How Uber Drivers Can Navigate Uber Taxes for Maximum Profit

In the bustling landscape of gig economy employment, Uber drivers find themselves at the intersection of flexible income and complex financial obligations. As ride-hailing services revolutionized urban transport, the tax implications for drivers have become an increasingly critical area of concern. Understanding how to navigate Uber taxes effectively is essential for maximizing profit, minimizing liability, and ensuring compliance with ever-evolving regulatory frameworks. This comprehensive examination delves into the nuanced world of ride-share taxation, providing Uber drivers with a strategic guide rooted in financial expertise, industry insights, and practical applications.

Understanding the Uber Tax Landscape: Key Concepts and Frameworks

Uber drivers are classified as independent contractors rather than employees, positioning them outside traditional payroll tax systems. Consequently, they bear responsibility for managing their tax obligations, including income tax, self-employment tax, and applicable deductions. The nature of Uber’s business model entails variable income streams, which complicates tax planning and necessitates proactive strategies.

Federal and state tax regulations impact how Uber drivers report earnings and claim deductions. Federal income tax brackets, self-employment tax rates (currently at 15.3% combined for Social Security and Medicare), and state-specific levies (such as California’s SDI or New York’s local taxes) create a complex mosaic of compliance requirements. To optimize after-tax income, drivers must approach their tax strategies with a detailed understanding of allowable deductions, record-keeping best practices, and timing considerations.

Tax Classification and Its Implications for Uber Drivers

Classified as independent contractors, Uber drivers lack access to employer-sponsored benefits, yet they enjoy the flexibility to determine working hours. This classification influences tax liability, as drivers must report their income via Schedule C and pay self-employment taxes. Misclassification errors, either from drivers or regulatory bodies, can lead to audits or penalties, emphasizing the importance of accurate documentation and adherence to IRS guidelines.

| Relevant Category | Substantive Data |

|---|---|

| Self-Employment Tax Rate | 15.3% on net earnings, covering Social Security and Medicare contributions |

| Income Tax Brackets | Progressive rates ranging from 10% to 37%, depending on income level |

Strategies for Maximizing Uber-Related Profit: Deduction Mastery

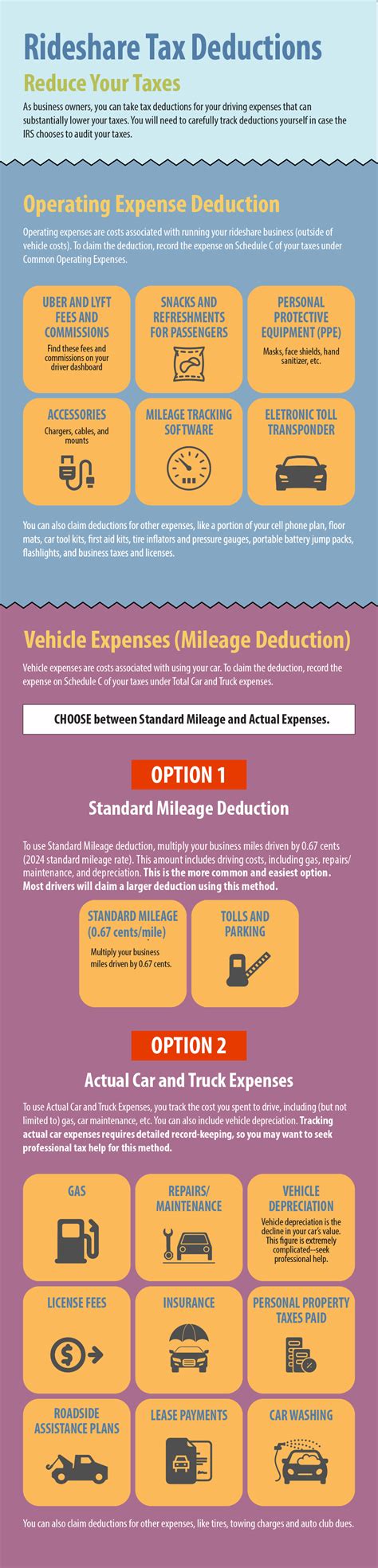

One of the most potent means for Uber drivers to enhance profitability is through leveraging deductions effectively. Recognizing and substantiating expenses considered ordinary and necessary in the trade allows drivers to lower their taxable income significantly.

