St Croix County Wi Property Tax

Property taxes are an essential aspect of local government funding in the United States, with each state and county having its own unique system. In St. Croix County, Wisconsin, property taxes play a significant role in supporting community services and infrastructure. This article delves into the specifics of St. Croix County's property tax system, shedding light on how it works, its implications for homeowners, and its impact on the local economy.

Understanding St. Croix County’s Property Tax System

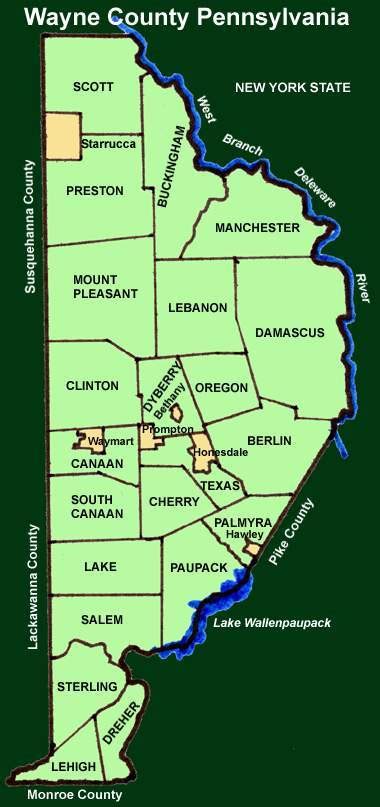

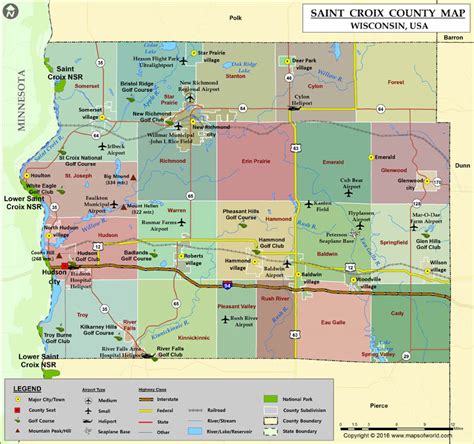

St. Croix County, located in western Wisconsin, boasts a diverse landscape ranging from rural farmlands to suburban communities and vibrant urban centers. The county’s property tax system is a critical component of its financial framework, providing revenue for vital services such as education, public safety, healthcare, and infrastructure development.

The property tax system in St. Croix County operates similarly to other counties in Wisconsin. It involves a comprehensive process that assesses the value of each property, calculates the applicable tax rate, and determines the final tax liability for property owners.

Property Assessment Process

The foundation of St. Croix County’s property tax system is the assessment process. The county employs a team of professional assessors who are responsible for evaluating the value of each property within the county. These assessments are conducted periodically, typically every two years, to ensure an up-to-date valuation of properties.

During the assessment process, assessors consider various factors such as the property's location, size, condition, recent sales data, and other market indicators. They aim to determine the fair market value of each property, which serves as the basis for calculating property taxes.

| Assessment Year | Total Properties Assessed | Average Property Value Increase |

|---|---|---|

| 2022 | 34,500 | 5.2% |

| 2020 | 33,800 | 3.8% |

| 2018 | 33,000 | 6.2% |

The assessment process is a complex undertaking, requiring assessors to stay abreast of market trends and ensure consistency and fairness in their valuations. Property owners have the right to appeal their assessed values if they believe the assessment is inaccurate or unfair.

Tax Rate Determination

Once the assessment process is complete, the county’s tax rate is set. The tax rate is a percentage applied to the assessed value of each property to calculate the property tax owed. In St. Croix County, the tax rate is determined by the County Board of Supervisors, who consider the budget requirements of various county departments and services.

The tax rate is typically expressed in terms of dollars per thousand dollars of assessed value, known as the "mill rate." For example, a mill rate of 10 would mean that for every $1,000 of assessed property value, the property owner would pay $10 in property taxes.

| Year | Tax Rate (Mills) |

|---|---|

| 2022 | 12.5 |

| 2021 | 12.0 |

| 2020 | 11.8 |

It's important to note that the tax rate can vary not only from county to county but also within different municipalities and school districts within the county. This variation is due to the unique needs and budgetary requirements of each jurisdiction.

Calculating Property Taxes

To calculate the property tax liability, the assessed value of the property is multiplied by the applicable tax rate. For example, if a property has an assessed value of $200,000 and the tax rate is 12 mills, the property tax would be calculated as follows:

Property Tax = Assessed Value x Tax Rate

Property Tax = $200,000 x 0.012 = $2,400

So, in this case, the property owner would owe $2,400 in property taxes for the year.

Tax Bill Distribution and Payment

Once the property taxes are calculated, the county issues tax bills to property owners. These bills provide a detailed breakdown of the taxes owed, including any applicable surcharges or credits. Property owners typically receive their tax bills in the fall, with payment due by a specified deadline, usually early the following year.

St. Croix County offers various payment options, including online payments, payments by mail, and in-person payments at designated locations. Property owners who fail to pay their taxes by the due date may incur late fees and penalties, and in extreme cases, their property could be subject to a tax lien or foreclosure.

Impact of Property Taxes on Homeowners

Property taxes in St. Croix County have a significant impact on homeowners, influencing their financial planning and decision-making. While property taxes contribute to the maintenance and improvement of the community, they also represent a substantial expense for homeowners.

