North Carolina Tax Return

North Carolina's tax system is a crucial aspect of the state's economic landscape, impacting residents and businesses alike. Understanding the intricacies of North Carolina tax returns is essential for individuals and businesses to navigate their financial obligations effectively. In this comprehensive guide, we will delve into the specifics of North Carolina tax returns, covering key aspects such as tax rates, filing requirements, deductions, and more. By the end of this article, you'll have a solid understanding of the process and be equipped with valuable insights to streamline your tax-filing journey.

Unraveling the North Carolina Tax Landscape

North Carolina operates a progressive tax system, which means that higher incomes are taxed at higher rates. This approach ensures fairness and contributes to the state’s revenue stream. The tax structure is designed to balance the needs of residents and businesses while supporting essential public services and infrastructure.

The state imposes income taxes on various sources, including wages, salaries, investments, and business profits. Additionally, North Carolina levies taxes on specific goods and services, such as gasoline, tobacco products, and lodging. These taxes contribute to the overall revenue pool and help fund vital state programs.

| Tax Category | Rate |

|---|---|

| Income Tax | 5.25% (standard rate) |

| Sales Tax | 4.75% (statewide rate) |

| Gasoline Tax | $0.3035/gallon |

| Lodging Tax | 6% (state rate) |

Income Tax Rates and Brackets

North Carolina’s income tax rates are structured in brackets, with the tax liability increasing as income rises. The current tax brackets for individuals are as follows:

| Income Bracket | Tax Rate |

|---|---|

| Up to $10,000 | 5.25% |

| $10,001 - $25,000 | 5.5% |

| $25,001 - $50,000 | 5.75% |

| $50,001 - $150,000 | 5.9% |

| Over $150,000 | 5.9% |

Filing Requirements and Deadlines

North Carolina residents and businesses are required to file their tax returns annually. The due date for filing and paying taxes is typically April 15th, following the tax year. However, this deadline may be extended under certain circumstances, such as natural disasters or other emergencies.

For individuals, the filing process involves completing the NC-400 individual income tax return form. This form collects information on income, deductions, credits, and tax liabilities. Businesses, on the other hand, may need to file additional forms depending on their structure and tax obligations.

It's crucial to note that failure to file or pay taxes on time can result in penalties and interest charges. Therefore, staying informed about filing requirements and deadlines is essential to avoid unnecessary complications.

Deductions and Credits: Maximizing Your Savings

North Carolina offers various deductions and credits to help taxpayers reduce their tax liabilities. These incentives are designed to promote economic growth, support specific industries, and provide relief to certain groups of taxpayers.

Some common deductions available to North Carolina taxpayers include:

- Standard deduction: This allows taxpayers to deduct a set amount from their taxable income, providing a simplified way to reduce their tax burden.

- Itemized deductions: Taxpayers can opt to itemize their deductions, which include expenses such as medical costs, charitable donations, state and local taxes, and mortgage interest.

- Business deductions: Businesses can deduct expenses related to their operations, such as office rent, equipment, and employee salaries.

In addition to deductions, North Carolina offers a range of tax credits. These credits provide a direct reduction in the amount of tax owed and can be particularly beneficial for specific industries or taxpayers with qualifying circumstances.

| Credit Name | Description |

|---|---|

| Child and Dependent Care Credit | This credit helps offset the cost of childcare for working parents. |

| Historic Preservation Tax Credit | Incentivizes the preservation and rehabilitation of historic properties. |

| Research and Development Credit | Encourages businesses to invest in research and development activities. |

| Film and Entertainment Credit | Supports the film industry by providing tax incentives for productions in North Carolina. |

Electronic Filing and Payment Options

North Carolina offers convenient electronic filing and payment options to streamline the tax return process. Taxpayers can utilize online platforms, such as the North Carolina Department of Revenue’s website, to file their returns digitally. This method is not only efficient but also reduces the risk of errors compared to manual filing.

Additionally, taxpayers can choose to pay their taxes electronically, either through direct bank transfers or credit/debit card payments. These options provide flexibility and ensure a secure transaction process.

Resources and Support for Taxpayers

Navigating the complexities of tax returns can be daunting, but North Carolina provides resources and support to assist taxpayers. The North Carolina Department of Revenue offers comprehensive guides, tutorials, and FAQs on its website, covering various tax-related topics.

Taxpayers can also seek assistance from tax professionals, such as accountants or tax attorneys, who specialize in North Carolina tax laws. These experts can provide personalized advice and ensure compliance with the latest regulations.

Conclusion: Navigating the North Carolina Tax Journey

Understanding the intricacies of North Carolina tax returns is a crucial step towards financial compliance and responsibility. By familiarizing yourself with tax rates, filing requirements, deductions, and credits, you can maximize your savings and ensure a smooth tax-filing experience.

Stay informed about any changes to tax laws and regulations, as these can impact your tax obligations. Additionally, consider seeking professional advice when needed to ensure accuracy and compliance.

Remember, effective tax planning and preparation can lead to significant savings and contribute to your financial well-being. Embrace the opportunity to learn and grow your understanding of North Carolina's tax landscape, and you'll be well-equipped to navigate this essential aspect of your financial journey.

What are the income tax rates for businesses in North Carolina?

+North Carolina imposes a flat tax rate of 3% on business income. This rate applies to various business entities, including corporations, partnerships, and limited liability companies (LLCs). It’s important to note that certain types of income, such as capital gains and dividends, may be taxed at different rates.

Are there any sales tax exemptions in North Carolina?

+Yes, North Carolina offers sales tax exemptions for certain items. These exemptions include purchases made by government entities, charitable organizations, and educational institutions. Additionally, certain items like groceries, prescription drugs, and non-prepared food are exempt from sales tax.

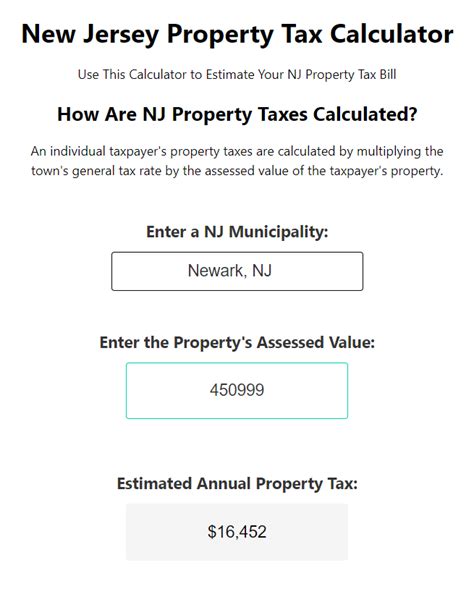

How can I calculate my estimated tax payments in North Carolina?

+To calculate your estimated tax payments, you can use the North Carolina Department of Revenue’s online tool. This calculator considers your income, deductions, and tax liabilities to estimate the amount you need to pay throughout the year. It’s important to make accurate estimates to avoid penalties for underpayment.