Dakota County Mn Property Tax

Welcome to an in-depth exploration of the Dakota County property tax system, an essential aspect of homeownership and community funding in this vibrant Minnesota county. This article aims to provide a comprehensive understanding of the property tax landscape, shedding light on the processes, rates, and implications for homeowners.

Understanding Dakota County’s Property Tax System

Dakota County, nestled in the southern reaches of Minnesota, is known for its picturesque landscapes, vibrant communities, and a thriving residential and commercial property market. The property tax system in Dakota County plays a pivotal role in funding essential public services and maintaining the county’s infrastructure.

The property tax, often regarded as one of the most stable sources of revenue for local governments, is a crucial element of the county's financial structure. It contributes significantly to the funding of schools, emergency services, road maintenance, and various other public amenities and services that enhance the quality of life for residents.

How Property Taxes are Determined in Dakota County

The process of assessing and collecting property taxes in Dakota County is a well-regulated procedure governed by state laws and county ordinances. Here’s a simplified breakdown of how it works:

- Property Assessment: The first step involves the county's assessors evaluating each property within the county. This assessment considers various factors such as the property's location, size, improvements (like buildings or additions), and market value. The goal is to determine a fair and accurate value for each property.

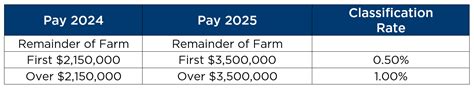

- Tax Rate Setting: Once the assessed values are determined, the county and its various taxing districts (such as school districts, cities, and townships) set their tax rates. These rates are expressed as a percentage of the property's assessed value. The rates are carefully calibrated to meet the budget needs of each district while striving for fiscal responsibility.

- Calculating Tax Liability: The tax rate is then applied to the assessed value of each property to calculate the property tax liability. For instance, if a property has an assessed value of $200,000 and the tax rate is 1.5%, the annual property tax would be $3,000 ($200,000 x 0.015 = $3,000).

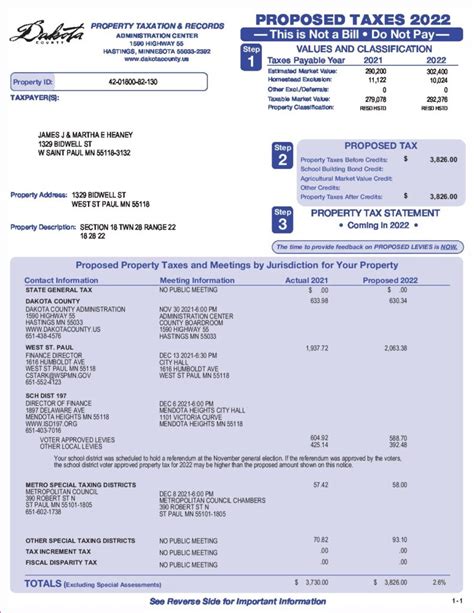

- Billing and Collection: Property owners receive tax statements, detailing the assessed value, tax rate, and the total tax due. The county collects these taxes, which are then distributed to the various taxing districts based on their share of the property tax revenue.

It's worth noting that Dakota County, like many other counties, offers certain exemptions and deferral programs to eligible homeowners. These initiatives aim to provide relief to specific categories of homeowners, such as seniors or those with limited incomes, by reducing their tax burden or allowing them to defer payment under certain conditions.

Dakota County’s Property Tax Rates and Comparison

Dakota County’s property tax rates are a reflection of the county’s commitment to fiscal responsibility and efficient governance. The rates are determined annually by the county commissioners, taking into account the budget needs of various public services and the county’s overall financial health.

As of the most recent assessment, the county's average property tax rate stands at 1.45%, which is slightly below the state average of 1.5%. This rate, however, can vary significantly across the county's different taxing districts, with some areas experiencing higher rates due to the specific needs and services provided in those districts.

| Dakota County Taxing District | Property Tax Rate |

|---|---|

| City of Hastings | 1.38% |

| Burnsville School District | 1.62% |

| Rosemount-Apple Valley-Eagan School District | 1.52% |

| Dakota County General Revenue | 0.28% |

The table above provides a glimpse into the varying tax rates across different districts within Dakota County. These rates can influence a homeowner's decision-making process, especially when considering the overall cost of living and the specific services and amenities offered by each district.

Impact of Property Taxes on Homeowners

For homeowners in Dakota County, understanding the property tax system is not just a matter of financial planning but also a crucial aspect of their civic responsibilities. Property taxes directly influence a homeowner’s cost of living and can impact their financial planning and investment strategies.

Factors Influencing Property Tax Liability

The property tax liability of a homeowner in Dakota County is influenced by several key factors, including:

- Property Value: As mentioned earlier, the assessed value of a property is a primary determinant of its tax liability. Higher-value properties generally attract higher tax bills.

