Beverly Hills Sales Tax

Welcome to the comprehensive guide on the Beverly Hills Sales Tax, an essential aspect of doing business and shopping in one of the most iconic cities in the world. As a bustling hub of luxury and commerce, Beverly Hills has its own unique sales tax regulations that businesses and consumers alike should be aware of. This expert-level article aims to provide an in-depth analysis of the sales tax landscape in Beverly Hills, offering valuable insights and practical tips for both businesses and individuals.

Understanding the Beverly Hills Sales Tax

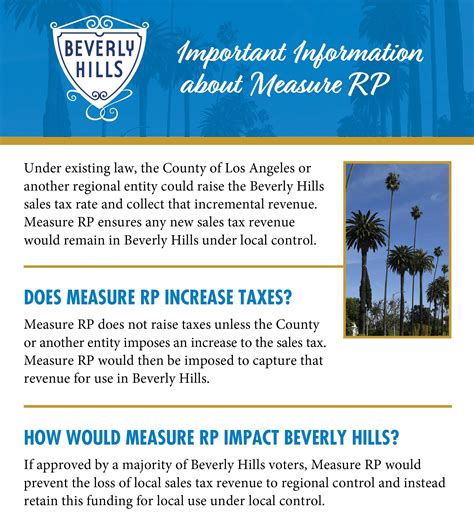

The sales tax in Beverly Hills, like in many other cities and states, is a vital revenue stream for local governments, contributing to the funding of essential public services and infrastructure. However, the specific rates and regulations surrounding sales tax can vary greatly, making it crucial to understand the intricacies of the system.

In the case of Beverly Hills, the sales tax is a combination of state, county, and city taxes, each with its own rate and purpose. As of [current year], the total sales tax rate in Beverly Hills stands at X.XX%, which includes:

- The California State Sales Tax of Y.YY%, which applies to all qualifying sales and purchases across the state.

- The Los Angeles County Sales Tax of Z.ZZ%, allocated for county-wide projects and services.

- The Beverly Hills City Sales Tax of W.WW%, specifically designated for the city's unique needs and initiatives.

These rates are subject to change, and it is the responsibility of businesses and individuals to stay updated on any modifications. The sales tax applies to a wide range of goods and services, from retail items to restaurant meals, with certain exemptions and special considerations for specific industries.

How Sales Tax Works in Beverly Hills

Sales tax in Beverly Hills operates on a point of sale basis, meaning the tax is calculated and collected at the time of purchase. This ensures that the burden of tax collection falls on the seller, who is responsible for remitting the collected taxes to the appropriate tax authorities.

For businesses operating in Beverly Hills, this entails registering with the appropriate tax agencies, obtaining the necessary permits, and implementing robust systems for accurate tax calculation and reporting. Failure to comply with sales tax regulations can result in significant penalties and legal consequences.

From a consumer perspective, it is important to be aware of the sales tax rates when making purchases in Beverly Hills. While the tax may not be visible until the final transaction, understanding the rates can help individuals budget and make informed purchasing decisions, especially when comparing prices across different cities or states.

Sales Tax for Beverly Hills Businesses

For businesses operating in Beverly Hills, navigating the sales tax landscape is a critical aspect of their financial and legal obligations. Here’s a deeper dive into the key considerations and best practices for businesses in this regard.

Registration and Permits

Before commencing operations in Beverly Hills, businesses must register with the California Department of Tax and Fee Administration (CDTFA) and obtain the necessary Seller’s Permit. This permit authorizes the business to collect and remit sales tax on behalf of the state and local governments.

The registration process typically involves providing detailed information about the business, including its legal structure, ownership, and the types of goods or services it offers. It is a crucial step to ensure compliance and avoid penalties for non-registration.

Sales Tax Calculation and Collection

Once registered, businesses in Beverly Hills are responsible for calculating the applicable sales tax on each transaction and collecting it from customers. This involves understanding the specific rates for the various taxes (state, county, and city) and applying them accurately.

To ensure precision, businesses often utilize specialized software or accounting systems that integrate with their point-of-sale (POS) systems. These tools automate the tax calculation process, reducing the risk of errors and simplifying the overall tax management.

It is worth noting that certain products and services may be exempt from sales tax, and businesses should stay informed about these exemptions to avoid overcharging customers. Additionally, there may be special considerations for specific industries, such as hospitality or e-commerce, which require tailored sales tax strategies.

Remitting Sales Tax

After collecting sales tax from customers, businesses in Beverly Hills have the responsibility to remit these taxes to the appropriate tax authorities. This process involves periodic reporting, typically on a monthly or quarterly basis, depending on the business’s sales volume and tax liability.

Businesses must submit detailed reports outlining their sales tax collections and make the corresponding payments. Late or inaccurate remittances can lead to penalties and interest charges, so it is essential to maintain accurate records and stay up-to-date with reporting deadlines.

Compliance and Audits

Maintaining compliance with sales tax regulations is an ongoing responsibility for Beverly Hills businesses. This includes staying informed about any changes in tax rates or laws and ensuring that internal systems and processes are updated accordingly.

