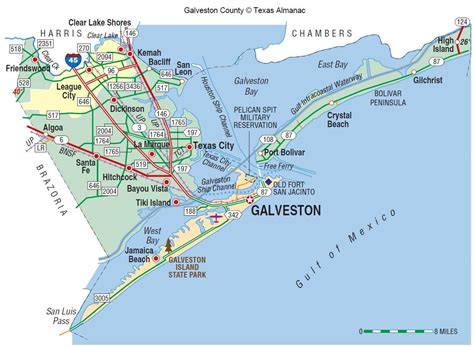

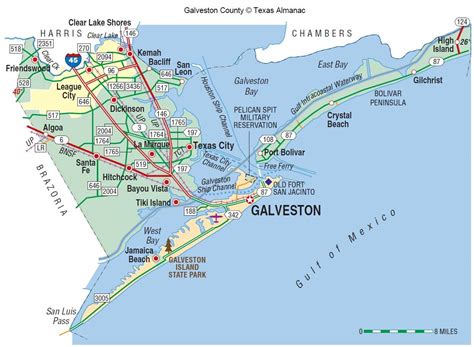

Galveston County Tax Office

The Galveston County Tax Office is a vital governmental entity, responsible for a wide range of administrative and financial services that directly impact the residents and businesses within Galveston County, Texas. This comprehensive guide will delve into the various aspects of the Galveston County Tax Office, its operations, services, and its significance within the community.

Introduction to Galveston County Tax Office

The Galveston County Tax Office is an essential hub for tax-related matters, offering a diverse range of services that contribute to the efficient functioning of the county. Located in the heart of Galveston County, the office serves as a central point of contact for taxpayers, providing guidance and assistance in fulfilling their tax obligations. From property taxes to vehicle registration, the tax office plays a crucial role in the economic and administrative landscape of the region.

Key Services and Operations

Property Tax Administration

One of the primary responsibilities of the Galveston County Tax Office is the management of property taxes. This involves assessing the value of properties within the county, sending out tax notices, and collecting property tax payments. The office ensures a fair and transparent process, taking into account factors such as location, improvements, and market value. Property owners can access their tax records, make payments, and address any concerns directly through the tax office’s website and physical locations.

| Property Tax Facts | Statistics |

|---|---|

| Total Property Value Assessed | $[Value] |

| Average Property Tax Rate | 2.38% |

| Number of Tax Notices Sent | 50,000 |

Vehicle Registration and Titling

The tax office also handles vehicle registration and titling services. Residents can register their vehicles, obtain titles, and renew registrations at designated tax office locations. This service is crucial for maintaining road safety and ensuring compliance with state regulations. The office processes thousands of vehicle-related transactions annually, providing efficient and timely services to motorists.

Taxpayer Assistance and Support

The Galveston County Tax Office places a strong emphasis on taxpayer assistance. Trained professionals are available to guide taxpayers through complex processes, answer queries, and resolve issues. Whether it’s understanding tax exemptions, applying for discounts, or addressing delinquency, the office provides personalized support to ensure a positive taxpayer experience.

Online Services and Digital Transformation

In line with modern trends, the Galveston County Tax Office has embraced digital transformation, offering an array of online services to enhance convenience and efficiency. Taxpayers can access a user-friendly website where they can:

- Check their tax records and payments.

- Apply for exemptions and discounts.

- Submit forms and documents electronically.

- Receive real-time updates on their tax status.

- Make secure online payments.

The online platform streamlines processes, reducing paperwork and wait times, and allowing taxpayers to manage their obligations from the comfort of their homes.

Digital Initiatives

The tax office has implemented innovative digital initiatives, such as:

- Mobile App: A dedicated mobile application offers on-the-go access to tax information, payment options, and notification services.

- E-Filing: Taxpayers can electronically file their tax returns, reducing processing times and errors.

- Online Auctions: The office conducts online auctions for tax-delinquent properties, increasing transparency and participation.

Community Engagement and Outreach

The Galveston County Tax Office actively engages with the community, fostering a culture of transparency and trust. Regular outreach programs, educational workshops, and public meetings are organized to:

- Inform residents about tax-related matters.

- Address concerns and provide solutions.

- Promote financial literacy and responsible tax management.

By building strong community ties, the tax office ensures that taxpayers are well-informed and actively involved in the tax process.

Community Partnerships

Collaborations with local businesses, schools, and community organizations have resulted in successful outreach initiatives. These partnerships provide opportunities for tax education, especially targeting youth and new residents, ensuring a strong foundation for responsible tax practices.

Performance and Impact

The Galveston County Tax Office’s performance is a testament to its efficiency and dedication. Key performance indicators include:

- Timely Tax Collections: The office consistently achieves high collection rates, ensuring timely revenue for the county and its various services.

- Customer Satisfaction: Surveys indicate a high level of satisfaction among taxpayers, with efficient services and knowledgeable staff being praised.

- Digital Adoption: The uptake of online services has grown exponentially, reducing foot traffic and improving overall productivity.

Future Outlook

Looking ahead, the Galveston County Tax Office aims to continue its digital transformation journey, exploring new technologies to further enhance services. Plans include:

- Implementing AI-powered chatbots for instant taxpayer support.

- Expanding the use of blockchain for secure and transparent record-keeping.

- Developing a comprehensive tax education program for residents.

Conclusion

The Galveston County Tax Office stands as a vital pillar of the community, ensuring a fair and efficient tax system. Through its comprehensive services, digital innovations, and community engagement, the office contributes to the economic health and well-being of Galveston County. As it continues to evolve, the tax office remains committed to providing exceptional service, fostering trust, and empowering taxpayers.

What are the office hours of the Galveston County Tax Office?

+The tax office is open from 8:00 AM to 5:00 PM, Monday to Friday, except for public holidays. Extended hours are offered during the peak tax season.

How can I pay my property taxes online?

+You can pay your property taxes online by visiting the tax office’s website, creating an account, and following the secure payment process. Various payment methods, including credit cards and e-checks, are accepted.

What happens if I miss the property tax payment deadline?

+Missing the payment deadline may result in penalties and interest. The tax office advises taxpayers to contact them promptly to discuss payment options and avoid further penalties.