City Of Seattle Sales Tax

Welcome to the comprehensive guide on the City of Seattle's sales tax system. In this article, we will delve into the intricacies of Seattle's sales tax structure, its historical context, the latest regulations, and its impact on businesses and consumers alike. Understanding the sales tax landscape is crucial for anyone operating within the city limits, and we aim to provide an expert-level analysis to ensure you are well-informed.

A Comprehensive Guide to Seattle's Sales Tax

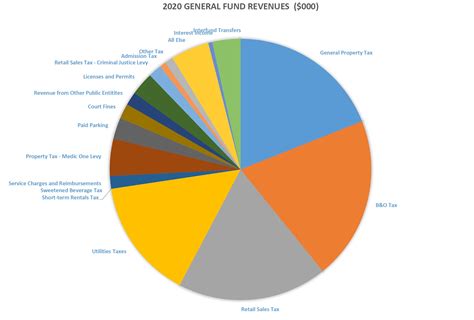

The sales tax in Seattle, Washington, is an essential component of the city's revenue stream and plays a significant role in shaping its economic landscape. With a rich history and evolving tax policies, Seattle's sales tax system has become a vital aspect of doing business within the city. Let's explore the key aspects and implications of this tax structure.

Historical Perspective: The Evolution of Seattle's Sales Tax

The history of sales tax in Seattle dates back to the early 20th century when the state of Washington first introduced a general sales tax. Over the years, the tax structure has undergone several revisions and adjustments to accommodate the changing economic landscape and the needs of the city. Here's a brief overview of its evolution:

- 1933: The state of Washington implemented a 2% general sales tax, marking the beginning of sales taxation in the region.

- 1961: Seattle, along with other cities, was granted the authority to levy a local sales tax, which initially stood at 1%.

- 1980s: The city experienced significant economic growth, prompting discussions on tax reforms. During this period, the sales tax rate fluctuated, with adjustments made to align with the city's financial needs.

- 1990s: Seattle's sales tax rate was set at 8.6%, comprising both state and local taxes. This decade saw the introduction of specific tax exemptions and incentives to promote certain industries.

- 2010s: With the city's focus on sustainability and environmental initiatives, Seattle introduced targeted sales tax measures to support green technologies and initiatives. The tax rate remained relatively stable during this period.

Today, Seattle's sales tax structure is a result of this historical evolution, with a focus on balancing revenue generation and supporting the city's economic and social development goals.

Current Sales Tax Regulations: A Detailed Breakdown

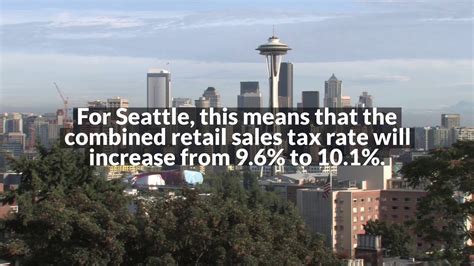

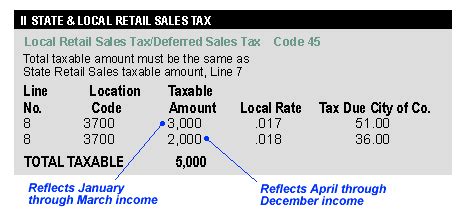

As of our last update, the sales tax rate in Seattle stands at 10.1%, which includes both the state and local components. This rate is subject to change, and it's essential for businesses and consumers to stay informed about the latest tax regulations. Here's a breakdown of the current sales tax structure:

| Tax Component | Rate |

|---|---|

| State Sales Tax | 6.5% |

| City of Seattle Sales Tax | 3.6% |

| Total Sales Tax | 10.1% |

It's important to note that Seattle's sales tax applies to most tangible goods and certain services. However, there are specific exemptions and exclusions, such as groceries, prescription drugs, and certain types of manufacturing equipment. Understanding these exemptions is crucial for accurate tax compliance.

Impact on Businesses: Navigating Sales Tax Obligations

For businesses operating within Seattle, understanding and complying with sales tax regulations is a critical aspect of financial management. Here's how the sales tax system impacts businesses:

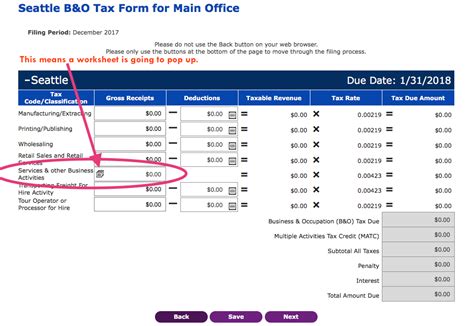

- Registration and Licensing: Businesses are required to obtain a Business License and a Unified Business Identifier (UBI) number. Additionally, they must register with the Washington Department of Revenue to collect and remit sales tax.

- Sales Tax Collection: Businesses act as tax collectors, adding the applicable sales tax to the retail price of taxable goods and services. They are responsible for accurately calculating and collecting the tax from customers.

- Filing and Remittance: Sales tax collected must be reported and remitted to the state and city authorities on a regular basis, typically monthly or quarterly. Accurate record-keeping and timely filing are essential to avoid penalties.

