacart shoppers will encounter is the 1099-K form. This form is issued by payment settlement entities, such as Instacart, to report the total payment volume of a contractor's services. In the case of Instacart, this form reports the total payment volume of a shopper's earnings from delivering groceries. It's crucial for shoppers to understand that the 1099-K form does not equate to taxable income, as it includes the total payment volume, which may include tips and refunds.

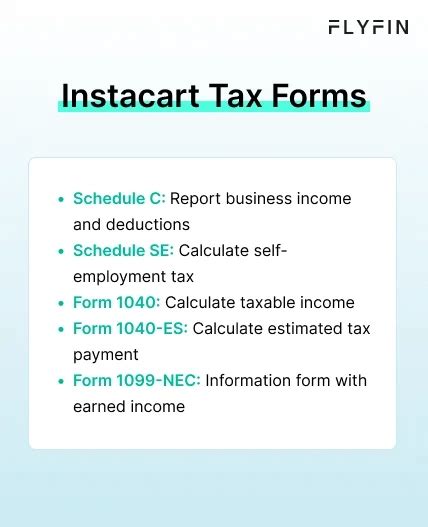

In addition to the 1099-K form, Instacart shoppers may also receive a 1099-NEC form if they meet certain criteria. This form is used to report non-employee compensation, such as income earned from freelance work or contract-based jobs. The 1099-NEC form is issued by Instacart when a shopper's earnings reach a certain threshold, typically $600 or more. It's essential for shoppers to be aware of this form and understand how it impacts their tax obligations.

Key Tax Forms and Their Implications

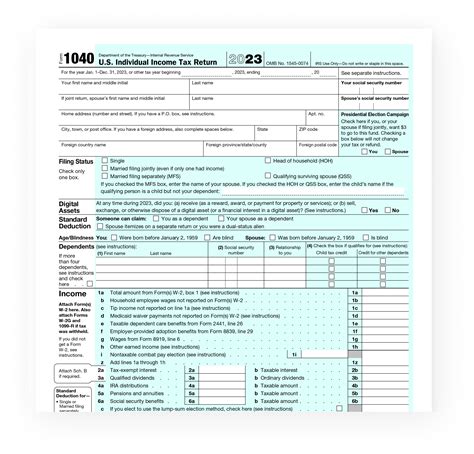

Let’s delve deeper into the key tax forms Instacart shoppers should be familiar with and understand their implications:

1099-K Form

The 1099-K form is a critical document for Instacart shoppers, as it provides a detailed breakdown of their total payment volume. This form is typically received by shoppers in early February of the following year and is due to the IRS by January 31st. It’s important to note that the 1099-K form does not differentiate between business and personal expenses, so shoppers will need to maintain accurate records to determine their taxable income.

One key aspect of the 1099-K form is that it reports the total payment volume, including any tips received by shoppers. While tips are considered taxable income, they are not specifically reported on the 1099-K form. Shoppers will need to track and report their tips separately to ensure accurate tax reporting.

1099-NEC Form

The 1099-NEC form is issued to report non-employee compensation, which includes earnings from freelance work or contract-based jobs. In the context of Instacart, this form is issued when a shopper’s earnings exceed a certain threshold, typically $600 or more. The 1099-NEC form is due to the IRS by January 31st and provides a detailed breakdown of the shopper’s earnings for the tax year.

It's important for Instacart shoppers to understand that the 1099-NEC form is not a substitute for tax preparation. While it provides a summary of their earnings, it does not account for business expenses or other deductions. Shoppers will need to carefully review their records and consult with a tax professional to ensure they are taking advantage of all available deductions and credits.

Self-Employment Tax

As independent contractors, Instacart shoppers are responsible for paying self-employment tax, which covers both Social Security and Medicare taxes. This tax is typically paid on the net earnings from self-employment, which is calculated by subtracting allowable business expenses from gross income.

It's crucial for shoppers to understand that self-employment tax is in addition to income tax. While the IRS allows for certain deductions and credits, self-employment tax is generally not deductible. Shoppers should carefully calculate their net earnings and plan accordingly to ensure they can meet their self-employment tax obligations.

