Inheritance Tax Michigan

Inheritance tax in Michigan is a crucial aspect of estate planning and wealth transfer for individuals and families within the state. This article aims to provide an in-depth exploration of the inheritance tax landscape in Michigan, covering its unique characteristics, applicable laws, and potential strategies to mitigate its impact on beneficiaries.

Understanding Michigan’s Inheritance Tax

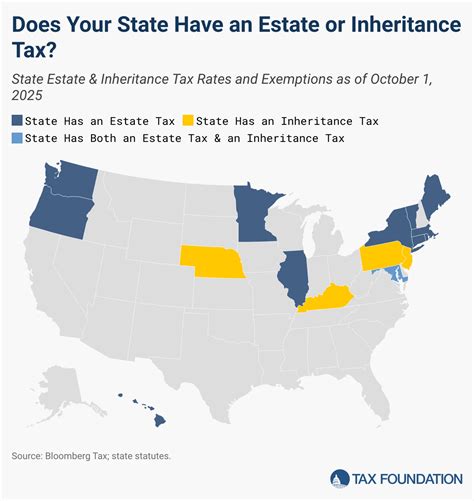

Michigan’s inheritance tax, often referred to as the “inheritance tax on non-residents,” is a state-level tax levied on the transfer of assets from a deceased individual to their beneficiaries. Unlike some other states, Michigan has a unique approach to inheritance taxation, which primarily affects non-resident beneficiaries and certain specific relationships.

The tax is distinct from the federal estate tax, which is a tax on the transfer of a deceased person's assets at the federal level. Michigan's inheritance tax operates independently, and its rules and exemptions differ significantly from federal estate tax regulations.

Key Characteristics of Michigan Inheritance Tax

- Applicability: The tax is applicable to non-resident beneficiaries who inherit assets from a deceased Michigan resident. This means that if you reside outside Michigan and inherit assets from a loved one who lived in the state, you may be subject to this tax.

- Exemptions: Michigan offers exemptions for certain relationships, including spouses and direct descendants. This means that if you inherit assets from your spouse or a child who was a Michigan resident, you are typically exempt from the inheritance tax.

- Tax Rates: The tax rates in Michigan vary depending on the beneficiary’s relationship to the deceased and the value of the inherited assets. The tax is generally imposed as a percentage of the gross value of the inherited property.

- Reporting and Payment: Executors or personal representatives of the estate are responsible for filing the necessary inheritance tax returns and making the required payments on behalf of the beneficiaries. The deadlines for filing and paying the tax are strictly enforced.

Navigating Michigan’s Inheritance Tax Landscape

Understanding the intricacies of Michigan’s inheritance tax is essential for individuals planning their estates or those who stand to inherit assets from a Michigan resident. Here’s a comprehensive guide to help you navigate this complex tax landscape.

Exemptions and Exempt Relationships

Michigan offers exemptions for specific relationships, which can significantly reduce or eliminate the inheritance tax burden. The following relationships are typically exempt from the tax:

- Spouses: Inheritances between spouses are exempt from Michigan’s inheritance tax, regardless of the value of the assets.

- Direct Descendants: Children, grandchildren, and other direct descendants of the deceased are generally exempt from the tax, provided they are U.S. citizens.

- Charitable and Educational Institutions: Gifts to qualified charitable and educational organizations are also exempt from inheritance tax.

Tax Rates and Calculations

The tax rates in Michigan are progressive, meaning they increase as the value of the inherited assets rises. The current tax rates for non-resident beneficiaries are as follows:

| Value of Inherited Assets | Tax Rate |

|---|---|

| 0 to 25,000 | 1.5% |

| 25,001 to 100,000 | 2% |

| 100,001 to 250,000 | 2.5% |

| 250,001 to 500,000 | 3% |

| Over $500,000 | 4.5% |

For example, if a non-resident beneficiary inherits assets valued at 300,000, the tax calculation would be as follows:</p> <ul> <li>25,000 x 1.5% = 375</li> <li>75,000 (remaining value) x 2% = 1,500</li> <li>200,000 (remaining value) x 2.5% = 5,000</li> <li>Total Inheritance Tax Due: 6,875

Strategies to Minimize Inheritance Tax

There are several strategies individuals can employ to minimize the impact of Michigan’s inheritance tax:

- Gift Giving: Making gifts during the lifetime of the donor can help reduce the value of the estate and, consequently, the inheritance tax. However, it’s essential to understand the gift tax implications and exemptions.

- Life Insurance: Proceeds from life insurance policies are generally exempt from inheritance tax. Strategically planning life insurance policies can provide a tax-efficient way to transfer wealth.

- Trusts: Establishing a trust can help manage and protect assets while potentially reducing tax liability. Trusts can be structured to benefit specific individuals or charitable causes, offering flexibility and tax advantages.

- Estate Planning: Working with experienced estate planning professionals is crucial. They can guide you through the complexities of Michigan’s inheritance tax laws and help structure your estate to minimize tax burdens.

Future Implications and Considerations

Michigan’s inheritance tax landscape is subject to change, and it’s essential to stay informed about any potential updates or amendments to the tax laws. Here are some key considerations for the future:

- Legislative Changes: Keep an eye on any proposed or enacted changes to the inheritance tax laws. Michigan’s legislature may introduce amendments that could impact tax rates, exemptions, or the overall structure of the tax.

- Economic Factors: Economic conditions, such as inflation or changes in the value of assets, can influence the overall tax burden. Monitoring these factors can help you anticipate potential increases or decreases in the value of inherited assets.

- Beneficiary Planning: As a beneficiary, understanding your rights and obligations is crucial. Stay informed about the inheritance tax implications and consider seeking professional advice to ensure you make informed decisions regarding the inheritance.

Frequently Asked Questions

Are there any exemptions for siblings inheriting assets in Michigan?

+No, Michigan does not offer specific exemptions for siblings inheriting assets. However, if the assets are transferred to a sibling as part of a larger estate plan, such as through a trust or gift, it may reduce the overall tax burden.

What happens if I fail to pay the inheritance tax on time?

+Late payments of inheritance tax may result in penalties and interest charges. It’s crucial to adhere to the filing deadlines and ensure timely payment to avoid additional financial burdens.

Can I contest the inheritance tax assessment if I believe it’s incorrect?

+Yes, if you believe the inheritance tax assessment is incorrect, you have the right to contest it. Contact the Michigan Department of Treasury’s Inheritance Tax Division to initiate a review process and provide supporting documentation for your claim.