Erie County Taxes

Welcome to an in-depth exploration of Erie County Taxes, a topic that impacts the lives of many residents and businesses in this vibrant region. Erie County, located in New York State, boasts a diverse economy, a rich cultural heritage, and a vibrant community spirit. The tax system in Erie County plays a crucial role in funding essential public services, infrastructure, and community development initiatives. This comprehensive guide aims to provide a detailed understanding of the tax landscape in Erie County, shedding light on its intricacies, implications, and future prospects.

Understanding Erie County’s Tax Structure

Erie County operates under a comprehensive tax system designed to support its various governmental functions and services. The tax structure is complex, incorporating a range of tax types and assessment methodologies. Understanding this system is essential for residents, businesses, and stakeholders to navigate their tax obligations effectively and make informed financial decisions.

Property Taxes: A Significant Revenue Source

Property taxes are a cornerstone of Erie County’s tax revenue. The county assesses properties based on their value, with residential, commercial, and industrial properties all contributing to the tax base. The Erie County Tax Assessor’s Office plays a pivotal role in this process, ensuring fair and accurate assessments.

Here’s a breakdown of the property tax landscape in Erie County:

- Assessment Process: Properties are assessed annually, taking into account factors like location, size, improvements, and market conditions. The assessment determines the taxable value of each property.

- Tax Rates: Erie County utilizes a progressive tax rate structure, where higher-value properties are taxed at a higher rate. This approach aims to distribute the tax burden fairly across different property types.

- Tax Relief Programs: The county offers various tax relief programs to support eligible homeowners, including senior citizens and veterans. These programs aim to reduce the financial burden of property taxes for vulnerable populations.

| Property Type | Average Tax Rate |

|---|---|

| Residential | 2.5% |

| Commercial | 3.2% |

| Industrial | 3.5% |

Sales and Use Taxes: Supporting Economic Activity

Sales and use taxes are an essential component of Erie County’s tax revenue. These taxes are levied on the sale of goods and services and are collected by businesses, which then remit the funds to the county. The proceeds from these taxes contribute significantly to the county’s budget, supporting a range of public services.

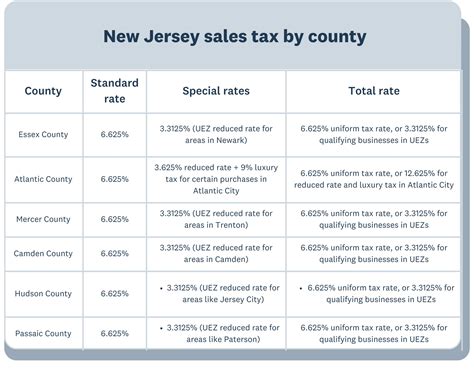

Key aspects of Erie County’s sales and use tax system include:

- Tax Rates: The county imposes a standard sales tax rate of 8%, which is combined with the state sales tax rate to create a total sales tax burden. This rate applies to most goods and services.

- Use Tax: Erie County also enforces a use tax, which is applicable to out-of-state purchases brought into the county. This tax ensures fairness and prevents tax evasion.

- Exemptions and Rebates: Certain items, such as food, clothing, and prescription drugs, are exempt from sales tax to alleviate the financial burden on residents. Additionally, the county offers rebate programs for businesses that meet specific criteria.

Taxes and Community Development

Erie County’s tax system plays a pivotal role in driving community development and supporting essential public services. The revenue generated from taxes is allocated to various sectors, including education, healthcare, public safety, and infrastructure development.

Education: A Priority Investment

Education is a key focus area for Erie County, and a significant portion of tax revenue is dedicated to supporting local schools and educational institutions. This investment aims to enhance the quality of education, foster academic excellence, and provide equal opportunities for all students.

Here’s how tax revenue contributes to education in Erie County:

- Funding for Public Schools: A substantial portion of property tax revenue is allocated to local school districts, ensuring that schools have the resources needed to provide a high-quality education.

- Scholarship Programs: Erie County offers scholarship opportunities for students pursuing higher education. These programs are funded through dedicated tax initiatives, encouraging academic achievement and providing financial support.

- Education Initiatives: Tax revenue is also utilized to support various education-related initiatives, such as after-school programs, early childhood education, and adult literacy programs.

Healthcare and Public Safety: Essential Services

Erie County’s tax system ensures the availability of essential public services, including healthcare and public safety. These services are vital for maintaining the well-being and security of the community.

