Idaho State Taxes

Idaho, known for its stunning landscapes and outdoor adventures, offers a unique tax landscape that differs significantly from many other states in the United States. Understanding the state's tax system is crucial for residents, businesses, and anyone considering relocating to this beautiful region. This comprehensive guide delves into the intricacies of Idaho state taxes, shedding light on the various taxes levied, exemptions, and how they impact individuals and businesses.

A Comprehensive Guide to Idaho State Taxes

Idaho's tax system is designed to generate revenue for the state's operations while maintaining a competitive business environment. The state collects taxes from its residents and businesses through a variety of means, including income tax, sales tax, property tax, and various other levies. This guide aims to provide an in-depth understanding of each of these tax categories, their implications, and how they contribute to Idaho's overall fiscal health.

Income Tax: A Key Revenue Stream

Income tax forms a significant portion of Idaho's tax revenue. The state's income tax system is structured on a marginal rate basis, meaning taxpayers pay different rates depending on their income level. As of [date of last update], Idaho has [number of brackets] income tax brackets, with rates ranging from [lowest rate]% to [highest rate]%. This progressive tax system ensures that higher-income earners contribute a larger portion of their income in taxes.

For instance, consider the case of Mr. Johnson, a resident of Boise, Idaho. Mr. Johnson's annual income is $75,000. Based on Idaho's income tax brackets, he would fall into the [bracket number] bracket, paying a rate of [rate]% on the portion of his income that falls within this bracket. This straightforward and progressive system makes it easier for residents to understand their tax obligations.

Additionally, Idaho offers several deductions and credits to reduce the tax burden on its residents. These include deductions for medical expenses, charitable contributions, and even a deduction for sales tax paid on certain items. Furthermore, Idaho residents can claim federal tax credits, such as the Child Tax Credit and the Earned Income Tax Credit, on their state tax returns.

Tax Rates and Brackets

| Income Bracket (USD) | Tax Rate |

|---|---|

| $0 - $2,500 | 1.6% |

| $2,501 - $4,000 | 2.4% |

| Above $4,000 | 6.925% |

Filing Requirements and Deadlines

Idaho residents must file their state income tax returns annually by the 15th of April, following the federal tax filing deadline. However, if this date falls on a weekend or holiday, the deadline is extended to the next business day. Idaho accepts both paper and electronic filing, with electronic filing being encouraged for faster processing and reduced environmental impact.

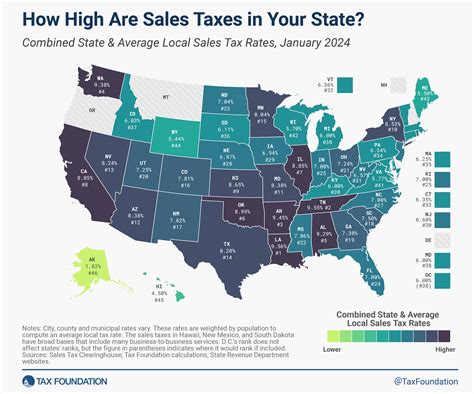

Sales and Use Tax: Revenue from Consumption

Sales and use tax is another critical component of Idaho's tax system. As of [date of last update], Idaho's sales tax rate stands at [current rate]%, one of the lowest in the nation. This tax is levied on the sale of goods and certain services within the state. Idaho's sales tax is unique in that it is not a single rate across the state but varies depending on the jurisdiction, with local governments often adding their own sales tax on top of the state rate.

For example, in the city of Idaho Falls, the sales tax rate is [local rate]%, which includes the state sales tax rate and an additional local option tax. This means that a resident purchasing a new television would pay [local rate]% in sales tax, with a portion of that going to the state and the rest to the local government.

Exemptions and Special Cases

Idaho provides exemptions from sales tax for certain items, such as food, prescription drugs, and select medical devices. Additionally, Idaho offers a temporary sales tax holiday each year, typically in August, during which certain items, such as school supplies and clothing, are exempt from sales tax. This holiday provides a significant boost to local economies and helps families save money during back-to-school shopping.

