Calculate Taxes On 401K Withdrawal

Understanding the tax implications of a 401(k) withdrawal is crucial for anyone considering tapping into their retirement savings early. The tax rules surrounding these withdrawals can be complex, but with the right knowledge, you can navigate this process more confidently. This comprehensive guide aims to demystify the calculations involved and provide a step-by-step breakdown, ensuring you're well-prepared for any potential tax consequences.

Unraveling the 401(k) Withdrawal Process

When you withdraw funds from your 401(k) before reaching the age of 59½, the Internal Revenue Service (IRS) treats this as an early distribution, which comes with specific tax considerations. Here’s a breakdown of the key steps and calculations involved.

Step 1: Determine the Taxable Amount

Not all of your 401(k) funds are subject to tax. Only the portion that represents your pre-tax contributions and any earnings on those contributions are taxable. Here’s how to calculate this:

-

Pre-Tax Contributions: These are the funds you contributed to your 401(k) from your pre-tax salary. If you've made contributions over multiple years, you'll need to track the total amount contributed.

-

Earnings: The 401(k) provider can provide you with the total earnings on your pre-tax contributions. This includes interest, dividends, and capital gains.

-

Taxable Amount: Add your pre-tax contributions and earnings together. This sum represents the taxable portion of your withdrawal.

For example, if you've contributed a total of $50,000 to your 401(k) and the earnings on those contributions amount to $10,000, your taxable amount for the withdrawal would be $60,000.

Step 2: Calculate the Tax Rate

The tax rate applied to your 401(k) withdrawal depends on your overall income for the year. It’s crucial to understand that this withdrawal can push you into a higher tax bracket, potentially increasing your overall tax liability.

-

Federal Income Tax: The IRS has different tax brackets for different income levels. Your 401(k) withdrawal will be taxed at the applicable rate for your income bracket. For instance, if your income places you in the 22% tax bracket, any taxable amount from your 401(k) withdrawal will be taxed at this rate.

-

State and Local Taxes: Depending on your state of residence, you may also owe state and local income taxes on your 401(k) withdrawal. Each state has its own tax rates and rules, so be sure to check your state's guidelines.

Step 3: Consider Additional Fees

Beyond federal and state taxes, there are other fees and penalties that might apply to your 401(k) withdrawal:

-

Early Withdrawal Penalty: If you're under the age of 59½, the IRS imposes a 10% penalty on early distributions from retirement accounts like 401(k)s. This penalty is applied to the taxable amount of your withdrawal.

-

Loan Fees: If you're taking out a loan against your 401(k), there may be associated fees, such as origination fees or administrative costs.

Step 4: Understand the Reporting Process

When you withdraw funds from your 401(k), your financial institution will send you a Form 1099-R, which reports the distribution to the IRS. This form will detail the taxable amount and any applicable fees. You’ll use this information when filing your taxes for the year.

It's crucial to accurately report these distributions to avoid any potential audits or penalties. If you have multiple 401(k) accounts, be sure to keep track of the distributions from each.

Maximizing Your Withdrawal Strategy

While the tax implications of a 401(k) withdrawal can be significant, there are strategies you can employ to minimize the impact.

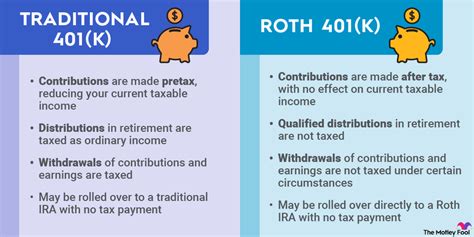

Strategy 1: Rollover to an IRA

If you’re switching jobs or retiring, consider rolling over your 401(k) into an Individual Retirement Account (IRA). This move can help you avoid immediate taxes and penalties, as the funds remain tax-deferred until you withdraw them in retirement.

Strategy 2: Take Advantage of Tax-Free Withdrawals

Certain 401(k) withdrawals are exempt from the 10% early withdrawal penalty. These include:

-

Substantially Equal Periodic Payments: If you choose to receive payments over your lifetime or a period of at least 5 years, you can avoid the penalty.

-

Health Insurance Premiums: Distributions used to pay for health insurance premiums while unemployed can be penalty-free.

-

Qualified Disaster Relief Payments: Withdrawals used for qualified disaster relief purposes are also exempt from the penalty.

Strategy 3: Tax-Efficient Withdrawals

To minimize your tax burden, consider the following:

-

Withdraw in Smaller Amounts: By taking smaller distributions over time, you can potentially stay in a lower tax bracket.

-

Convert to a Roth IRA: Converting your 401(k) to a Roth IRA can be beneficial if you expect your tax rate to increase in retirement. While this conversion is taxed at your current rate, future withdrawals from the Roth IRA are tax-free.

Real-Life Examples and Scenarios

Let’s look at some real-world scenarios to better understand the tax implications of 401(k) withdrawals.

Scenario 1: Early Retirement Withdrawal

John, aged 55, decides to withdraw $50,000 from his 401(k) to fund his early retirement. He’s in the 24% federal tax bracket and lives in a state with a 5% income tax. Here’s a breakdown of his tax liability:

| Tax Category | Amount |

|---|---|

| Federal Income Tax | $12,000 (24% of $50,000) |

| State Income Tax | $2,500 (5% of $50,000) |

| Early Withdrawal Penalty | $5,000 (10% of $50,000) |

| Total Tax Liability | $19,500 |

In this scenario, John's tax liability amounts to a significant portion of his withdrawal, highlighting the importance of careful planning.

Scenario 2: Emergency Withdrawal

Sarah, aged 35, faces a medical emergency and needs to withdraw $20,000 from her 401(k). She’s in the 12% federal tax bracket and doesn’t owe state income tax. Her tax liability would look like this:

| Tax Category | Amount |

|---|---|

| Federal Income Tax | $2,400 (12% of $20,000) |

| Early Withdrawal Penalty | $2,000 (10% of $20,000) |

| Total Tax Liability | $4,400 |

In Sarah's case, the early withdrawal penalty accounts for a significant portion of her tax liability, demonstrating the impact of early withdrawals.

Frequently Asked Questions

Can I avoid taxes on my 401(k) withdrawal if I use the funds for a down payment on a house?

+

No, the IRS doesn’t exempt 401(k) withdrawals for down payments from taxation. However, you may be able to avoid the 10% early withdrawal penalty if the funds are used for a first-time home purchase.

Are there any ways to reduce the tax impact of a 401(k) withdrawal?

+

Yes, you can consider strategies like rolling over your 401(k) to an IRA, taking advantage of tax-free withdrawal options, or planning your withdrawals to stay in a lower tax bracket.

What happens if I don’t report my 401(k) withdrawal on my taxes?

+

Failing to report a 401(k) withdrawal can lead to significant penalties and interest charges from the IRS. It’s important to accurately report all distributions to avoid potential audits.

Can I withdraw from my 401(k) without penalties if I’m disabled?

+

Yes, if you’re deemed permanently disabled by the Social Security Administration, you can withdraw from your 401(k) without incurring the 10% early withdrawal penalty.