Clark County Property Tax Payment

Understanding and managing property taxes is an essential aspect of homeownership, and Clark County, Nevada, offers a straightforward and user-friendly system for property tax payments. This comprehensive guide will delve into the various aspects of Clark County's property tax payment process, offering an expert analysis of the system, its benefits, and the steps involved.

The Clark County Property Tax Payment System: An Overview

Clark County’s property tax payment system is designed to provide homeowners with a convenient and accessible method to fulfill their tax obligations. The system, which is managed by the Clark County Treasurer’s Office, offers a range of options to cater to different preferences and circumstances.

One of the standout features of Clark County's property tax payment system is its online platform, which allows homeowners to access their tax information and make payments digitally. This platform, accessible through the Clark County website, provides a secure and efficient way to manage property taxes, making the process more transparent and less time-consuming.

In addition to the online platform, Clark County also offers traditional methods of payment, recognizing that not all homeowners are comfortable with digital transactions. This includes the option to pay by mail, ensuring that those who prefer a more traditional approach can still meet their tax obligations without any hassle.

Online Payment: A Step-by-Step Guide

For those who opt for the online payment method, the process is straightforward and user-friendly. Here’s a step-by-step guide to help you navigate the Clark County property tax payment system:

- Access the Clark County Website: Visit the official Clark County website, which serves as the gateway to various county services, including property tax payment.

- Locate the Property Tax Payment Portal: On the homepage, look for the "Property Tax Payment" or "Treasurer's Office" link. This will direct you to the dedicated payment portal.

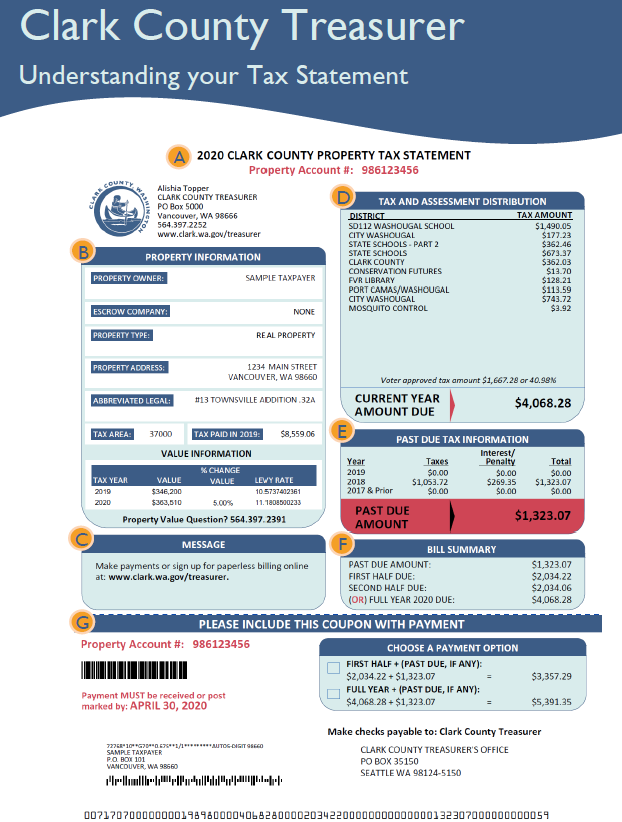

- Enter Your Property Information: You will be prompted to enter your property's details, including the parcel number or account number. These details can be found on your property tax bill or assessment notice.

- Review Your Tax Information: Once you've entered your property details, the system will display your tax balance, due dates, and any applicable penalties or discounts. Take a moment to review this information to ensure its accuracy.

- Select Your Payment Method: Clark County offers a variety of payment methods, including credit cards, debit cards, and electronic checks. Choose the method that suits your preference and follow the on-screen instructions to complete the payment process.

- Receive Confirmation: After successfully completing your payment, you will receive an on-screen confirmation and a unique transaction number. It's advisable to print or save this confirmation for your records.

- Check Your Email: If you provided an email address during the payment process, you will receive an email confirmation. This serves as an additional record of your transaction.

The online payment process is designed to be secure and efficient, with encryption protocols in place to protect your financial information. Additionally, the system provides real-time updates, ensuring that your payment is reflected promptly in your account.

Mail Payment: A Traditional Approach

For homeowners who prefer a more traditional approach, Clark County offers the option to pay property taxes by mail. Here’s how you can do it:

- Obtain a Remittance Coupon: Your property tax bill or assessment notice will include a remittance coupon. This coupon serves as a payment stub and contains important information about your property, including the parcel number and tax amount.

- Prepare Your Payment: Ensure that you have the correct tax amount ready. You can refer to your tax bill or the Clark County Treasurer's website for information on accepted payment methods, which may include checks, money orders, or cashier's checks.

- Fill Out the Remittance Coupon: Carefully fill out the remittance coupon, ensuring that all the required information is accurate and legible. This includes your property details, payment amount, and any other specific instructions.

- Enclose Your Payment and Coupon: Place your payment and the completed remittance coupon in a standard envelope. Ensure that the envelope is securely sealed to prevent any loss or tampering during transit.

