Madison County Property Taxes

Welcome to Madison County, a vibrant and diverse community nestled in the heart of Alabama. In this comprehensive guide, we delve into the intricate world of property taxes, a topic that impacts every homeowner and property owner within this vibrant county. With a rich history dating back to its establishment in 1808, Madison County has experienced significant growth and development, making it one of the most dynamic regions in the state. As we navigate the complexities of property taxation, this article aims to provide an in-depth analysis, offering valuable insights and practical information to navigate the property tax landscape effectively.

Unraveling the Madison County Property Tax Landscape

Madison County’s property tax system is a complex yet essential component of its economic framework. Understanding how property taxes work and their implications is crucial for homeowners, investors, and businesses alike. This section provides a comprehensive overview, shedding light on the various aspects that influence property tax assessments and rates.

Property Tax Assessment Process

The property tax assessment process in Madison County is meticulous and follows a well-defined procedure. The county’s tax assessor’s office is responsible for evaluating the fair market value of each property within its jurisdiction. This process involves physical inspections, analyzing recent sales data, and considering various factors such as location, size, improvements, and overall condition.

Once the assessment is complete, property owners receive a notice of assessment, detailing the estimated value of their property. This value serves as the basis for calculating property taxes, which are then determined by multiplying the assessed value by the applicable tax rate.

| Assessment Period | Assessment Frequency |

|---|---|

| Annual | Once a year, typically in the spring |

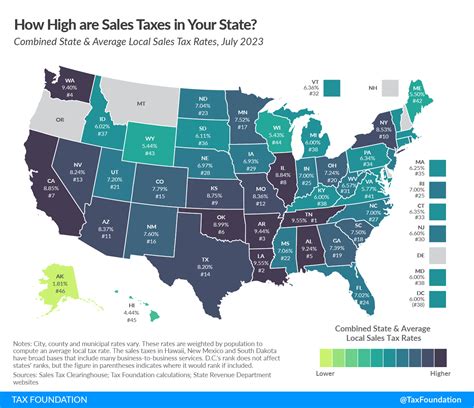

Tax Rates and Millage

Madison County utilizes a millage rate system to determine property tax rates. A millage rate is expressed in mills, where one mill represents one-tenth of a cent. This rate is applied to the assessed value of the property to calculate the annual property tax liability.

The millage rate is set by various taxing authorities within the county, including the county government, local school districts, municipalities, and special districts. Each entity’s millage rate contributes to the overall property tax rate, which can vary depending on the specific location of the property.

| Taxing Authority | Millage Rate |

|---|---|

| Madison County | 6.7 mills |

| Huntsville City Schools | 11.2 mills |

| Madison City Schools | 11.7 mills |

| Madison City | 5.0 mills |

| Huntsville City | 5.0 mills |

Property Tax Exemptions and Deductions

Madison County offers a range of property tax exemptions and deductions to eligible homeowners, providing financial relief and incentives. These include:

- Homestead Exemption: Property owners who use their property as their primary residence can apply for a homestead exemption, reducing the assessed value by a certain amount. This exemption varies based on factors such as age, disability, and military service.

- Senior Citizen Exemption: Madison County provides property tax relief to senior citizens aged 65 and above. Eligible seniors can apply for an exemption, reducing their property taxes based on their income and assessed property value.

- Veteran's Exemption: Active-duty military personnel and veterans are entitled to property tax exemptions. The amount of exemption varies depending on the veteran's disability status and length of service.

- Agricultural Exemption: Property owners utilizing their land for agricultural purposes may qualify for an agricultural exemption, reducing the assessed value and, consequently, their property taxes.

Property Tax Payment Options

Madison County offers convenient payment options for property taxes, ensuring flexibility and ease for taxpayers. Property owners can choose from the following methods:

- Online Payment: The Madison County Tax Collector's Office provides an online payment portal, allowing taxpayers to make secure payments using credit or debit cards. This method is efficient and accessible, offering a quick and convenient way to settle property tax liabilities.

- Mail-In Payment: Taxpayers can also opt to mail their property tax payments. The tax collector's office provides payment coupons, which should be included with the payment. Payments can be made by check or money order and sent to the designated address.

- In-Person Payment: For those who prefer a more traditional approach, in-person payments are accepted at the Madison County Tax Collector's Office. Taxpayers can visit the office during business hours and make payments by cash, check, or money order.

Property Tax Due Dates and Penalties

Understanding the property tax due dates and potential penalties is crucial to avoid any financial setbacks. Madison County property taxes are due in two installments:

- First Installment: The first installment is typically due in October, covering the period from October to March.

- Second Installment: The second installment is due in April, covering the period from April to September.

Failure to pay property taxes on time can result in penalties and interest charges. Madison County imposes a late payment penalty of 10% on the unpaid balance if taxes are not paid by the due date. Additionally, a 1% interest charge is applied monthly on the unpaid balance until the taxes are paid in full.

