Franklin County Tax Records

Welcome to an in-depth exploration of the Franklin County Tax Records, a vital resource for understanding property ownership, assessments, and financial obligations within this vibrant community. These records provide a transparent window into the financial landscape of Franklin County, offering insights that are crucial for both residents and businesses.

As we delve into the intricacies of Franklin County Tax Records, we will uncover the various facets that make up this comprehensive system. From understanding the assessment process to exploring the different types of taxes levied, we aim to provide a comprehensive guide that empowers taxpayers with knowledge and clarity.

Understanding the Assessment Process

At the heart of Franklin County’s tax system is the assessment process, a meticulous procedure that determines the value of each property within the county. This value, in turn, serves as the basis for calculating property taxes. The assessors in Franklin County are tasked with the challenging yet essential job of evaluating properties fairly and accurately.

The assessment process typically involves the following key steps:

- Data Collection: Assessors gather detailed information about each property, including its physical characteristics, location, and any recent improvements or alterations.

- Property Inspection: In some cases, assessors may conduct physical inspections to verify the data and ensure the accuracy of the property's assessment.

- Value Estimation: Using a combination of factors, such as recent sales data, building costs, and market trends, assessors estimate the property's fair market value.

- Assessment Notice: Property owners receive an assessment notice detailing the estimated value of their property and the corresponding tax liability.

It's important to note that Franklin County strives for transparency and fairness in its assessment process. Property owners have the right to appeal their assessments if they believe the estimated value is inaccurate or unfair.

The Role of the Franklin County Assessor’s Office

The Assessor’s Office in Franklin County plays a pivotal role in maintaining the integrity of the tax system. This dedicated team is responsible for ensuring that all properties are assessed accurately and in line with state regulations. They provide valuable resources and guidance to property owners, helping them understand the assessment process and their rights.

The Assessor's Office also conducts regular training sessions and workshops to keep assessors up-to-date with the latest assessment techniques and legal requirements. This commitment to continuous improvement ensures that Franklin County's tax records remain a reliable and trustworthy source of information.

Types of Taxes in Franklin County

Franklin County levies a range of taxes to support various public services and infrastructure projects. Understanding these taxes is essential for property owners and businesses to plan their financial obligations effectively.

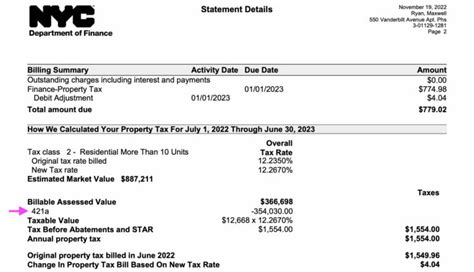

Property Taxes

Property taxes are the primary source of revenue for Franklin County. These taxes are calculated based on the assessed value of the property and the applicable tax rate, which can vary depending on the property’s location and usage.

The property tax rate in Franklin County is determined by the Board of Supervisors, taking into consideration the county's budget needs and the desire to provide essential services while keeping taxes manageable for residents and businesses.

| Property Type | Average Tax Rate (%) |

|---|---|

| Residential | 1.25 |

| Commercial | 1.5 |

| Agricultural | 0.9 |

Property owners can pay their taxes annually or choose to pay in installments. The county offers convenient online payment options and provides detailed information on due dates and penalties for late payments.

Other Taxes and Fees

In addition to property taxes, Franklin County collects various other taxes and fees to support specific services and projects. These include:

- Personal Property Tax: Levied on tangible personal property owned by businesses and individuals, such as vehicles, machinery, and equipment.

- Sales and Use Tax: A percentage of the sales price of goods and services, with the revenue going towards funding public infrastructure and services.

- Lodging Tax: Imposed on short-term rentals, with the proceeds dedicated to promoting tourism and supporting cultural attractions.

- Special Assessments: These are charges imposed on specific properties to fund local improvements like road repairs, sewer systems, or street lighting.

Tax Relief Programs and Incentives

Recognizing the diverse needs of its residents, Franklin County offers a range of tax relief programs and incentives to ease the financial burden on certain property owners. These programs aim to promote economic growth, support seniors, and encourage the preservation of historical properties.

Senior Citizen Relief

Franklin County provides a senior citizen relief program to assist eligible residents aged 65 and older. This program offers a reduction in property taxes, helping seniors maintain their independence and stay in their homes.

To qualify for this relief, seniors must meet certain income and residency criteria. The amount of relief is determined based on the individual's income and the assessed value of their property. The county's Assessor's Office provides detailed guidelines and application forms for interested seniors.

Historical Property Tax Credits

For owners of historical properties, Franklin County offers tax credits to encourage the preservation and restoration of these valuable assets. These credits can significantly reduce the tax liability for owners who undertake approved rehabilitation projects.

To be eligible for the historical property tax credits, properties must be listed on the National Register of Historic Places or designated as a local historic landmark. The county's Historic Preservation Office works closely with property owners to ensure that rehabilitation projects adhere to historic preservation guidelines.

Online Access to Tax Records

Franklin County understands the importance of providing easy access to tax records for its residents and businesses. The Franklin County Treasurer’s Office offers an online portal where property owners can:

- View their current tax assessments and payments.

- Access historical tax records.

- Make online payments securely.

- Receive important tax-related notifications.

This user-friendly online platform ensures that property owners can manage their tax obligations efficiently, from the comfort of their homes or offices. The portal also provides valuable tools for comparing tax assessments and tracking tax rate changes over time.

Conclusion: Empowering Taxpayers with Knowledge

In conclusion, the Franklin County Tax Records system is a comprehensive and well-organized framework that provides transparency and fairness to taxpayers. By understanding the assessment process, exploring the different types of taxes, and learning about the available relief programs, property owners can navigate their tax obligations with confidence.

Franklin County's dedication to providing resources, online accessibility, and educational initiatives ensures that taxpayers are not only compliant but also well-informed. This empowers residents and businesses to actively participate in the financial health of their community, fostering a sense of trust and collaboration.

Frequently Asked Questions

How often are properties reassessed in Franklin County?

+Properties in Franklin County are typically reassessed every three years. However, in certain circumstances, such as a significant improvement or damage to the property, a reassessment may be conducted outside of this cycle.

Can I appeal my property assessment if I disagree with the value?

+Yes, property owners have the right to appeal their assessment if they believe it is inaccurate or unfair. The process involves submitting an appeal to the Board of Equalization, providing supporting evidence, and attending a hearing to present their case.

Are there any tax breaks or incentives for energy-efficient homes in Franklin County?

+Yes, Franklin County offers a Green Building Tax Credit for homeowners who make energy-efficient improvements to their properties. This credit can reduce the property’s assessed value, resulting in lower taxes. Eligible improvements include solar panels, energy-efficient appliances, and insulation upgrades.