City Of Portland Arts Tax

The City of Portland Arts Tax is a unique initiative that has been implemented to support and sustain the vibrant arts and culture scene in Portland, Oregon. This tax, levied on residents and businesses, has become a pivotal source of funding for the city's artistic community, offering a creative solution to the challenge of funding the arts while engaging the public in a direct way. This article explores the origins, implementation, impact, and future of the Portland Arts Tax, shedding light on its significance and potential implications for other cities seeking innovative ways to support their cultural sectors.

The Birth of the Portland Arts Tax

The concept of the Arts Tax emerged in 2012 as a grassroots effort led by local artists and cultural advocates who recognized the need for sustainable funding for the arts in Portland. The idea was to create a dedicated source of revenue that would provide stable funding for arts and culture programs, ensuring their long-term viability and growth. This initiative gained traction and was eventually adopted by the city, becoming a key component of Portland’s cultural policy.

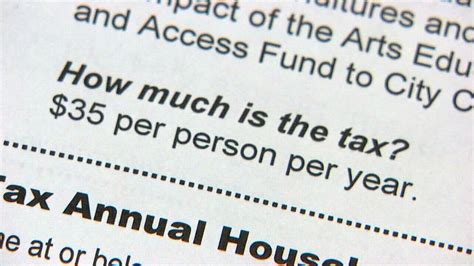

The tax is levied annually on individuals and households with an income above a certain threshold. The threshold, which is adjusted annually for inflation, was initially set at $1,000 in 2013. This means that individuals earning above this amount are required to pay a flat rate of $35 per year, making it an affordable contribution for most Portland residents.

Incentives and Exemptions

To encourage compliance and ensure the tax is accessible to all, the city offers several incentives and exemptions. For instance, individuals who engage in certain arts-related activities, such as volunteering or teaching arts classes, can receive a partial or full exemption. Additionally, the city provides resources and support to help residents understand their obligations and navigate the registration process.

| Exemption Categories | Description |

|---|---|

| Senior Exemption | Residents aged 65 or older are exempt from the tax. |

| Financial Hardship Exemption | Individuals with an annual income below $10,000 are eligible for a full exemption. |

| Active Military Exemption | Members of the armed forces on active duty are exempt. |

| Student Exemption | Full-time students with a valid student ID are exempt. |

Implementation and Collection Process

The implementation of the Arts Tax was a collaborative effort involving the city government, arts organizations, and the community. The city’s Revenue Bureau was tasked with administering the tax, which includes managing registrations, collecting payments, and distributing funds to eligible arts and culture organizations.

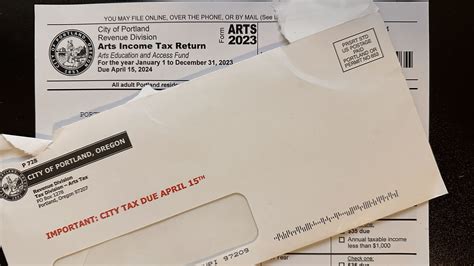

Registration for the Arts Tax is straightforward and can be done online or by mail. Residents are required to register annually, usually before the deadline of April 15th, which aligns with federal tax deadlines. This process ensures that the city has an accurate record of taxpayers and can effectively collect the tax.

The city employs a combination of strategies to collect the tax, including online payment portals, payment by mail, and, in some cases, partnerships with local businesses to facilitate payment. To encourage timely payments, the city offers a 10% discount for residents who pay by the early deadline of February 15th.

Compliance and Enforcement

While the Arts Tax is a voluntary compliance tax, the city has implemented measures to ensure compliance and address non-compliance. These measures include public education campaigns, outreach programs, and the use of data-matching techniques to identify non-filers. In cases of non-compliance, the city may issue penalty assessments or pursue legal action.

| Compliance Measures | Description |

|---|---|

| Public Education Campaigns | The city runs annual awareness campaigns to inform residents about their Arts Tax obligations. |

| Outreach Programs | Community organizations and volunteers are engaged to reach out to residents, especially those in underserved communities, to ensure they understand the tax and their rights. |

| Data-Matching Techniques | The Revenue Bureau uses data from various sources, including state tax records and voter registration lists, to identify residents who may be liable for the tax. |

Impact and Benefits

The Portland Arts Tax has had a profound impact on the city’s arts and culture scene, providing much-needed funding and support to a diverse range of organizations and initiatives. Since its inception, the tax has generated over $50 million, with the funds being distributed to hundreds of arts and culture organizations, artists, and community groups.

