How Much Is Sales Tax In Tennessee

The sales tax in Tennessee is an essential component of the state's revenue system, playing a crucial role in funding public services and infrastructure. While it might seem like a simple question, understanding the sales tax in Tennessee involves delving into the intricacies of the state's tax laws and how they impact businesses and consumers alike. In this comprehensive guide, we will explore the current sales tax rates, their application, and the unique features of Tennessee's sales tax system, providing you with a detailed insight into this important aspect of the state's economy.

Tennessee Sales Tax Rates: A Comprehensive Overview

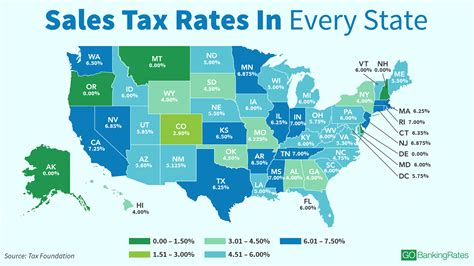

As of my last update in January 2023, Tennessee's state sales tax rate stands at 7%, which is applied to the sale of tangible personal property and certain digitally-provided products and services. This rate, however, is just the beginning of the story, as Tennessee's sales tax system is characterized by its local option taxes, which can significantly impact the overall tax burden on consumers.

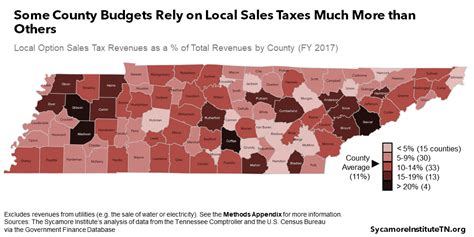

Tennessee allows local governments to impose an additional local option sales tax, also known as a local add-on tax, on top of the state sales tax. These local taxes can range from 1% to 2.75%, bringing the total sales tax rate in certain jurisdictions up to 9.75%. This variation in local tax rates means that the effective sales tax rate can differ significantly depending on where you are in the state.

For instance, consider the city of Memphis, which has a local option sales tax rate of 2.75%. When combined with the state sales tax rate, the total sales tax in Memphis is 9.75%. On the other hand, in counties like Bedford, Cannon, Clay, DeKalb, Jackson, Macon, and Overton, the local option tax is 1%, resulting in a total sales tax rate of 8%.

Here's a table outlining some of the notable local option sales tax rates in Tennessee:

| County/City | Local Option Sales Tax Rate |

|---|---|

| Memphis | 2.75% |

| Nashville | 2.5% |

| Chattanooga | 2.25% |

| Knoxville | 2.25% |

| Bedford, Cannon, Clay, DeKalb, Jackson, Macon, Overton Counties | 1% |

These local option taxes are often used to fund specific projects or initiatives within the community, such as infrastructure development, education, or public safety improvements. It's a strategy that provides local governments with a degree of financial autonomy while also ensuring that the tax burden is distributed equitably across the state.

Taxable Items and Exemptions: Understanding the Details

In Tennessee, the sales tax is applicable to a wide range of goods and services. This includes the sale of tangible personal property, such as clothing, electronics, and furniture, as well as digitally-provided services like streaming subscriptions and software downloads. The sales tax also extends to certain services, like repair and maintenance work, and rental transactions.

However, there are notable exceptions and exemptions to the sales tax. For instance, Tennessee does not impose a sales tax on groceries, prescription drugs, and certain medical devices. These exemptions are designed to alleviate the tax burden on essential items and ensure that basic necessities remain affordable for all residents.

Another significant exemption is the resale exemption. Under this provision, businesses that purchase goods for resale are not required to pay sales tax on their purchases. This exemption encourages economic activity and supports the state's vibrant retail sector by ensuring that businesses are not double-taxed on goods that are ultimately sold to consumers.

Tennessee also offers tax incentives and credits to encourage specific economic activities. For example, the Manufacturers' Sales and Use Tax Credit provides a refund of sales and use tax paid on machinery, equipment, and parts used in manufacturing processes. These incentives play a crucial role in attracting and retaining businesses in the state, contributing to Tennessee's robust economy.

