Lookup Federal Tax Id

A Federal Tax ID, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned to businesses by the Internal Revenue Service (IRS) in the United States. It serves as a vital identifier for tax purposes and is required for various business operations and filings.

An EIN is necessary for businesses to pay taxes, hire employees, open a business bank account, and apply for licenses and permits. It plays a crucial role in maintaining compliance with federal and state regulations, ensuring smooth business operations, and enabling accurate tax reporting.

Understanding the Importance of a Federal Tax ID

The Federal Tax ID is a fundamental aspect of the US tax system, especially for businesses. It provides a unique identification for entities, distinguishing them from other businesses and individuals in the eyes of the IRS. This identifier is used extensively in tax forms, payroll processes, and financial transactions, making it a critical component of any business’s administrative and financial infrastructure.

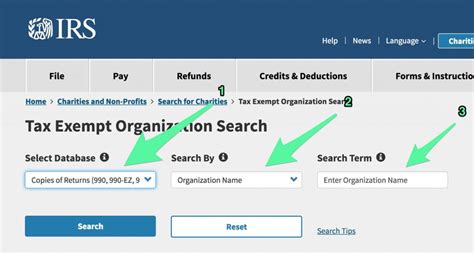

Businesses can obtain their EIN by completing an online application form on the IRS website. The process is generally straightforward, and the EIN is usually issued within a few minutes of submission. However, for certain entities, such as foreign businesses or those with complex structures, the process may require additional documentation and time.

Key Benefits of Having a Federal Tax ID

The advantages of securing a Federal Tax ID are manifold. Firstly, it allows businesses to establish their credibility and legitimacy, providing a unique identifier that can be referenced in various official and financial documents. This helps in building trust with partners, clients, and financial institutions.

Secondly, an EIN enables businesses to comply with tax regulations more efficiently. It simplifies the process of filing taxes, especially for businesses with employees, as it is used to report employee wages and tax withholdings. Additionally, an EIN is crucial for businesses to apply for loans, obtain business licenses, and open merchant accounts, which are essential for accepting payments from customers.

| Benefit | Description |

|---|---|

| Enhanced Legitimacy | An EIN provides official recognition and validation, boosting a business's credibility. |

| Simplified Tax Compliance | It streamlines the process of filing taxes and reporting employee-related information. |

| Access to Financial Services | A Federal Tax ID is often a prerequisite for opening business bank accounts and applying for loans. |

| Efficient Licensing and Permits | Many licenses and permits require an EIN, making it easier to comply with local regulations. |

The Process of Obtaining a Federal Tax ID

Securing a Federal Tax ID is a straightforward process, although the specific steps may vary depending on the type of business entity and the jurisdiction in which it operates. Here’s a general overview of the steps involved:

-

Determine Eligibility: Not all entities require a Federal Tax ID. Sole proprietors, for instance, may use their Social Security Number (SSN) for tax purposes. However, if you have employees, operate a corporation or partnership, or are a foreign entity doing business in the US, you'll need an EIN.

-

Gather Necessary Information: Before applying, ensure you have the required details ready. This includes the legal name of your business, its address, and the entity type (e.g., corporation, partnership, LLC). For some entity types, you may also need the names and SSNs of the responsible parties.

-

Choose Your Application Method: The IRS offers multiple ways to apply for an EIN, including an online application, fax, or by mail. The online method is the fastest and most convenient, typically taking just a few minutes to complete and providing immediate issuance of the EIN.

-

Complete the Application: Whether you choose to apply online, by fax, or by mail, you'll need to provide the same basic information. This includes details about your business, such as its legal name, address, and entity type, as well as information about the responsible party or owner.

-

Receive Your EIN: After submitting your application, you should receive your EIN immediately if you applied online. If you applied by fax or mail, it may take a few days to a week to receive your EIN via letter or fax.

Special Considerations for Certain Entities

While the process outlined above is generally applicable, there are some special considerations for certain types of businesses:

-

Foreign Businesses: Foreign businesses operating in the US must obtain an EIN. The application process may require additional documentation, such as a passport or a foreign identification number.

-

Partnerships and LLCs: These entities may have more complex structures, requiring additional information about the partners or members. It's essential to have the correct details ready to avoid delays in the application process.

-

Corporations: Corporations may need to provide information about their directors, officers, and shareholders. The application process may also require details about the corporation's date of incorporation and its state of incorporation.

Managing and Maintaining Your Federal Tax ID

Once you’ve obtained your Federal Tax ID, it’s important to manage and maintain it properly. Here are some key considerations:

Using Your EIN Correctly

Your Federal Tax ID should be used consistently across all your business operations and tax filings. It should be included on your tax forms, payroll records, and other official documents. Ensure that your employees, clients, and partners are aware of your EIN and use it correctly.

Updating Your Information

If there are any changes to your business structure, such as a change in ownership, address, or legal name, you’ll need to update your EIN information with the IRS. This can be done through the IRS website or by mailing or faxing a completed Form SS-4.

Protecting Your EIN

Your Federal Tax ID is a sensitive piece of information, much like your Social Security Number. It’s important to protect it from unauthorized use or disclosure. Be cautious when sharing your EIN, and ensure that your business records and documents containing your EIN are stored securely.

Renewal and Expiration

Unlike a Social Security Number, a Federal Tax ID does not expire. Once issued, it remains valid indefinitely. However, if your business ceases operations or you no longer require the EIN, you can close your account with the IRS. This can be done by submitting Form 8822-B.

Conclusion

Obtaining and managing a Federal Tax ID is a crucial aspect of running a business in the United States. It provides a unique identifier that facilitates tax compliance, enhances your business’s credibility, and enables you to access a range of financial services and business opportunities. By understanding the process and maintaining your EIN correctly, you can ensure your business operates smoothly and remains compliant with tax regulations.

Frequently Asked Questions

Can I Use My Personal SSN Instead of an EIN for My Business?

+

While it’s possible to use your Social Security Number (SSN) for certain business activities, such as sole proprietorships, it’s generally recommended to obtain an EIN. An EIN provides a separate identity for your business, helps maintain privacy, and is often required for various business transactions and tax filings.

How Long Does It Take to Receive an EIN After Applying Online?

+

If you apply for an EIN online, you should receive it immediately upon submission. The IRS processes online applications instantaneously, making it the fastest method to obtain an EIN.

What Should I Do If I Lose or Forget My EIN?

+

If you’ve misplaced your EIN, you can retrieve it by contacting the IRS Business & Specialty Tax Line at 800-829-4933. You may also be able to find your EIN on certain tax filings or business records, such as your payroll documents or business licenses.

Can I Change My EIN If I Make a Mistake in the Application Process?

+

If you realize you’ve made a mistake in your EIN application, you can correct it by submitting a new application with the correct information. However, it’s important to note that once an EIN is issued, it cannot be changed. You’ll need to close the old EIN and apply for a new one.

Are There Any Fees Associated with Obtaining an EIN?

+

There are no fees for obtaining an EIN from the IRS. The application process is free, whether you apply online, by fax, or by mail.