Property Tax Bill Nyc

In New York City, property taxes are a significant financial obligation for property owners, and understanding the intricacies of the property tax system is crucial for effective financial planning and management. This comprehensive guide aims to provide an in-depth analysis of the NYC property tax bill, offering insights into its structure, calculation, payment options, and potential strategies to optimize costs.

Unraveling the NYC Property Tax Bill

The property tax system in New York City is a complex yet essential component of the city’s revenue stream. It plays a vital role in funding essential public services, infrastructure, and community development projects. For property owners, a thorough understanding of this system is key to managing their financial obligations and maximizing the benefits of homeownership.

The Anatomy of a Property Tax Bill

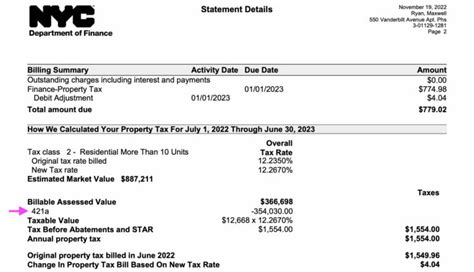

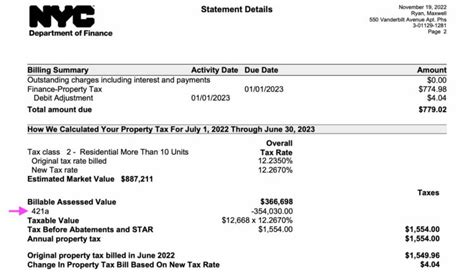

A NYC property tax bill is a comprehensive document that outlines the assessed value of a property, the applicable tax rates, and the resulting tax liability. It is typically issued twice a year, with the first half due in January and the second half due in July. Let’s break down the key components of this bill.

Assessed Value: The assessed value is the dollar amount assigned to a property by the Department of Finance (DOF) for tax purposes. It is based on a property's market value and is determined through a comprehensive assessment process. This value can be influenced by factors such as property improvements, neighborhood trends, and recent sales data.

Tax Rates: The tax rate is a crucial factor in determining the final tax liability. NYC's tax rates are set annually by the City Council and can vary based on the property's location and type. For instance, residential properties and commercial properties may have different tax rates. The tax rate is applied to the assessed value to calculate the tax liability.

Tax Liability: This is the amount of property tax that a property owner is required to pay for a given period. It is calculated by multiplying the assessed value by the applicable tax rate. The tax liability is then divided into two installments, with each installment due on the specified dates.

| Component | Description |

|---|---|

| Assessed Value | Dollar amount assigned to a property for tax purposes. |

| Tax Rate | Rate set by the City Council, varies by property type and location. |

| Tax Liability | Total property tax owed, calculated as Assessed Value x Tax Rate. |

Understanding the Assessment Process

The assessment process is a critical step in determining a property’s tax liability. It involves a detailed evaluation of a property’s characteristics, including its size, location, condition, and recent sales data. The DOF conducts periodic re-assessments to ensure that property values remain up-to-date and fair.

Property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. This process, known as a grievance, allows homeowners to present evidence and argue for a lower assessed value. Successful grievances can lead to reduced tax liabilities, making it a potentially beneficial strategy for homeowners.

Payment Options and Strategies

NYC offers several payment options to property owners, providing flexibility and convenience. The most common methods include:

- Online Payments: Property owners can make payments through the DOF's online portal, offering a secure and efficient way to manage their tax obligations.

- Mail-In Payments: For those who prefer traditional methods, mail-in payments are an option. Simply send a check or money order along with the payment coupon to the address provided on the tax bill.

- Electronic Funds Transfer (EFT): EFT allows for automatic withdrawals from a bank account on the due date. This option ensures timely payments and eliminates the need for manual processing.

- Credit Card Payments: NYC also accepts credit card payments, although there may be processing fees associated with this method.

When it comes to payment strategies, it's crucial to stay organized and plan ahead. Here are some tips to manage your property tax obligations effectively:

- Set up automatic payments to ensure timely payments and avoid late fees.

- Explore payment plans if you're facing financial difficulties. NYC offers options for homeowners who need assistance.

- Consider using tax escrow accounts if you're a homeowner with a mortgage. This can simplify your payment process and provide added financial security.

Maximizing Savings: Tax Abatements and Exemptions

NYC offers a range of tax abatements and exemptions designed to encourage homeownership, support specific industries, and provide relief to eligible individuals. These programs can significantly reduce a property’s tax liability, making homeownership more affordable and accessible.

Some common tax abatements and exemptions include:

- Senior Citizen Rent and Property Tax Abatement: Eligible senior citizens can receive a partial abatement on their rent or property taxes, providing financial relief during retirement.

- Cooperative and Condominium Abatements: These abatements are available to homeowners in cooperative and condominium buildings, reducing their tax liability based on the building's classification.

- Veterans Exemption: NYC offers an exemption for eligible veterans, reducing their property tax burden as a token of appreciation for their service.

- Star Exemption: The Star exemption is available to homeowners who occupy their primary residence. It provides a reduction in their assessed value, leading to lower tax bills.

Future Implications and Considerations

The NYC property tax system is subject to ongoing changes and developments. As the city’s needs and priorities evolve, so do the tax rates and assessment processes. Staying informed about these changes is crucial for property owners to ensure they are prepared for any potential impacts on their tax liabilities.

Additionally, the real estate market in NYC is dynamic, with property values fluctuating based on market conditions. This can directly influence a property's assessed value and, consequently, its tax liability. Property owners should stay abreast of market trends to anticipate potential changes in their tax obligations.

Conclusion: Empowering Property Owners

Understanding the NYC property tax bill is a powerful tool for property owners. By unraveling the complexities of this system, homeowners can make informed decisions, optimize their financial strategies, and fully leverage the benefits of homeownership. From exploring tax abatements to understanding the assessment process, each aspect of the property tax bill offers opportunities for savings and financial planning.

Stay informed, stay organized, and take advantage of the resources available to navigate the NYC property tax system with confidence and expertise.

How often are property tax bills issued in NYC?

+Property tax bills in NYC are issued twice a year, with the first half due in January and the second half due in July.

Can I appeal my property’s assessed value?

+Yes, property owners have the right to appeal their assessed value if they believe it is inaccurate or unfair. This process is known as a grievance and allows homeowners to present evidence and argue for a lower assessed value.

What are some common tax abatements and exemptions in NYC?

+NYC offers a range of tax abatements and exemptions, including the Senior Citizen Rent and Property Tax Abatement, Cooperative and Condominium Abatements, Veterans Exemption, and the Star Exemption for primary residences.