Mecklenburg Property Tax

Understanding property taxes is crucial for homeowners, especially when it comes to Mecklenburg County, North Carolina. This comprehensive guide will delve into the intricacies of Mecklenburg property tax, providing you with the knowledge needed to navigate this essential aspect of homeownership. From assessment processes to potential exemptions, we'll explore the key factors that influence the property tax landscape in Mecklenburg County.

Unraveling the Mechanics of Mecklenburg Property Tax

Property taxes are a significant financial obligation for homeowners, and Mecklenburg County’s tax system operates under a set of unique regulations and procedures. To provide a clear picture, let’s break down the process step by step.

Assessment and Valuation

The Mecklenburg County Assessor’s Office plays a pivotal role in determining property taxes. Each year, they conduct a thorough assessment of properties, taking into account various factors such as:

- Property type (residential, commercial, industrial)

- Square footage

- Age and condition of the structure

- Location and zoning

- Recent improvements or renovations

These assessments are used to calculate the fair market value of each property, which serves as the basis for tax calculations. The assessor’s team employs a combination of physical inspections, sales data analysis, and market trends to ensure accuracy.

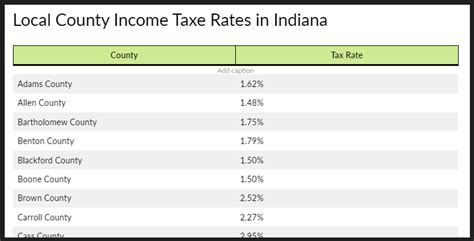

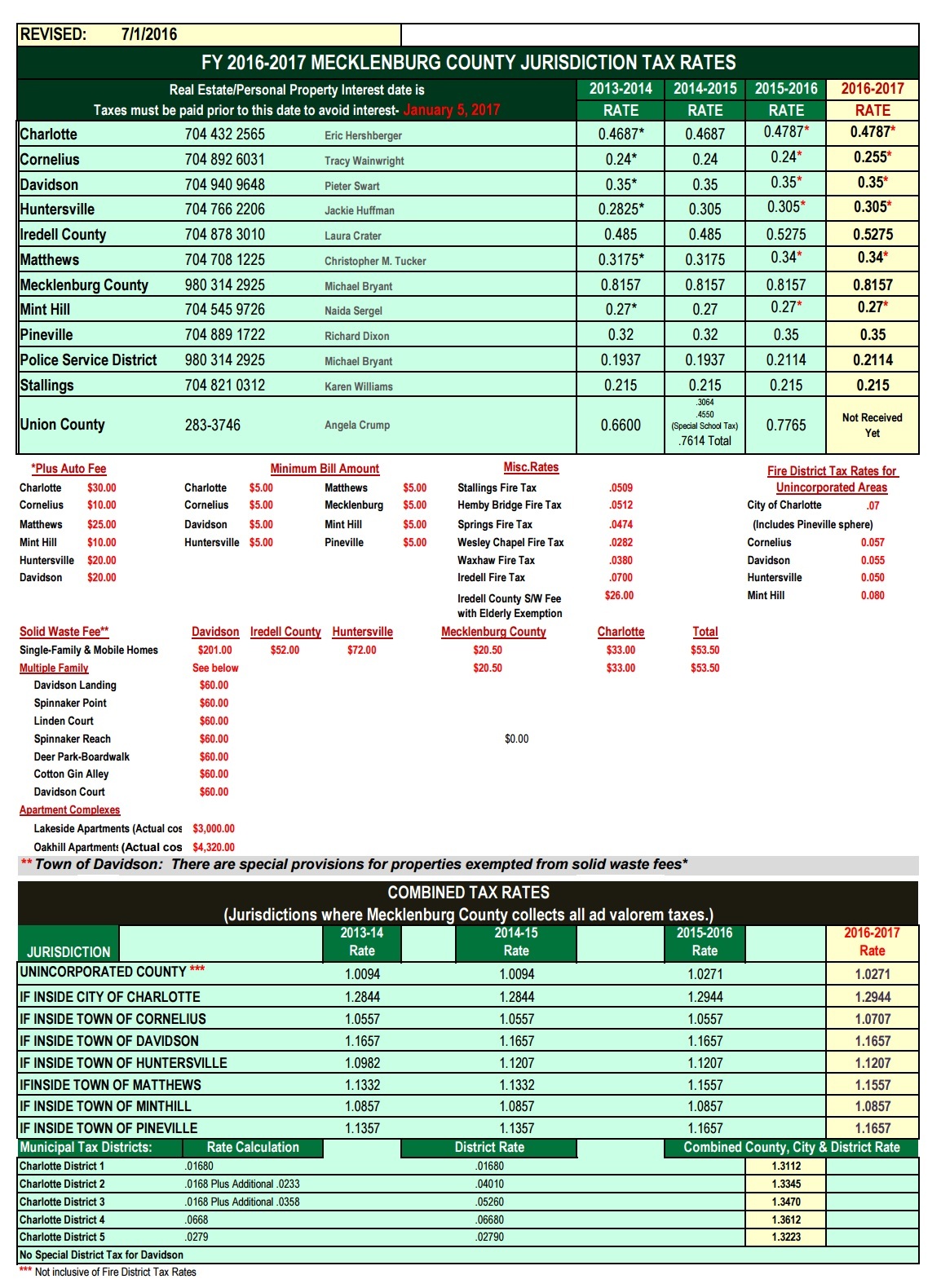

Tax Rate Determination

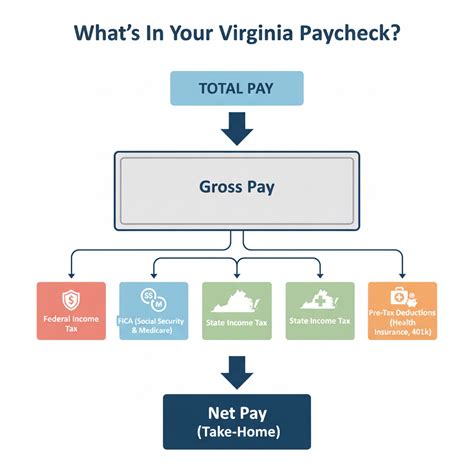

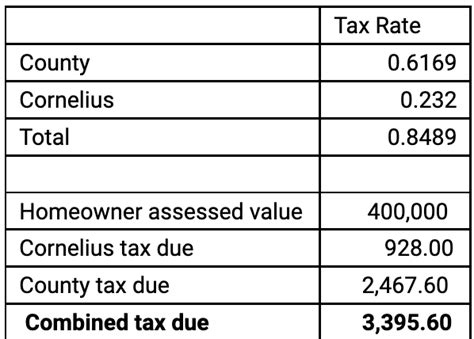

Once the assessed value is established, it is subjected to the applicable tax rate. In Mecklenburg County, the tax rate is determined by the local government and can vary across different areas within the county. This rate is expressed as a millage rate, which represents the amount of tax owed per 1,000 of assessed value.</p> <p>For instance, if a property is assessed at 200,000 and the millage rate is 0.8%, the annual property tax would be calculated as follows:

| Assessed Value | 200,000</td> </tr> <tr> <th>Millage Rate</th> <td>0.8%</td> </tr> <tr> <th>Property Tax</th> <td>1,600 |

|---|

It’s important to note that the millage rate can change annually, influenced by factors like budget requirements and local economic conditions.

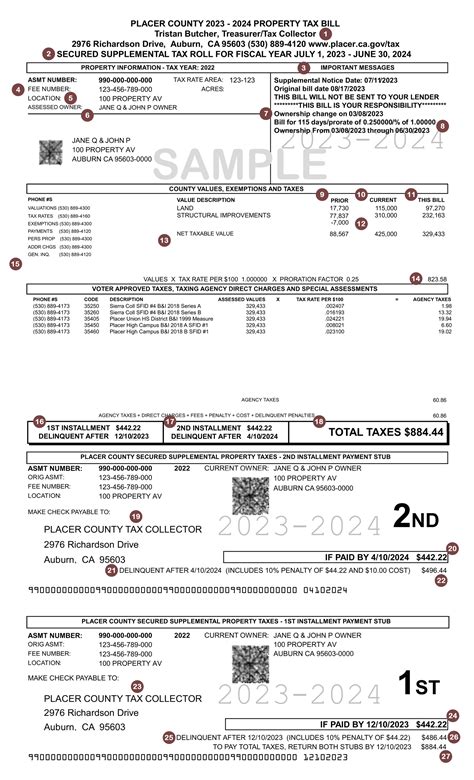

Tax Bill and Payment Options

After the assessment and tax rate determination, homeowners receive their property tax bill, which outlines the amount due and the payment deadline. In Mecklenburg County, property taxes are typically due in two installments: January 1st and July 1st.

