San Diego Tax

Welcome to a comprehensive guide on understanding the intricacies of San Diego Tax, a topic of great importance for residents, businesses, and investors in the vibrant city of San Diego. This article aims to demystify the tax landscape, offering a deep dive into the various tax structures, obligations, and opportunities unique to this region. Whether you're a newcomer navigating the financial aspects of life in San Diego or an established business seeking clarity on tax strategies, this guide will provide valuable insights and expert advice.

Unraveling the San Diego Tax Landscape

San Diego, with its thriving economy and diverse business landscape, presents a complex yet intriguing tax environment. From personal income taxes to business-specific levies, understanding the tax obligations is crucial for financial planning and strategy development. This section will provide an in-depth analysis of the key tax components, shedding light on their applicability, rates, and potential benefits.

Personal Income Tax: A Resident’s Perspective

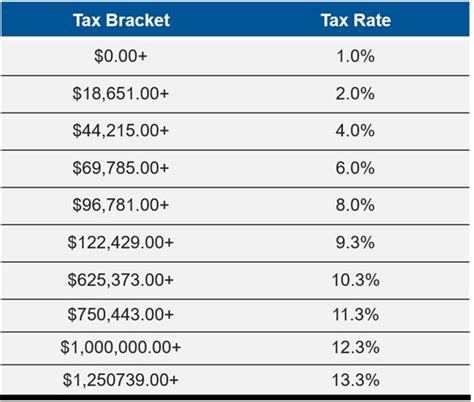

For individuals residing in San Diego, personal income tax is a significant consideration. The state of California imposes a progressive income tax system, with rates ranging from 1% to 12.3%. This section will explore the income brackets, deductions, and credits available to San Diego residents, offering practical tips for optimizing personal tax situations.

Moreover, we'll delve into the impact of local taxes, such as the San Diego City Business Tax, which applies to individuals earning income within the city limits. Understanding these local levies is essential for comprehensive tax planning.

Business Taxation: Strategies for Success

San Diego’s dynamic business environment attracts a wide range of enterprises, each with unique tax obligations. This section will provide an overview of the tax structures applicable to businesses, from sole proprietorships to corporations. We’ll discuss the advantages and considerations of different business entities, such as LLCs and S-Corps, and their tax implications.

Additionally, we'll explore the city's Business Tax Registration Program, which mandates tax registration for certain business activities. Understanding the registration process and compliance requirements is vital for businesses operating in San Diego.

Property Tax: Ownership and Investment

Property ownership in San Diego comes with its own set of tax considerations. The state’s Proposition 13 limits annual property tax increases, but understanding the assessment process and potential reassessments is crucial for property owners. This section will guide readers through the property tax landscape, including assessment appeals and the benefits of long-term ownership.

For investors, we'll also discuss the tax implications of real estate transactions, such as the California Real Estate Transfer Tax, and strategies for optimizing tax outcomes in the San Diego market.

Sales and Use Tax: Consumer and Business Impact

San Diego’s sales and use tax rates are a key consideration for both consumers and businesses. This section will clarify the distinction between sales and use taxes, their rates, and the products and services they apply to. We’ll also explore the tax obligations of online retailers, a critical aspect in today’s digital economy.

Furthermore, we'll discuss the San Diego Transit Development Sales Tax, a dedicated tax supporting public transportation, and its impact on local businesses and residents.

Tax Incentives and Credits: Maximizing Opportunities

San Diego, like many regions, offers a range of tax incentives and credits to encourage economic development and business growth. This section will highlight these opportunities, including tax breaks for specific industries, research and development credits, and incentives for job creation. Understanding these incentives can significantly impact a business’s bottom line and strategic direction.

| Tax Incentive | Description |

|---|---|

| California Competes Tax Credit | A discretionary program offering tax credits to businesses creating jobs and investing in California. |

| Research & Development Tax Credit | A state credit for businesses engaged in qualified research activities. |

| Film and Television Tax Credit | Incentives for film and TV productions in California, including San Diego. |

Tax Compliance and Reporting: Best Practices

Navigating the tax landscape requires a proactive approach to compliance and reporting. This section will provide best practices for tax record-keeping, deadline management, and accurate filing. We’ll also discuss the role of tax professionals and when it’s advisable to seek expert guidance.

For businesses, we'll explore the benefits of implementing robust tax management systems, ensuring compliance and minimizing the risk of audits.

Conclusion: Navigating San Diego’s Tax Opportunities

Understanding the tax landscape is a crucial step in maximizing financial opportunities in San Diego. Whether you’re an individual taxpayer, a business owner, or an investor, this guide has provided an in-depth look at the tax structures, obligations, and strategies unique to this region. By staying informed and proactive, you can navigate the tax landscape with confidence, ensuring compliance and optimizing your financial outcomes.

What is the average effective tax rate for San Diego residents?

+

The effective tax rate for San Diego residents varies based on income and deductions. On average, it falls between 6% and 8% of adjusted gross income, but can be higher for high-income earners.

How often are property taxes assessed in San Diego?

+

Property taxes are assessed annually, based on the property’s value as of January 1st. However, reassessments can occur under certain circumstances, such as significant improvements or changes in ownership.

Are there any tax incentives for renewable energy projects in San Diego?

+

Yes, San Diego offers tax incentives for renewable energy projects. The state’s Investment Tax Credit (ITC) provides a federal tax credit for solar energy systems, and local incentives may also be available through the city’s Climate Action Plan.

What is the deadline for filing San Diego City Business Taxes?

+

The deadline for filing San Diego City Business Taxes varies depending on the type of business and its tax obligations. Generally, the deadline is the 15th day of the fourth month following the close of the tax period. For example, for a calendar year business, the deadline is typically April 15th.

Can I appeal my property tax assessment in San Diego?

+

Yes, property owners in San Diego have the right to appeal their property tax assessments if they believe the assessed value is inaccurate or unfair. The appeal process involves submitting a formal application and providing evidence to support the request for a lower valuation.