- Tax Rates: The tax rate set by the county and its taxing districts directly impacts the tax bill. Higher tax rates result in higher property taxes, all else being equal.

- Property Improvements: Any improvements made to a property, such as additions, renovations, or upgrades, can increase its assessed value and subsequently its tax liability.

- Exemptions and Deferrals: Dakota County offers certain exemptions and deferral programs that can reduce a homeowner's tax burden. These include homestead exemptions, which provide a partial exemption for primary residences, and deferral programs for seniors and those with limited incomes.

Managing Property Tax Costs

Homeowners in Dakota County have several strategies at their disposal to manage their property tax costs effectively:

- Stay Informed: Regularly review your property's assessed value and tax rate. Any changes in these values can significantly impact your tax liability. Dakota County provides online resources to help homeowners stay informed and up-to-date.

- Appeal Assessments: If you believe your property's assessed value is inaccurate, you have the right to appeal. The process typically involves submitting documentation to support your claim and attending a hearing. Successful appeals can lead to reduced tax liabilities.

- Explore Exemptions: Research and understand the various exemptions and deferral programs offered by Dakota County. If you're eligible, these programs can provide substantial savings on your property taxes.

- Budgeting and Planning: Incorporate property taxes into your financial planning and budgeting. Consider setting aside funds specifically for tax payments to avoid any surprises or financial strain.

Dakota County’s Commitment to Transparency and Service

Dakota County’s approach to property taxes is characterized by a strong commitment to transparency and efficient service delivery. The county’s efforts in this regard are evident in several key initiatives and resources available to homeowners and taxpayers.

Online Resources and Accessibility

Dakota County has embraced digital technologies to enhance transparency and accessibility for its residents. The county’s official website serves as a comprehensive hub for property tax-related information, offering the following resources:

- Property Search: A user-friendly search tool that allows homeowners to look up their property's assessed value, tax rates, and tax statements.

- Tax Payment Options: Homeowners can explore various payment options, including online payments, direct debit, and payment plans, ensuring convenience and flexibility.

- Appeal and Exemption Information: Detailed guides and resources are provided to help homeowners understand the appeal and exemption processes, making it easier for them to exercise their rights.

- News and Updates: The website keeps residents informed about any changes to tax policies, assessment procedures, and important deadlines.

Community Engagement and Outreach

Dakota County recognizes the importance of community engagement and outreach in fostering a sense of trust and understanding among its residents. The county regularly hosts public meetings, workshops, and informational sessions to address property tax-related concerns and provide clarity on complex issues.

These initiatives not only empower residents with knowledge but also create opportunities for direct dialogue with county officials, fostering a collaborative environment where concerns and suggestions can be shared and addressed.

Looking Ahead: Future Prospects and Challenges

As Dakota County continues to grow and evolve, the property tax system will play a pivotal role in shaping the county’s future. While the current system is well-structured and transparent, there are ongoing discussions and initiatives to further enhance its efficiency and fairness.

Key areas of focus include:

- Equitable Tax Distribution: Ensuring that the tax burden is distributed fairly across different communities and property types is a priority. The county is exploring ways to balance the needs of various taxing districts while maintaining a competitive tax rate.

- Technological Innovations: The county is investing in technological upgrades to streamline the assessment and collection processes, reducing administrative costs and enhancing accuracy.

- Community Feedback and Participation: Dakota County values resident feedback and actively seeks input on tax-related matters. This two-way communication ensures that the county's tax policies remain aligned with the needs and aspirations of its diverse communities.

Conclusion

In conclusion, the Dakota County property tax system is a well-regulated and transparent mechanism that plays a vital role in funding essential public services and maintaining the county’s vibrant communities. Homeowners have access to a wealth of resources and support to understand and manage their property tax liabilities effectively.

As Dakota County moves forward, its commitment to fiscal responsibility, transparency, and community engagement will continue to shape a property tax system that is not only efficient but also reflective of the county's values and the diverse needs of its residents.

How often are property taxes assessed in Dakota County?

+Property taxes in Dakota County are assessed annually. The county’s assessors evaluate each property to determine its assessed value, which forms the basis for calculating tax liabilities.

Can I appeal my property’s assessed value in Dakota County?

+Yes, Dakota County provides a process for property owners to appeal their assessed value if they believe it is inaccurate. The appeal process typically involves submitting evidence and attending a hearing.

What are the eligibility criteria for property tax exemptions in Dakota County?

+Dakota County offers several exemptions, including homestead exemptions for primary residences and deferral programs for seniors and those with limited incomes. Eligibility criteria vary based on the specific exemption or program.

How can I stay informed about property tax-related news and updates in Dakota County?

+Dakota County provides regular updates and news on its official website. Additionally, the county hosts public meetings and workshops to keep residents informed about tax-related matters and provide opportunities for community engagement.