Homeowners have the flexibility to choose from various payment methods, including online payment platforms, traditional mail-in checks, or even automatic deductions from their bank accounts. Late payments may incur penalties and interest, so staying informed about due dates is crucial.

Exemptions and Relief Programs

Mecklenburg County offers a range of exemptions and relief programs designed to alleviate the property tax burden for certain eligible individuals and properties. These programs aim to provide financial assistance and ensure fairness in the tax system.

Homestead Exemption

The homestead exemption is a popular program that reduces the taxable value of a homeowner’s primary residence. To qualify, homeowners must meet specific residency and income criteria. The exemption amount can vary but often covers a portion of the property’s assessed value, effectively lowering the tax liability.

Senior Citizen and Disability Exemptions

Mecklenburg County extends exemptions to senior citizens and individuals with disabilities. These exemptions consider factors such as age, disability status, and income levels. Qualifying individuals may be eligible for reduced tax rates or even complete exemption from property taxes, providing much-needed financial relief.

Veteran Exemptions

In recognition of their service, Mecklenburg County offers property tax exemptions to qualifying veterans. These exemptions can vary based on factors like the veteran’s disability status, length of service, and other criteria. The aim is to honor and support those who have served our country.

Appealing Your Property Assessment

If you believe your property assessment is inaccurate or unfair, Mecklenburg County provides a process for appealing these decisions. This ensures that homeowners have a chance to voice their concerns and potentially reduce their tax liability.

The Appeal Process

To initiate an appeal, homeowners must submit a formal request to the Mecklenburg County Board of Equalization and Review. This request should include detailed information supporting your claim, such as recent sales data, appraisal reports, or other relevant evidence. The board carefully reviews each case and may schedule a hearing to further assess the appeal.

Outcome and Next Steps

After the appeal process, the board will issue a decision, either upholding the original assessment or adjusting it based on the evidence presented. If you are dissatisfied with the outcome, you have the right to pursue further legal avenues, such as filing an appeal with the North Carolina Property Tax Commission.

Future Implications and Tax Planning

Staying informed about potential changes in the tax landscape is essential for effective tax planning. Mecklenburg County, like many areas, experiences shifts in tax policies and regulations over time, influenced by factors such as economic trends and local government decisions.

Market Fluctuations and Reassessments

Property values can be subject to market fluctuations, and Mecklenburg County regularly conducts reassessments to ensure tax fairness. These reassessments may result in changes to your property’s assessed value, impacting your tax liability. Monitoring market trends and staying updated on reassessment schedules can help you anticipate potential changes.

Tax Relief Initiatives

Mecklenburg County may introduce new tax relief programs or expand existing ones to support homeowners. Keeping an eye on local government announcements and community initiatives can provide valuable insights into potential opportunities for tax savings. Engaging with local officials and staying involved in community discussions can also contribute to shaping future tax policies.

Conclusion

Understanding the intricacies of Mecklenburg property tax is a crucial aspect of responsible homeownership. By familiarizing yourself with the assessment process, tax rates, and available exemptions, you can effectively manage your tax obligations. Additionally, staying informed about potential changes and exploring appeal processes empowers you to navigate the tax landscape with confidence.

How often are property assessments conducted in Mecklenburg County?

+Property assessments in Mecklenburg County are typically conducted annually. However, the county may conduct reassessments more frequently to ensure tax fairness and reflect market changes.

Can I receive a copy of my property assessment report?

+Absolutely! You can request a copy of your property assessment report from the Mecklenburg County Assessor’s Office. This report provides detailed information about your property’s assessed value and the factors considered during the assessment process.

Are there any online resources for tracking property tax rates and due dates?

+Yes, Mecklenburg County provides an online property tax portal where you can access your tax bill, view payment history, and stay updated on tax rates and due dates. This portal is a convenient tool for managing your property tax obligations.

What happens if I miss a property tax payment deadline?

+Late payments may result in penalties and interest charges. It’s important to stay informed about payment deadlines and explore available payment options to avoid any financial consequences.

Can I appeal my property assessment if I disagree with the valuation?

+Absolutely! If you believe your property assessment is inaccurate, you have the right to appeal. The Mecklenburg County Board of Equalization and Review provides a formal process for appealing assessments. Gather supporting evidence and follow the appeal guidelines to present your case.