Butte County Tax Collector

The Butte County Tax Collector's Office plays a crucial role in the financial ecosystem of Butte County, California, serving as the gateway for taxpayers to fulfill their fiscal obligations and ensuring the smooth functioning of the county's revenue system. In this comprehensive guide, we will delve into the various aspects of the Butte County Tax Collector's Office, exploring its services, responsibilities, and the impact it has on the local community.

Introduction to the Butte County Tax Collector

The Butte County Tax Collector’s Office is a vital governmental department tasked with the efficient collection and distribution of taxes, fees, and assessments within the county. This office operates under the authority of the Butte County Board of Supervisors, ensuring transparency and accountability in its operations. With a dedicated team of professionals, the Tax Collector’s Office aims to provide exceptional service to taxpayers while facilitating the county’s financial operations.

Services Offered by the Butte County Tax Collector

The Tax Collector’s Office offers a wide array of services to cater to the diverse needs of Butte County residents and businesses. These services include, but are not limited to:

- Property Tax Collection: One of the primary responsibilities is the collection of property taxes. Property owners within Butte County can pay their taxes online, by mail, or in person at the Tax Collector's Office. The office provides detailed information on assessment values, tax rates, and due dates to ensure taxpayers are well-informed.

- Business Tax Services: The Tax Collector's Office assists businesses in obtaining necessary permits and licenses. This includes business license renewals, fees for various business activities, and the collection of taxes related to business operations.

- Vehicle Registration and Fees: Residents can register their vehicles and pay associated fees at the Tax Collector's Office. This includes vehicle registration renewals, title transfers, and the processing of vehicle-related tax documents.

- Assessment Appeals: Property owners who believe their property assessment is incorrect can file an appeal with the Tax Collector's Office. The office provides guidance and facilitates the appeal process, ensuring fairness in property tax assessments.

- Online Payment Options: Recognizing the convenience and efficiency of digital transactions, the Tax Collector's Office offers secure online payment portals. Taxpayers can pay their taxes, fees, and assessments online, reducing the need for physical visits to the office.

- Tax Delinquency Management: The office actively manages tax delinquency cases. It works with taxpayers to resolve delinquent accounts, offering payment plans and providing information on potential penalties and interest.

- Tax Research and Records: The Tax Collector's Office maintains a comprehensive database of tax records, providing taxpayers with access to historical tax information and assessment data.

Impact on the Butte County Community

The operations of the Butte County Tax Collector’s Office have a profound impact on the local community and the overall economy of the county. Here are some key ways in which the office contributes to the well-being of Butte County:

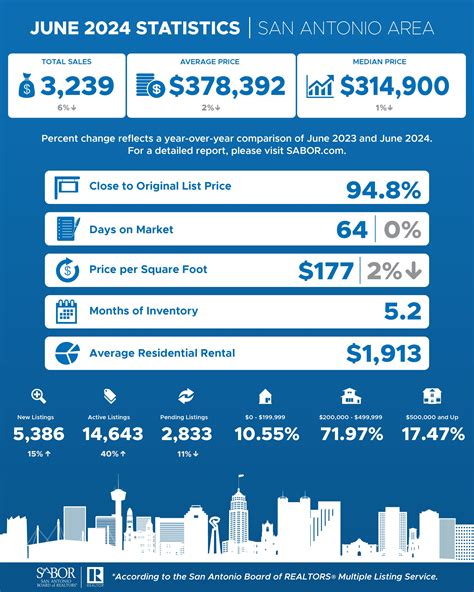

Revenue Generation and Allocation

The tax collection process is vital for generating revenue that funds essential public services and infrastructure development. Property taxes, business taxes, and vehicle registration fees contribute significantly to the county’s budget, supporting areas such as education, public safety, healthcare, and social services.

| Revenue Source | Allocation |

|---|---|

| Property Taxes | Education, Public Safety, General Government Services |

| Business Taxes | Economic Development, Infrastructure Projects |

| Vehicle Registration Fees | Transportation and Road Maintenance |

Efficient Tax Administration

The Tax Collector’s Office ensures that taxes are collected efficiently and distributed fairly. By streamlining the tax collection process, the office minimizes administrative burdens on taxpayers and businesses, allowing them to focus on their core activities.

Community Engagement and Education

The office actively engages with the community through outreach programs and educational initiatives. It provides resources and workshops to help taxpayers understand their fiscal responsibilities, offering guidance on tax payment options, assessment appeals, and more. This community engagement fosters a culture of transparency and financial literacy.

Economic Development

By providing efficient business tax services and supporting the local business community, the Tax Collector’s Office plays a pivotal role in fostering economic growth. Business owners can access necessary licenses and permits, and the office’s online payment systems streamline business operations, making Butte County an attractive location for entrepreneurs and investors.

Financial Stability and Planning

The Tax Collector’s Office contributes to the county’s financial stability by ensuring timely and accurate tax collection. This predictability in revenue generation allows the county to plan its budget effectively, making informed decisions about public spending and investments.

Conclusion: A Pillar of Butte County’s Financial Ecosystem

The Butte County Tax Collector’s Office stands as a cornerstone of the county’s financial ecosystem, facilitating the smooth flow of revenue and supporting the well-being of its residents. Through its comprehensive services, efficient tax administration, and community engagement, the office ensures that taxpayers have the resources and guidance they need to fulfill their fiscal obligations. As a result, the office plays a pivotal role in shaping the economic landscape and overall prosperity of Butte County.

What are the tax rates in Butte County?

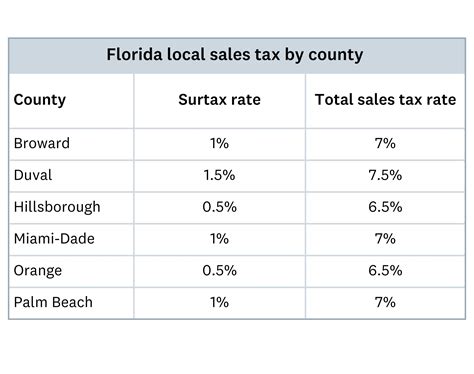

+Tax rates in Butte County vary depending on the type of tax and the specific property or business. For instance, property tax rates are determined by the assessed value of the property and the applicable tax rate. The Tax Collector’s Office provides detailed information on tax rates for different categories, ensuring taxpayers have the necessary data to calculate their tax obligations accurately.

How can I pay my taxes in Butte County?

+Butte County Tax Collector’s Office offers a variety of payment methods for taxpayers’ convenience. You can pay your taxes online through their secure payment portal, by mail, or in person at the Tax Collector’s Office. Additionally, the office provides options for automatic payment plans and payment by phone.

What happens if I don’t pay my taxes on time in Butte County?

+Tax delinquency is a serious matter in Butte County. If you fail to pay your taxes on time, you may incur penalties and interest on the outstanding amount. The Tax Collector’s Office works with taxpayers to resolve delinquent accounts, but prolonged non-payment can lead to legal action and potential liens on your property.

How can I appeal my property assessment in Butte County?

+If you believe your property assessment is incorrect, you have the right to appeal. The Tax Collector’s Office provides a step-by-step guide on how to file an assessment appeal. This process typically involves gathering evidence, filling out an appeal form, and potentially attending a hearing to present your case.

What are the business tax obligations for a new business in Butte County?

+New businesses in Butte County must obtain the necessary licenses and permits to operate legally. The Tax Collector’s Office assists businesses in understanding their tax obligations, including business license fees, sales tax collection, and any other applicable taxes based on the nature of the business. It’s crucial for new businesses to consult with the office to ensure they meet all tax requirements.