Does Utah Have State Tax

Welcome to the comprehensive guide on Utah's tax system! In this article, we will delve into the intricacies of state taxes in Utah, providing you with an in-depth understanding of the tax landscape. Utah, known for its stunning natural beauty and vibrant economy, has a unique tax structure that impacts individuals, businesses, and investors alike. Let's explore the various aspects of state taxes in Utah and uncover the key considerations for residents and those considering a move to this dynamic state.

The Tax Landscape of Utah: A Comprehensive Overview

Utah boasts a competitive tax environment, which has played a significant role in its economic growth and prosperity. The state's tax system is designed to support business development, encourage investment, and provide essential services to its residents. Understanding the state tax structure is crucial for individuals and businesses operating within Utah's borders, as it directly impacts financial planning and decision-making.

Utah's Tax System: A Snapshot

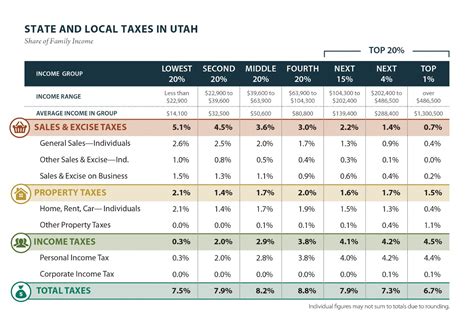

Utah's tax system comprises a range of taxes, each serving a specific purpose. The state levies taxes on income, sales, property, and certain business activities. These taxes contribute to the funding of essential services such as education, healthcare, infrastructure development, and public safety.

- Income Tax: Utah imposes an income tax on individuals and businesses. The state's income tax rate is progressive, with higher income brackets facing higher tax rates. This tax is a significant source of revenue for the state, supporting various public services and initiatives.

- Sales and Use Tax: Utah applies a sales tax to the purchase of goods and services within the state. This tax is collected by businesses and remitted to the state. Utah's sales tax rate varies depending on the type of transaction and the location of the sale. Additionally, the state allows for the collection of local option sales taxes, further contributing to the overall tax burden.

- Property Tax: Property owners in Utah are subject to property taxes. These taxes are levied on both real estate and personal property, such as vehicles and boats. The property tax rates vary across different counties and municipalities, and the revenue generated is primarily used to fund local services and schools.

- Business Taxes: Utah imposes various taxes on businesses, including corporate income tax, franchise taxes, and excise taxes. These taxes vary depending on the nature of the business and its activities. The state also offers incentives and tax credits to attract and support businesses, fostering economic growth and job creation.

Let's take a closer look at each of these tax categories and explore their specific details, rates, and implications.

Income Tax in Utah: Progressive Taxation

Utah's income tax system operates on a progressive basis, meaning that higher income earners pay a higher proportion of their income in taxes. This approach ensures that the tax burden is distributed fairly across different income levels. The state's income tax rates are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $3,650 | 0% |

| $3,651 - $5,500 | 2.5% |

| $5,501 - $8,350 | 4.5% |

| $8,351 - $11,350 | 5% |

| $11,351 and above | 5% |

It's important to note that these rates are subject to change, and Utah's tax authorities periodically review and adjust the income tax brackets and rates to ensure fairness and alignment with economic conditions.

Utah's income tax system offers various deductions and credits to alleviate the tax burden on individuals and families. These include deductions for dependents, education expenses, and certain medical costs. Additionally, the state provides tax credits for charitable contributions, retirement savings, and energy-efficient home improvements.

Sales and Use Tax: A Consumer Perspective

Utah's sales and use tax applies to the purchase of tangible personal property and certain services. The state's base sales tax rate is 4.70%, which is levied on most retail transactions. However, the overall tax rate can vary depending on the specific location of the sale and any applicable local option sales taxes.

Local option sales taxes are imposed by counties and municipalities to fund specific projects or services. These additional taxes can range from 0.10% to 1.75%, bringing the total sales tax rate to a maximum of 6.45% in certain areas. It's important for consumers to be aware of these local variations when making purchasing decisions.

Utah's sales tax applies to a wide range of goods and services, including clothing, electronics, groceries, and restaurant meals. However, there are certain exemptions and exclusions, such as prescription medications, most food products, and certain manufacturing inputs.

For businesses, collecting and remitting sales tax is a crucial responsibility. Utah provides resources and guidance to assist businesses in understanding their sales tax obligations and ensuring compliance. Failure to comply with sales tax regulations can result in penalties and legal consequences.

Property Tax: Assessing Real Estate and Personal Property

Utah's property tax system applies to both real estate and personal property. Real estate includes land, buildings, and other improvements, while personal property encompasses vehicles, boats, and other tangible assets.

The property tax rate in Utah is set by individual counties and municipalities. These rates can vary significantly, with some counties having lower rates to attract businesses and residents, while others have higher rates to fund specific initiatives. The property tax rate is typically expressed as a percentage of the property's assessed value.

The assessment process for property taxes involves evaluating the fair market value of the property. Assessors consider various factors, such as location, size, condition, and recent sales data, to determine the assessed value. This assessed value is then multiplied by the applicable tax rate to calculate the property tax liability.

Property owners in Utah receive annual tax notices, which outline the assessed value, tax rate, and the amount due. Property taxes are typically due in two installments, with specific due dates set by the county.

It's worth noting that Utah offers various property tax exemptions and reductions for qualifying individuals and organizations. These include exemptions for veterans, the disabled, and certain agricultural properties. Additionally, the state provides tax credits for homeowners who make energy-efficient improvements to their properties.