- Healthcare Funding: Tax revenue contributes to the operation of local hospitals, clinics, and healthcare facilities. It supports the provision of healthcare services, including emergency care, specialized treatments, and community health programs.

- Public Safety Expenditures: A significant portion of the tax revenue is allocated to public safety departments, including the police, fire, and emergency services. This funding ensures that the county can maintain a robust public safety infrastructure and respond effectively to emergencies.

Tax Incentives and Economic Development

Erie County actively promotes economic development through a range of tax incentives and initiatives. These measures aim to attract businesses, stimulate job growth, and enhance the county’s economic vitality.

Business Tax Incentives

The county offers a variety of tax incentives to encourage business growth and investment. These incentives can significantly reduce the tax burden for businesses, making Erie County an attractive location for entrepreneurs and established companies alike.

Key business tax incentives in Erie County include:

- Tax Abatements: Businesses investing in designated development areas may be eligible for tax abatements, reducing their property tax obligations for a set period.

- Tax Credits: The county offers tax credits for businesses engaging in specific activities, such as job creation, research and development, or renewable energy projects.

- Enterprise Zones: Certain areas within the county are designated as enterprise zones, offering reduced tax rates and streamlined regulatory processes to encourage business development.

Impact on Economic Growth

The tax incentives and economic development initiatives implemented by Erie County have had a positive impact on the local economy. They have attracted new businesses, created jobs, and stimulated economic activity in various sectors.

Some notable outcomes include:

- Increased Employment Opportunities: Tax incentives have led to the creation of new jobs across different industries, reducing unemployment rates and improving the overall economic well-being of the community.

- Business Growth and Expansion: Existing businesses have benefited from tax incentives, allowing them to expand their operations, invest in new technologies, and enhance their competitiveness.

- Diversified Economy: Erie County’s tax incentives have attracted businesses from a range of sectors, including technology, healthcare, and renewable energy, contributing to a more diversified and resilient local economy.

Future Prospects and Challenges

As Erie County looks to the future, the tax system faces both opportunities and challenges. The county aims to strike a balance between maintaining a robust tax base and ensuring that the tax burden is fair and manageable for residents and businesses.

Opportunities for Growth

Erie County has a strong foundation for future economic growth and development. The county’s strategic location, skilled workforce, and supportive business environment provide a solid platform for continued success.

Key opportunities include:

- Technology and Innovation: Erie County can leverage its strong technological infrastructure and talent pool to attract tech-based businesses and foster innovation.

- Sustainable Development: The county can capitalize on its commitment to sustainability by promoting renewable energy projects and encouraging environmentally friendly business practices.

- Tourism and Recreation: With its rich cultural heritage and natural attractions, Erie County has the potential to develop its tourism industry, creating new economic opportunities and enhancing the quality of life for residents.

Addressing Challenges

Despite its strengths, Erie County faces certain challenges that impact its tax system and overall economic health.

Key challenges include:

- Population Trends: Erie County has experienced a decline in population over the years, which can impact the tax base and revenue generation. The county must explore strategies to attract and retain residents.

- Infrastructure Maintenance: Aging infrastructure, including roads, bridges, and public facilities, requires significant investment. Balancing the need for infrastructure upgrades with the tax burden is a delicate task.

- Economic Diversification: While Erie County has a diversified economy, further diversification is essential to mitigate the risks associated with reliance on any single industry.

Conclusion

Erie County’s tax system is a complex yet vital component of the local economy and community. It supports essential public services, drives economic development, and shapes the future of the county. By understanding the intricacies of the tax landscape, residents, businesses, and stakeholders can make informed decisions and actively contribute to the county’s prosperity.

As Erie County navigates the challenges and opportunities ahead, a collaborative approach involving the community, businesses, and governmental entities will be crucial in shaping a sustainable and thriving future.

What are the key tax rates in Erie County?

+Erie County has a progressive tax rate structure for property taxes, with rates varying based on property type. The standard sales tax rate is 8%, combined with the state sales tax rate. Use tax applies to out-of-state purchases brought into the county.

How does Erie County support education through taxes?

+A significant portion of tax revenue is allocated to local school districts, and the county also offers scholarship programs and supports various education initiatives.

What tax incentives are available for businesses in Erie County?

+Businesses can benefit from tax abatements, tax credits, and enterprise zones, which offer reduced tax rates and streamlined processes to encourage investment and growth.

How does Erie County address infrastructure maintenance with tax revenue?

+A portion of tax revenue is dedicated to infrastructure upgrades and maintenance, ensuring the county can invest in its aging infrastructure while balancing the tax burden.