- Mail Your Payment: Send your payment and coupon to the address specified on the remittance coupon or the Clark County Treasurer's website. It's advisable to use a traceable mailing service to ensure the delivery of your payment.

- Track Your Payment: Once you've mailed your payment, it's a good practice to track its delivery. This ensures that your payment reaches the intended destination and is processed correctly.

While the mail payment method may take longer to process, it provides an alternative for those who prefer a more traditional approach or who may have limited access to digital payment methods.

Benefits of the Clark County Property Tax Payment System

The Clark County property tax payment system offers several benefits to homeowners, making the process of fulfilling tax obligations more manageable and less stressful.

Convenience and Accessibility

One of the key advantages of the Clark County system is its convenience. The online platform allows homeowners to access their tax information and make payments from the comfort of their homes, at any time that suits them. This eliminates the need for long waits at government offices or the hassle of mailing checks.

Additionally, the system's accessibility extends to those who may have physical limitations or mobility issues. By offering an online platform, Clark County ensures that all homeowners can access their tax information and make payments without any barriers.

Transparency and Accountability

The Clark County property tax payment system prioritizes transparency and accountability. The online platform provides detailed information about tax obligations, due dates, and any applicable discounts or penalties. This transparency ensures that homeowners are aware of their financial responsibilities and can plan their payments accordingly.

Furthermore, the system's digital nature allows for better record-keeping. Homeowners can easily access their payment history, tax assessments, and other relevant documents, making it simpler to track and manage their property tax obligations over time.

Efficiency and Timeliness

Clark County’s property tax payment system is designed with efficiency in mind. The online platform offers a fast and secure payment process, with real-time updates ensuring that payments are reflected promptly in homeowners’ accounts. This efficiency reduces the risk of late payments and the associated penalties.

The system's efficiency also benefits the county's administrative processes. By streamlining the payment process, Clark County can manage tax collections more effectively, ensuring that funds are allocated promptly for essential public services.

Performance Analysis and Future Implications

The Clark County property tax payment system has demonstrated its effectiveness in providing a user-friendly and accessible platform for homeowners. The system’s success can be attributed to its combination of digital innovation and traditional payment methods, catering to a diverse range of preferences and circumstances.

Looking ahead, the future of the Clark County property tax payment system appears promising. With ongoing technological advancements, the system is likely to become even more efficient and user-friendly. Potential enhancements could include mobile payment options, further streamlining the process for homeowners on the go.

Additionally, the system's integration with other county services could provide further benefits. For instance, linking the property tax payment system with the county's assessment database could offer homeowners a more comprehensive view of their property's tax obligations and history. This integration would enhance transparency and make it easier for homeowners to understand the factors influencing their tax assessments.

The Clark County property tax payment system serves as a model for other counties and municipalities, demonstrating how a well-designed system can simplify a complex process. By prioritizing user experience, accessibility, and transparency, Clark County has created a system that benefits both homeowners and the county's administrative processes.

Key Takeaways and Recommendations

In summary, the Clark County property tax payment system offers a range of benefits, including convenience, transparency, and efficiency. By providing both online and traditional payment methods, the system caters to a wide range of homeowner preferences and circumstances.

For homeowners, the key takeaways include the following:

- Utilize the online payment platform for its convenience and security.

- Take advantage of the system's transparency to stay informed about your tax obligations.

- Explore the various payment methods to find the one that suits your needs and preferences.

- Keep records of your payments and tax assessments for future reference.

For the Clark County Treasurer's Office, continued investment in the system's development and maintenance is recommended. This includes staying abreast of technological advancements to enhance the user experience and exploring further integration with other county services to provide a more holistic view of property-related information.

In conclusion, the Clark County property tax payment system is a well-designed and user-friendly platform that simplifies a critical aspect of homeownership. By understanding and utilizing the system's features, homeowners can efficiently manage their tax obligations, ensuring a smooth and stress-free process.

What are the due dates for Clark County property taxes?

+

Clark County property taxes are due in two installments. The first installment is typically due on November 1st, and the second installment is due on March 1st. It’s important to note that if the due date falls on a weekend or holiday, the payment is considered timely if received on the next business day.

Are there any discounts or penalties associated with late payments?

+

Yes, Clark County offers a discount for early payment. If you pay the first installment by December 31st, you receive a 2% discount. However, late payments are subject to a penalty. A 10% penalty is applied to the unpaid amount if the second installment is not paid by April 1st.

How can I obtain my property tax bill or assessment notice?

+

You can access your property tax bill or assessment notice online through the Clark County Treasurer’s Office website. Alternatively, you can request a copy by mail or in person at the Treasurer’s Office. It’s important to keep your contact information updated to ensure timely receipt of these documents.

What if I have questions or need assistance with my property tax payment?

+

The Clark County Treasurer’s Office provides dedicated customer support to assist homeowners with their property tax payments. You can reach out to them by phone, email, or in person. Their contact information can be found on the Treasurer’s Office website.

Are there any payment plans available for property taxes?

+

Yes, Clark County offers a payment plan option for property taxes. This plan allows homeowners to make monthly payments towards their tax obligations. To enroll in the payment plan, you need to complete an application and meet certain eligibility criteria. More information can be found on the Treasurer’s Office website.