Pay State Of Missouri Taxes Online

Managing your state taxes can be a crucial aspect of financial planning, especially when it comes to navigating the various payment methods offered by different states. This article will guide you through the process of paying your state taxes online in Missouri, providing a step-by-step breakdown, along with valuable insights and tips to ensure a smooth and efficient transaction.

Navigating the Missouri Tax System

The Missouri Department of Revenue offers a user-friendly online platform for taxpayers to fulfill their state tax obligations conveniently. This system, designed to simplify the tax payment process, allows individuals and businesses to pay their taxes securely and efficiently. Whether you’re a resident filing your annual income tax return or a business owner making quarterly estimated tax payments, the online system caters to a wide range of tax-related needs.

Step-by-Step Guide to Paying Missouri State Taxes Online

To ensure a seamless experience when paying your Missouri state taxes online, follow these detailed steps:

- Access the Missouri Tax Payment Portal: Begin by visiting the official Missouri Department of Revenue website. Look for the "Online Tax Payment" section, which is usually prominently displayed on the homepage. Click on the relevant link to access the payment portal.

- Select Your Tax Type: Once you're on the payment portal, you'll be prompted to choose the type of tax you wish to pay. This could include income tax, sales tax, corporate tax, or any other applicable state taxes. Make your selection carefully, ensuring it aligns with your tax filing requirements.

- Enter Taxpayer Information: The next step involves providing your taxpayer details. This typically includes your name, address, and taxpayer identification number (which could be your Social Security Number or Employer Identification Number, depending on your tax filing status). Ensure that all information is accurate and up-to-date.

- Choose Payment Method: Missouri offers a range of payment options, including credit/debit cards, electronic checks (e-checks), and online banking transfers. Select the method that best suits your preferences and financial situation. Each method has its own set of advantages and potential fees, so choose wisely.

- Review and Confirm Payment Details: Before finalizing your payment, carefully review all the information you've entered. This includes the tax type, taxpayer details, and the amount to be paid. Ensure that everything is accurate to avoid any discrepancies or delays in processing your payment.

- Complete the Payment Process: Once you've verified all the details, proceed with the payment. Follow the on-screen instructions provided by the payment gateway, which will guide you through the final steps. Depending on your chosen payment method, you may need to enter additional information, such as card details or banking credentials.

- Receive Payment Confirmation: After successfully completing the payment, you should receive an instant confirmation on the screen. This confirmation will typically include a unique transaction number and a summary of your payment details. It's advisable to take a screenshot or print this confirmation for your records.

- Save Payment Receipt: The Missouri Department of Revenue also sends an email confirmation to the address associated with your taxpayer account. This email will contain a detailed receipt, which serves as an official record of your tax payment. Save this email and keep it for your records, as it may be required for future reference or audit purposes.

| Payment Method | Advantages | Potential Fees |

|---|---|---|

| Credit/Debit Cards | Convenient and fast; no need for physical checks or visits to a bank. | May incur processing fees, typically a small percentage of the transaction amount. |

| Electronic Checks (e-checks) | Cost-effective; no processing fees. Direct transfer from your bank account. | None, but may take a few days to process. |

| Online Banking Transfers | Secure and efficient. No additional fees, as funds are transferred directly from your bank account. | None, but the transfer process may vary depending on your bank's policies. |

Understanding Missouri’s Tax Structure

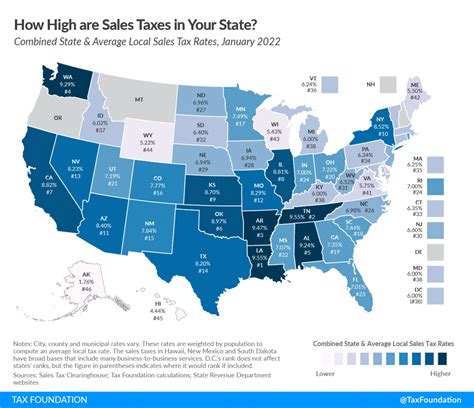

Missouri’s tax system is designed to be progressive, meaning that the tax rate increases as your income level rises. The state operates on a six-bracket income tax system, with rates ranging from 1.5% to 6%. Understanding these brackets and how they apply to your income can help you estimate your tax liability and plan your payments accordingly.

