Nc Income Tax Rate

North Carolina, often praised for its vibrant economy and thriving businesses, is a state that has long been considered a favorable location for both residents and investors. One of the key factors influencing economic decisions in this state is its tax structure, specifically the income tax rate. Understanding the nuances of North Carolina's income tax system is essential for individuals and businesses alike, as it can significantly impact financial planning and decision-making.

The Landscape of North Carolina’s Income Tax

North Carolina operates on a progressive income tax system, which means that the state’s income tax rate varies based on an individual’s or a business’s taxable income. This approach ensures that those with higher incomes contribute a greater proportion of their earnings towards state revenue. As of 2023, North Carolina’s income tax rates range from 5.25% to 5.75%, with different rates applying to different income brackets.

| Income Bracket | Tax Rate |

|---|---|

| Up to $30,000 | 5.25% |

| $30,001 - $75,000 | 5.45% |

| $75,001 and above | 5.75% |

It's important to note that these rates are subject to change, and individuals should refer to the most recent tax guidelines issued by the North Carolina Department of Revenue for accurate and up-to-date information. Additionally, North Carolina offers various deductions and credits that can reduce an individual's taxable income, potentially resulting in a lower overall tax liability.

Factors Influencing Income Tax Rates

The income tax rates in North Carolina are determined by a combination of economic, political, and social factors. The state’s government aims to balance the need for revenue generation with the desire to encourage economic growth and maintain a competitive business environment. As such, the tax rates are regularly reviewed and adjusted to align with the state’s financial goals and economic realities.

One notable aspect of North Carolina's tax system is its commitment to tax fairness. The progressive nature of the income tax ensures that those who can afford to contribute more do so, while lower-income individuals face a lower tax burden. This approach is designed to promote social equity and support the state's most vulnerable residents.

Impact on Personal Finance and Business Operations

For individuals, understanding the income tax rate is crucial when planning their finances. It allows them to estimate their tax liability accurately and make informed decisions about savings, investments, and other financial strategies. Additionally, knowing the income tax rate can influence where individuals choose to live and work, as it may be a significant factor in their overall financial well-being.

From a business perspective, North Carolina's income tax rate is an essential consideration when evaluating the state as a potential location for operations. Businesses often compare tax rates across different states to determine the most favorable environment for their specific industry and scale of operations. A competitive tax rate can attract new businesses and encourage existing ones to expand, contributing to the state's economic growth.

Moreover, the income tax rate can impact a business's financial planning, including its pricing strategies, profit margins, and overall profitability. It's a key factor in determining the cost of doing business in North Carolina and can influence a company's decision-making processes, especially when considering expansion or relocation.

Strategies for Effective Tax Management

Given the significance of income tax rates, individuals and businesses alike can benefit from implementing effective tax management strategies. Here are some key considerations:

- Tax Planning: Engage in proactive tax planning to optimize your financial situation. This may involve consulting with tax professionals to understand the latest tax laws, deductions, and credits available to you.

- Income Stream Management: For businesses, managing income streams strategically can help minimize tax liabilities. This could involve timing revenue recognition or utilizing tax-efficient payment structures.

- Investment Strategies: Consider investing in tax-advantaged accounts or assets. For individuals, this might include contributing to retirement accounts, while businesses can explore options like investing in research and development to take advantage of specific tax incentives.

- Compliance and Reporting: Ensure you are compliant with North Carolina's tax laws and regulations. Accurate and timely reporting is essential to avoid penalties and ensure a smooth tax filing process.

By staying informed about North Carolina's income tax rates and implementing thoughtful tax management strategies, individuals and businesses can make the most of their financial opportunities while contributing to the state's economic prosperity.

The Evolving Landscape of North Carolina’s Tax System

North Carolina’s tax system is not static; it is continually evolving to meet the changing needs of the state’s economy and its residents. In recent years, the state has taken significant steps to modernize its tax structure, enhance transparency, and improve the overall tax experience for its citizens.

Recent Tax Reforms and Initiatives

One of the most notable recent developments in North Carolina’s tax landscape is the reduction in income tax rates. Over the past few years, the state has gradually lowered its income tax rates, making it more competitive with other states and providing tax relief to its residents. This move has been well-received by taxpayers and has contributed to a more favorable business environment.