Business Taxes: Supporting Economic Growth

Utah's business tax landscape is designed to encourage entrepreneurship and support economic development. The state imposes various taxes on businesses, each serving a specific purpose and contributing to the overall tax revenue.

- Corporate Income Tax: Corporations doing business in Utah are subject to a corporate income tax. The tax rate is 4.95%, which applies to the net income of the corporation. This tax contributes to the funding of essential state services and infrastructure development.

- Franchise Tax: Utah imposes a franchise tax on certain types of businesses, such as financial institutions and public utilities. The tax is calculated based on the business's net worth or capital structure. This tax ensures that businesses contribute to the state's financial stability and supports the regulation of specific industries.

- Excise Taxes: Utah levies excise taxes on specific goods and services, such as gasoline, tobacco products, and alcohol. These taxes are often used to fund specific initiatives or programs related to public health, transportation, and environmental protection.

Utah also offers a range of tax incentives and credits to attract and support businesses. These incentives can take the form of tax credits for research and development, job creation, and investment in renewable energy. Additionally, the state provides tax breaks for businesses operating in designated enterprise zones, promoting economic development in targeted areas.

The Impact of Utah's Tax System: Analysis and Insights

Utah's tax system has a significant impact on the state's economy, businesses, and residents. Let's explore some key considerations and implications of the state's tax landscape.

Economic Growth and Business Environment

Utah's tax system plays a crucial role in fostering economic growth and creating a favorable business environment. The state's competitive tax rates, particularly in the income and corporate tax categories, make it an attractive destination for businesses and investors. The availability of tax incentives and credits further enhances the state's appeal, encouraging businesses to establish operations and create jobs.

Utah's commitment to supporting entrepreneurship and economic development has led to a thriving business climate. The state's diverse economy, with a strong focus on technology, manufacturing, and tourism, has attracted a range of industries. As a result, Utah has experienced robust economic growth, outpacing many other states in terms of job creation and business expansion.

The tax system's focus on encouraging investment and business development has contributed to Utah's success in attracting major corporations and startups alike. The state's business-friendly policies and competitive tax rates have made it a hub for innovation and entrepreneurship, fostering a vibrant and dynamic economy.

Impact on Residents: Tax Burden and Quality of Life

Utah's tax system directly impacts the financial well-being of its residents. The state's progressive income tax structure ensures that higher-income earners contribute a larger share of their income, providing a sense of fairness and equity. Additionally, the availability of deductions and credits helps alleviate the tax burden on individuals and families, allowing them to retain more of their earnings.

Utah's competitive sales tax rates and the presence of local option sales taxes contribute to the overall tax burden on consumers. While these taxes support essential services and infrastructure development, they can also impact the purchasing power of residents. However, the state's commitment to providing high-quality public services, such as education and healthcare, ensures that residents benefit from the tax revenue generated.

Property taxes, although varying across counties, play a crucial role in funding local services and schools. Utah's property tax system ensures that residents have access to well-maintained infrastructure, quality education, and essential public amenities. The availability of property tax exemptions and reductions further assists certain individuals and organizations in managing their financial obligations.

Overall, Utah's tax system strikes a balance between revenue generation and tax relief, aiming to provide residents with a high quality of life while supporting the state's economic growth and development.

Future Implications and Policy Considerations

As Utah continues to evolve and adapt to changing economic conditions, its tax system will play a pivotal role in shaping the state's future. Here are some key considerations and potential implications for the future of Utah's tax landscape:

- Economic Diversity: Utah's economy has traditionally relied on a few key industries, but the state is actively working to diversify its economic base. As new industries emerge and grow, the tax system will need to adapt to support these sectors and encourage their development.

- Population Growth: Utah is experiencing rapid population growth, which puts pressure on public services and infrastructure. The tax system will need to generate sufficient revenue to keep pace with the increasing demand for services, ensuring that residents continue to receive high-quality education, healthcare, and public amenities.

- Tax Reform: As economic conditions change, there may be calls for tax reform to ensure fairness and competitiveness. Utah's tax authorities will need to carefully evaluate the impact of any proposed changes, considering the potential benefits and drawbacks for businesses and residents alike.

- Technological Advancements: The rise of e-commerce and digital platforms has impacted tax collection and compliance. Utah will need to stay abreast of these technological advancements and implement policies to ensure efficient tax collection and compliance, particularly in the context of online sales and remote transactions.

- Intergovernmental Relations: Utah's tax system is interconnected with federal and local tax policies. As federal and local governments make changes to their tax structures, Utah will need to consider the potential impact on its own tax system and ensure alignment and coordination.

By proactively addressing these considerations and adapting its tax policies, Utah can continue to foster economic growth, support its residents, and maintain its position as a desirable state for businesses and individuals.

Frequently Asked Questions (FAQ)

What is the state income tax rate in Utah?

+

Utah’s state income tax rate is progressive, ranging from 0% to 5%. The rate depends on the income bracket. Higher income earners pay a higher tax rate.

Are there any sales tax exemptions in Utah?

+

Yes, certain items are exempt from sales tax in Utah, such as prescription medications, most food products, and certain manufacturing inputs.

How often do property taxes change in Utah?

+

Property tax rates in Utah can change annually. Each county sets its own tax rate, so it’s important to check with your local authorities for the most up-to-date information.

Does Utah offer any tax incentives for businesses?

+

Absolutely! Utah provides a range of tax incentives and credits to attract and support businesses. These include tax credits for research and development, job creation, and investment in renewable energy.

How can I stay updated on Utah’s tax policies and changes?

+

You can stay informed by regularly checking the official website of the Utah State Tax Commission. They provide up-to-date information on tax rates, deadlines, and any changes to tax policies.