Florida Sale Tax

The topic of Florida Sale Tax is an important consideration for both residents and businesses operating within the Sunshine State. Florida, known for its vibrant tourism industry and diverse economy, has a unique sales tax system that impacts a wide range of transactions. Understanding the intricacies of Florida's sales tax laws is crucial for compliance and financial planning.

Unraveling Florida’s Sales Tax Structure

Florida’s sales tax system is a comprehensive framework that applies to various goods and services. The state levies a general sales tax rate, but it is important to note that local governments can also impose additional taxes, creating a complex landscape for taxpayers.

The base sales tax rate in Florida is set at 6%, which applies to most tangible personal property and certain services. This rate is a standard across the state, providing a uniform foundation for sales tax calculations. However, the real complexity arises when we delve into the world of local taxes.

Local Taxes: A Patchwork of Rates

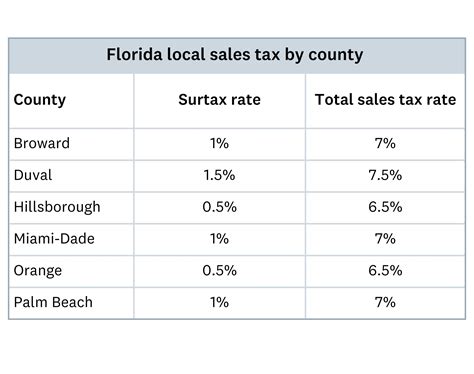

Florida allows counties and municipalities to levy their own local option taxes, often referred to as discretionary sales surtaxes. These surtaxes can vary significantly, with rates ranging from 0% to 1.5% across different jurisdictions. This patchwork of local taxes adds a layer of complexity to sales tax calculations, especially for businesses operating in multiple regions.

| County | Local Surtax Rate |

|---|---|

| Miami-Dade | 1.5% |

| Broward | 1.5% |

| Palm Beach | 1.5% |

| Hillsborough | 1.5% |

| Orange | 1.5% |

As illustrated in the table above, some of Florida's most populous counties impose the maximum local surtax rate of 1.5%. This means that in these areas, the total sales tax rate can reach 7.5%, significantly higher than the state's base rate.

Taxable Items and Exemptions

Florida’s sales tax applies to a broad range of goods and services, including clothing, electronics, restaurant meals, and entertainment tickets. However, there are certain categories that are exempt from sales tax, such as most groceries, prescription drugs, and certain agricultural products.

The state also offers various sales tax holidays, during which specific items are exempt from sales tax for a limited time. These holidays often target back-to-school shopping, hurricane preparedness, and energy-efficient appliances. Understanding these exemptions and holiday periods is crucial for both consumers and businesses to optimize their purchases and pricing strategies.

Collection and Remittance Process

Businesses operating in Florida are responsible for collecting and remitting sales tax to the state. The Florida Department of Revenue provides a comprehensive guide for businesses, outlining the registration process, tax calculation methods, and filing requirements. Failure to comply with these regulations can result in penalties and interest charges.

For remote sellers, Florida's economic nexus laws come into play. Out-of-state businesses that exceed a certain sales threshold must register with the state and collect sales tax on transactions with Florida residents. This threshold is currently set at $100,000 in annual sales, or 200 transactions within the state.

Compliance and Penalties

Florida takes sales tax compliance seriously, and non-compliance can lead to significant consequences. The state imposes penalties for late payments, underreporting, and non-filing. These penalties can range from 5% to 25% of the tax due, depending on the severity of the violation.

To ensure compliance, businesses are encouraged to stay updated on sales tax laws, utilize tax calculation tools, and seek professional advice when needed. The Florida Department of Revenue offers resources and support to help businesses navigate the complex world of sales tax.

The Impact on Businesses and Consumers

Florida’s sales tax structure has a direct impact on both businesses and consumers. For businesses, the varying tax rates and complex regulations can pose challenges in pricing strategies and administrative processes. Accurate tax calculations and compliance become crucial aspects of their financial operations.

Consumers, on the other hand, experience the sales tax as an additional cost added to their purchases. The varying tax rates across different regions can influence shopping decisions, with consumers potentially opting for lower-tax jurisdictions. Understanding these dynamics is essential for businesses to attract and retain customers.

Strategies for Businesses

Businesses operating in Florida can employ several strategies to navigate the sales tax landscape effectively:

- Centralized Tax Calculation: Implement a centralized system for tax calculation, ensuring accuracy and consistency across all sales channels.

- Local Tax Awareness: Stay informed about local tax rates and changes, especially for businesses with multiple locations.

- Pricing Strategies: Consider pricing strategies that incorporate sales tax to provide transparency and avoid surprises at checkout.

- Compliance Training: Invest in training for employees to ensure they understand sales tax regulations and their roles in compliance.

Consumer Considerations

Consumers in Florida can benefit from understanding the sales tax system to make informed purchasing decisions. Here are some tips for consumers:

- Compare Prices: Research and compare prices across different retailers, especially when considering significant purchases. The sales tax difference can impact the overall cost.

- Tax-Free Holidays: Take advantage of sales tax holidays to save on essential items like school supplies or emergency preparedness gear.

- Online Shopping: Consider online retailers, as they may offer competitive pricing and shipping options, especially for items with higher sales tax rates.

Future Trends and Developments

The world of sales tax is dynamic, and Florida is no exception. As the state’s economy evolves, so too will its sales tax laws and regulations. Here are some potential future trends to watch:

Online Sales Tax Collection

With the rise of e-commerce, the collection of sales tax from online transactions is an ongoing discussion. Florida may consider implementing stricter regulations to ensure compliance from out-of-state sellers, especially as online shopping continues to grow.

Simplification of Local Taxes

The patchwork of local taxes can be a challenge for both businesses and consumers. There is a possibility that Florida could explore ways to simplify or standardize local tax rates to create a more uniform system.

Exemptions and Incentives

Florida may consider expanding or introducing new sales tax exemptions to encourage specific behaviors or support certain industries. For instance, the state could offer incentives for renewable energy purchases or promote local agriculture by exempting certain produce.

Technological Advancements

The integration of technology in tax calculation and compliance processes is on the rise. Florida could adopt innovative solutions, such as automated tax calculation tools or blockchain-based systems, to enhance accuracy and efficiency.

Conclusion

Florida’s sales tax system is a dynamic and intricate framework that impacts both businesses and consumers. Understanding the base rate, local variations, and exemptions is crucial for compliance and strategic decision-making. As the state’s economy continues to evolve, staying informed about sales tax laws and future developments will be essential for all stakeholders.

What is the current base sales tax rate in Florida?

+The base sales tax rate in Florida is 6%.

Are there any counties with a 0% local surtax rate?

+Yes, there are several counties in Florida that do not impose a local surtax, resulting in a total sales tax rate of 6%.

When are sales tax holidays typically held in Florida?

+Sales tax holidays in Florida are usually scheduled during specific periods, such as back-to-school season or hurricane preparedness months.