Use Tax and Online Purchases

Idaho also imposes a use tax on purchases made outside the state but used within Idaho. This tax ensures that residents pay their fair share of taxes, even when purchasing items online or from out-of-state retailers. The use tax rate is the same as the state's sales tax rate, ensuring consistency in taxation.

Property Tax: Assessing Real Estate

Property tax is an essential revenue source for Idaho's local governments, funding schools, fire departments, and other essential services. Idaho's property tax system is based on the assessed value of real estate, which is determined by county assessors. The tax rate varies depending on the location and type of property, with residential properties typically having lower rates than commercial properties.

Assessment and Tax Rates

Property values are assessed every two years, with the assessed value being a percentage of the property's fair market value. The assessment rate is set by the Idaho State Tax Commission and varies depending on the property's classification (residential, commercial, agricultural, etc.). Once the assessed value is determined, the tax rate is applied to calculate the property tax owed.

For instance, if a residential property in Ada County has an assessed value of $300,000 and the current tax rate is [current rate]%, the property owner would owe [calculation result] in property taxes annually.

Homestead Exemptions

Idaho offers a homestead exemption, which reduces the assessed value of a primary residence for property tax purposes. This exemption is designed to provide relief to homeowners and encourage homeownership. To qualify for the homestead exemption, homeowners must occupy the property as their primary residence and meet certain income criteria. The exemption amount is [current exemption amount] for the current tax year.

Other Taxes and Levies

In addition to the above taxes, Idaho levies several other taxes and fees to fund specific state and local initiatives. These include:

- Motor Vehicle Registration Tax: A tax based on the value of a vehicle when it is registered or renewed.

- Real Estate Transfer Tax: A tax levied on the sale of real estate, typically paid by the seller.

- Severance Tax: A tax on the extraction of natural resources, such as timber, oil, and minerals.

- Cigarette and Tobacco Tax: A tax on the sale of cigarettes and other tobacco products.

- Hotel and Motel Tax: A tax levied on accommodations, which varies depending on the location.

Tax Incentives and Economic Development

Idaho recognizes the importance of a competitive tax environment in attracting businesses and fostering economic growth. As such, the state offers a range of tax incentives and credits to encourage investment and job creation. These incentives include:

- Research and Development Tax Credit: A credit for businesses engaged in research and development activities within Idaho.

- High-Tech Investment Tax Credit: A credit for businesses investing in high-tech equipment and infrastructure.

- New Markets Tax Credit: A federal tax credit program that Idaho participates in to encourage investment in underserved communities.

- Job Creation Tax Credit: A credit for businesses creating new jobs within the state.

Economic Impact

These tax incentives have played a significant role in attracting businesses to Idaho, particularly in the technology and manufacturing sectors. The state's low tax rates and business-friendly environment have contributed to a thriving economy, with many companies choosing to establish or expand their operations in Idaho.