Tax authorities may conduct audits to verify compliance, and businesses should be prepared to provide comprehensive documentation and records. Having robust systems in place, such as accurate sales records, tax calculation logs, and clear financial reporting, can significantly ease the audit process and demonstrate a commitment to compliance.

| Sales Tax Compliance Tips for Businesses |

|---|

| Stay informed about tax rate changes and legal updates. |

| Utilize sales tax software or accounting tools for accurate calculations. |

| Keep detailed records of sales transactions and tax collections. |

| Train staff on sales tax procedures and best practices. |

| Conduct internal audits periodically to identify and correct any errors. |

Sales Tax for Beverly Hills Consumers

For consumers, understanding the sales tax landscape in Beverly Hills is essential for making informed purchasing decisions and budgeting effectively. Here’s a closer look at how sales tax impacts shoppers in this iconic city.

Sales Tax Inclusion in Prices

In Beverly Hills, sales tax is typically not included in the advertised or listed prices of goods and services. This means that the final cost of an item or service will be higher than the displayed price, with the sales tax added at the point of sale.

While this may come as a surprise to some consumers, especially those unfamiliar with the city's sales tax rates, it is important to be aware of this practice to avoid sticker shock at the register.

Budgeting and Comparison Shopping

Given the impact of sales tax on the final purchase price, consumers in Beverly Hills should incorporate this factor into their budgeting and comparison shopping strategies.

When considering purchases, especially larger or more expensive items, it is beneficial to calculate the estimated sales tax cost and factor it into the overall budget. This ensures that consumers have a realistic understanding of the financial commitment involved.

Additionally, comparing prices across different retailers or cities can provide valuable insights into the impact of sales tax on the overall cost of goods. This can help consumers make more informed decisions about where to shop and how to maximize their purchasing power.

Exemptions and Special Considerations

It is worth noting that certain items or services in Beverly Hills may be exempt from sales tax, providing potential savings for consumers. These exemptions can vary based on the type of product, the purpose of the purchase, or the consumer’s eligibility.

For instance, some states offer sales tax exemptions for certain types of food, clothing, or educational materials. Additionally, there may be special considerations for specific consumer groups, such as seniors or individuals with disabilities, who may be eligible for reduced sales tax rates or exemptions.

Staying informed about these exemptions and special considerations can help consumers maximize their savings and make the most of their purchasing power in Beverly Hills.

Future of Sales Tax in Beverly Hills

As with any aspect of taxation, the sales tax landscape in Beverly Hills is subject to change and evolution. Here, we explore some of the potential future developments and their implications for businesses and consumers alike.

Tax Rate Adjustments

Sales tax rates are not static and can be adjusted by local governments to meet changing fiscal needs or address specific initiatives. In Beverly Hills, as in many other cities, there may be future proposals to increase or decrease the sales tax rate, depending on various economic and political factors.

Businesses and consumers should stay vigilant for any proposed changes and be prepared to adapt their financial strategies accordingly. This may involve adjusting pricing structures, budgeting practices, or tax collection and remittance processes to ensure continued compliance and financial viability.

Technological Innovations

The world of taxation is increasingly influenced by technological advancements, and sales tax is no exception. In Beverly Hills, as elsewhere, there may be future opportunities to leverage technology to streamline sales tax processes, enhance compliance, and improve the overall consumer experience.

For instance, the adoption of digital sales tax systems or the integration of blockchain technology could simplify tax calculation, reporting, and remittance processes. These innovations could reduce administrative burdens, minimize errors, and provide real-time visibility into tax obligations and collections.

Policy and Legal Developments

The sales tax system is also subject to ongoing policy and legal developments, which can have significant implications for businesses and consumers in Beverly Hills.

Changes in tax laws, regulations, or enforcement practices can impact the way sales tax is calculated, collected, and remitted. Additionally, there may be emerging legal considerations, such as the treatment of e-commerce sales or the impact of remote work on sales tax obligations, which require careful navigation.

Staying informed about these developments and seeking expert guidance when needed can help businesses and consumers navigate the evolving sales tax landscape with confidence and compliance.

How often are sales tax rates updated in Beverly Hills?

+Sales tax rates in Beverly Hills, as in many other cities, can be subject to periodic updates. These updates may occur annually or in response to specific economic or legislative changes. It is crucial for businesses and consumers to stay informed about any rate adjustments to ensure compliance and accurate budgeting.

Are there any sales tax exemptions or special considerations in Beverly Hills?

+Yes, Beverly Hills, like many other jurisdictions, offers certain sales tax exemptions and special considerations. These can vary based on the type of product, the purpose of the purchase, or the consumer’s eligibility. It is advisable to consult the relevant tax authorities or seek professional advice to understand these exemptions fully.

What happens if a business fails to collect or remit sales tax in Beverly Hills?

+Failing to collect or remit sales tax in Beverly Hills can result in significant penalties and legal consequences for businesses. These may include fines, interest charges, and even criminal prosecution in severe cases. It is crucial for businesses to prioritize compliance and seek professional guidance to avoid such situations.