Sales Tax In Boston Usa

Understanding sales tax is essential for both businesses and consumers, especially in a vibrant city like Boston. The sales tax system in Massachusetts, and specifically in Boston, is a key component of the state's revenue generation and plays a significant role in the local economy. This comprehensive guide aims to unravel the complexities of sales tax in Boston, USA, offering an in-depth analysis and practical insights.

The Fundamentals of Sales Tax in Boston

Sales tax in Boston, like the rest of Massachusetts, is a consumption tax imposed on the sale of tangible personal property and some services. It is a critical source of revenue for the state and local governments, contributing to the funding of essential public services and infrastructure. The sales tax rate in Boston consists of a state sales tax rate and a local sales tax rate, which is set by the municipality.

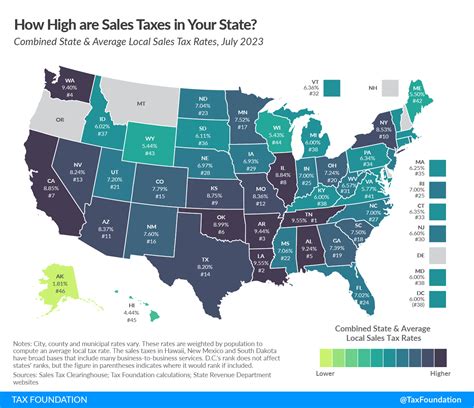

State Sales Tax Rate

The state sales tax rate in Massachusetts, including Boston, is currently set at 6.25%. This rate is applied to most retail sales, with some exceptions and exemptions, such as certain groceries, clothing items under $175, and prescription medications.

Local Sales Tax Rate

In addition to the state sales tax, Boston imposes its own local sales tax rate, which is 1.5%. This local sales tax is applied on top of the state rate, making the total sales tax rate in Boston 7.75%. This additional tax revenue helps fund city-specific initiatives and services.

The local sales tax rate in Boston has been relatively stable, but it's important for businesses and consumers to stay updated on any potential changes. The city may adjust the rate to meet budgetary needs or to align with state policies.

Sales Tax Exemptions and Special Cases

Massachusetts, including Boston, offers a range of sales tax exemptions and special cases. These exemptions can be complex and often require a deep understanding of the state's tax code. Some common exemptions include:

- Food and Groceries: Certain food items, such as unprepared food, produce, and non-taxable groceries, are exempt from sales tax.

- Clothing and Shoes: Clothing and footwear items priced under $175 are exempt from sales tax. This exemption provides a significant savings for Boston's shoppers.

- Prescription Medications: Sales tax is not applied to prescription medications, making healthcare more affordable for residents.

- Manufacturing and Resale: Sales tax is often not applicable to manufacturing processes or items intended for resale. This exemption is particularly important for Boston's robust manufacturing sector.

Sales Tax Collection and Remittance

For businesses operating in Boston, sales tax collection and remittance is a crucial aspect of their financial operations. Here's a closer look at the process:

Collection at Point of Sale

Businesses in Boston are responsible for collecting sales tax from customers at the point of sale. This includes online sales, where the business is required to collect and remit the appropriate sales tax based on the customer's shipping address.

To facilitate this process, businesses often use point-of-sale (POS) systems that automatically calculate and apply the correct sales tax rate based on the customer's location. This ensures compliance with the state's tax laws and simplifies the collection process.

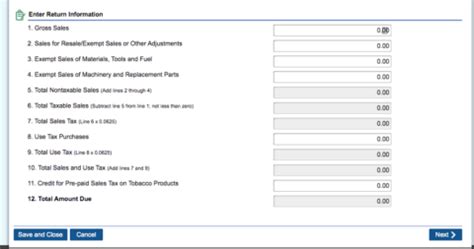

Remittance to the State

After collecting sales tax from customers, businesses are required to remit the collected tax to the Massachusetts Department of Revenue. The frequency of remittance depends on the business's sales volume and can range from monthly to quarterly. Larger businesses with higher sales volumes may be required to remit more frequently.