The Impact of Sales Tax on Tennessee's Economy

The sales tax is a critical component of Tennessee's tax revenue, accounting for a significant portion of the state's annual income. In the fiscal year 2021-2022, Tennessee's total state and local sales tax collections amounted to $6.46 billion, a substantial increase from the previous year's total of $5.68 billion. This growth in sales tax revenue can be attributed to a combination of factors, including increased consumer spending and the state's robust economic recovery from the impacts of the COVID-19 pandemic.

The sales tax not only provides a stable source of revenue for the state but also serves as an economic indicator. As consumer spending increases, so does the sales tax revenue, offering a real-time snapshot of the state's economic health. This makes the sales tax a vital tool for policymakers and economists in assessing the state's fiscal landscape and making informed decisions about future economic strategies.

Moreover, the local option taxes play a crucial role in empowering local communities to address their unique needs and priorities. By allowing local governments to impose additional sales taxes, Tennessee's sales tax system ensures that communities have the financial means to invest in their own development, whether it's through infrastructure improvements, education initiatives, or public safety enhancements. This decentralized approach to taxation fosters a sense of local control and accountability, contributing to the overall resilience and vitality of Tennessee's communities.

The Future of Sales Tax in Tennessee: Trends and Projections

As we look to the future, several trends and projections are shaping the landscape of sales tax in Tennessee. One of the most significant developments is the ongoing shift towards e-commerce and digital transactions. With more consumers shopping online, Tennessee, like many other states, is navigating the complexities of taxing these transactions, particularly those that occur across state lines.

The rise of e-commerce presents both opportunities and challenges for Tennessee's sales tax system. On one hand, it offers a potential increase in tax revenue as more online transactions become taxable. On the other hand, it requires a more nuanced understanding of the laws surrounding interstate commerce and the application of sales tax to online sales. Tennessee, along with other states, is actively working to clarify these regulations and ensure a fair and efficient taxation system for the digital age.

Another trend to watch is the potential for tax reform and modernization. As Tennessee's economy continues to evolve, there may be calls for updating the sales tax system to better align with the state's economic priorities. This could involve reevaluating the rates, exemptions, and application of sales tax to ensure it remains a sustainable and equitable source of revenue for the state.

In the context of broader tax reform, there are discussions around the potential for a consumption tax, such as a value-added tax (VAT), to replace or supplement the current sales tax system. While this idea is still in the realm of speculation, it reflects a growing recognition of the need to adapt tax systems to the changing nature of the economy and consumer behavior.

Furthermore, as Tennessee continues to attract new businesses and industries, particularly in the technology and innovation sectors, the sales tax system will need to adapt to accommodate these changes. This may involve revisiting tax incentives and credits to ensure they remain relevant and effective in attracting and supporting these new economic ventures.

In conclusion, the sales tax in Tennessee is a complex and dynamic component of the state's tax system, with far-reaching implications for both businesses and consumers. From the state sales tax rate to the local option taxes, each aspect of the system plays a crucial role in funding public services, supporting local communities, and shaping the state's economic landscape. As Tennessee continues to evolve and adapt to the challenges and opportunities of the modern economy, the sales tax will undoubtedly remain a focal point of discussion and reform efforts.

How often are sales tax rates updated in Tennessee?

+Sales tax rates in Tennessee are subject to periodic updates, typically driven by changes in state legislation or local government decisions. While the state sales tax rate remains consistent across the state, local option sales tax rates can be adjusted by local governments based on their specific needs and priorities. These adjustments are often made to fund new initiatives or projects within the community.

Are there any special sales tax holidays in Tennessee?

+Yes, Tennessee does observe certain sales tax holidays. These are designated periods when specific items, such as school supplies, clothing, and energy-efficient appliances, are exempt from sales tax. These holidays are designed to provide consumers with tax savings on essential items and to stimulate local economies. The dates and items eligible for tax exemption vary each year, so it’s important to stay updated with the latest information.

How does Tennessee handle sales tax for online purchases?

+Tennessee has implemented laws to address the taxation of online purchases, particularly those made from out-of-state vendors. The state’s Wayfair decision compliance requires online retailers with substantial connections to Tennessee to collect and remit sales tax on transactions with Tennessee residents. This ensures that online purchases are subject to the same sales tax as traditional in-store purchases, maintaining a level playing field for local businesses.