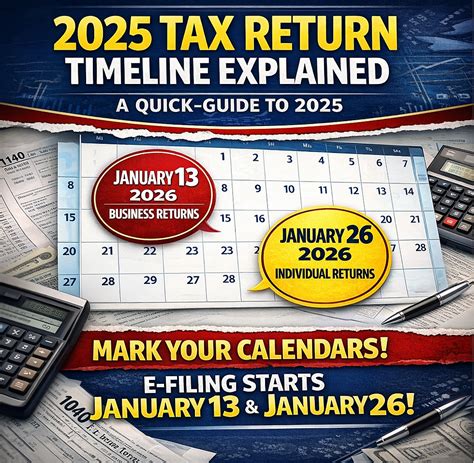

Additionally, North Carolina has been proactive in implementing measures to simplify its tax system. The state has introduced online filing systems and digital payment options, making it more convenient for taxpayers to meet their obligations. These initiatives have not only streamlined the tax process but have also improved accuracy and reduced administrative burdens for both taxpayers and the state.

Furthermore, North Carolina has shown a commitment to tax fairness and equity. The state has actively worked to ensure that its tax system is progressive and that the tax burden is distributed fairly across different income levels. This approach has helped maintain social stability and has been a key factor in the state's overall economic success.

The Role of Technology in Tax Administration

Technology has played a pivotal role in transforming North Carolina’s tax administration. The state has embraced digital innovations to enhance its tax collection processes and improve taxpayer services. By leveraging technology, the state has been able to offer more efficient and user-friendly tax filing and payment options, making it easier for taxpayers to comply with their obligations.

For instance, North Carolina has implemented an online tax portal that allows taxpayers to access their tax information, file returns, and make payments from the comfort of their homes or offices. This portal is designed to be user-friendly and secure, providing a seamless experience for taxpayers. Additionally, the state has introduced mobile apps and text message alerts to keep taxpayers informed about important deadlines and updates.

The use of technology has not only benefited taxpayers but has also helped the state streamline its internal processes. Tax administrators can now access real-time data, automate certain tasks, and improve data accuracy, leading to more efficient tax administration and better decision-making.

Conclusion: Navigating North Carolina’s Tax Landscape

North Carolina’s income tax rate is a critical aspect of the state’s tax system, impacting both individuals and businesses. Understanding the rate structure, staying informed about tax reforms, and implementing effective tax management strategies are essential for optimizing financial outcomes. With its progressive tax system, commitment to fairness, and focus on technological advancements, North Carolina is well-positioned to continue its economic growth and provide a favorable environment for its residents and businesses.

As North Carolina continues to evolve and adapt its tax policies, staying abreast of these changes will be key to making informed financial decisions. Whether you're an individual taxpayer or a business owner, keeping up with the latest tax developments can help you make the most of your financial opportunities while contributing to the state's thriving economy.

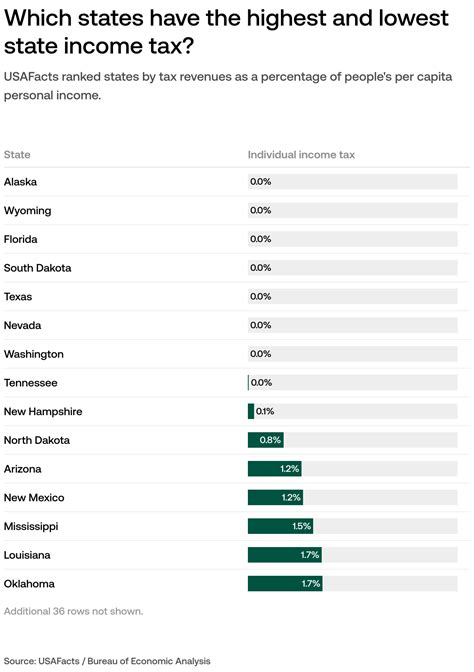

How does North Carolina’s income tax rate compare to other states?

+North Carolina’s income tax rates are relatively competitive when compared to other states. While some states have higher or lower rates, North Carolina’s progressive structure ensures that it remains an attractive option for taxpayers and businesses.

Are there any tax incentives or credits available in North Carolina?

+Yes, North Carolina offers a range of tax incentives and credits to support businesses and individuals. These include tax credits for research and development, job creation, and certain types of investments. It’s advisable to consult with a tax professional to understand the specific incentives available.

How can I stay updated on changes to North Carolina’s tax laws and rates?

+To stay informed, you can regularly visit the North Carolina Department of Revenue’s website, which provides the latest tax guidelines and updates. Additionally, subscribing to tax-related newsletters or following reputable tax blogs can keep you abreast of any significant changes.