Income Tax Brackets in Missouri

Here’s a breakdown of Missouri’s income tax brackets for the current tax year:

| Income Bracket | Tax Rate |

|---|---|

| $0 - $1,000 | 1.5% |

| $1,001 - $2,500 | 2% |

| $2,501 - $4,000 | 2.5% |

| $4,001 - $8,000 | 3% |

| $8,001 - $11,000 | 4.5% |

| Over $11,000 | 6% |

Special Considerations for Business Owners

If you’re a business owner in Missouri, it’s essential to understand the state’s tax obligations for businesses. This includes not only income tax but also sales tax, franchise tax, and various other taxes depending on your business structure and industry.

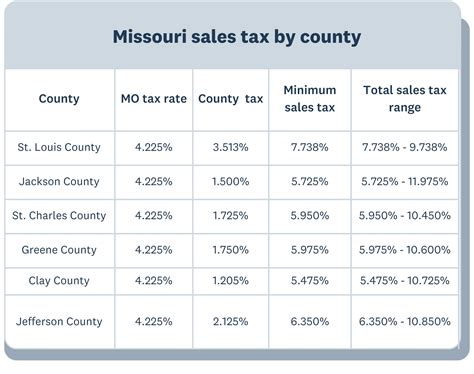

Missouri's sales tax rate is 4.225%, but this can vary based on local jurisdictions, with some counties and cities imposing additional sales tax. Business owners must register for a seller's permit and collect sales tax on all taxable goods and services sold in Missouri. This collected sales tax must be remitted to the state regularly, typically on a monthly or quarterly basis.

Tips for a Seamless Online Tax Payment Experience

To ensure a smooth and hassle-free online tax payment process, consider the following tips:

- Stay Informed: Keep yourself updated on the latest tax laws, deadlines, and payment options in Missouri. This can help you avoid late fees and ensure compliance with state regulations.

- Plan Your Payments: If you owe state taxes, consider setting up a payment plan or making estimated tax payments throughout the year to avoid a large lump sum at the end of the tax year.

- Use Secure Devices and Networks: When accessing the Missouri tax payment portal, ensure you're using a secure device and network to protect your personal and financial information.

- Keep Records: As mentioned earlier, maintain a record of your tax payments, receipts, and related documents. This can be useful for future reference and for preparing your next tax return.

- Seek Professional Help: If you're unsure about any aspect of your tax obligations or the online payment process, consider consulting a tax professional or accountant. They can provide expert guidance tailored to your specific circumstances.

Future of Online Tax Payments in Missouri

The Missouri Department of Revenue is continually working to enhance its online tax payment system, aiming to make it even more user-friendly and secure. With technological advancements, we can expect to see improvements in the platform’s efficiency, including faster processing times and enhanced security features. Additionally, the department may introduce new payment methods or features to cater to the evolving needs of taxpayers.

In conclusion, paying your state taxes online in Missouri is a straightforward process when you have the right guidance and tools. By following the steps outlined above and staying informed about Missouri's tax system, you can efficiently manage your tax obligations and ensure compliance with state regulations. Remember, a well-planned and timely tax payment strategy can contribute significantly to your overall financial well-being and peace of mind.

Can I pay my Missouri state taxes using a credit card without incurring additional fees?

+While credit card payments are accepted, they may incur processing fees, which are typically a small percentage of the transaction amount. It’s advisable to check with your credit card issuer or the Missouri Department of Revenue for the most current fee structure.

What if I encounter technical issues while using the online tax payment portal?

+If you experience any technical difficulties, contact the Missouri Department of Revenue’s technical support team. They can provide guidance and assistance to resolve any issues you may encounter during the online payment process.

Are there any alternatives to online payment for Missouri state taxes?

+Yes, you can also pay your Missouri state taxes by mail or in person at designated Department of Revenue offices. However, online payment is often the most convenient and efficient method, offering real-time confirmation and a secure transaction process.