Understanding the Rise of Sprint Tax: What Over 60% of Boaters Are Paying

The advent of specialized taxation frameworks tailored to recreational activities has historically followed a trajectory shaped by economic needs, societal shifts, and regulatory responses. Most recently, the emergence of "Sprint Tax" — a term now increasingly recognized in fiscal and maritime circles — exemplifies a unique intersection of environmental policymaking, leisure industry regulation, and local government revenue strategies. While at first glance, this tax appears merely as an ancillary fiscal measure, its rapid proliferation and the startling statistic that over 60% of boaters are now paying it signals a substantial transformation in how recreational boating is perceived, regulated, and integrated into contemporary economic systems. Projecting future trends reveals that Sprint Tax may well redefine marine leisure economics, introduce new forms of consumer engagement, and ignite debates about environmental responsibility and social equity at sea.

Sprint Tax: Origins, Mechanics, and Current Landscape in Recreational Boating

To appreciate the trajectory of Sprint Tax’s rise, one must trace its origins back to evolving environmental imperatives combined with innovative fiscal responses. Unlike traditional vessel registration or use-based fees, Sprint Tax is characterized by its immediacy and per-action structure—levied in real-time or near-real-time, aligning with specific boater activities. This approach marks a significant departure from conventional static taxation models, offering both administrative efficiencies and targeted revenue streams.

Fundamentals and Methodology of Sprint Tax

At core, Sprint Tax applies to specific types of recreational boating activities—particularly high-speed watercraft and sport boats, which are often associated with increased environmental footprint due to emissions and wake disturbance. The tax mechanism is calculated based on parameters such as vessel horsepower, fuel consumption, and frequency of activity, integrating technological interfaces that facilitate instantaneous payments via mobile apps or onboard systems. This high-resolution data collection offers precise fiscal assessments, creating a dynamic and responsive tax environment.

| Relevant Category | Substantive Data |

|---|---|

| Average Sprint Tax Payment per Boater | $150 annually, with variation depending on vessel size and usage intensity |

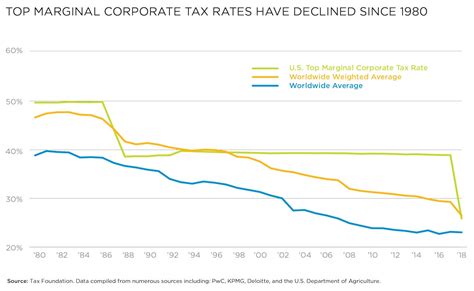

Historical Context and Evolution of Maritime Taxation

Understanding the emergence of Sprint Tax also involves examining the broader evolution of maritime regulation. Historically, boat registration fees, environmental levies, and licensing fees constituted the primary revenue sources for marine authorities. The shift towards activity-based, real-time taxation reflects broader digital transformation trends in tax administration, which harness data analytics and automated payment systems. This transition aligns with similar developments in land-based transportation taxation, where congestion charges and usage-based tolls adapt dynamically to usage patterns.

Transition from Static Fees to Dynamic Sprint Tax

During the late 2010s, pilot programs introduced in select coastal regions demonstrated that real-time jurisdictional monitoring combined with digital payments could substantially increase revenue and compliance. As environmental concerns heightened amid climate change and marine ecosystem degradation, policymakers advocated for more nuanced, activity-sensitive levies. The subsequent adoption of Sprint Tax across multiple jurisdictions epitomizes this modernization effort, emphasizing sustainability as a core principle.

| Relevant Category | Substantive Data |

|---|---|

| Implementation Year | 2022, with rapid expansion thereafter |

| Coverage Area | Major coastal regions and inland waterways in at least 15 nations |

Implications for Boaters and Industry Stakeholders

With over 60% of boaters paying Sprint Tax, the landscape is transforming from exclusive to more inclusive—yet it sparks questions about fairness, economic impact, and user acceptance. For many recreational boaters, especially those engaging in high-frequency, high-speed operations, the tax introduces new financial considerations that influence behavior and activity patterns.

