Travis County Tax Records

Travis County, nestled in the heart of Texas, is renowned for its vibrant culture, thriving economy, and diverse communities. However, one aspect that often piques the interest of residents and stakeholders alike is the intricate world of Travis County Tax Records. These records, encompassing property assessments, tax rates, and payment history, serve as a crucial component of the county's financial ecosystem. In this comprehensive guide, we will delve into the depths of Travis County Tax Records, exploring their significance, inner workings, and impact on the local community.

Unraveling the Complexity of Travis County Tax Records

Travis County Tax Records represent a comprehensive database that captures the financial obligations and contributions of property owners within the county. This intricate system is managed by the Travis Central Appraisal District (TCAD), a dedicated entity responsible for assessing property values and maintaining accurate tax records.

At its core, the tax system in Travis County operates on a foundation of fairness and transparency. TCAD employs a meticulous process to determine the appraised value of each property, taking into account factors such as location, size, improvements, and market conditions. This appraised value forms the basis for calculating property taxes, ensuring that every property owner contributes their fair share to the county's revenue stream.

Key Components of Travis County Tax Records

Travis County Tax Records encompass a wide array of information, each playing a vital role in the overall tax process:

- Property Assessment: This involves the determination of the property's value, which is crucial for calculating tax liabilities.

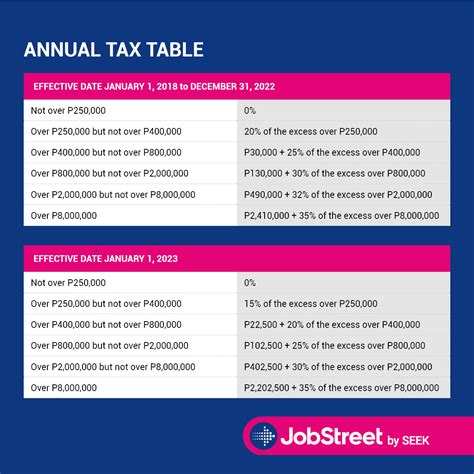

- Tax Rates: The tax rate, set by various taxing entities, determines the amount of tax owed based on the property's appraised value.

- Payment History: Records of tax payments, including due dates, amounts paid, and any penalties or interest accrued, provide a comprehensive overview of a property owner's financial obligations.

- Exemptions and Deductions: Travis County offers certain exemptions and deductions to eligible property owners, reducing their taxable value and, consequently, their tax burden.

- Appeal Process: Property owners have the right to appeal their property's assessed value if they believe it is inaccurate. The appeal process ensures that property values are fair and reflective of market realities.

By examining these components, we can gain a deeper understanding of how Travis County Tax Records impact the lives of its residents and shape the county's financial landscape.

The Impact of Travis County Tax Records on Property Owners

Travis County Tax Records have a direct and significant impact on the lives of property owners within the county. These records influence various aspects of property ownership, including:

Property Value Determination

The appraised value of a property, as determined by TCAD, serves as a critical factor in determining a property’s market value. This value not only affects property taxes but also plays a role in real estate transactions, refinancing, and home equity loans. Accurate property assessments ensure that property owners receive a fair valuation, allowing them to make informed decisions regarding their assets.

Tax Liability Calculation

Travis County Tax Records are pivotal in calculating the tax liability of each property owner. The tax rate, set by entities such as the county government, school districts, and special purpose districts, is applied to the property’s appraised value to determine the annual tax amount. This process ensures that property owners contribute to the funding of essential services and infrastructure within the county.

Exemptions and Relief

Travis County offers a range of exemptions and relief programs to eligible property owners, providing financial assistance and reducing their tax burden. These exemptions include homestead exemptions, over-65 exemptions, and disabled veteran exemptions. By taking advantage of these benefits, property owners can save on their tax obligations, making homeownership more affordable.

Appeal and Dispute Resolution

In cases where property owners believe their property’s assessed value is inaccurate or unfair, Travis County Tax Records provide a pathway for appeal and dispute resolution. The appeal process allows property owners to challenge their appraised value, ensuring that their tax liability is based on a fair and accurate assessment. This process is crucial for maintaining transparency and fairness in the tax system.

Navigating Travis County Tax Records: A Step-by-Step Guide

Understanding and navigating Travis County Tax Records can be a complex process, but with the right guidance, it becomes more accessible. Here’s a step-by-step guide to help property owners and stakeholders navigate the world of Travis County Tax Records:

Step 1: Accessing Tax Records

Travis County provides online access to tax records through the Travis Central Appraisal District (TCAD) website. Property owners and interested parties can search for specific properties by address, account number, or even by owner name. This online portal offers a convenient way to view detailed tax information, including appraised values, tax rates, and payment history.

