Crypto Tax Calculator

The world of cryptocurrencies has experienced a rapid surge in popularity, attracting a diverse range of investors, traders, and enthusiasts. With this rise in crypto adoption comes an increased need for efficient and accurate ways to manage and calculate taxes associated with cryptocurrency transactions. The complexity of crypto tax regulations and the unique nature of blockchain technology pose unique challenges for both individuals and businesses. This article aims to delve into the intricacies of crypto tax calculators, exploring their features, benefits, and the transformative impact they have on simplifying the tax management process for the crypto community.

Understanding the Need for Crypto Tax Calculators

Cryptocurrencies operate within a decentralized ecosystem, offering users a level of financial freedom and privacy not typically seen in traditional financial systems. However, this decentralized nature also brings complexities when it comes to tax compliance. Crypto transactions can range from simple buys and sells to more intricate activities like staking, mining, and participating in decentralized finance (DeFi) protocols. Each of these activities may have tax implications, often requiring meticulous record-keeping and calculations to ensure compliance with local tax laws.

The traditional method of manually calculating crypto taxes can be time-consuming, error-prone, and challenging to keep up with as the number of transactions grows. Additionally, the dynamic nature of crypto markets, with their volatile price fluctuations, further complicates the process. Crypto tax calculators were developed to address these challenges, providing a streamlined solution for crypto users to accurately compute their tax liabilities and stay compliant with relevant tax regulations.

