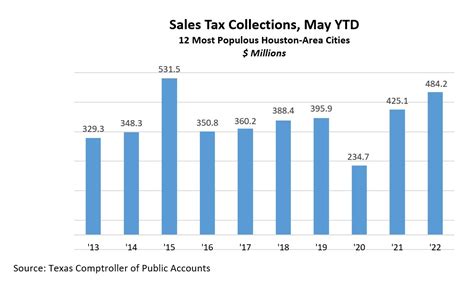

Texas Houston Sales Tax Rate

Texas, known for its diverse economy and thriving business landscape, has a unique sales tax structure that plays a significant role in the state's revenue generation. In this article, we will delve into the intricacies of the sales tax rate in Houston, Texas, providing an in-depth analysis of its impact on businesses and consumers alike.

Understanding the Houston Sales Tax Rate

The sales tax in Houston, like other areas in Texas, is a combination of state, county, and city taxes. This layered structure ensures that the tax burden is distributed across various levels of government, allowing for efficient revenue collection and allocation. The sales tax rate in Houston consists of the following components:

- State Sales Tax: The state of Texas imposes a sales tax rate of 6.25% on most tangible goods and some services. This rate is applied uniformly across the state, making it a significant source of revenue for the state government.

- County Sales Tax: Harris County, where Houston is located, levies an additional 0.50% sales tax. This county-level tax is used to fund local projects and initiatives, ensuring that the needs of the community are met.

- City Sales Tax: Houston, being the largest city in Texas, has its own sales tax rate. The city imposes a 1.25% sales tax on top of the state and county taxes. This additional tax is crucial for the city's infrastructure development, maintenance, and various municipal services.

When these three components are combined, the total sales tax rate in Houston amounts to 8.00%. This rate is applied to most retail purchases, including clothing, electronics, and other tangible goods. However, it's important to note that certain items, such as groceries and prescription medications, are exempt from sales tax in Texas.

How Does the Sales Tax Affect Businesses in Houston?

The sales tax rate in Houston has a direct impact on the profitability and competitiveness of businesses operating within the city. While the tax provides a stable revenue stream for the government, it also influences the pricing strategies and operational costs of businesses.

For retailers, the sales tax is typically added to the selling price of goods. This means that the final price a customer pays includes the cost of the item plus the applicable sales tax. As a result, businesses must carefully consider their pricing to remain competitive while still generating a reasonable profit margin.

Additionally, businesses in Houston must ensure compliance with the tax regulations. This includes accurately calculating and remitting the sales tax to the appropriate authorities. Failure to comply with these regulations can result in penalties and legal consequences, which can be detrimental to a business's reputation and financial health.

| Sales Tax Component | Rate (%) |

|---|---|

| State Sales Tax | 6.25 |

| County Sales Tax (Harris County) | 0.50 |

| City Sales Tax (Houston) | 1.25 |

| Total Sales Tax Rate in Houston | 8.00 |

Impact on Consumers: Balancing Benefits and Costs

From a consumer perspective, the sales tax in Houston can significantly impact purchasing decisions and overall spending habits. While the tax provides essential funding for public services and infrastructure, it also increases the cost of goods and services for residents and visitors.

For example, when purchasing a new appliance, the sales tax of 8.00% in Houston adds a substantial amount to the final price. This can discourage consumers from making impulsive purchases or prompt them to seek out tax-free alternatives, such as online shopping from out-of-state retailers.

However, it's important to recognize that the sales tax also contributes to the overall economic well-being of the city. It ensures that vital services, such as public transportation, emergency response, and public education, are adequately funded. This balance between consumer costs and public benefits is a critical aspect of the sales tax system in Houston.

Sales Tax Exemptions and Special Considerations

While the majority of retail goods are subject to the 8.00% sales tax in Houston, certain items and circumstances enjoy exemptions or special considerations.

Groceries and Essential Items

One notable exemption is the sales tax on groceries. In Texas, most food items intended for consumption at home, such as bread, dairy products, and produce, are exempt from sales tax. This exemption is a significant relief for households, as it reduces the tax burden on essential household expenses.

Additionally, certain essential items like prescription medications, over-the-counter drugs, and medical devices are also exempt from sales tax. This exemption ensures that individuals with medical needs can access necessary items without incurring additional costs.

Online Sales and Remote Transactions

With the rise of e-commerce, the sales tax landscape has become more complex. When purchasing goods online from out-of-state retailers, consumers may not be subject to the same sales tax rates as in-store purchases. This can create a disparity in pricing and potentially encourage consumers to seek out online alternatives.

However, it's important to note that certain online retailers are required to collect and remit sales tax based on the destination of the shipment. This ensures that, even with online purchases, the applicable sales tax is still collected and directed towards the appropriate governmental entities.

Conclusion: Navigating the Houston Sales Tax Landscape

The sales tax rate in Houston, Texas, is a critical component of the city’s economic ecosystem. It provides a stable revenue stream for the state, county, and city governments while influencing the pricing and competitiveness of local businesses. For consumers, it represents a balance between the cost of goods and the funding of essential public services.

Understanding the intricacies of the sales tax rate is essential for businesses and consumers alike. By staying informed about the applicable rates and exemptions, individuals and businesses can make informed decisions that align with their financial goals and contribute to the overall economic health of Houston.

Are there any sales tax holidays in Houston, Texas?

+Yes, Texas occasionally offers sales tax holidays, during which certain items are exempt from sales tax for a limited time. These holidays typically coincide with back-to-school shopping or energy-efficient appliance purchases. Stay updated with the Texas Comptroller’s office for specific dates and eligible items.

How often do sales tax rates change in Houston?

+Sales tax rates in Houston and Texas are generally stable, with infrequent changes. However, it’s crucial to stay informed, as any changes in tax rates or regulations can impact businesses and consumers. Regularly checking official sources like the Texas Comptroller’s website ensures you have the most up-to-date information.

Can businesses in Houston offer tax-free promotions to attract customers?

+Yes, businesses in Houston can strategically offer tax-free promotions or discounts to attract customers. This practice is particularly effective during holiday seasons or to boost sales during slower periods. However, it’s essential to ensure compliance with tax regulations and accurately calculate the applicable tax for each transaction.