Tracking Income and Expenses

Accurate tracking of income and expenses is paramount for Instacart shoppers to ensure they are prepared for tax season. By maintaining meticulous records, shoppers can maximize their deductions, minimize their tax liability, and avoid potential audits.

When it comes to tracking income, Instacart provides shoppers with a detailed earnings statement that outlines their total earnings, including tips and any refunds or adjustments. Shoppers should reconcile this statement with their 1099-K and 1099-NEC forms to ensure accuracy. It's also important to note that Instacart's earnings statement may not align perfectly with the tax forms, as it may include additional information such as tips and expenses.

On the expense side, Instacart shoppers can deduct a variety of business-related costs, including vehicle expenses, phone bills, insurance, and more. To maximize deductions, shoppers should maintain a log of their expenses, detailing the date, amount, and purpose of each expense. This log should be backed up by receipts or other documentation to support the deductions claimed on their tax returns.

Vehicle Expenses

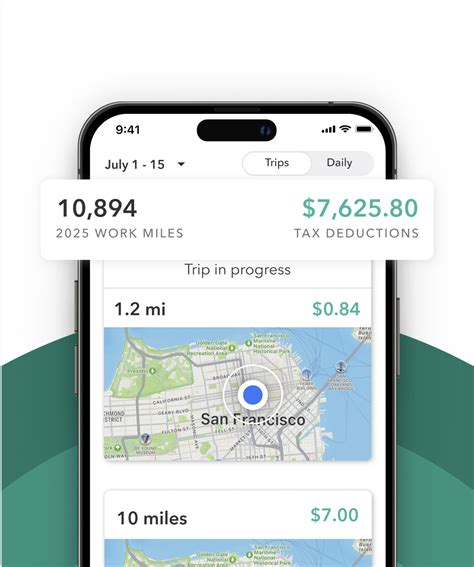

One of the most significant expenses for Instacart shoppers is vehicle-related costs. These expenses can include fuel, maintenance, repairs, insurance, and depreciation. To maximize deductions, shoppers should track their mileage and calculate their vehicle expenses based on the IRS standard mileage rate or the actual cost method. The IRS standard mileage rate changes annually, so it’s important for shoppers to stay updated with the latest rates.

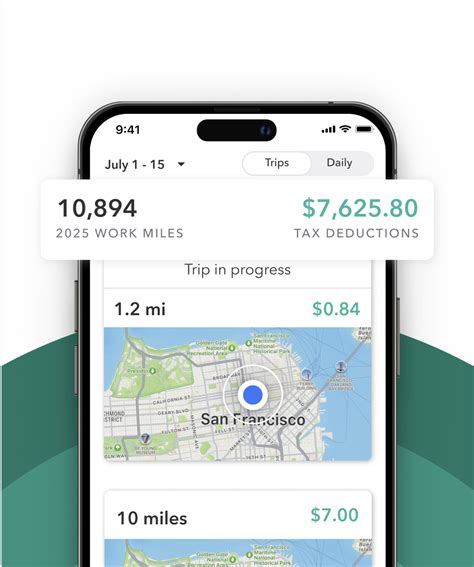

Mileage Tracking

Accurate mileage tracking is essential for Instacart shoppers to claim vehicle expenses accurately. Shoppers can use a variety of methods to track their mileage, including manual tracking, GPS tracking apps, or mileage tracking devices. By consistently recording their mileage, shoppers can calculate their vehicle expenses and maximize their deductions.

| Expense Category | Deduction Examples |

|---|---|

| Vehicle Expenses | Fuel, Maintenance, Repairs, Insurance, Depreciation |

| Phone Bills | Cell Phone Plans, Data Usage |

| Insurance | Liability Insurance, Health Insurance |

| Office Supplies | Pens, Notebooks, Printer Ink |

Maximizing Deductions and Credits

Maximizing deductions and credits is a strategic way for Instacart shoppers to reduce their tax liability and increase their tax refund. By understanding the various deductions and credits available, shoppers can make informed decisions to optimize their tax situation.

Business Deductions

Instacart shoppers are eligible for a range of business deductions, which can significantly reduce their taxable income. These deductions include vehicle expenses, phone bills, insurance, office supplies, and more. It’s crucial for shoppers to maintain accurate records of their expenses to substantiate these deductions and ensure they are claiming all eligible deductions.