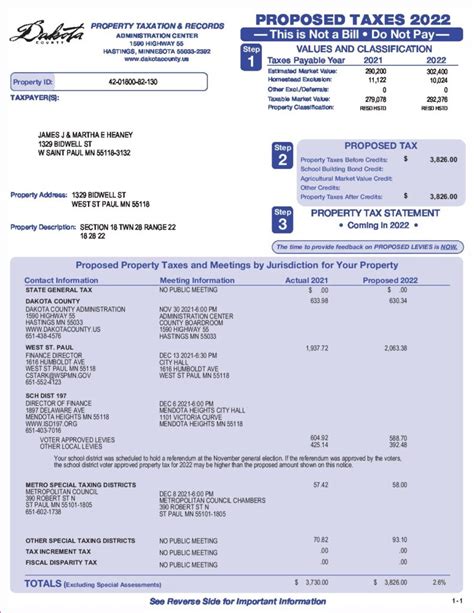

Step 2: Understanding Tax Bills

Tax bills, sent out annually by the county, provide a summary of a property’s tax obligations. These bills include important details such as the appraised value, tax rate, and the total amount due. Property owners should carefully review their tax bills to ensure accuracy and identify any potential discrepancies.

Step 3: Exploring Exemptions and Deductions

Travis County offers a range of exemptions and deductions to eligible property owners. These include homestead exemptions, which reduce the taxable value of a primary residence, and various other exemptions for seniors, disabled individuals, and veterans. Property owners should explore these options to determine their eligibility and potential savings.

Step 4: The Appeal Process

In cases where property owners believe their property’s appraised value is inaccurate, they have the right to appeal. The appeal process involves submitting evidence and documentation to support their case. TCAD provides detailed guidelines and deadlines for the appeal process, ensuring a fair and transparent resolution.

Step 5: Payment Options and Deadlines

Travis County offers various payment options for property taxes, including online payments, mail-in payments, and in-person payments. Property owners should be aware of the payment deadlines to avoid penalties and interest. Late payments can result in additional fees and potential legal consequences.

The Future of Travis County Tax Records: Innovations and Trends

As technology advances and best practices evolve, Travis County Tax Records are poised for significant improvements and innovations. Here are some key trends and developments to watch out for:

Digital Transformation

Travis County is embracing digital transformation by enhancing its online platforms and services. The TCAD website is expected to undergo further improvements, making it more user-friendly and efficient. This digital shift will streamline the process of accessing tax records, submitting appeals, and making payments, enhancing the overall user experience.

Data Analytics and Insights

Advanced data analytics and predictive modeling techniques are being explored to improve the accuracy and efficiency of property assessments. By leveraging big data and machine learning, TCAD aims to refine its valuation methods, ensuring fair and consistent appraisals across the county.

Community Engagement and Transparency

Travis County is committed to fostering community engagement and transparency in its tax processes. This includes hosting public meetings, providing educational resources, and encouraging open dialogue between property owners and taxing entities. By involving the community, Travis County aims to build trust and address concerns related to tax records and assessments.

Integration of GIS Technology

Geographic Information Systems (GIS) technology is being integrated into the tax record system, providing a spatial representation of properties and their assessments. This technology enables more accurate and efficient property mapping, improving the overall efficiency of the tax administration process.

Travis County Tax Records: A Community-Driven Initiative

At the heart of Travis County Tax Records lies a commitment to serving the community and ensuring a fair and transparent tax system. TCAD, in collaboration with local governments and taxing entities, works tirelessly to provide accurate assessments, transparent processes, and accessible information to property owners.

By embracing technological advancements, fostering community engagement, and prioritizing transparency, Travis County Tax Records continue to evolve, benefiting both property owners and the county as a whole. As the county's financial landscape evolves, Travis County Tax Records remain a cornerstone, shaping the economic vitality and prosperity of the region.

How often are property values assessed in Travis County?

+Property values in Travis County are typically assessed annually by the Travis Central Appraisal District (TCAD). This annual assessment ensures that property values remain up-to-date and accurate.

What is the deadline for paying property taxes in Travis County?

+The deadline for paying property taxes in Travis County is typically January 31st of each year. However, it’s important to note that late payments may incur penalties and interest.

How can I appeal my property’s assessed value in Travis County?

+To appeal your property’s assessed value, you must submit an appeal application to TCAD within a specified deadline. The appeal process involves providing evidence and supporting documentation to justify your claim. It’s recommended to consult TCAD’s website for detailed guidelines and timelines.

Are there any exemptions or relief programs available for property owners in Travis County?

+Yes, Travis County offers various exemptions and relief programs to eligible property owners. These include homestead exemptions, over-65 exemptions, and disabled veteran exemptions. It’s advisable to explore these options to determine your eligibility and potential savings.

Where can I find more information about Travis County Tax Records and TCAD’s services?

+For comprehensive information about Travis County Tax Records and TCAD’s services, you can visit the official TCAD website. The website provides detailed resources, guidelines, and contact information to assist property owners and stakeholders.