- Compliance Challenges: Navigating the complex sales tax regulations can be a challenge, especially for small businesses. Staying updated on tax rate changes, understanding exemptions, and ensuring accurate tax calculations are crucial aspects of compliance.

To assist businesses, the Washington Department of Revenue provides resources and guidelines to help with sales tax compliance. It's recommended for businesses to consult these resources and seek professional advice if needed.

Consumer Perspective: Understanding the Impact

While businesses bear the primary responsibility for sales tax compliance, consumers are the ones who ultimately pay the tax. Here's how the sales tax system affects consumers:

- Increased Prices: The sales tax is typically added to the retail price of taxable goods and services, resulting in higher prices for consumers. This can impact purchasing decisions, especially for high-value items.

- Tax Awareness: Consumers should be aware of the sales tax rate and its application to different products and services. Understanding tax-inclusive pricing can help in making informed purchasing choices.

- Tax Exclusions: Consumers benefit from certain tax exclusions, such as the exemption on groceries and prescription drugs. These exclusions can provide significant savings, especially for households with tight budgets.

- Online Shopping: With the rise of e-commerce, consumers often face different tax scenarios for online purchases. Understanding the tax implications of online shopping, especially when buying from out-of-state vendors, is crucial for accurate tax reporting.

By being informed about sales tax regulations, consumers can make more financially conscious decisions and take advantage of tax-saving opportunities.

Future Outlook: Trends and Potential Changes

The sales tax landscape in Seattle is dynamic and subject to ongoing discussions and potential reforms. Here are some trends and considerations for the future:

- Economic Development Initiatives: Seattle's focus on economic growth and development may lead to targeted tax incentives and reforms to attract businesses and support specific industries.

- Environmental Considerations: With the city's commitment to sustainability, we may see continued efforts to implement sales tax measures that promote eco-friendly initiatives and technologies.

- Revenue Generation Needs: As the city's financial needs evolve, there may be discussions around adjusting the sales tax rate to meet revenue targets. However, any changes would likely be carefully considered to minimize the impact on businesses and consumers.

- Technological Innovations: The rise of e-commerce and digital technologies may prompt the development of new sales tax collection and reporting mechanisms to ensure compliance in the digital age.

Staying informed about these trends and potential changes is essential for businesses and consumers to adapt to the evolving sales tax landscape in Seattle.

Expert Insights and Recommendations

As an expert in the field, here are some key insights and recommendations for businesses and consumers navigating Seattle's sales tax system:

- Stay Informed: Regularly update yourself on sales tax regulations, rate changes, and any new exemptions or incentives. The Washington Department of Revenue provides valuable resources and notifications to keep businesses and consumers informed.

- Seek Professional Advice: For businesses, consulting with tax professionals or accounting firms can provide tailored guidance on sales tax compliance and strategic planning. This ensures accurate tax management and minimizes the risk of penalties.

- Accurate Record-Keeping: Maintain detailed records of sales transactions, tax calculations, and remittances. This practice ensures compliance and facilitates easy access to information during audits or tax inspections.

- Utilize Technology: Embrace digital tools and software that assist with sales tax calculations, reporting, and compliance. These tools can streamline the process and reduce the risk of errors.

- Engage with Local Authorities: Stay connected with local business associations and government bodies to stay updated on sales tax-related developments and to provide feedback on potential improvements.

By following these expert insights, businesses and consumers can navigate Seattle's sales tax system with confidence and ensure compliance while contributing to the city's economic growth.

FAQ

Are there any sales tax holidays in Seattle?

+Currently, Seattle does not have designated sales tax holidays. However, the state of Washington occasionally offers sales tax holidays for specific items, such as back-to-school supplies or energy-efficient appliances. These holidays provide temporary tax exemptions, allowing consumers to save on certain purchases.

How often do sales tax rates change in Seattle?

+Sales tax rates in Seattle can change annually or at specific intervals, depending on the city’s financial needs and legislative decisions. It’s essential for businesses and consumers to stay updated on any rate changes to ensure accurate tax calculations and compliance.

Are there any sales tax incentives for small businesses in Seattle?

+Yes, Seattle offers various sales tax incentives and programs to support small businesses. These incentives may include reduced tax rates for specific industries, tax exemptions for certain equipment purchases, or tax credits for job creation. It’s advisable for small businesses to consult with local authorities or tax professionals to explore these opportunities.

How does Seattle’s sales tax compare to other major cities in Washington state?

+Seattle’s sales tax rate is relatively higher compared to some other major cities in Washington state. While the state sales tax rate is uniform across the state, local sales tax rates can vary. For instance, cities like Tacoma and Spokane have lower local sales tax rates, resulting in an overall lower combined sales tax.

Are there any online resources to assist with sales tax compliance in Seattle?

+Absolutely! The Washington Department of Revenue provides a comprehensive website with resources, guides, and tools to assist businesses and consumers with sales tax compliance. These resources include tax rate lookup tools, registration forms, and guidelines for specific industries. Utilizing these online resources is an excellent way to stay informed and ensure compliance.