How To Do Previous Years Taxes

Filing taxes can be a daunting task, especially when it comes to tackling previous years' returns. Whether you've missed a filing deadline, encountered unexpected life events, or simply want to ensure accurate records, catching up on past tax years is crucial. This comprehensive guide will walk you through the process, offering expert insights and practical steps to ensure a smooth and successful tax journey.

Understanding the Importance of Filing Previous Years’ Taxes

Filing taxes for previous years, often referred to as back taxes, is more than just a legal obligation; it’s a vital step towards financial clarity and compliance. Unfiled tax returns can lead to a range of complications, including penalties, interest charges, and even legal repercussions. Additionally, accurate tax records are essential for financial planning, securing loans, and accessing government benefits.

For instance, consider the case of Mr. Smith, who, due to a change in personal circumstances, missed filing his taxes for three consecutive years. This oversight not only led to significant financial penalties but also hindered his ability to secure a mortgage for a new home. By understanding the importance of timely tax filing, individuals can avoid such pitfalls and maintain a healthy financial standing.

Step-by-Step Guide: Filing Previous Years’ Taxes

Here’s a comprehensive roadmap to help you navigate the process of filing back taxes efficiently and effectively:

1. Gather Essential Documentation

Start by collecting all relevant financial documents for the tax years in question. This includes pay stubs, W-2 forms, 1099 forms, expense receipts, and any other records that support your income, deductions, and credits. Ensure that you have access to accurate and complete information to facilitate the filing process.

For instance, if you're self-employed, you'll need to gather records of your business income and expenses, such as invoices, bank statements, and receipts. Organizing these documents beforehand can streamline the tax preparation process.

2. Determine the Number of Years to File

The Internal Revenue Service (IRS) requires taxpayers to file returns for the current tax year and any prior years for which they owe taxes or are due a refund. It’s crucial to identify the number of years for which you need to file to ensure compliance and avoid unnecessary delays.

| Scenario | Years to File |

|---|---|

| Missed a Single Year | 1 Year |

| Multiple Missed Years | Variable, based on individual circumstances |

| Self-Employed or Complex Returns | Consult a tax professional for guidance |

3. Assess Your Tax Liability

Before filing, it’s essential to understand your tax liability for each year. This involves calculating your taxable income, deductions, and credits to determine whether you owe taxes or are due a refund. Online tax preparation software or a tax professional can assist in this process, providing accurate calculations and guidance.

For instance, if you've experienced significant life changes, such as a marriage, divorce, or the birth of a child, these events can impact your tax liability. Understanding these implications can help you prepare accurate returns and optimize your tax strategy.

4. Choose the Right Filing Method

There are several methods to file previous years’ taxes, each with its own advantages and considerations. The most common methods include:

- Paper Filing: This traditional method involves completing paper tax forms and submitting them to the IRS by mail. While it may be more time-consuming, it can be suitable for simple tax situations.

- Online Filing: Electronic filing is often the preferred method, offering convenience, speed, and reduced chances of errors. The IRS provides online filing options through their website, and many tax preparation software programs facilitate this process.

- Tax Professional Assistance: Engaging a tax professional, such as a Certified Public Accountant (CPA) or Enrolled Agent (EA), can be beneficial for complex tax situations or if you prefer personalized guidance.

5. File and Pay Any Outstanding Taxes

Once you’ve determined your tax liability and chosen a filing method, it’s time to submit your tax returns. If you owe taxes, ensure that you pay the full amount due to avoid further penalties and interest charges. The IRS offers payment plans for those who cannot pay the full amount immediately.

It's important to note that filing late can result in penalties, which are typically a percentage of the amount owed. By filing promptly and accurately, you can minimize these penalties and maintain a positive relationship with the IRS.

6. Keep Accurate Records

After filing your back taxes, it’s crucial to maintain organized records. Keep copies of your filed returns, supporting documentation, and any correspondence with the IRS. These records can be essential for future reference and audit protection.

Consider using a secure digital storage system or a physical filing system to keep your tax records organized and easily accessible. This practice ensures that you can quickly retrieve information if needed and simplifies the process of filing taxes in subsequent years.

Expert Tips and Strategies for Successful Tax Filing

Navigating the world of taxes can be complex, but with the right strategies and mindset, the process can become more manageable. Here are some expert tips to enhance your tax filing experience:

- Stay Informed: Keep yourself updated with the latest tax laws and regulations. The IRS website and reputable tax resources can provide valuable insights and guidance.

- Seek Professional Help: For complex tax situations or if you're unsure about any aspect of the filing process, consider consulting a tax professional. Their expertise can save you time, reduce errors, and optimize your tax strategy.

- Organize Your Finances: Maintaining a well-organized financial system throughout the year can simplify tax filing. Keep track of income, expenses, and deductions to streamline the preparation process.

- Utilize Tax Software: Online tax preparation software can be a powerful tool, offering convenience, accuracy, and guidance. Many programs provide step-by-step instructions and calculate taxes automatically, reducing the risk of errors.

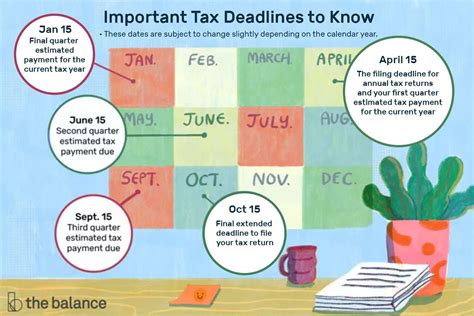

- Set Reminders: Tax deadlines can be easily overlooked, especially when dealing with multiple years. Set reminders for important dates, such as filing deadlines and payment due dates, to stay on track.

Frequently Asked Questions (FAQs)

How long do I have to file previous years’ taxes?

+

The IRS generally allows taxpayers to file tax returns for the past three tax years. However, if you are due a refund, there is no time limit for filing. It’s advisable to file as soon as possible to avoid penalties and maintain compliance.

What happens if I owe taxes for previous years?

+

If you owe taxes for previous years, you’ll need to file your returns and pay the full amount due. The IRS may impose penalties and interest charges for late payments. However, they offer payment plans to help taxpayers manage their tax liabilities.

Can I file previous years’ taxes electronically?

+

Yes, you can file previous years’ taxes electronically through the IRS website or using tax preparation software. Electronic filing is often faster, more accurate, and reduces the risk of errors compared to paper filing.

What if I can’t afford to pay my back taxes?

+

If you’re unable to pay your back taxes in full, the IRS offers various payment options, including installment agreements and temporary delays. It’s important to communicate with the IRS and explore these options to manage your tax liability effectively.

Are there any penalties for filing late?

+

Yes, the IRS imposes penalties for filing tax returns late. The penalty is typically a percentage of the unpaid tax and can accumulate over time. However, the IRS may waive or reduce penalties under certain circumstances, so it’s advisable to consult with a tax professional.