Key Features of Crypto Tax Calculators

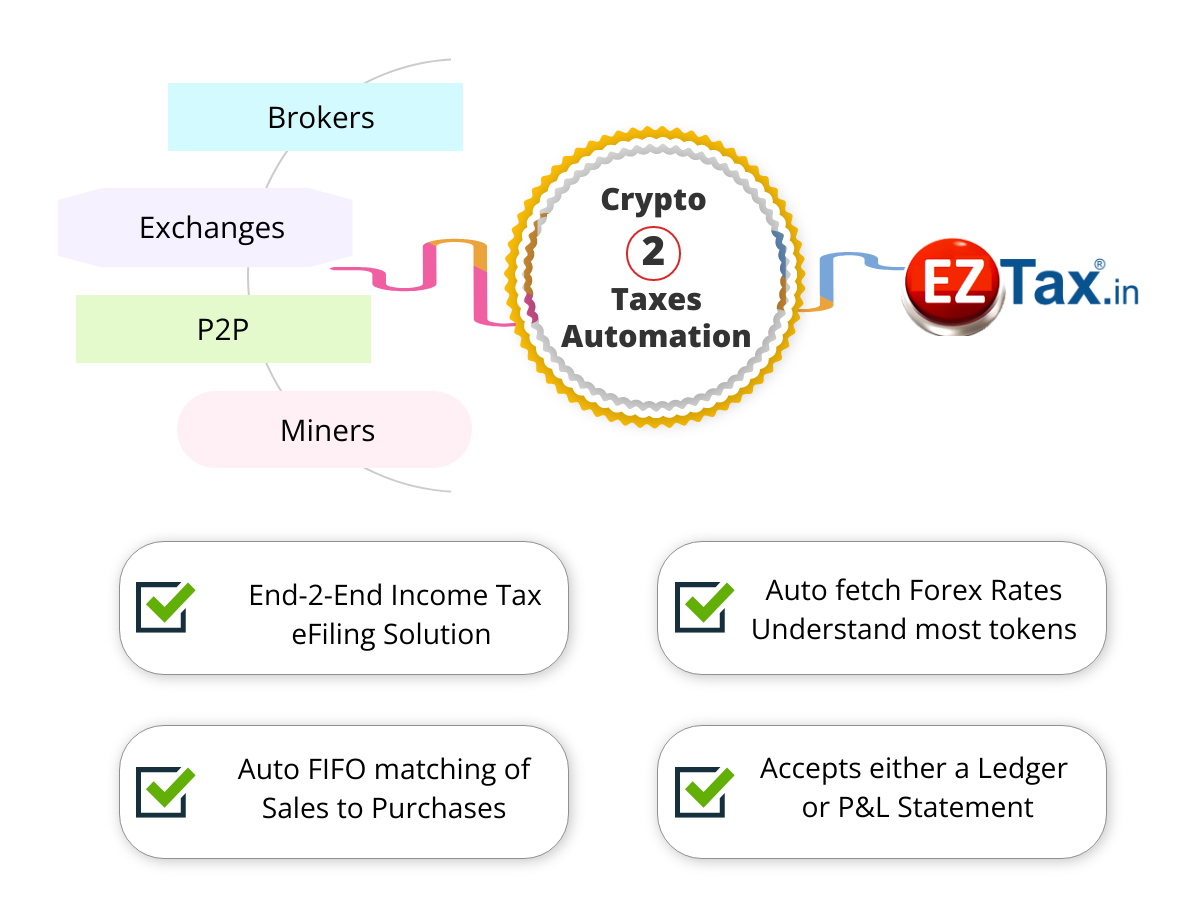

Comprehensive Transaction Import

One of the standout features of crypto tax calculators is their ability to import transaction data from various crypto exchanges and wallets. These calculators support a wide range of platforms, ensuring that users can seamlessly integrate their entire crypto portfolio into the system. By importing transaction data, users can gain a holistic view of their crypto activities, including purchases, sales, trades, airdrops, and more.

Some advanced calculators even offer the capability to import data directly from blockchain explorers, providing an additional layer of accuracy and security. This feature ensures that users can account for all their crypto activities, even those conducted outside of traditional exchanges or wallets.

Automated Tax Calculation

The core functionality of crypto tax calculators lies in their ability to automate tax calculations. These calculators utilize sophisticated algorithms to apply the relevant tax rules and regulations based on the user’s jurisdiction and transaction history. By inputting basic information such as cost basis, acquisition date, and disposal date, the calculator can automatically compute capital gains or losses for each transaction.

Furthermore, many calculators offer advanced features like accounting for different tax rates based on holding periods (short-term vs. long-term capital gains) and adjusting for factors like wash sales and staking rewards. This automation not only saves users significant time but also reduces the risk of errors, ensuring accurate tax computations.

Tax Report Generation

Crypto tax calculators go beyond simple calculation by generating comprehensive tax reports. These reports provide a detailed breakdown of each transaction, showing the date, type, cost basis, proceeds, and resulting capital gains or losses. The reports often include summaries of overall gains and losses for the tax year, making it easier for users to understand their tax obligations.

Additionally, many calculators offer the option to customize reports to meet specific requirements, such as generating reports in a format suitable for submission to tax authorities. This feature ensures that users can efficiently and accurately file their crypto-related tax returns, contributing to overall tax compliance and minimizing the risk of audits.

Benefits of Using Crypto Tax Calculators

Time and Cost Efficiency

One of the most significant advantages of crypto tax calculators is the time and cost savings they offer. The automated nature of these calculators eliminates the need for manual calculations, which can be extremely time-consuming, especially for individuals with a large number of crypto transactions. By leveraging these tools, users can quickly generate tax reports, reducing the time spent on crypto tax management.

Moreover, the accuracy provided by these calculators can help users avoid costly mistakes that may result in underreporting or overpaying taxes. This precision ensures that users are compliant with tax regulations, reducing the risk of penalties and legal issues.

Enhanced Compliance and Transparency

Crypto tax calculators play a pivotal role in enhancing compliance with tax regulations. By providing a clear and concise overview of crypto transactions and their tax implications, these calculators empower users to understand their tax obligations better. This transparency helps users make informed decisions about their crypto activities and ensures they stay compliant with the ever-evolving crypto tax landscape.

Additionally, many calculators offer features like tracking cost basis adjustments, accounting for hard forks, and managing tax lots. These advanced functionalities further contribute to accurate tax reporting and compliance, helping users maintain a robust record-keeping system for their crypto investments.

Simplified Tax Filing

The tax reports generated by crypto tax calculators are designed to streamline the tax filing process. Users can easily export these reports in formats compatible with popular tax software, making it simpler to integrate crypto transactions into their overall tax returns. This integration ensures that users can accurately account for their crypto activities alongside their traditional investments and income sources.

Furthermore, some calculators offer direct integration with tax filing platforms, allowing users to file their crypto-related taxes directly through the calculator interface. This level of integration simplifies the entire tax filing journey, making it more accessible and less daunting for crypto users.

