What Is Sales Tax Nj

Sales tax is an essential component of the tax system in the United States, with each state having its own unique tax regulations. This article will delve into the intricacies of sales tax in the state of New Jersey, exploring its history, current regulations, exemptions, and implications for businesses and consumers alike. By understanding the sales tax landscape in New Jersey, businesses can navigate the tax system effectively and ensure compliance, while consumers can make informed decisions about their purchases.

Understanding Sales Tax in New Jersey

Sales tax in New Jersey is a state-imposed tax on the sale or lease of tangible personal property and certain services. It is an important revenue source for the state, contributing significantly to its budget. The tax is administered by the New Jersey Division of Taxation, which ensures compliance and collects the revenue.

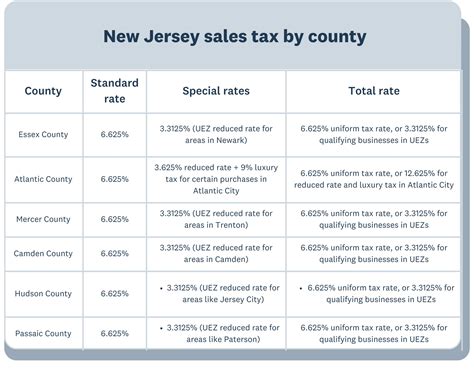

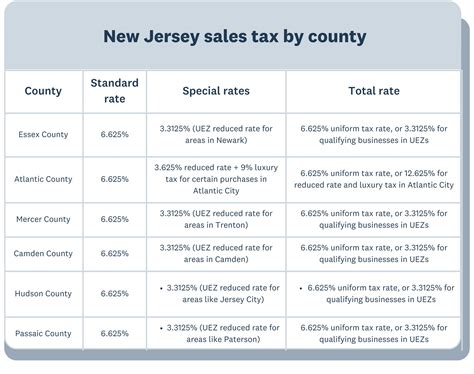

The sales tax rate in New Jersey is 6.625%, which is applied to most retail sales. However, it's important to note that this rate can vary depending on the jurisdiction and the nature of the sale. For instance, certain municipalities may have additional local sales taxes, increasing the overall rate.

Taxable and Exempt Items

The list of taxable items in New Jersey is extensive and includes most tangible goods and certain services. This includes clothing, electronics, furniture, and groceries (excluding certain food items). However, there are specific exemptions and exceptions to this general rule.

Some notable exemptions include:

- Prescription medications and certain medical devices are exempt from sales tax.

- Residential utilities such as electricity, gas, and water are not subject to sales tax.

- Educational materials and textbooks purchased for educational institutions are exempt.

- Machinery and equipment used in manufacturing processes are also tax-exempt.

It's crucial for businesses to understand these exemptions, as incorrect tax application can lead to legal consequences.

Tax Calculation and Remittance

Sales tax is calculated as a percentage of the sale price, excluding any applicable discounts or coupons. Businesses are responsible for collecting this tax from customers at the point of sale and remitting it to the state. The frequency of remittance depends on the business’s sales volume, with higher-volume businesses typically required to remit more frequently.

The process of calculating and remitting sales tax can be complex, especially for businesses with multiple locations or online sales. Tax software and accounting professionals can greatly assist in ensuring accuracy and compliance.

Sales Tax Compliance and Registration

All businesses operating in New Jersey that make taxable sales are required to register with the New Jersey Division of Taxation and obtain a Sales and Use Tax Permit. This permit authorizes the business to collect and remit sales tax. The registration process involves providing detailed information about the business, including its legal structure, location, and nature of sales.

Once registered, businesses must adhere to the state's sales tax regulations, which include accurate tax calculation, proper record-keeping, and timely remittance. Failure to comply can result in penalties, interest charges, and potential legal action.

Record-Keeping and Audits

Maintaining accurate records is a crucial aspect of sales tax compliance. Businesses must keep detailed records of all sales transactions, including the date, amount, and nature of the sale. These records should also indicate whether sales tax was applied and the rate used.

