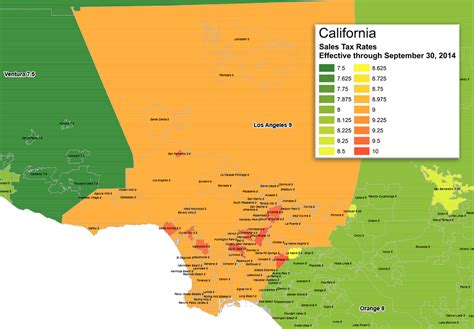

Ca Sales Tax Rate By County

California, known for its diverse landscapes and vibrant cities, also boasts a complex sales tax system. Understanding the sales tax rates across the state's counties is crucial for both businesses and consumers. In this comprehensive guide, we will delve into the intricacies of California's county-specific sales tax rates, shedding light on the variations that exist and providing valuable insights for tax compliance and strategic planning.

Unraveling California’s County Sales Tax Landscape

The Golden State, with its 58 counties, presents a unique challenge when it comes to sales tax administration. Each county has the authority to set its own additional sales tax rate, creating a patchwork of tax rates that can vary significantly. This complexity is further amplified by the fact that certain cities and special districts within counties may also impose their own sales taxes, adding an extra layer of complexity to the tax landscape.

As of [Current Year], the statewide base sales tax rate in California stands at [Base Rate]%, which serves as the foundation for the county-specific rates. However, it is the local add-on rates that truly shape the sales tax picture, with some counties opting for minimal additional taxes while others implement more substantial surcharges.

A County-by-County Breakdown

To navigate this intricate sales tax terrain, let’s explore a selection of California counties and their respective sales tax rates. Keep in mind that these rates are subject to change, so it’s essential to consult official sources for the most up-to-date information.

| County | Sales Tax Rate |

|---|---|

| Los Angeles County | [LA County Rate]% |

| Orange County | [Orange County Rate]% |

| San Diego County | [San Diego County Rate]% |

| Santa Clara County | [Santa Clara County Rate]% |

| Alameda County | [Alameda County Rate]% |

These rates showcase the diversity of California's sales tax structure. For instance, Los Angeles County, with its vibrant economy and diverse population, imposes a higher sales tax rate to fund various local initiatives. In contrast, smaller counties like Alpine County may opt for lower rates, reflecting their unique economic considerations.

The Impact on Businesses and Consumers

The county-specific sales tax rates have a direct impact on both businesses and consumers. For businesses, especially those with a presence in multiple counties, navigating these variations can be a logistical challenge. It requires careful tax compliance strategies to ensure accurate reporting and remittance. Additionally, businesses may need to consider pricing strategies to account for the varying tax rates across their customer base.

Consumers, on the other hand, may find themselves faced with unexpected variations in prices when shopping across different counties. This can influence purchasing decisions and even prompt consumers to consider online shopping, where tax rates may be more transparent and consistent.

Navigating the Future of California’s Sales Tax

As California’s economy continues to evolve, so too will its sales tax landscape. The state’s history is replete with instances of counties adjusting their sales tax rates to meet changing fiscal needs. For instance, during periods of economic downturn, counties may opt to increase their sales tax rates to bolster local revenue streams. Conversely, as the economy strengthens, some counties might choose to reduce rates to stimulate consumer spending.

Moreover, the ongoing trend of e-commerce and the rise of remote sellers have prompted discussions about the fairness and efficiency of the current sales tax system. This has led to initiatives such as the Marketplace Fairness Act, which aims to streamline sales tax collection for remote sellers. While the future of this legislation remains uncertain, it underscores the evolving nature of sales tax regulations and the need for businesses to stay abreast of these changes.

Conclusion: Embracing the Complexity

California’s county-by-county sales tax rates present a unique challenge, but also an opportunity for businesses to showcase their adaptability and tax compliance expertise. By staying informed about these rates and their potential impact, businesses can make strategic decisions that align with both their financial goals and their commitment to tax compliance. For consumers, understanding these rates empowers them to make informed purchasing choices and advocate for fair and transparent tax policies.

As we navigate the intricate web of California's sales tax system, it becomes clear that knowledge is power. By unraveling the complexities of county-specific sales tax rates, we can better appreciate the fiscal landscape of the Golden State and make decisions that benefit both businesses and individuals alike.

How often do California counties adjust their sales tax rates?

+

Counties in California have the authority to adjust their sales tax rates, often to address budgetary needs or infrastructure projects. While there is no set timeline, rate changes typically occur every few years, with some counties opting for more frequent adjustments based on their financial requirements.

Are there any counties with unique sales tax exemptions or regulations?

+

Yes, California’s diverse landscape also extends to its sales tax regulations. Some counties have implemented unique exemptions, such as tax holidays for specific items or reduced rates for certain industries. It’s crucial to stay informed about these variations to ensure compliance.

What are the implications of California’s sales tax variations for e-commerce businesses?

+

E-commerce businesses operating in California face a unique challenge due to the state’s diverse sales tax rates. They must ensure accurate tax calculations for each county, which can be complex. Utilizing tax management software or consulting with tax professionals can help navigate these complexities.