Performance Analysis and Comparative Study

To provide a comprehensive understanding of the capabilities and performance of crypto tax calculators, it is essential to conduct a comparative analysis. While the market offers a range of crypto tax calculator solutions, each with its unique features and pricing models, some stand out for their accuracy, user-friendliness, and comprehensive functionality.

| Crypto Tax Calculator | Key Features | Pricing |

|---|---|---|

| CryptoTrader.tax | Supports over 500 cryptocurrencies, direct import from major exchanges, advanced tax strategies, and IRS-ready tax reports. | Starting at $49.99/year for basic plan, with premium plans offering additional features. |

| CoinTracker | Offers automated tax calculations, portfolio tracking, and tax loss harvesting strategies. Integrates with popular wallets and exchanges. | Free for up to 250 transactions, with premium plans starting at $199/year. |

| ZenLedger | Provides automated tax reporting, supports DeFi transactions, and offers tax optimization strategies. Integrates with over 500 exchanges and wallets. | Starts at $69 for basic tax report, with premium plans offering more features. |

| Coinpanda | Features tax loss harvesting, portfolio tracking, and IRS-compliant tax reports. Supports over 100 exchanges and wallets. | Free for up to 100 transactions, with premium plans starting at $119/year. |

| TokenTax | Offers advanced tax strategies, portfolio tracking, and tax loss harvesting. Integrates with major exchanges and wallets. | Free for basic plan, with premium plans starting at $149/year. |

The above table provides a glimpse into the diverse offerings of popular crypto tax calculator platforms. Each platform caters to different user needs, with varying features and pricing structures. It is essential for users to evaluate their specific requirements and choose a calculator that aligns with their crypto activities and tax needs.

Future Implications and Industry Insights

As the crypto industry continues to evolve and mature, the role of crypto tax calculators becomes increasingly vital. The rising popularity of cryptocurrencies and the growing complexity of the crypto ecosystem highlight the need for robust and accessible tax management solutions. Here are some key insights and future implications for the industry:

-

Regulatory Compliance: With governments worldwide increasingly recognizing cryptocurrencies, tax regulations surrounding crypto assets are becoming more defined and stringent. Crypto tax calculators will play a crucial role in helping users navigate these complex regulations and ensure compliance.

-

Integration with Traditional Finance: As crypto assets gain mainstream acceptance, their integration with traditional finance will become more seamless. Crypto tax calculators will need to adapt to accommodate this integration, allowing users to manage their crypto and traditional investments within a single platform.

-

Advanced Tax Strategies: Crypto tax calculators will continue to innovate, offering advanced tax strategies such as tax loss harvesting, cost basis optimization, and tax-efficient portfolio rebalancing. These strategies will help users minimize their tax liabilities and maximize their crypto investments' potential.

-

User Experience Enhancements: With the growing popularity of crypto tax calculators, providers will focus on enhancing user experience. This includes simplifying the onboarding process, improving data visualization, and offering personalized tax optimization recommendations.

-

DeFi and NFT Integration: The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) presents new challenges and opportunities for crypto tax calculators. Integrating these emerging sectors into tax calculators will be essential to provide a comprehensive solution for users participating in these innovative ecosystems.

Conclusion

Crypto tax calculators have emerged as a vital tool for the crypto community, offering a streamlined approach to managing the complex world of crypto taxation. With their ability to automate calculations, generate comprehensive reports, and enhance compliance, these calculators are transforming the way crypto users approach tax management. As the crypto industry continues to evolve, crypto tax calculators will play a crucial role in ensuring that users can participate in the crypto ecosystem while remaining compliant with tax regulations.

Frequently Asked Questions

How do crypto tax calculators work?

+

Crypto tax calculators utilize advanced algorithms to analyze your crypto transactions, applying relevant tax rules and regulations based on your jurisdiction. They automate the process of calculating capital gains or losses, taking into account factors like cost basis, holding period, and transaction type.

Are crypto tax calculators accurate?

+

Yes, reputable crypto tax calculators are designed to provide accurate tax calculations. They rely on the data you input, so it’s essential to ensure that your transaction records are complete and correct. Additionally, some calculators offer audit protection, providing further assurance of accuracy.

Can crypto tax calculators handle complex tax scenarios like DeFi and NFTs?

+

Yes, many advanced crypto tax calculators are capable of handling complex tax scenarios, including DeFi transactions and NFT activities. These calculators can account for the unique tax implications of these emerging sectors, ensuring that users can accurately report their crypto-related income and expenses.

Are crypto tax calculators suitable for both individuals and businesses?

+

Absolutely! Crypto tax calculators are designed to cater to a wide range of users, from individual investors to crypto businesses. They offer scalable solutions, allowing users to manage a few transactions or an extensive portfolio. Many calculators also provide features tailored to the specific needs of businesses, such as multiple user accounts and enhanced security.

How can I choose the right crypto tax calculator for my needs?

+

When selecting a crypto tax calculator, consider your specific needs and preferences. Evaluate factors such as the number of transactions you manage, the complexity of your crypto activities, and your budget. Read reviews, compare features, and opt for a calculator that offers a free trial or a money-back guarantee to ensure it meets your expectations.