One important consideration for business deductions is the distinction between ordinary and necessary expenses. Ordinary expenses are those that are common and accepted in the business, while necessary expenses are those that are helpful and appropriate for the business. Shoppers should carefully evaluate their expenses to determine which category they fall into and maximize their deductions accordingly.

Home Office Deduction

If Instacart shoppers work from home and have a dedicated home office, they may be eligible for the home office deduction. This deduction allows shoppers to deduct a portion of their home expenses, such as rent, mortgage interest, utilities, and insurance, based on the percentage of their home used exclusively for business purposes. To claim this deduction, shoppers must meet certain requirements, such as having a dedicated space used solely for business purposes and using it regularly and exclusively for business.

Health Insurance Premium Deduction

Instacart shoppers who purchase their own health insurance may be eligible for a deduction for their health insurance premiums. This deduction is particularly beneficial for shoppers who are self-employed and not eligible for employer-provided health insurance. To claim this deduction, shoppers must meet certain requirements, such as having a valid health insurance policy and maintaining records to substantiate their expenses.

Tax Preparation and Strategies

As tax season approaches, Instacart shoppers should have a solid plan in place for tax preparation. By being proactive and organized, shoppers can ensure a smooth and stress-free tax filing process. Here are some key strategies to consider:

Seek Professional Advice

Tax laws and regulations can be complex, and it’s always a good idea to seek professional advice from a tax expert or accountant. A tax professional can provide personalized guidance based on a shopper’s specific circumstances, ensuring they are taking advantage of all available deductions and credits. They can also help with tax planning to minimize tax liability and maximize tax refunds.

File Taxes Electronically

Filing taxes electronically is a convenient and efficient way to submit tax returns. The IRS offers various electronic filing options, including online filing through its website or using tax preparation software. Electronic filing reduces the risk of errors and provides a faster refund process. Shoppers should ensure they have all the necessary documents and information ready before filing to streamline the process.

Stay Updated with Tax Changes

Tax laws and regulations are subject to change, and it’s crucial for Instacart shoppers to stay updated with the latest developments. The IRS and other tax authorities provide resources and updates on their websites, so shoppers should regularly check for any changes that may impact their tax obligations. Staying informed allows shoppers to adapt their tax strategies and ensure compliance with the latest tax regulations.

Consider Tax-Advantaged Accounts

Instacart shoppers may benefit from utilizing tax-advantaged accounts, such as a Health Savings Account (HSA) or a retirement account. These accounts offer tax benefits, such as tax-free contributions and tax-free growth, which can significantly reduce a shopper’s tax liability. Shoppers should explore these options and consult with a financial advisor to determine if they are eligible and how to maximize the benefits.

Conclusion

Understanding the tax landscape as an Instacart shopper is crucial for managing your financial obligations and maximizing your earnings. By staying informed about the various tax forms, tracking your income and expenses, and taking advantage of available deductions and credits, you can navigate the tax process with confidence and ensure compliance with tax regulations. Remember, tax preparation is an essential part of being an independent contractor, and seeking professional advice can provide valuable insights to optimize your tax situation.

FAQ

What happens if I don’t receive my 1099-K or 1099-NEC form from Instacart?

+

If you don’t receive your 1099-K or 1099-NEC form from Instacart, you should contact their support team to request a copy. It’s important to keep track of your earnings and tax obligations, so ensure you have the necessary forms to file your taxes accurately.

Can I deduct the cost of my Instacart shopping bag and other equipment as business expenses?

+

Yes, you can deduct the cost of your Instacart shopping bag and other equipment used exclusively for your Instacart business. These expenses fall under the category of business supplies and can be deducted as long as they are ordinary and necessary for your work.

Are there any tax benefits for contributing to a retirement account as an Instacart shopper?

+

Yes, contributing to a retirement account, such as a traditional IRA or a Solo 401(k), can provide significant tax benefits for Instacart shoppers. These contributions are tax-deductible, which reduces your taxable income and can lower your tax liability. Additionally, the funds grow tax-deferred, and withdrawals in retirement are typically taxed at a lower rate.