Financial Considerations

For many homeowners, property taxes are a significant portion of their annual expenses. The tax liability can vary greatly depending on the assessed value of the property and the applicable tax rate. Homeowners must budget for this expense, especially when purchasing a new property or making significant improvements that could lead to an increase in their assessed value.

Property taxes are typically included in the overall cost of homeownership, along with mortgage payments, insurance, and maintenance costs. Therefore, understanding the property tax system and being aware of potential changes in assessments or tax rates is crucial for financial planning.

Tax Relief Programs

St. Croix County recognizes the financial burden that property taxes can impose on certain segments of the population, particularly senior citizens and individuals with limited incomes. To provide relief, the county offers various tax credit and deferral programs.

One such program is the Property Tax Refund Program, which provides eligible homeowners with a refund based on their income and property tax payments. Additionally, the county offers the Homestead Credit, which provides a tax credit to homeowners who use their property as their primary residence.

These programs aim to ease the financial strain of property taxes on vulnerable populations and ensure that homeownership remains accessible and affordable for all residents.

Appeals and Disputes

In cases where homeowners believe their property assessment is inaccurate or unfair, they have the right to appeal. St. Croix County provides a formal appeals process, allowing homeowners to present their case and challenge the assessed value of their property.

The appeals process typically involves a review by an independent board of assessors, who consider the evidence and arguments presented by the homeowner. If the appeal is successful, the assessed value may be adjusted, resulting in a lower property tax liability.

Economic Impact and Community Development

Property taxes are not just a financial obligation for homeowners; they also play a vital role in the economic development and growth of St. Croix County.

Funding Community Services

The revenue generated from property taxes is a primary source of funding for various community services and infrastructure projects. These funds support essential services such as:

- Education: Property taxes contribute to the funding of public schools, ensuring quality education for the county's youth.

- Public Safety: Police, fire, and emergency medical services rely on property tax revenue to maintain their operations and protect the community.

- Healthcare: Property taxes help fund public health initiatives, clinics, and hospitals, providing access to healthcare services for all residents.

- Infrastructure: Road maintenance, snow removal, and the development of public parks and recreational facilities are all supported by property tax revenue.

By investing in these services, St. Croix County enhances the quality of life for its residents and attracts new businesses and residents, contributing to economic growth.

Economic Growth and Investment

A stable and predictable property tax system, like the one in St. Croix County, can encourage economic growth and investment. Businesses and investors are more likely to choose locations with a transparent and consistent tax system, knowing that their financial obligations are clearly defined.

The county's focus on maintaining a fair and efficient property tax system has attracted businesses, leading to job creation and a thriving local economy. Additionally, the county's commitment to investing tax revenue back into the community through infrastructure development and public services further enhances its appeal as a desirable place to live, work, and invest.

Community Engagement and Participation

Property taxes also foster a sense of community engagement and participation. Residents who actively participate in the property tax system, whether through appeals, tax relief programs, or community meetings, feel a greater sense of ownership and responsibility for their community.

Community engagement leads to better-informed residents who are more likely to participate in local government processes, contribute to community initiatives, and support local businesses. This sense of community spirit and involvement strengthens the fabric of St. Croix County, making it a vibrant and cohesive place to call home.

Conclusion

St. Croix County’s property tax system is a complex yet essential component of the county’s financial framework. It provides the necessary revenue to support vital community services and infrastructure while also impacting homeowners’ financial planning and decision-making.

By understanding the assessment process, tax rate determination, and calculation of property taxes, homeowners can navigate the system with confidence. Additionally, the county's commitment to tax relief programs and community engagement ensures that property taxes remain a fair and accessible financial obligation for all residents.

As St. Croix County continues to grow and develop, its property tax system will play a crucial role in shaping the future of the community. Through effective financial management and a commitment to transparency, the county can continue to provide essential services, encourage economic growth, and maintain its position as a desirable place to live and invest.

How often are property assessments conducted in St. Croix County?

+Property assessments in St. Croix County are conducted every two years to ensure an up-to-date valuation of properties. This periodic assessment helps maintain fairness and accuracy in the property tax system.

Can property owners appeal their assessed values?

+Yes, property owners have the right to appeal their assessed values if they believe the assessment is inaccurate or unfair. St. Croix County provides a formal appeals process, allowing homeowners to present their case and potentially adjust their assessed value.

What happens if property taxes are not paid by the due date?

+Failure to pay property taxes by the due date can result in late fees and penalties. In extreme cases, the county may place a tax lien on the property or initiate foreclosure proceedings. It is important for homeowners to stay informed about payment deadlines and make timely payments to avoid such consequences.

Are there any tax relief programs available for homeowners in St. Croix County?

+Yes, St. Croix County offers several tax relief programs to ease the financial burden of property taxes on vulnerable populations. These include the Property Tax Refund Program and the Homestead Credit, which provide refunds and tax credits to eligible homeowners.

How does St. Croix County’s property tax system contribute to economic growth and development?

+St. Croix County’s property tax system plays a crucial role in economic growth by providing stable and predictable funding for community services and infrastructure. This, in turn, attracts businesses and investors, leading to job creation and a thriving local economy. Additionally, the county’s commitment to reinvesting tax revenue back into the community further enhances its appeal as a desirable place to live and invest.