Property Tax Appeals and Disputes

If a property owner disagrees with the assessed value of their property or believes there has been an error in the assessment process, they have the right to appeal. Madison County provides a comprehensive appeals process, ensuring transparency and fairness.

The first step in the appeals process is to file a written notice of appeal with the Madison County Board of Equalization. This notice should be filed within a specified timeframe, typically 30 to 60 days after receiving the assessment notice. The board will then review the appeal and make a determination, which can be further appealed to the Alabama Tax Tribunal or the Circuit Court.

Madison County Property Tax Trends and Insights

Delving deeper into the Madison County property tax landscape, this section offers a comprehensive analysis of the latest trends, insights, and potential future implications. By examining historical data, current market conditions, and economic factors, we provide valuable context for property owners and investors to make informed decisions.

Historical Property Tax Rates

Analyzing historical property tax rates in Madison County provides valuable insights into the long-term trends and stability of the tax landscape. Over the past decade, the county has experienced a relatively stable tax rate environment. While there have been minor fluctuations, the overall trend indicates a commitment to maintaining a balanced and predictable tax structure.

| Year | Overall Tax Rate (Mills) |

|---|---|

| 2013 | 17.4 |

| 2014 | 17.6 |

| 2015 | 17.8 |

| 2016 | 17.7 |

| 2017 | 17.6 |

| 2018 | 17.5 |

| 2019 | 17.4 |

| 2020 | 17.5 |

| 2021 | 17.6 |

| 2022 | 17.7 |

Impact of Economic Factors

The economic health and growth of Madison County directly influence property tax rates and assessments. As the county’s economy expands, driven by factors such as job growth, industrial development, and a thriving technology sector, property values tend to increase. This, in turn, can lead to higher property tax assessments and revenues for the county.

On the other hand, economic downturns or recessions can have the opposite effect, potentially leading to reduced property values and, consequently, lower property tax assessments. Madison County’s diverse economy and robust industrial base provide a certain level of resilience, helping to mitigate the impact of economic fluctuations on property taxes.

Real Estate Market Trends

The real estate market in Madison County has experienced significant growth and development in recent years. As the county continues to attract new businesses and residents, demand for housing and commercial properties has surged. This increased demand has led to rising property values, particularly in desirable neighborhoods and commercial districts.

However, it’s important to note that property values can vary significantly across the county. Rural areas and less developed regions may have lower property values compared to urban centers and established residential communities. Understanding these local market dynamics is crucial for property owners and investors when assessing the potential impact on property taxes.

Future Outlook and Potential Changes

Looking ahead, Madison County’s property tax landscape is poised for continued stability and growth. The county’s commitment to economic development, infrastructure improvements, and a business-friendly environment positions it well for future prosperity. As the county continues to attract new investments and businesses, property values are likely to remain strong, supporting a healthy tax base.

However, it’s important to remain vigilant and aware of potential changes and challenges. Economic shifts, changes in state or local tax policies, and unforeseen events can impact property tax rates and assessments. Staying informed and engaged with local government and community initiatives is essential for property owners to navigate any future changes effectively.

Conclusion: Navigating Madison County Property Taxes

Madison County’s property tax system, while complex, is designed to ensure fairness and transparency. By understanding the assessment process, tax rates, exemptions, and payment options, property owners can navigate the system with confidence. This comprehensive guide aims to empower homeowners, investors, and businesses with the knowledge and tools to make informed decisions regarding their property tax obligations.

As Madison County continues to thrive and grow, its property tax landscape will remain a vital component of its economic ecosystem. By staying informed and engaged, property owners can contribute to the county’s prosperity while managing their financial responsibilities effectively. We encourage readers to explore the resources provided by the Madison County Tax Assessor’s Office and Tax Collector’s Office for further guidance and assistance.

How often are property taxes assessed in Madison County?

+

Property taxes in Madison County are assessed annually, typically in the spring. This assessment process ensures that property values are up-to-date and accurate for tax purposes.

What is the deadline for paying property taxes in Madison County?

+

Property taxes in Madison County are due in two installments. The first installment is typically due in October, while the second installment is due in April. Failure to pay by the due date may result in penalties and interest charges.

Are there any property tax exemptions available in Madison County?

+

Yes, Madison County offers a range of property tax exemptions, including homestead exemptions, senior citizen exemptions, veteran’s exemptions, and agricultural exemptions. These exemptions provide financial relief to eligible homeowners and property owners.

How can I appeal my property tax assessment in Madison County?

+

If you believe your property tax assessment is inaccurate or unfair, you have the right to appeal. The process involves filing a written notice of appeal with the Madison County Board of Equalization within a specified timeframe. The board will review your appeal and make a determination, which can be further appealed if necessary.

What payment options are available for paying property taxes in Madison County?

+

Madison County offers several convenient payment options for property taxes. You can pay online using a credit or debit card, mail your payment with the provided payment coupon, or visit the Madison County Tax Collector’s Office during business hours to make an in-person payment.