The New Jersey Division of Taxation conducts audits to ensure compliance. These audits can be comprehensive, examining a business's sales records, tax returns, and even physical inventory. It is essential for businesses to be prepared for audits and to maintain a high level of accuracy in their sales tax practices.

| Compliance Checklist | Actions |

|---|---|

| Register with the state | Obtain a Sales and Use Tax Permit |

| Understand taxable and exempt items | Study the official guidelines and seek professional advice |

| Accurate tax calculation | Use tax software or accounting tools |

| Timely remittance | Set up a schedule based on sales volume |

| Maintain detailed sales records | Implement a robust record-keeping system |

Implications for Businesses and Consumers

Sales tax has significant implications for both businesses and consumers in New Jersey. For businesses, sales tax compliance is a complex but necessary aspect of operations. It involves understanding the tax regulations, accurately calculating and collecting tax, and properly remitting it to the state. Failure to comply can lead to financial penalties and damage to the business’s reputation.

For consumers, sales tax adds to the cost of their purchases. However, understanding the sales tax landscape can help them make more informed buying decisions. Consumers can also take advantage of tax-free events or exemptions to save on certain purchases.

Strategies for Businesses

Businesses operating in New Jersey can employ various strategies to ensure sales tax compliance and minimize the administrative burden.

- Implement robust accounting practices: Invest in accounting software or tools that can automate tax calculation and record-keeping.

- Stay updated on tax regulations: Subscribe to updates from the New Jersey Division of Taxation to stay informed about any changes in tax laws.

- Seek professional advice: Consult with tax professionals or accountants who specialize in sales tax to ensure accurate compliance.

- Conduct internal audits: Regularly review sales tax practices to identify and correct any errors or inconsistencies.

Consumer Awareness

Consumers in New Jersey can benefit from understanding the sales tax system. This includes being aware of the standard sales tax rate, as well as any additional local taxes that may apply. By knowing the tax rate, consumers can factor it into their purchasing decisions and budget accordingly.

Additionally, consumers should be aware of tax-free events or exemptions. For instance, New Jersey often has tax-free weekends for certain items, such as clothing or school supplies. By taking advantage of these events, consumers can save on their purchases.

Future of Sales Tax in New Jersey

The sales tax landscape in New Jersey is likely to evolve in the coming years. As the state’s economy and consumer behavior change, the tax system may need to adapt to meet new challenges and opportunities.

One potential development is the expansion of online sales tax collection. With the rise of e-commerce, the state may look to collect sales tax on online purchases more aggressively. This could involve implementing new regulations or leveraging technology to track and tax online sales.

Additionally, the state may consider changes to the tax rate or exemptions to address budget needs or changing economic conditions. It is essential for businesses and consumers alike to stay informed about any potential changes to the sales tax system.

Stay Informed and Adapt

In the dynamic world of sales tax, staying informed is crucial. Businesses should regularly monitor tax regulations and consider consulting tax professionals to ensure they are prepared for any changes. Consumers, too, can benefit from staying updated on tax rates and exemptions to make the most of their purchasing power.

As the sales tax system in New Jersey continues to evolve, it is essential for all stakeholders to adapt and embrace new practices to ensure compliance and minimize the impact on their operations or personal finances.

What is the current sales tax rate in New Jersey?

+The current sales tax rate in New Jersey is 6.625%, but this rate can vary depending on local jurisdictions.

How often do businesses need to remit sales tax in New Jersey?

+The frequency of remittance depends on sales volume. High-volume businesses may need to remit more frequently, while smaller businesses may have quarterly or annual remittance requirements.

Are there any online resources to help businesses with sales tax compliance in New Jersey?

+Yes, the New Jersey Division of Taxation provides online resources, including guides, forms, and tools to assist businesses with sales tax compliance.