Minnesota State Income Tax

Minnesota, like many states in the US, imposes an income tax on its residents and businesses. The state's income tax system plays a crucial role in funding various public services and initiatives, making it an essential aspect of the state's economic framework. Understanding the intricacies of Minnesota's income tax is key for individuals and businesses operating within the state.

Understanding Minnesota’s Income Tax Structure

Minnesota employs a progressive income tax system, which means that higher income earners are subject to higher tax rates. This approach aims to distribute the tax burden fairly across different income brackets. The state’s income tax rates are divided into several brackets, and the applicable rate depends on an individual’s or business’s taxable income.

For individuals, Minnesota offers six tax brackets, ranging from 5.35% for the lowest income earners to 9.85% for the highest income bracket. These rates are applied to taxable income after deductions and exemptions have been taken into account. It's important to note that Minnesota's income tax rates are slightly higher than the national average, which provides a significant source of revenue for the state.

On the other hand, businesses in Minnesota are subject to a flat tax rate of 9.8%, which is applied to their net income. This rate is consistent across all business entities, including corporations, partnerships, and sole proprietorships. The state's business income tax is relatively higher compared to many other states, which can impact the financial planning and decision-making of businesses operating within Minnesota.

Taxable Income and Deductions

When calculating taxable income, Minnesota residents and businesses must consider various factors. For individuals, taxable income includes wages, salaries, bonuses, investment income, and other forms of earnings. However, certain deductions and exemptions can reduce the taxable income and, consequently, the amount of tax owed. These deductions include contributions to retirement accounts, medical expenses, and certain educational expenses.

Businesses, on the other hand, have different considerations when calculating their taxable income. They can deduct expenses related to their operations, such as salaries, rent, utilities, and supplies. Additionally, businesses can take advantage of depreciation deductions, which allow them to recover the cost of assets over time. These deductions play a crucial role in determining the net income subject to taxation.

| Income Tax Brackets for Individuals in Minnesota | Tax Rate |

|---|---|

| Up to $23,800 | 5.35% |

| $23,801 - $41,500 | 5.85% |

| $41,501 - $75,000 | 7.05% |

| $75,001 - $250,000 | 7.85% |

| $250,001 - $387,000 | 8.85% |

| Over $387,000 | 9.85% |

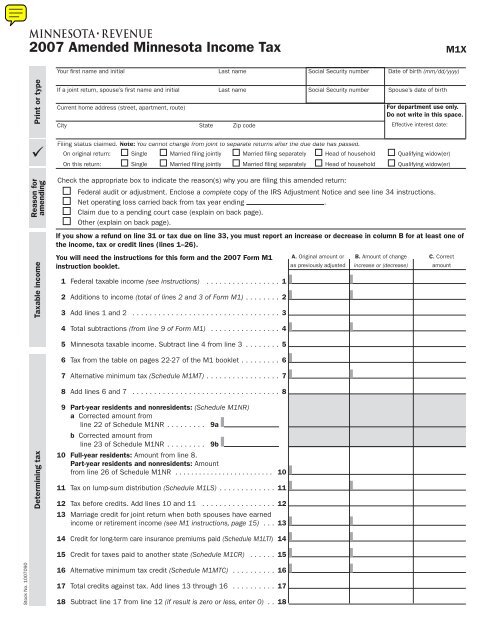

Filing and Payment Process

Individuals and businesses in Minnesota are required to file their income tax returns annually, typically by the 15th of April. The filing process involves completing the appropriate tax forms and providing accurate financial information. For individuals, this often includes Form M1, while businesses may use Form M1NR or other relevant forms depending on their entity type.

To simplify the filing process, Minnesota offers online filing options through its Department of Revenue website. This platform provides a user-friendly interface for taxpayers to input their information and calculate their tax liability. Online filing also allows for faster processing and potential refunds, if applicable.

Payment of income tax in Minnesota can be made through various methods, including direct debit, credit or debit card, check, or money order. Taxpayers have the option to pay their entire liability in one installment or set up a payment plan with the Department of Revenue. It's important for taxpayers to ensure timely payments to avoid penalties and interest charges.

Late Filing and Payment Penalties

Minnesota imposes penalties for late filing and late payment of income taxes. For individuals, a penalty of 5% of the unpaid tax is applied for each month the return is late, up to a maximum of 25%. Additionally, interest accrues on the unpaid tax balance at a rate of 0.5% per month, or portion of a month, until the tax is paid in full.

Businesses face similar penalties for late filing and payment. The penalty for late filing is also 5% of the unpaid tax for each month the return is late, with a maximum of 25%. Interest on unpaid business taxes accrues at a rate of 1% per month until the tax is settled.

It's crucial for taxpayers to stay informed about their filing and payment deadlines to avoid these penalties. The Minnesota Department of Revenue provides resources and guidance to help taxpayers understand their obligations and navigate the income tax system effectively.

Minnesota’s Income Tax in Context

Minnesota’s income tax system is an integral part of the state’s fiscal policy, contributing significantly to its overall revenue. The state uses the income tax revenue to fund various public services, including education, healthcare, infrastructure development, and social welfare programs. By collecting income taxes, Minnesota ensures that its residents have access to essential services and supports a robust economy.

However, the income tax system also has its critics. Some argue that Minnesota's relatively high income tax rates may discourage businesses from operating within the state or lead to out-migration of high-income earners. Balancing the need for revenue with the potential economic impact is an ongoing challenge for policymakers.

Despite these considerations, Minnesota's income tax system remains a critical component of the state's fiscal framework. It provides a stable source of revenue, supports public services, and contributes to the overall well-being of its residents. Understanding and effectively managing Minnesota's income tax obligations is essential for individuals and businesses alike.

Future Implications and Potential Reforms

As Minnesota’s economy and population continue to evolve, the state’s income tax system may undergo reforms to address changing economic realities and policy priorities. Some potential areas of focus include:

- Adjusting tax brackets and rates to ensure fairness and competitiveness.

- Expanding or modifying deductions and exemptions to provide relief for specific demographics or industries.

- Implementing measures to simplify the tax filing process and reduce compliance costs for taxpayers.

- Exploring alternative revenue streams to supplement income tax revenue and reduce the tax burden on individuals and businesses.

Staying informed about these potential reforms and their implications is crucial for taxpayers and businesses operating in Minnesota. By understanding the evolving tax landscape, individuals and businesses can make informed decisions and effectively manage their financial obligations.

What is the deadline for filing income tax returns in Minnesota?

+The deadline for filing income tax returns in Minnesota is typically the 15th of April each year. However, it’s important to note that this deadline may be extended in certain circumstances, such as during a state of emergency.

Are there any tax breaks or credits available for specific groups in Minnesota?

+Yes, Minnesota offers various tax breaks and credits to support specific groups and promote certain activities. For example, there are credits available for homeowners, renewable energy investments, and childcare expenses. It’s advisable to consult the Minnesota Department of Revenue’s website for a comprehensive list of available credits and their eligibility criteria.

How does Minnesota’s income tax compare to other states in the region?

+Minnesota’s income tax rates are generally higher compared to its neighboring states. For instance, Wisconsin has a flat income tax rate of 4% for individuals and a corporate income tax rate of 7.9%. Meanwhile, North Dakota has a progressive income tax system with rates ranging from 1.1% to 2.9%. Understanding these regional variations can provide valuable insights for taxpayers and businesses considering cross-state operations.