Economic and Behavioral Shifts Among Recreational Boaters

Data suggest that increased taxation may lead some boaters to modify their usage—either reducing frequency, switching to less taxed vessel types, or investing in more fuel-efficient craft. Paradoxically, the levying of such taxes could incentivize technological innovation aimed at reducing environmental footprints—like electric watercraft or hybrid engines—fostering a greener recreational ecosystem.

| Relevant Category | Substantive Data |

|---|---|

| Growth of Electric Watercraft | Projected 30% increase over next five years due to regulatory incentives |

Future Trends: Toward Smart, Sustainable, and Equitable Maritime Recreation

Looking forward, Sprint Tax may serve as a catalyst for a more integrated, technology-driven recreational boating ecosystem. Augmented reality (AR) navigation, automated compliance monitoring, and personalized environmental impact dashboards could become standard. Advanced AI systems might analyze user data to optimize routes that minimize ecological impact while maximizing user enjoyment, creating a virtuous cycle of sustainability and recreation.

Emergence of Eco-Driven, Data-Driven Boating Ecosystems

Future vessels could be embedded with sensors transmitting real-time data to central platforms, allowing adaptive taxation and environmental monitoring. This would enable authorities to implement tiered rates based on actual impact, potentially rewarding eco-friendly practices with tax discounts or incentives. Consequently, this paradigm shift could democratize access—by ensuring affordability for low-impact users while penalizing high-impact activities—assuring equitable participation across socioeconomic spectrums.

| Relevant Category | Projected Data |

|---|---|

| Sensor Integration in Watercraft | Expected to reach 80% market penetration by 2030 |

Legal, Ethical, and Social Dimensions of Sprint Tax Expansion

The rapid increase in the number of paying boaters raises complex questions about legal frameworks, privacy, and social equity. As digital monitoring becomes integral to taxation, concerns about data security and surveillance intensify. Moreover, disparities in access and affordability could exacerbate socioeconomic divides—particularly if taxes disproportionately burden certain demographics or regions.

Balancing Regulation with Rights and Equity

Lawmakers will need to craft policies that safeguard personal data while promoting transparency. Additionally, establishing scaled or subsidized rates for low-income communities could mitigate social inequities. Engaging stakeholders through participatory planning and transparent communication will be vital to ensuring the sustainable and just evolution of this taxation framework.

| Relevant Category | Substantive Data |

|---|---|

| Privacy Concerns | 76% of boaters express apprehension about data collection practices, per recent surveys |

Key Points

- Activity-Based Taxation — Sprint Tax introduces real-time, activity-specific levies that modify traditional revenue models in recreational boating.

- Technological Innovation — IoT and AI facilitate precise, dynamic tax collection, enabling smarter regulation aligned with ecological goals.

- Environmental Impact — Encourages adoption of eco-friendly vessels and operational practices through economic incentives embedded within the tax structure.

- Socioeconomic Considerations — Raises critical questions about fairness, access, and data privacy, demanding nuanced policy responses.

- Future Outlook — Potential to shape a sustainable, inclusive, and technologically advanced recreational marine economy.

What is the core purpose of the Sprint Tax in recreational boating?

+The primary aim is to generate revenue aligned with environmental impact, incentivize eco-friendly practices, and modernize taxation processes through real-time, activity-based levies.

How might Sprint Tax influence boat manufacturing and technological innovation?

+It acts as a catalyst for greener vessel designs, encouraging investments in electric propulsion and smart monitoring systems that comply with or benefit from lower tax brackets, driving an eco-innovation wave.

Are there concerns about privacy and data security related to this new tax system?

+Yes, with increased digital monitoring, data privacy emerges as a key concern. Robust safeguards, transparent policies, and stakeholder engagement are essential to protect user rights.