Nj Tax Calculator

The New Jersey Tax Calculator is an essential tool for individuals and businesses operating within the state of New Jersey, United States. This calculator simplifies the process of estimating and calculating various taxes, ensuring compliance with the state's tax regulations. With a user-friendly interface and accurate computations, it has become a go-to resource for taxpayers seeking clarity and convenience in their financial planning.

Understanding the NJ Tax Calculator

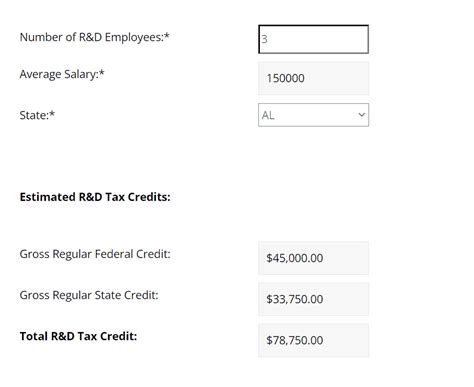

The NJ Tax Calculator is a sophisticated online tool designed to assist taxpayers in determining their tax liabilities. It covers a range of tax categories, including income tax, sales tax, property tax, and various other state-specific taxes. Developed by tax experts, it incorporates the latest tax laws and regulations, making it an accurate and reliable resource for both personal and business use.

One of the key advantages of this calculator is its ability to provide instant estimates, saving taxpayers time and effort. Users can input relevant information, such as income, purchase details, or property values, and the calculator instantly generates an estimated tax figure. This not only helps in financial planning but also ensures that taxpayers are well-prepared when it comes to filing their tax returns.

Income Tax Calculation

New Jersey has a progressive income tax system, with rates ranging from 1.4% to 8.97% based on taxable income. The NJ Tax Calculator considers various factors, including filing status (single, married filing jointly, head of household, etc.), deductions, and exemptions, to calculate the precise income tax liability. It also accounts for the state’s Earned Income Tax Credit (EITC) program, which provides a refundable tax credit for eligible low- to moderate-income workers.

| Filing Status | Tax Rate |

|---|---|

| Single | 1.4% - 8.97% |

| Married Filing Jointly | 1.4% - 8.97% |

| Head of Household | 1.4% - 8.97% |

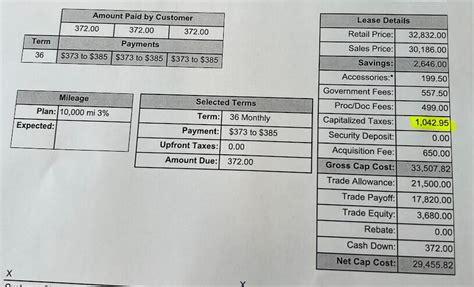

Sales and Use Tax

New Jersey imposes a 6.625% sales tax on most retail sales, rentals, and certain services. However, the rate can vary based on the municipality, with some areas having additional local taxes. The NJ Tax Calculator considers these variations, allowing users to estimate the total sales tax on their purchases accurately. It also provides information on tax-free items and periods, ensuring taxpayers are aware of any potential savings.

| Tax Category | Tax Rate |

|---|---|

| Sales Tax | 6.625% (base rate) |

| Local Sales Tax | Varies by municipality |

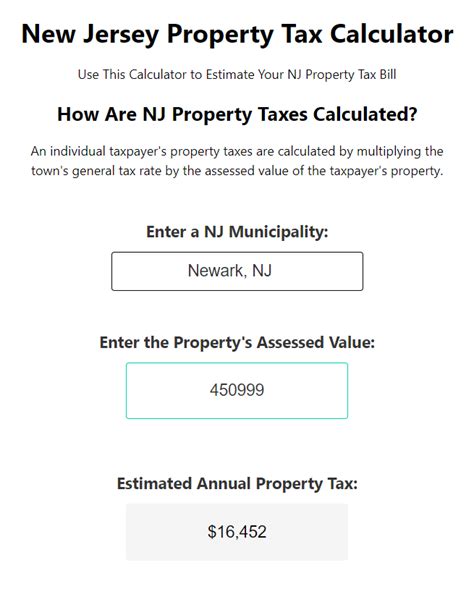

Property Tax

New Jersey is known for having one of the highest property tax rates in the nation. The NJ Tax Calculator assists homeowners and property owners in estimating their property tax liability. It considers factors such as the property’s assessed value, tax rate, and any applicable exemptions or deductions. This helps property owners budget effectively and plan for their annual tax payments.

Benefits and Features of the NJ Tax Calculator

The NJ Tax Calculator offers a range of features that make it an invaluable tool for taxpayers:

- Accuracy: The calculator is updated regularly to reflect the latest tax laws, ensuring precise calculations.

- User-Friendly Interface: Its intuitive design makes it easy for users to navigate and input information.

- Multiple Tax Calculations: It covers various tax types, providing a comprehensive tax estimation solution.

- Real-Time Updates: Users can access the latest tax rates and regulations, ensuring their calculations are up-to-date.

- Save and Share Options: The calculator allows users to save their calculations for future reference and share them with tax professionals.

- Helpful Tax Tips: It provides informative tax tips and guides, offering valuable insights into New Jersey's tax system.

Using the NJ Tax Calculator: A Step-by-Step Guide

Here’s a simple guide on how to utilize the NJ Tax Calculator effectively:

- Access the Calculator: Visit the official New Jersey tax website or use a reputable third-party tax calculator platform.

- Select Tax Type: Choose the type of tax you wish to calculate, such as income tax, sales tax, or property tax.

- Input Information: Fill in the required details, such as income, purchase amount, or property value.

- Review Calculations: The calculator will generate an estimated tax figure along with a breakdown of the calculation.

- Save and Share: If needed, save the calculation for future reference or share it with your tax advisor.

Future of Tax Calculations in New Jersey

As technology continues to advance, the future of tax calculations in New Jersey looks promising. With the development of more sophisticated tax calculators and the integration of AI, taxpayers can expect even more accurate and personalized tax estimates. Additionally, the potential for digital tax filing and real-time tax updates will further streamline the tax process, making it more efficient and accessible for all New Jersey residents.

Conclusion

The New Jersey Tax Calculator is an indispensable tool for anyone navigating the complex world of New Jersey taxes. Its accuracy, user-friendliness, and comprehensive coverage of tax categories make it an essential resource for taxpayers seeking clarity and efficiency. By staying updated with the latest tax laws and offering valuable insights, the calculator ensures that taxpayers can make informed decisions and fulfill their tax obligations with confidence.

Can I use the NJ Tax Calculator for business taxes?

+Absolutely! The NJ Tax Calculator is designed to cater to both personal and business tax calculations. It includes features specific to business taxes, such as calculating estimated tax payments and understanding business-related deductions.

How often are the tax rates updated in the calculator?

+The calculator is updated regularly to reflect any changes in tax laws and rates. Typically, these updates occur annually to align with the new fiscal year, ensuring that users have access to the most current tax information.

Is the NJ Tax Calculator free to use?

+Yes, the NJ Tax Calculator is available free of charge on the official New Jersey tax website and some third-party platforms. However, it’s always recommended to check for any potential fees or limitations when using third-party tools.