The remittance process typically involves filing a sales tax return, which details the total sales, the amount of sales tax collected, and any applicable exemptions or deductions. The business then submits this return along with the remittance to the Department of Revenue.

| Sales Tax Remittance Frequency | Businesses with Monthly Sales of... |

|---|---|

| Monthly | $50,000 or more |

| Quarterly | Less than $50,000 |

Sales Tax Registration

To collect and remit sales tax in Boston, businesses must first register with the Massachusetts Department of Revenue. This registration process ensures that the business is compliant with state tax laws and allows the Department of Revenue to track the business's sales and tax collections.

The registration process involves providing detailed information about the business, including its legal structure, location(s) of operation, and the types of goods and services it sells. Once registered, the business receives a sales tax certificate, which it must display at its place of business.

Compliance and Enforcement

Ensuring compliance with sales tax laws is a critical aspect of doing business in Boston. The Massachusetts Department of Revenue has established robust systems to monitor and enforce sales tax compliance.

Audit and Review

The Department of Revenue conducts regular audits and reviews of businesses to ensure they are accurately collecting and remitting sales tax. These audits can be random or targeted based on various factors, such as sales volume, industry, or previous compliance history.

During an audit, the Department of Revenue will review the business's sales records, tax returns, and remittances. They may also conduct onsite visits to verify the accuracy of the business's sales tax practices.

Penalties and Consequences

Non-compliance with sales tax laws can result in significant penalties for businesses. These penalties can include fines, interest on overdue taxes, and even criminal charges in cases of fraud or willful evasion.

The severity of penalties depends on the nature and extent of the non-compliance. For example, a business that accidentally fails to collect sales tax on a few transactions may face different consequences than a business that deliberately evades sales tax on a large scale.

Appeals and Disputes

If a business disagrees with the findings of an audit or believes it has been penalized unfairly, it has the right to appeal the decision. The appeals process involves a review by an independent administrative law judge, who will consider the evidence and make a final determination.

It's important for businesses to carefully document their sales tax practices and maintain accurate records to support their case in any appeals or disputes.

The Future of Sales Tax in Boston

As Boston and Massachusetts continue to evolve, the sales tax system is likely to see changes and updates. Here are some potential future developments:

Online Sales Tax Collection

With the rise of e-commerce, the collection of sales tax on online sales has become a growing focus for state and local governments. Boston, like many other cities, may implement measures to ensure that online retailers collect and remit sales tax on transactions with Boston residents.

Sales Tax Simplification

The complexity of the sales tax system can be a challenge for businesses, especially those operating in multiple states. Boston and Massachusetts may explore ways to simplify the sales tax process, such as through uniform tax rates or streamlined registration and remittance procedures.

Tax Incentives for Businesses

To attract and support businesses, Boston and Massachusetts may offer tax incentives, such as tax credits or reduced sales tax rates for certain industries or businesses that meet specific criteria. These incentives can make Boston a more attractive location for businesses to operate.

Impact of Remote Work

The shift to remote work during the COVID-19 pandemic has raised questions about the sales tax nexus. Boston, like other cities, may need to clarify its sales tax policies for remote workers and their purchases, especially if they are located outside the city or state.

Conclusion

Understanding and navigating the sales tax landscape in Boston is a critical aspect of doing business in the city. From collection and remittance to compliance and future developments, sales tax is a dynamic and evolving component of the local economy. By staying informed and compliant, businesses can contribute to Boston's economic vitality while also ensuring their financial stability.

Frequently Asked Questions

What is the current sales tax rate in Boston, Massachusetts?

+

The current sales tax rate in Boston is 7.75%, which includes a state sales tax rate of 6.25% and a local sales tax rate of 1.5%.

Are there any sales tax exemptions in Boston?

+

Yes, Boston and Massachusetts offer a range of sales tax exemptions, including exemptions for certain food items, clothing under 175, and prescription medications.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How often do businesses need to remit sales tax in Boston?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The frequency of sales tax remittance depends on a business's sales volume. Businesses with monthly sales of 50,000 or more are required to remit sales tax monthly, while those with lower sales volumes remit quarterly.

What happens if a business fails to register for sales tax in Boston?

+

Failing to register for sales tax in Boston can result in significant penalties and legal consequences. It is crucial for businesses to register with the Massachusetts Department of Revenue to avoid these issues.

How can businesses stay compliant with sales tax laws in Boston?

+

Businesses can stay compliant by accurately collecting sales tax at the point of sale, remitting it to the state on time, and keeping detailed records. Regularly reviewing sales tax laws and seeking professional advice can also help ensure compliance.