Tracking and Claiming Mileage

The Internal Revenue Service (IRS) offers two primary methods for vehicle expense deduction: the standard mileage rate and actual expense method. Most Uber drivers prefer the mileage rate—currently set at 58.5 cents per mile for the first half of 2023 and 62.5 cents thereafter—as it simplifies record-keeping and often yields higher deductions, particularly for high-mileage drivers. Maintaining a detailed mileage log that captures dates, starting point, ending point, and purpose of trips is essential for audits and accurate reporting.

Operational Expense Deduction Optimization

Beyond mileage, drivers can deduct expenses such as fuel, maintenance, repairs, insurance, vehicle registration, and depreciation. High-quality, contemporaneous records—receipts, invoices, and bank statements—are fundamental. Utilizing accounting software tailored for self-employed individuals, like QuickBooks Self-Employed or Expensify, enhances accuracy and efficiency.

| Relevant Category | Substantive Data |

|---|---|

| Average Mileage Deduction | For a driver logging 20,000 miles annually, potential deductions could total approximately $11,600 based on IRS mileage rate |

| Insurance Deduction Limits | Premiums paid for commercial or rideshare-specific insurance are fully deductible |

Optimizing Tax Payments: Estimated Taxes and Record-Keeping

A key component for Uber drivers is the proactive management of estimated quarterly taxes. Unlike traditional employees who have taxes withheld by employers, independent contractors must calculate and remit payments four times per year to avoid penalties.

Accurately estimating quarterly payments hinges on maintaining detailed, organized records of income and expenses. Using IRS Form 1040-ES guidelines and leveraging accounting tools streamlines this process. Failure to pay sufficient estimated taxes can lead to interest charges and penalties, especially if the year-end tax liability exceeds payments.

Retirement and Savings Strategies

Maximizing after-tax income also involves integrating retirement accounts such as Solo 401(k)s or SEP IRAs. Contributions to these plans are often tax-deductible, providing both immediate tax relief and long-term savings. Given the variable income pattern, disciplined contribution schedules can smooth tax obligations and bolster retirement security.

| Relevant Category | Substantive Data |

|---|---|

| Solo 401(k) Contribution Limits | Up to $66,000 for 2023, including employee deferrals |

| SEP IRA Contribution Limit | 25% of net self-employment income, max $66,000 in 2023 |

Legal and Regulatory Considerations: Staying Ahead of Change

Tax laws related to gig workers are under continual review, with recent debates around worker classification and reporting obligations. Riders, drivers, and self-employed professionals alike must stay informed of legislative changes—such as the introduction of gig worker bills, local levies, or shifts in IRS policy—that could alter deduction eligibility, tax rates, or reporting requirements.

Consulting qualified tax professionals for periodic reviews and personalized strategies ensures compliance and optimizes potential refunds or liabilities.

Emerging Trends and Future Directions

Legislative efforts like California’s AB 5 aimed to reclassify independent contractors, impacting Uber drivers’ tax treatment. While such measures face judicial challenges, their potential enactment underscores the importance of staying vigilant. Additionally, technological developments—such as integrated financial apps and real-time reporting—are transforming how drivers manage taxes, enabling more precise and automated compliance.

| Relevance to Drivers | Implication |

|---|---|

| Legal Reclassification | Potential shift toward employee status, affecting tax deductions and benefits |

| Technology Integration | Automated mileage tracking and tax reporting tools simplify compliance and maximize deductions |

Conclusion: Strategic Navigation for Financial Success

For Uber drivers committed to maximizing profit, understanding and strategically managing tax obligations is as critical as the driving itself. By meticulously tracking income and expenses, leveraging deductions creatively, and staying informed about legislative shifts, drivers can substantially improve their financial outcomes. The landscape is dynamic, but with disciplined record-keeping, judicious planning, and expert guidance, Uber drivers can turn the complex realm of taxes from a daunting obstacle into a pathway for sustained profitability.

What are the most important deductions Uber drivers should claim?

+The most significant deductions include mileage (using IRS standard rates), vehicle expenses (gas, maintenance, insurance), and operational supplies. Precise tracking of these costs can lead to substantial tax savings.

How can Uber drivers avoid legal issues with tax authorities?

+Maintaining accurate, contemporaneous records of all income and expenses, filing quarterly estimated taxes, and consulting with tax professionals help ensure compliance and reduce audit risks.

Are there specific tools or software that can assist with Uber tax planning?

+Yes, applications like QuickBooks Self-Employed, Stride Tax, and Everlance facilitate mileage tracking, expense categorization, and tax estimation, simplifying the complex process of tax compliance for Uber drivers.

What future changes could impact Uber drivers’ taxes?

+Legislative proposals around worker reclassification and local gig taxes, as well as technological advances, could alter deduction policies and reporting requirements. Staying informed and adaptive is essential.