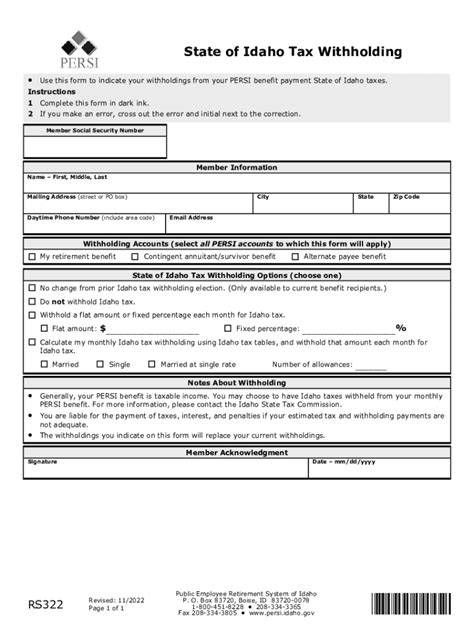

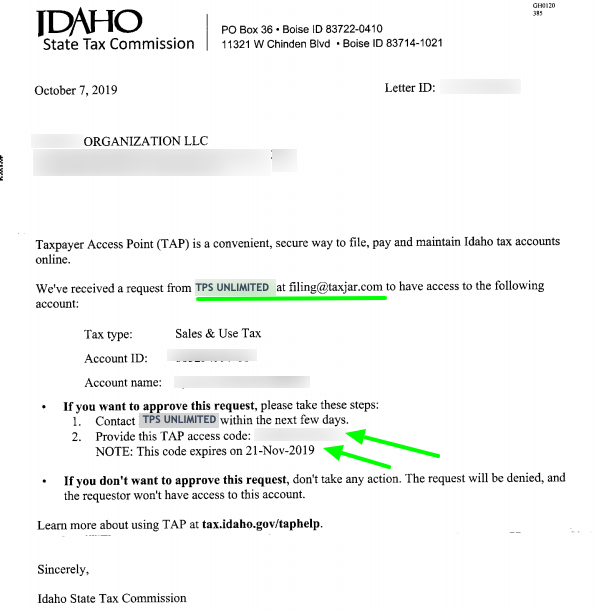

Compliance and Enforcement

The Idaho State Tax Commission is responsible for enforcing tax laws and ensuring compliance. The commission has a range of enforcement tools at its disposal, including audits, penalties, and interest charges for late or non-payment of taxes. Additionally, the commission works closely with taxpayers to ensure they understand their obligations and can take advantage of available deductions and credits.

Audit Process

Audits are a key component of the commission's enforcement strategy. Audits can be triggered by various factors, including random selection, high-risk indicators, or suspected non-compliance. During an audit, the commission reviews a taxpayer's records to ensure accurate reporting and payment of taxes. Taxpayers are encouraged to maintain proper records and cooperate fully during the audit process.

Future of Idaho State Taxes

As Idaho continues to grow and evolve, its tax system will likely undergo changes to adapt to new economic realities and the needs of its residents. Currently, the state is focused on maintaining its competitive tax environment while ensuring sufficient revenue for essential services. The future may see further refinements to tax rates, brackets, and incentives to remain attractive to businesses and residents alike.

Furthermore, with the increasing complexity of the digital economy, Idaho, like many other states, will need to address the challenge of taxing online sales and remote workers. This evolving landscape will present both opportunities and challenges for Idaho's tax system.

Conclusion

Idaho's state tax system is designed to be fair, efficient, and supportive of economic growth. With its low tax rates, generous deductions, and incentives, Idaho offers a welcoming environment for individuals and businesses. Understanding the state's tax landscape is crucial for making informed financial decisions and contributing to Idaho's vibrant economy.

What is the current sales tax rate in Idaho?

+As of [date of last update], Idaho’s sales tax rate is [current rate]%. This rate can vary based on local jurisdictions, with some areas imposing additional taxes.

Are there any tax incentives for businesses in Idaho?

+Yes, Idaho offers a range of tax incentives for businesses, including research and development tax credits, high-tech investment credits, and job creation incentives. These incentives are designed to attract and support businesses in the state.

How often are property values assessed for tax purposes in Idaho?

+Property values in Idaho are assessed every two years. The assessed value is a percentage of the property’s fair market value, and the tax rate is applied to this assessed value to calculate the property tax owed.

Are there any sales tax holidays in Idaho?

+Yes, Idaho typically has a sales tax holiday each year, usually in August. During this time, certain items, such as school supplies and clothing, are exempt from sales tax, providing a significant savings opportunity for families.

What is the homestead exemption in Idaho, and how does it work?

+The homestead exemption in Idaho reduces the assessed value of a primary residence for property tax purposes. To qualify, homeowners must occupy the property as their primary residence and meet certain income criteria. The exemption amount is [current exemption amount] for the current tax year.