The impact of the Arts Tax is evident in the thriving arts scene in Portland. The tax has supported a wide array of programs, from visual and performing arts to literary arts and cultural heritage initiatives. It has funded public art installations, music and dance performances, theater productions, literary festivals, and much more. The tax has also provided crucial support to arts education programs, ensuring that Portland's youth have access to high-quality arts education.

Community Engagement and Access

One of the key strengths of the Arts Tax is its ability to engage the community in supporting the arts. By making the tax a voluntary contribution, it encourages residents to actively participate in shaping their cultural landscape. This engagement has led to increased attendance at arts events, greater community involvement in arts projects, and a heightened appreciation for the arts across Portland.

Furthermore, the tax has helped make the arts more accessible to underserved communities. A portion of the funds is dedicated to providing arts opportunities to low-income individuals and communities, ensuring that everyone in Portland has the chance to experience and engage with the arts.

Challenges and Criticisms

Despite its success, the Portland Arts Tax has not been without its challenges and criticisms. Some residents and businesses have expressed concerns about the tax, citing issues such as the administrative burden, the potential for non-compliance, and the impact on low-income individuals.

The tax's administration requires significant resources, and there have been concerns about the efficiency and effectiveness of the collection process. Additionally, the voluntary nature of the tax has led to compliance issues, with some residents choosing not to register or pay. This has resulted in lower-than-expected revenue in certain years.

Addressing Concerns and Moving Forward

The city has been proactive in addressing these concerns and has implemented several measures to improve the tax’s administration and compliance. These include enhancing public education campaigns, improving the online registration and payment process, and exploring partnerships with community organizations to increase awareness and compliance.

To mitigate the impact on low-income individuals, the city has expanded its exemption categories and provides resources to help residents understand their eligibility. Additionally, the city is exploring ways to further support arts and culture initiatives that serve underserved communities, ensuring that the benefits of the Arts Tax are felt across Portland.

The Future of the Portland Arts Tax

As Portland continues to evolve and its arts scene thrives, the future of the Arts Tax looks promising. The tax has become an integral part of the city’s cultural fabric, providing a stable source of funding for arts and culture organizations. The city’s commitment to the tax is evident in its ongoing efforts to improve its administration and reach.

Looking ahead, the city aims to further enhance the tax's impact by exploring innovative funding models and partnerships. This includes potential collaborations with private sector entities and foundations to leverage additional resources for the arts. The city is also considering ways to engage younger generations in the Arts Tax, recognizing the importance of their participation in shaping Portland's cultural future.

Expanding Arts Education and Access

A key focus for the future of the Arts Tax is expanding arts education and access. The city aims to ensure that all Portland residents, regardless of their background or income, have the opportunity to engage with the arts. This includes supporting arts education in schools, providing arts programs in underserved communities, and creating more public art installations that are accessible to all.

The city recognizes that the Arts Tax is not just about funding, but also about fostering a culture of appreciation and engagement with the arts. By continuing to support and expand arts initiatives, the city aims to create a vibrant, inclusive, and culturally rich community that celebrates the arts in all its forms.

Frequently Asked Questions

How does the Portland Arts Tax benefit the community?

+

The Portland Arts Tax provides crucial funding for arts and culture organizations, artists, and community groups. This support has led to a thriving arts scene, with increased access to arts events, education, and opportunities for all Portland residents.

What is the registration process for the Arts Tax?

+

Registration is simple and can be done online or by mail. Residents must register annually, usually before the deadline of April 15th. The process involves providing basic personal information and declaring any applicable exemptions.

How are the Arts Tax funds distributed?

+

The funds are distributed to eligible arts and culture organizations, artists, and community groups. The city’s Revenue Bureau manages the distribution process, ensuring that the funds reach a diverse range of initiatives and programs.

Are there any incentives for early payment of the Arts Tax?

+

Yes, residents who pay by the early deadline of February 15th receive a 10% discount on their Arts Tax payment. This incentive encourages timely payments and helps with the tax’s administration.

How can I learn more about the Arts Tax and its impact on Portland’s arts scene?

+

You can visit the City of Portland’s official website, which provides detailed information about the Arts Tax, including registration guidelines, exemption details, and a breakdown of how the funds are distributed. Additionally, the city’s Revenue Bureau offers resources and support to help residents understand their obligations.